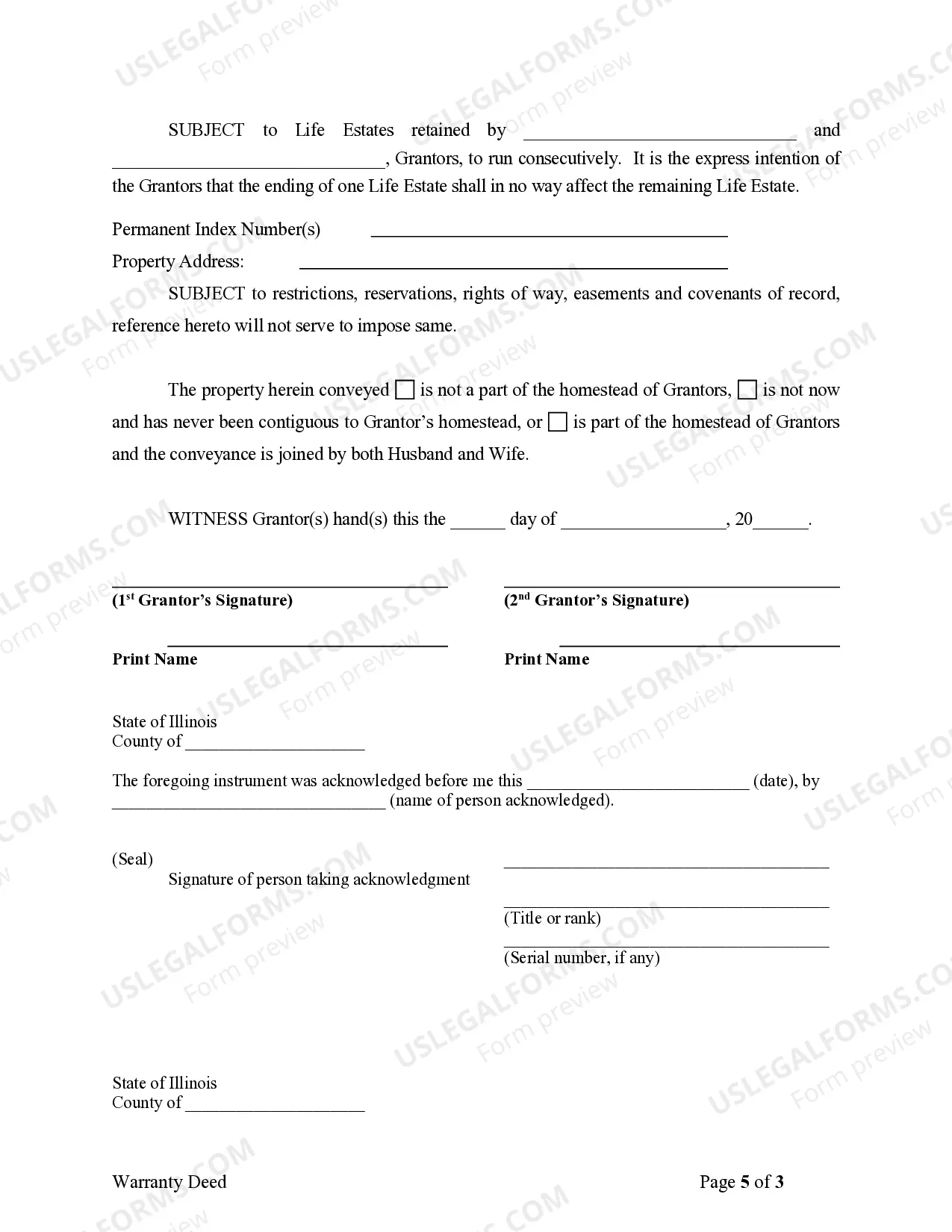

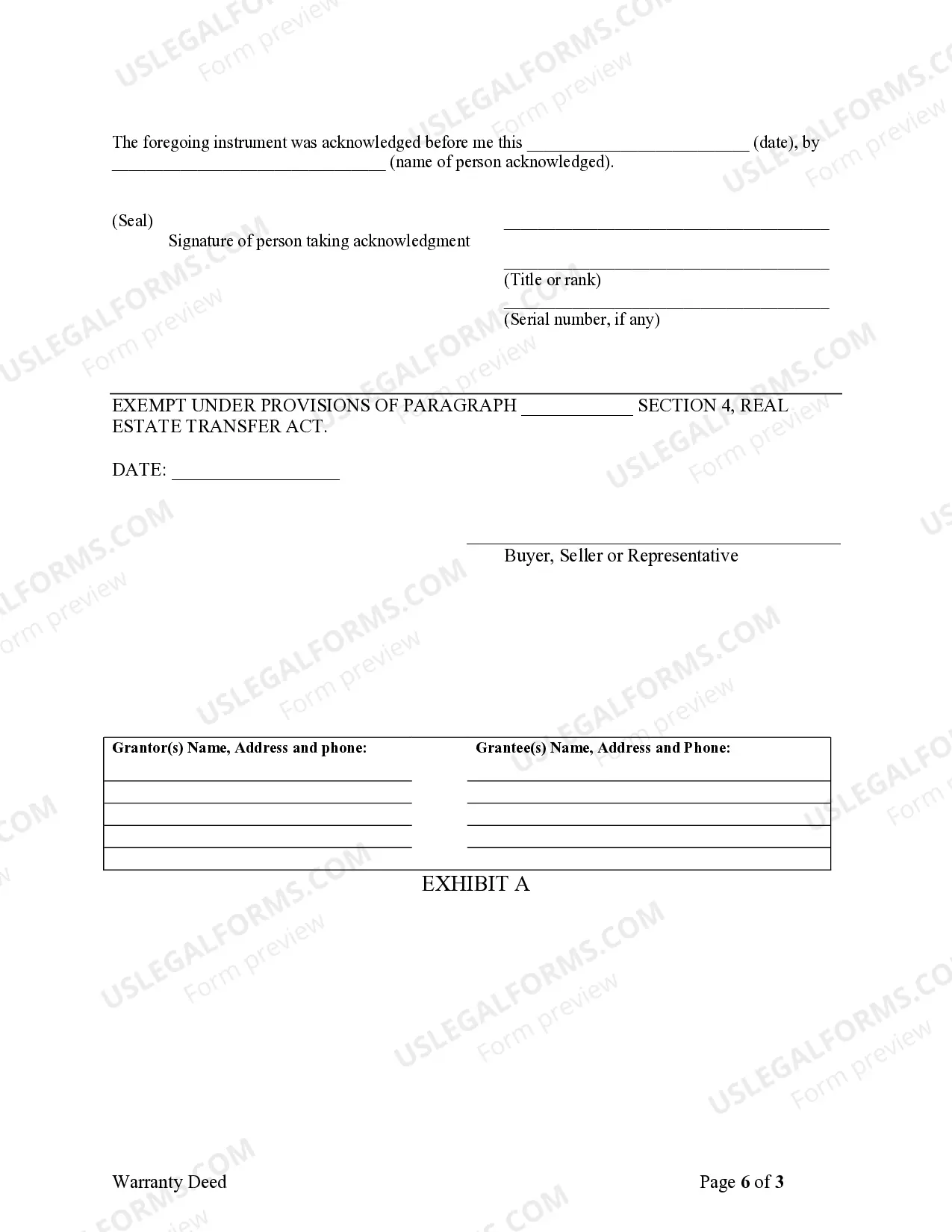

Title: Exploring the Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents: Types and Key Considerations Introduction: The Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents is a legal arrangement in real estate transactions that grants the child ownership rights to a property while allowing the parents to retain a life estate. This unique arrangement ensures that the child inherits the property in the future, while the parents can continue residing in it until they pass away. This article will delve into the different types of Elgin Illinois Warranty Deeds to Child Reserving a Life Estate in the Parents and provide key considerations related to this arrangement. 1. Traditional Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents: This type of warranty deed is a commonly used legal instrument that establishes ownership of the property with the child while reserving a life estate for the parents. It ensures a smooth transfer of ownership upon the parents' passing, avoiding probate. 2. Joint Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents: In this arrangement, both parents are listed as joint owners of the property, with the child as the beneficiary. This type allows both parents to retain the right to reside in the property and enjoy the benefits of ownership until both parents pass away. 3. Revocable Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents: This type of warranty deed allows the parents to retain the right to revoke the life estate at any time during their lives. It offers more flexibility and control regarding the property's ownership and its disposal. Key Considerations for Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents: 1. Legal expertise: It is crucial to consult an experienced real estate attorney to ensure the proper drafting and execution of the warranty deed, considering all legal requirements and implications. 2. Understanding life estate rights: Both parents and child should have a clear understanding of the parents' rights to occupy and use the property during their lifetime. It is advisable to establish expectations and obligations to avoid potential conflicts. 3. Estate planning implications: The Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents may have implications for estate planning. Parents should consider working with an estate planning attorney to ensure this arrangement aligns with their broader estate planning goals. 4. Tax implications: It is essential to consult a tax professional to understand any potential tax consequences, such as property tax reassessments, gift tax implications, or capital gains tax, resulting from the warranty deed transfer and the parents' continued life tenancy. Conclusion: The Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents offers a unique solution for transferring property ownership while ensuring the parents' ability to reside in the property until their passing. Understanding the different types of warranty deeds and considering the legal and financial implications are crucial steps in implementing this arrangement effectively. Working with knowledgeable professionals can help navigate the complexities and ensure a smooth and legally sound transition of property ownership.

Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents

Description

How to fill out Elgin Illinois Warranty Deed To Child Reserving A Life Estate In The Parents?

Do you need a reliable and affordable legal forms provider to buy the Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, find the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is intended for.

- Restart the search if the form isn’t good for your legal situation.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Elgin Illinois Warranty Deed to Child Reserving a Life Estate in the Parents in any available format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online for good.