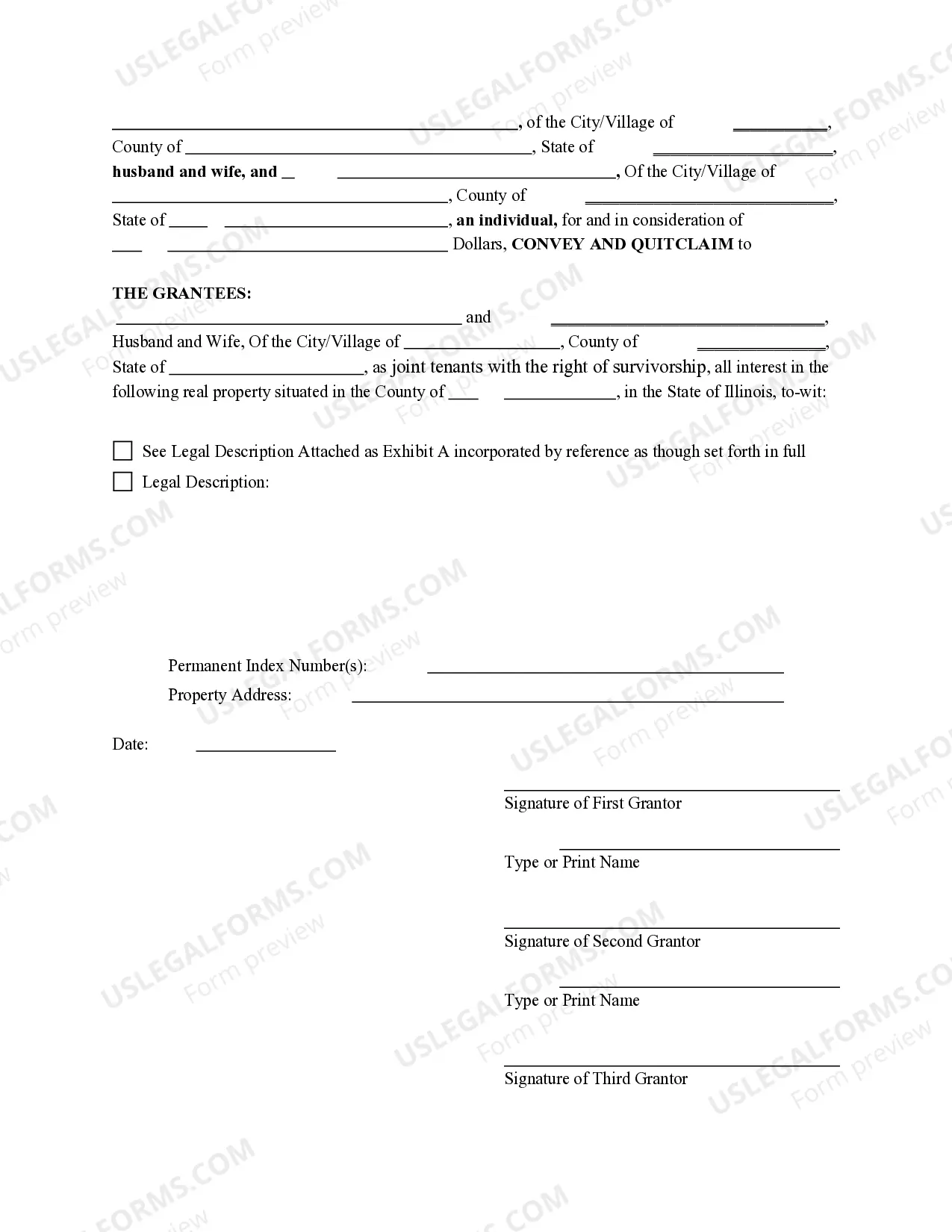

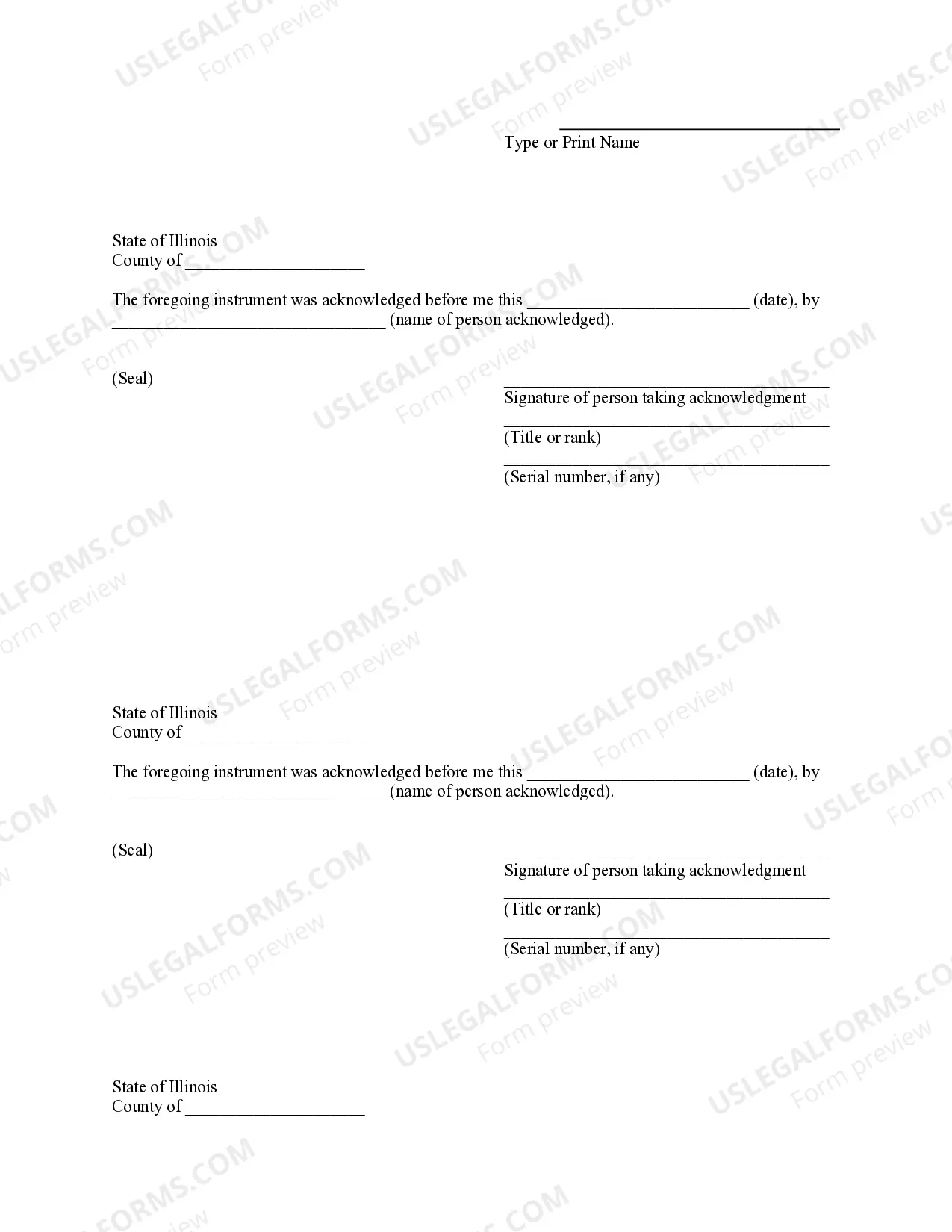

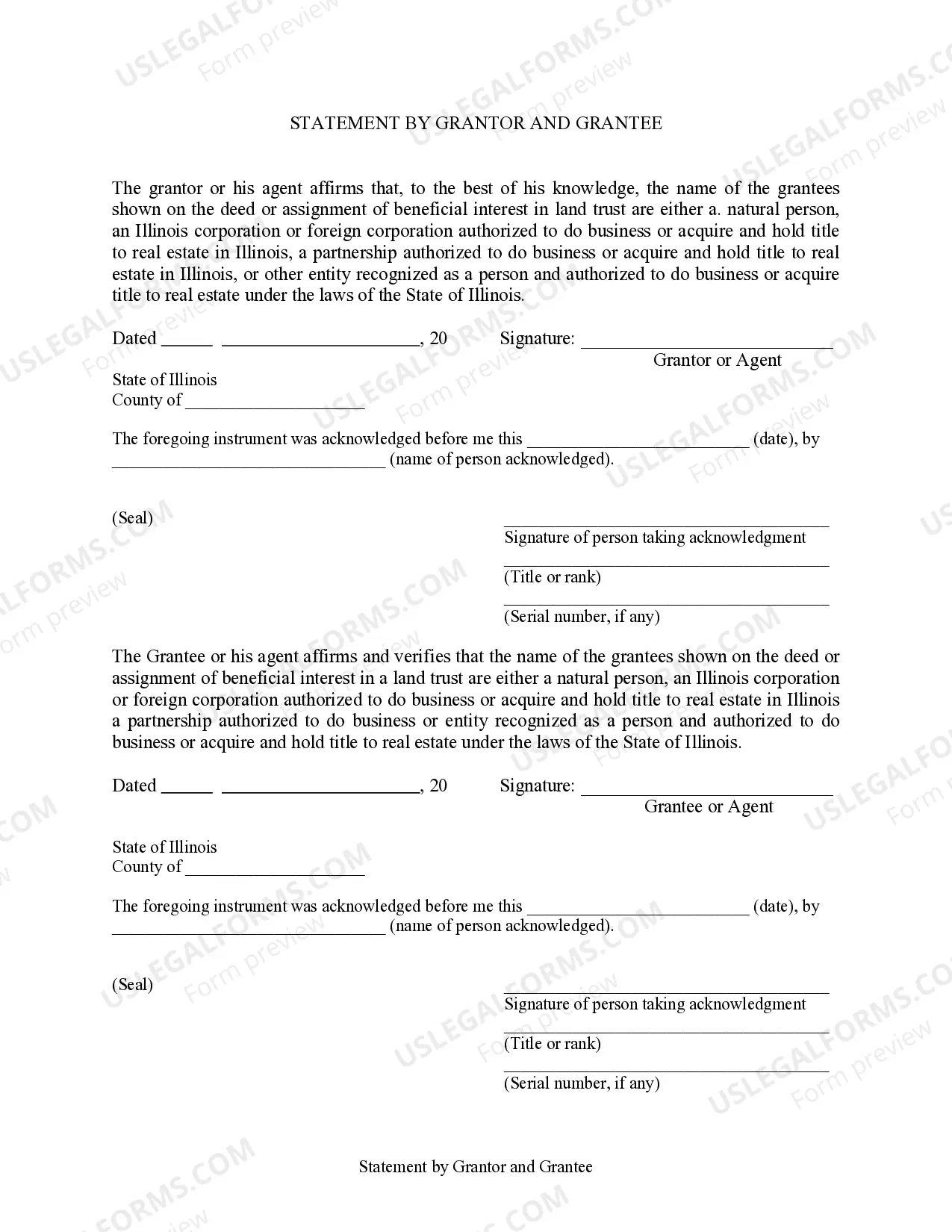

This form is a Quitclaim Deed where the Grantors are Husband, Wife and an Individual and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Title: Understanding Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife Keywords: Rockford Illinois, Quitclaim Deed, Husband, Wife, Individual, Property Transfer, Types Introduction: A Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife is a legal document utilized in real estate transactions within the state. It enables the transfer of property ownership rights from a husband, wife, and an individual to a husband and wife. In this article, we will explore the different types of Rockford Illinois Quitclaim Deeds pertaining to this specific scenario. Types of Rockford Illinois Quitclaim Deed — Husband, Wife, and an Individual to Husband and Wife: 1. Traditional Rockford Illinois Quitclaim Deed: This is the most common type of deed used in property transfers. It allows the owner (individual or couple) to release any claim or interest in the property to a husband and wife. The deed serves as evidence of a transfer from the original owners to the new owners, signifying a change in property ownership. 2. Marital Dissolution Rockford Illinois Quitclaim Deed: This type of quitclaim deed is used when a married couple decides to separate or divorce. It allows one spouse to relinquish their interest in the property to the other spouse and their new partner. It often requires the consent and approval of both parties involved. 3. Estate Planning Rockford Illinois Quitclaim Deed: This type of quitclaim deed is used when a couple wishes to transfer their property to themselves and the other spouse in order to establish joint ownership. It is often employed as part of the estate planning process to ensure the smooth transfer of assets upon the death of one spouse. It helps avoid probate and simplifies the distribution of property to the surviving spouse. 4. Tax and Debt Liability Rockford Illinois Quitclaim Deed: This type of quitclaim deed may be used when a husband, wife, and an individual wish to transfer property to a husband and wife for the purpose of sharing the tax and debt liabilities associated with the property. It allows for equal distribution of responsibility among the new owners. Conclusion: Understanding the different types of Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife is essential for individuals involved in property transfers. Whether it is a traditional deed, one related to marital dissolution, estate planning, or tax and debt liability, seeking professional legal advice is crucial to ensure a smooth and legally sound transfer. By utilizing the appropriate quitclaim deed, property owners can safeguard their rights while facilitating the accurate transfer of ownership.Title: Understanding Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife Keywords: Rockford Illinois, Quitclaim Deed, Husband, Wife, Individual, Property Transfer, Types Introduction: A Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife is a legal document utilized in real estate transactions within the state. It enables the transfer of property ownership rights from a husband, wife, and an individual to a husband and wife. In this article, we will explore the different types of Rockford Illinois Quitclaim Deeds pertaining to this specific scenario. Types of Rockford Illinois Quitclaim Deed — Husband, Wife, and an Individual to Husband and Wife: 1. Traditional Rockford Illinois Quitclaim Deed: This is the most common type of deed used in property transfers. It allows the owner (individual or couple) to release any claim or interest in the property to a husband and wife. The deed serves as evidence of a transfer from the original owners to the new owners, signifying a change in property ownership. 2. Marital Dissolution Rockford Illinois Quitclaim Deed: This type of quitclaim deed is used when a married couple decides to separate or divorce. It allows one spouse to relinquish their interest in the property to the other spouse and their new partner. It often requires the consent and approval of both parties involved. 3. Estate Planning Rockford Illinois Quitclaim Deed: This type of quitclaim deed is used when a couple wishes to transfer their property to themselves and the other spouse in order to establish joint ownership. It is often employed as part of the estate planning process to ensure the smooth transfer of assets upon the death of one spouse. It helps avoid probate and simplifies the distribution of property to the surviving spouse. 4. Tax and Debt Liability Rockford Illinois Quitclaim Deed: This type of quitclaim deed may be used when a husband, wife, and an individual wish to transfer property to a husband and wife for the purpose of sharing the tax and debt liabilities associated with the property. It allows for equal distribution of responsibility among the new owners. Conclusion: Understanding the different types of Rockford Illinois Quitclaim Deed — Husband, Wife and an Individual to Husband and Wife is essential for individuals involved in property transfers. Whether it is a traditional deed, one related to marital dissolution, estate planning, or tax and debt liability, seeking professional legal advice is crucial to ensure a smooth and legally sound transfer. By utilizing the appropriate quitclaim deed, property owners can safeguard their rights while facilitating the accurate transfer of ownership.