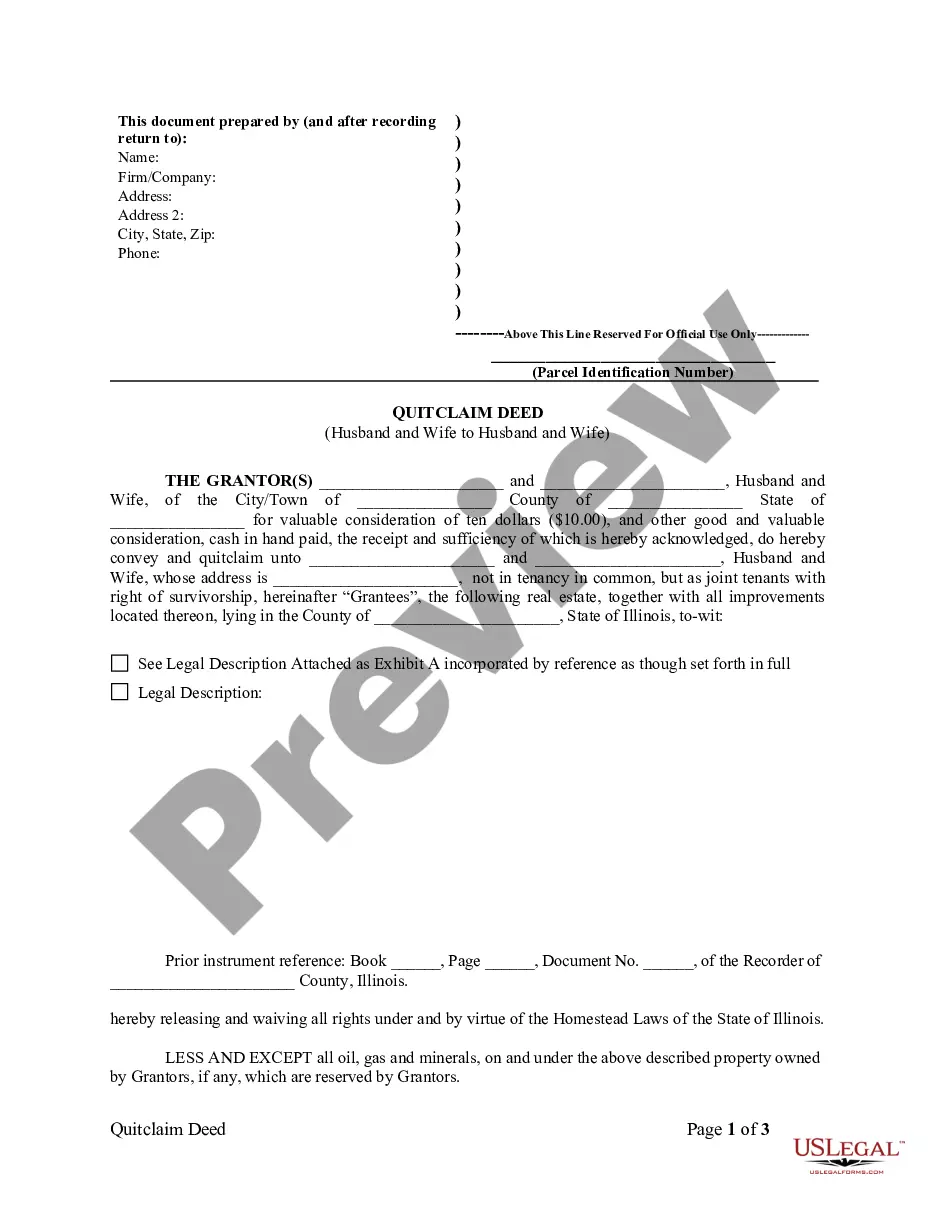

A Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife is a legal document that allows married couples to transfer their joint ownership rights or interests in a property to one spouse, typically for the purpose of estate planning, divorce, or refinancing. In this type of Quitclaim Deed, the property is being transferred from both the husband and wife as joint owners to one of the spouses, who remains married to the other. It is important to note that a Quitclaim Deed only transfers the individual's ownership interest in the property and does not guarantee or imply clear title or any warranties regarding the property's condition. There are several types of Naperville Illinois Quitclaim Deeds from Husband and Wife to Husband and Wife: 1. Naperville Illinois Joint Tenancy Quitclaim Deed: This type of Quitclaim Deed allows both spouses to transfer their undivided interest in the property, which is then merged into a joint interest held by the remaining spouse. If one spouse passes away, their interest automatically transfers to the surviving spouse, regardless of any conflicting provisions in a will or trust. 2. Naperville Illinois Tenancy by the Entirety Quitclaim Deed: This type of Quitclaim Deed is specific to married couples and establishes joint ownership with the right of survivorship. It provides additional protection as it prevents creditors from seizing the property in the event of an individual spouse's debts or liabilities. If a spouse passes away, their interest automatically transfers to the surviving spouse. 3. Naperville Illinois Community Property Quitclaim Deed: This type of Quitclaim Deed is generally not applicable in Illinois as it is not a community property state. However, if the couple acquired the property in a community property state and later moved to Naperville, they may use this deed to transfer their interest to one spouse. When drafting a Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife, it is essential to include accurate legal descriptions of the property, names of the spouses as granters (transferors) and grantees (transferees), consideration amount if any, and the signatures of both spouses in front of a notary public. Additionally, it is advisable to consult with an experienced real estate attorney to ensure compliance with all applicable laws and regulations for a smooth and legally binding transfer of property.

Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out Naperville Illinois Quitclaim Deed From Husband And Wife To Husband And Wife?

Make use of the US Legal Forms and obtain instant access to any form template you want. Our beneficial platform with a huge number of documents allows you to find and get virtually any document sample you will need. You are able to save, fill, and sign the Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife in just a matter of minutes instead of browsing the web for hours looking for the right template.

Using our library is a superb strategy to improve the safety of your record filing. Our experienced lawyers regularly check all the records to make certain that the forms are appropriate for a particular state and compliant with new laws and polices.

How do you get the Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction below:

- Open the page with the form you need. Ensure that it is the template you were seeking: verify its title and description, and take take advantage of the Preview option if it is available. Otherwise, use the Search field to find the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Export the file. Choose the format to get the Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife and change and fill, or sign it for your needs.

US Legal Forms is among the most considerable and reliable document libraries on the internet. Our company is always happy to help you in any legal process, even if it is just downloading the Naperville Illinois Quitclaim Deed from Husband and Wife to Husband and Wife.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!