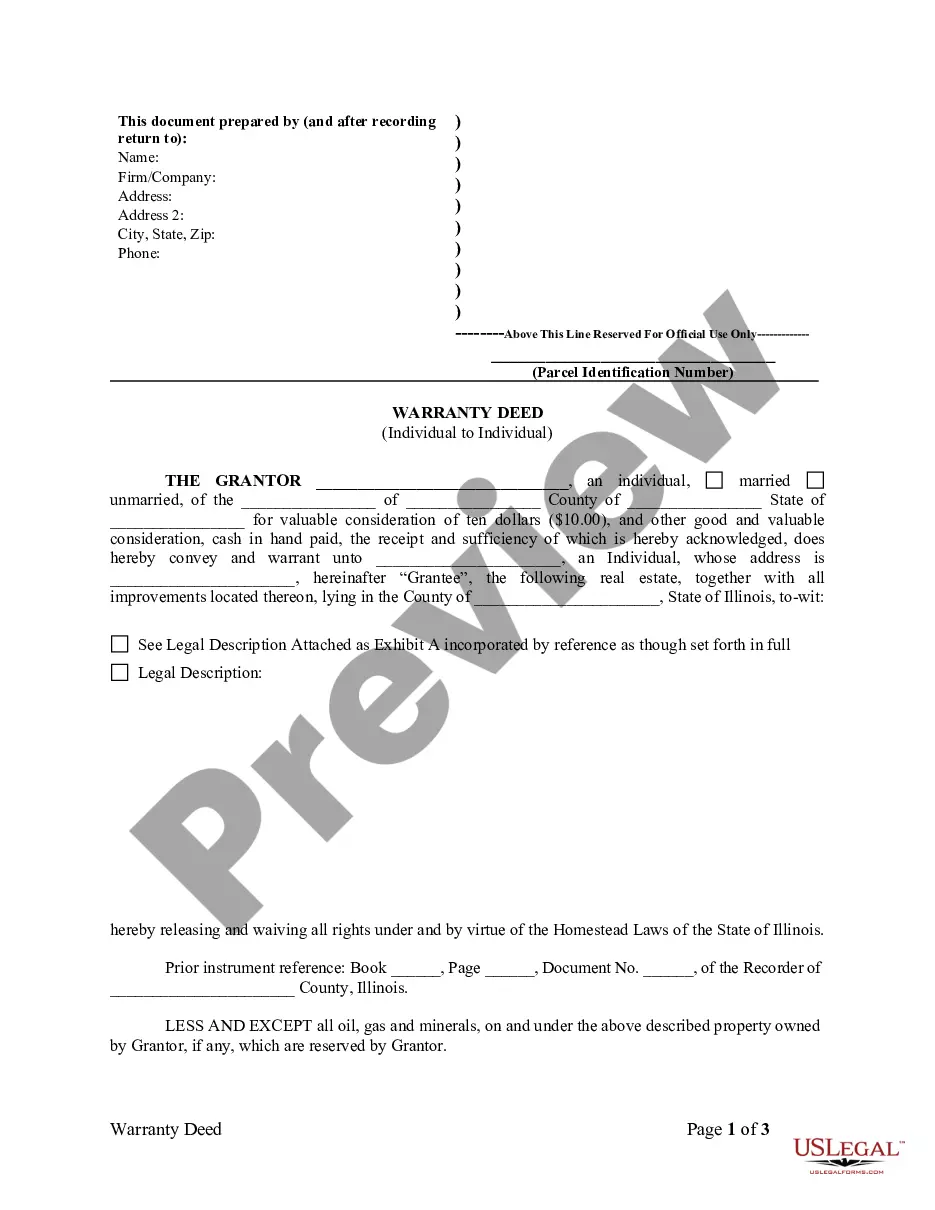

Chicago Illinois Warranty Deed from Individual to Individual

Description

How to fill out Illinois Warranty Deed From Individual To Individual?

If you have previously made use of our service, Log In to your account and store the Chicago Illinois Warranty Deed from Individual to Individual on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to all the documents you have purchased: you can find it in your profile within the My documents menu whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly locate and store any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Browse through the description and use the Preview feature, if available, to verify if it satisfies your needs. If it does not suit you, utilize the Search tab above to discover the correct one.

- Buy the template. Hit the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your Chicago Illinois Warranty Deed from Individual to Individual. Choose the file format for your document and download it to your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

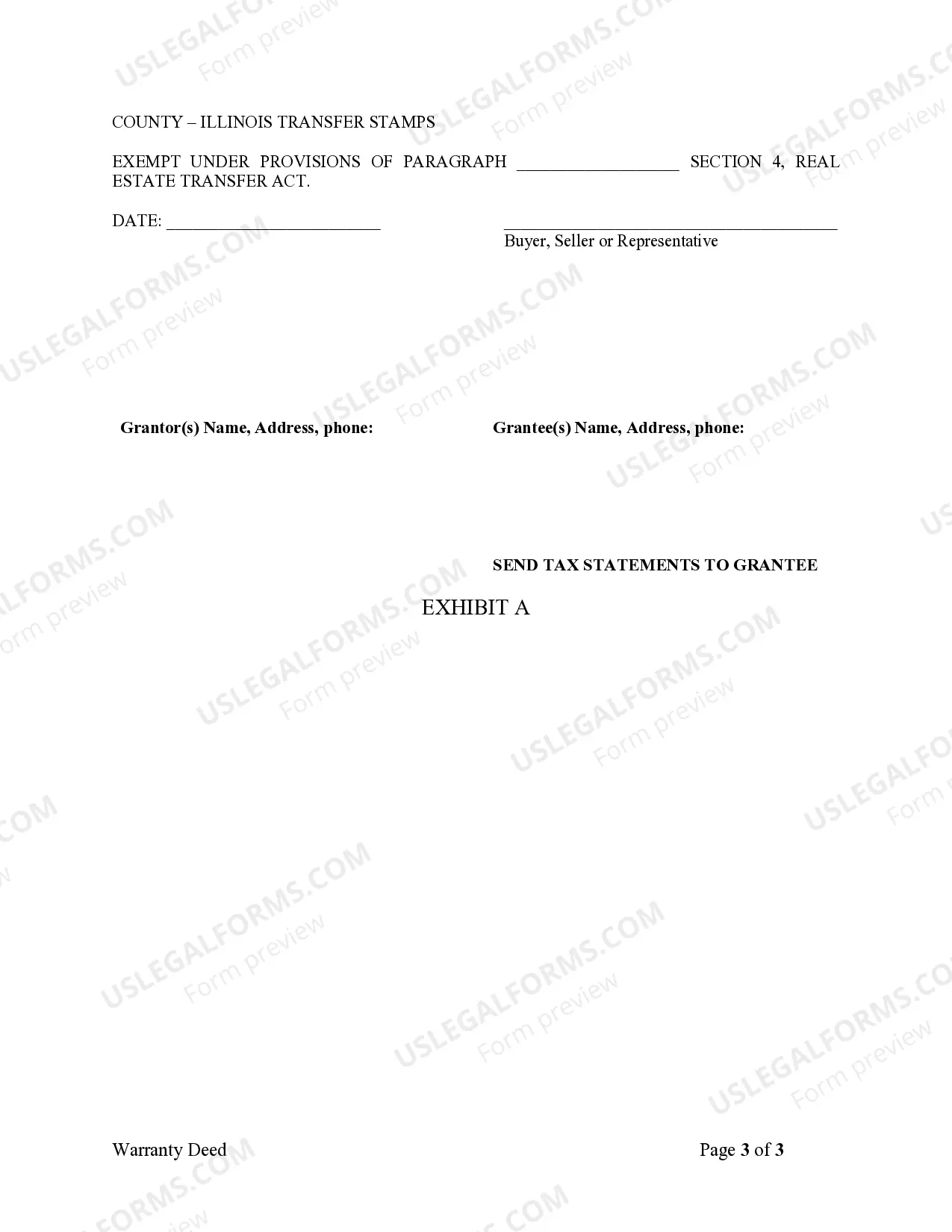

Tax Rate: $5.25 per $500.00 of the transfer price, or fraction thereof, of the real property or the beneficial interest in real property. In general, The Buyer is responsible for $3.75 and the Seller is responsible for $1.50.

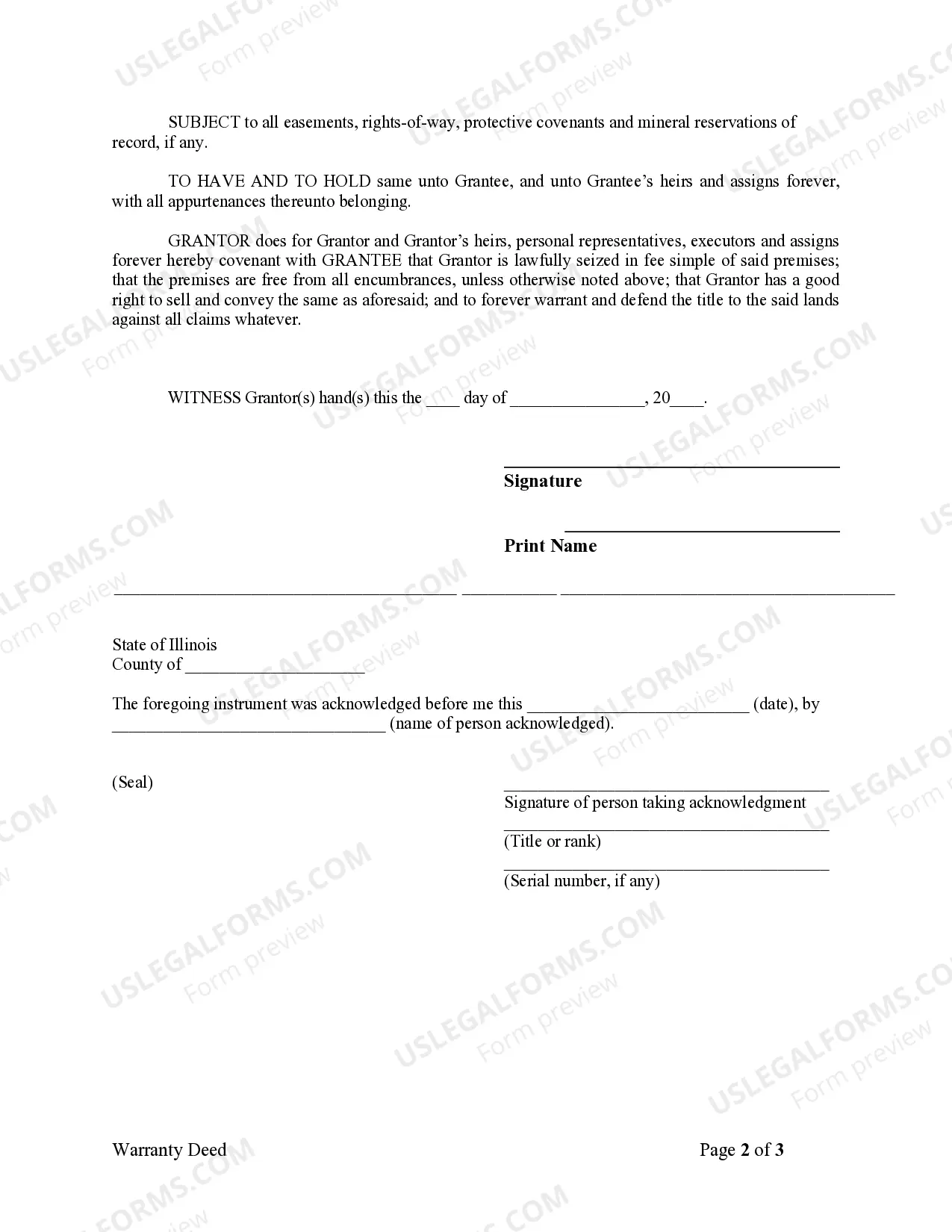

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

In most cases, the fees will amount to between £100 and £500 +VAT. Your conveyancer may or may not include cover for additional charges within their service.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.