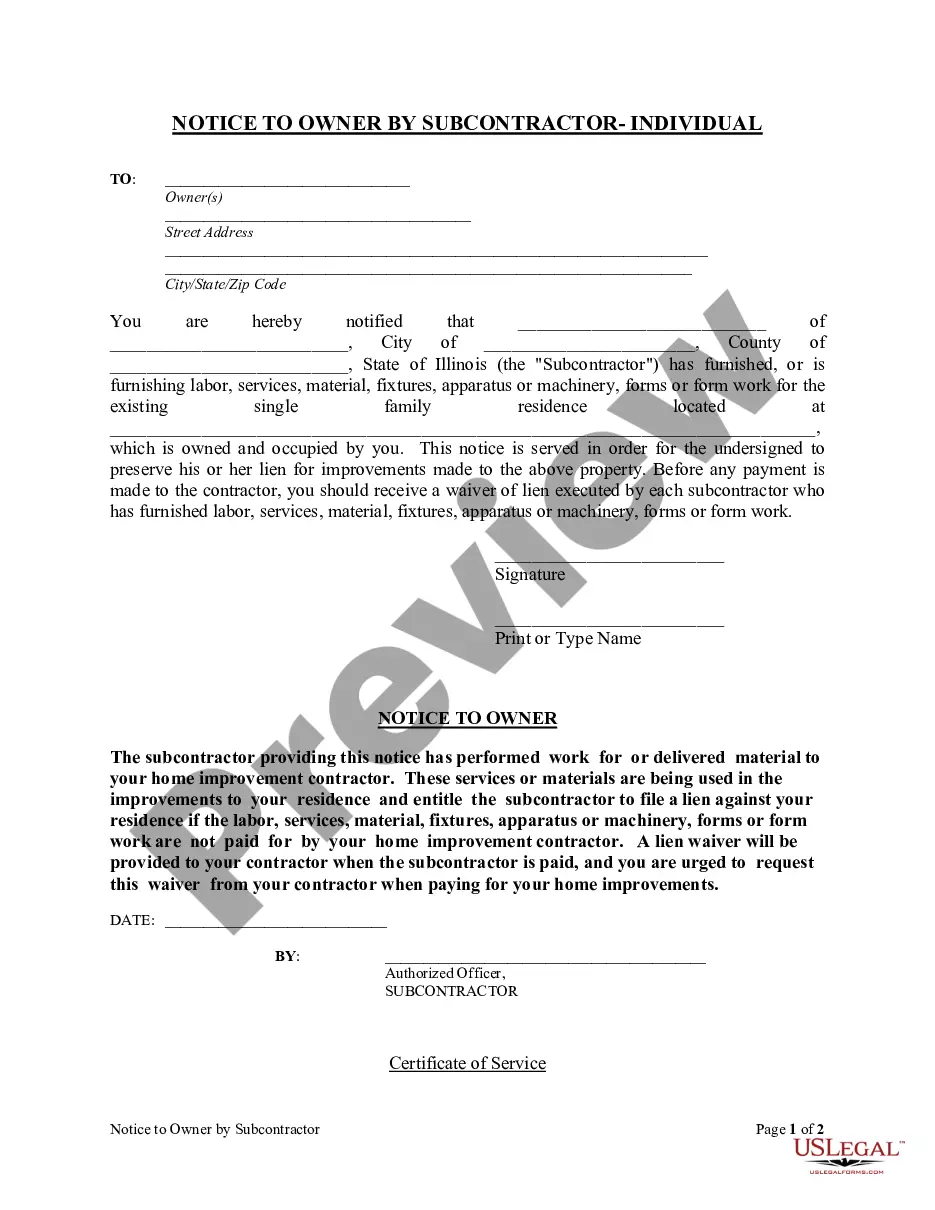

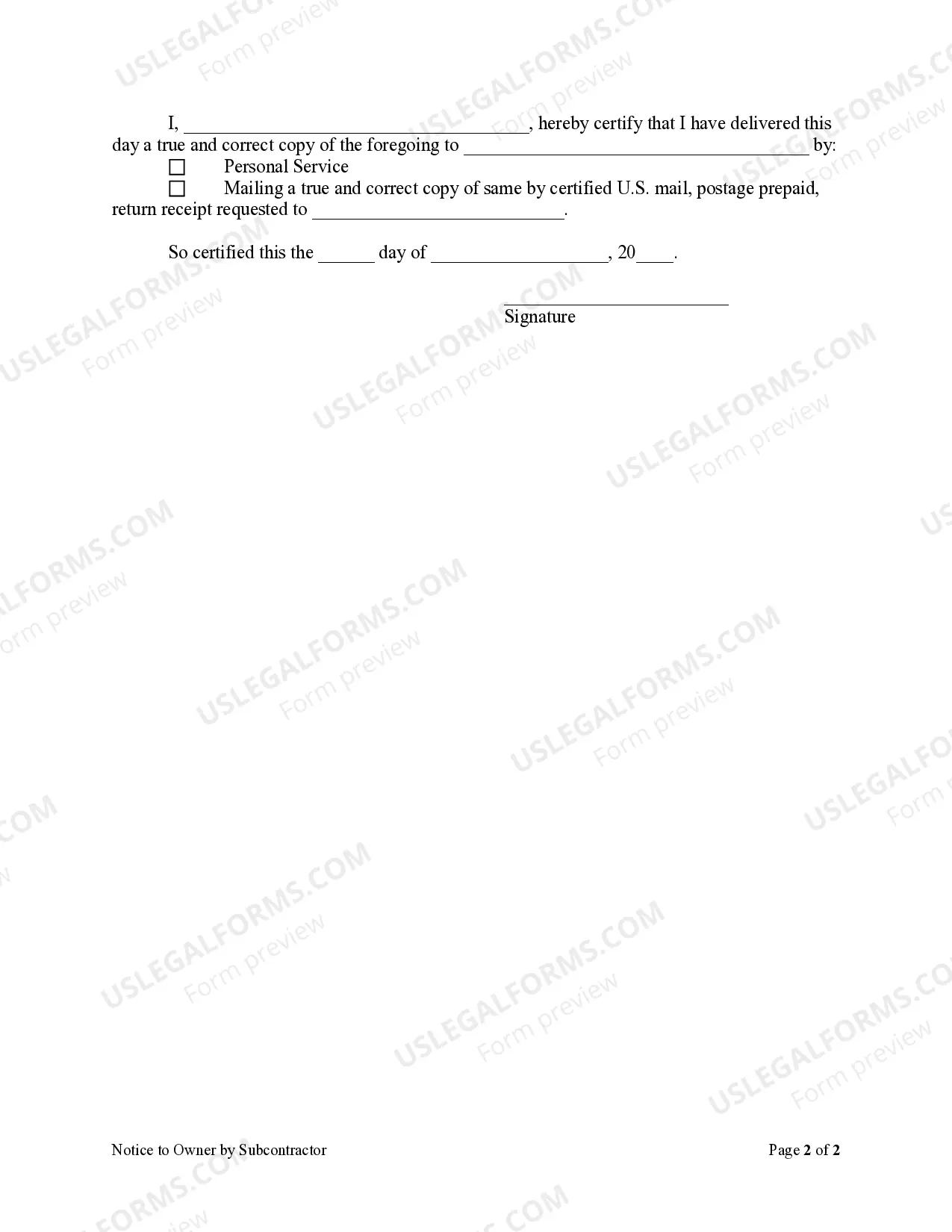

Elgin Illinois Notice to Owner — Subcontractor’s Perspective In Elgin, Illinois, subcontractors play a vital role in the construction industry. To ensure their rights and protect their interests, subcontractors often utilize the Elgin Illinois Notice to Owner. This legal document serves as a notice to the property owner and other relevant parties that the subcontractor has contributed to the construction project and is entitled to certain lien rights. The Elgin Illinois Notice to Owner by Subcontractor — Individual highlights the specific rights and responsibilities of subcontractors when it comes to payment and potential claims against the property. This notice is typically sent after the subcontractor has furnished labor, materials, or services to the project. This notice includes various crucial elements, such as identifying information of the subcontractor and the project, a detailed description of the work performed or materials provided, the dates of the work, and the amount of money owed to the subcontractor. By serving this notice to the property owner and other relevant parties, the subcontractor formally establishes their right to file a mechanics lien if necessary. There are several types of Elgin Illinois Notice to Owner by Subcontractor — Individual that may be used based on the circumstances: 1. Preliminary Notice: This type of notice is typically filed at the beginning of a construction project to inform the property owner and general contractor of the subcontractor’s intent to assert lien rights if payment issues arise. 2. Notice of Intent to Lien: If payment becomes overdue or other disputes arise, subcontractors may send this notice to the property owner as a warning before filing an actual mechanics lien. It notifies the owner of the subcontractor's intention to pursue a lien unless payment is promptly made. 3. Final Notice of Intent to Lien: This notice is sent as a final warning before filing a mechanics lien. It communicates the subcontractor's intent to file a lien within a specified timeframe if the outstanding payments are not resolved. 4. Mechanics Lien: If all payment attempts fail, the subcontractor may file a mechanics lien, a legal claim against the property. This lien puts a cloud on the property's title and can lead to foreclosure if the debt remains unresolved. By utilizing the Elgin Illinois Notice to Owner by Subcontractor — Individual, subcontractors can protect their rights and ensure proper compensation for their labor, materials, and services. These notices play a significant role in the construction industry, facilitating fair payment practices and encouraging timely resolution of payment disputes.

Elgin Illinois Notice to Owner by Subcontractor - Individual

Description

How to fill out Elgin Illinois Notice To Owner By Subcontractor - Individual?

If you are searching for a valid form, it’s extremely hard to choose a more convenient platform than the US Legal Forms website – probably the most comprehensive libraries on the internet. With this library, you can get a large number of document samples for company and personal purposes by categories and states, or keywords. With our high-quality search option, finding the latest Elgin Illinois Notice to Owner by Subcontractor - Individual is as easy as 1-2-3. Moreover, the relevance of every document is verified by a group of expert lawyers that on a regular basis check the templates on our platform and update them based on the most recent state and county regulations.

If you already know about our system and have a registered account, all you need to receive the Elgin Illinois Notice to Owner by Subcontractor - Individual is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the form you require. Check its explanation and make use of the Preview option (if available) to see its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the appropriate document.

- Confirm your selection. Click the Buy now button. Next, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the file format and download it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Elgin Illinois Notice to Owner by Subcontractor - Individual.

Every single template you add to your account does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to have an additional version for enhancing or printing, you may return and download it once again whenever you want.

Make use of the US Legal Forms extensive catalogue to gain access to the Elgin Illinois Notice to Owner by Subcontractor - Individual you were looking for and a large number of other professional and state-specific templates on one platform!