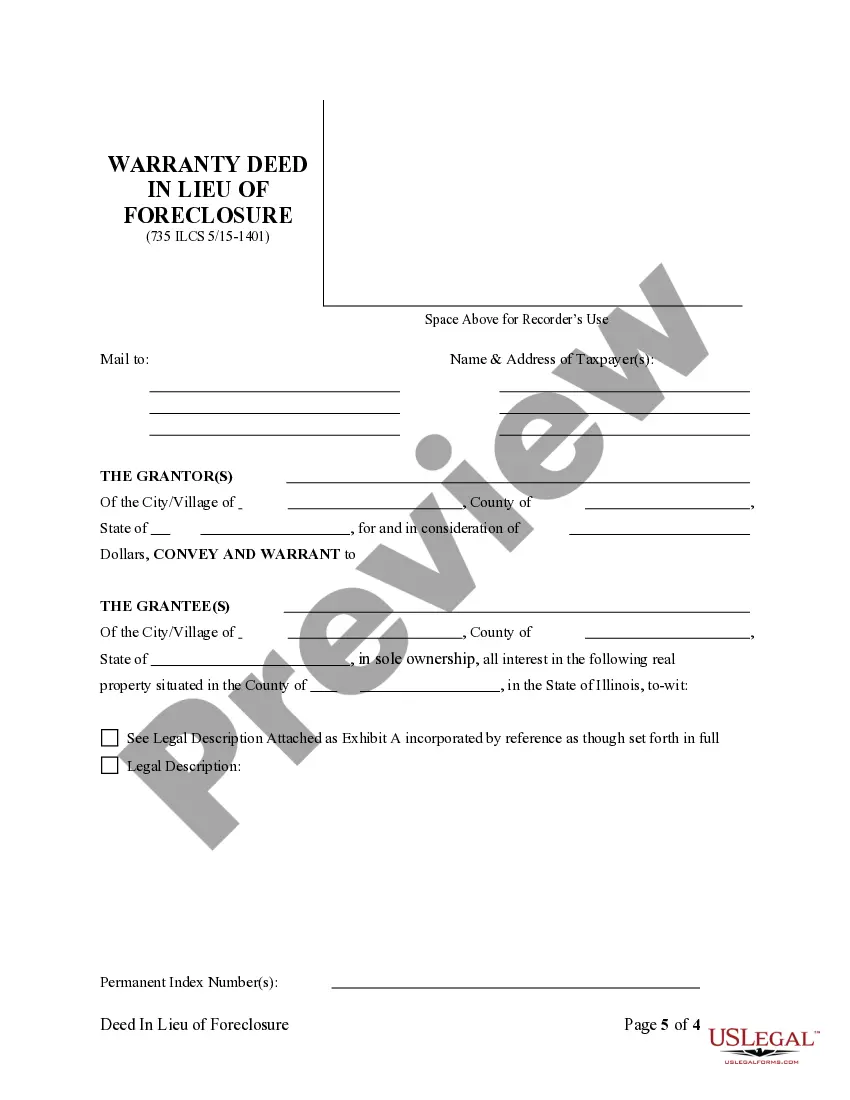

This form is a Warranty Deed where the grantor(s) transfer all interest in the real property to the grantee(s) in lieu or in place of foreclosure. This deed complies with all state statutory laws.

Joliet Illinois Warranty Deed in Lieu of Foreclosure

Description

How to fill out Illinois Warranty Deed In Lieu Of Foreclosure?

If you’ve previously employed our service, sign in to your account and download the Joliet Illinois Warranty Deed in Lieu of Foreclosure onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

In case this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Make use of the US Legal Forms service to effortlessly discover and save any template for your personal or professional requirements!

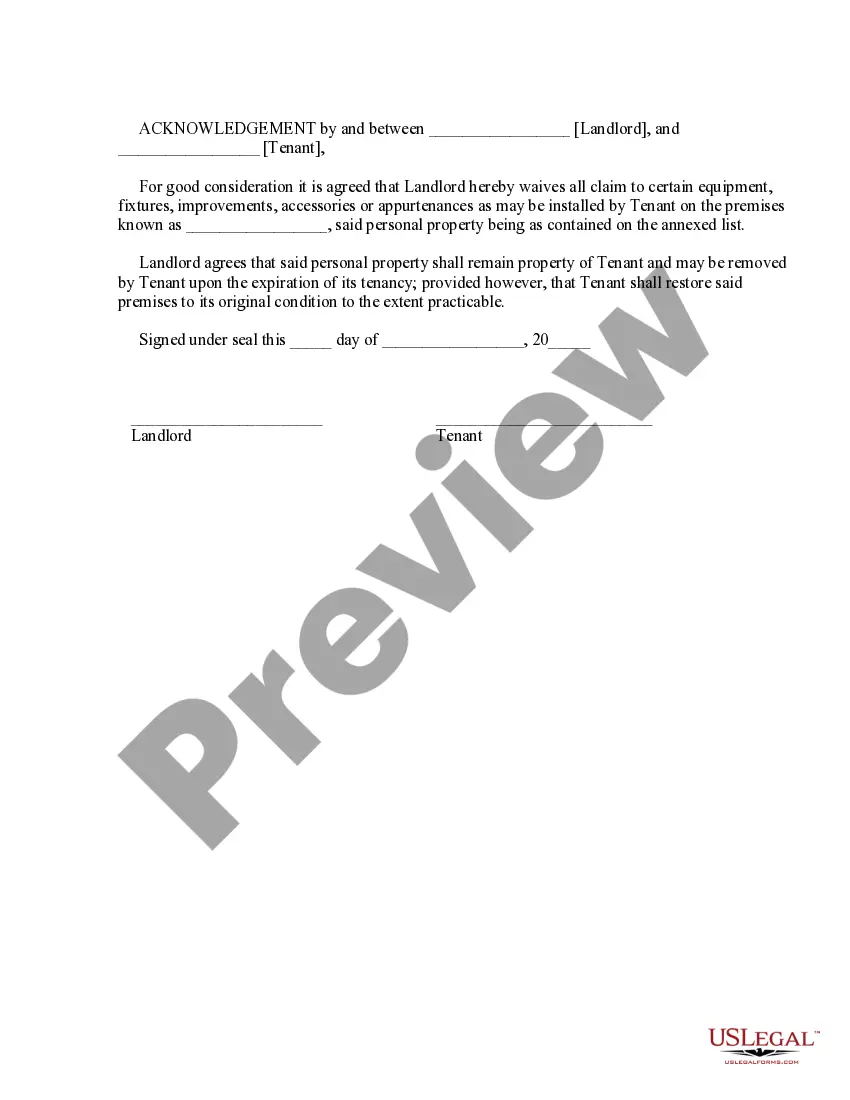

- Verify you’ve found an appropriate document. Browse through the description and utilize the Preview option, if available, to see if it satisfies your requirements. If it doesn’t suit you, employ the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Receive your Joliet Illinois Warranty Deed in Lieu of Foreclosure. Select the file format for your document and save it to your device.

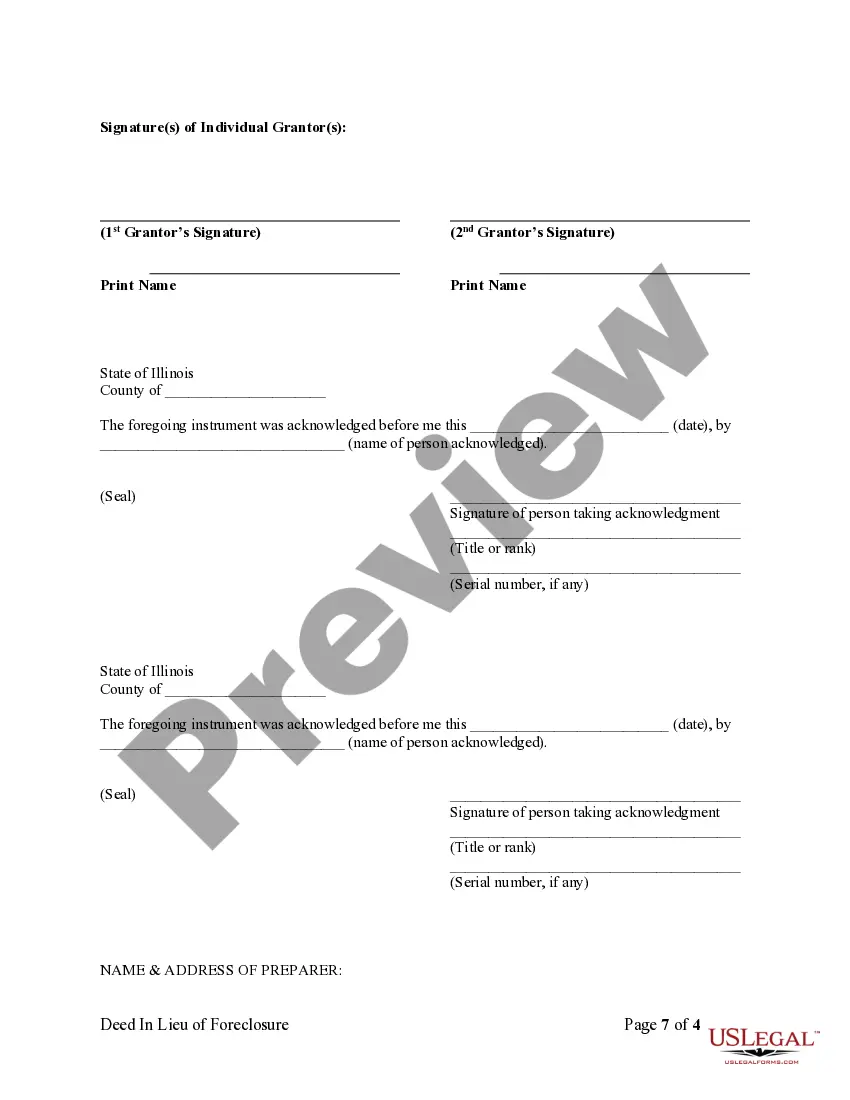

- Finalize your template. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

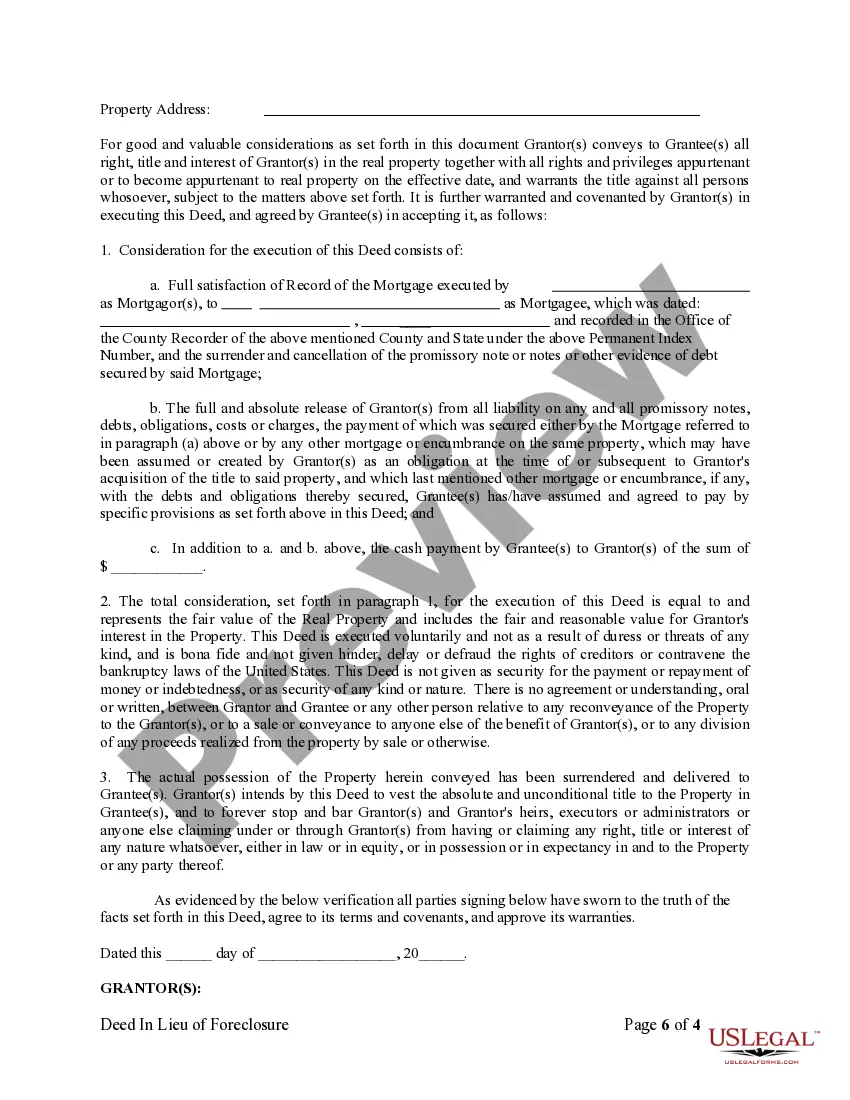

A Joliet Illinois Warranty Deed in Lieu of Foreclosure example involves a homeowner who is unable to continue mortgage payments and chooses to transfer their property back to the lender to avoid foreclosure. In this scenario, the homeowner typically provides the lender with a deed that relinquishes their ownership. This process alleviates the burden of foreclosure on the homeowner while allowing the lender to acquire the property directly. Resources like US Legal Forms can help you understand the nuances and prepare the necessary documents effectively.

Filing a Joliet Illinois Warranty Deed in Lieu of Foreclosure requires a few key steps. First, gather all essential documents, including your mortgage information and evidence of the property's condition. Next, you’ll need to contact your lender to express your intention and follow their specific requirements. Using platforms like US Legal Forms can simplify this process, as they offer templates and guidance to ensure you file correctly.

The duration of the Joliet Illinois Warranty Deed in Lieu of Foreclosure process can vary significantly depending on several factors, including the lender's response time and the completeness of your documentation. Generally, this process can take anywhere from a few weeks to a couple of months. However, if the paperwork is in order and the parties communicate effectively, it can be expedited. Being prepared can help you navigate this timeline with ease.

After completing a deed in lieu of foreclosure, you may be eligible to buy a house again in about two to four years, depending on the lender's policies. This timeframe may vary based on how you manage your credit and financial recovery during that period. If you're interested in accelerating your return to homeownership, consider using tools and resources available through platforms like uslegalforms, which can help you navigate the necessary steps towards a Joliet Illinois Warranty Deed in Lieu of Foreclosure.

In Illinois, a deed in lieu of foreclosure is a legal agreement in which a homeowner voluntarily hands over their property to the lender in exchange for forgiveness of the mortgage debt. This process can prevent lengthy foreclosure proceedings and provide a smoother exit from ownership. If you're facing financial difficulties and considering this route, a Joliet Illinois Warranty Deed in Lieu of Foreclosure can be an effective solution. It’s advisable to consult with legal professionals to guide you through the process.

While a deed in lieu of foreclosure can simplify the process of relinquishing property, there are disadvantages to consider. You may experience a negative impact on your credit score, limiting your borrowing options. Additionally, if you have other liens on the property, they may not be wiped away with a Joliet Illinois Warranty Deed in Lieu of Foreclosure. It’s essential to weigh these factors before making your decision.

A deed in lieu of foreclosure typically remains on your credit report for about seven years. This can significantly impact your ability to secure future loans or credit during this time. If you're dealing with a Joliet Illinois Warranty Deed in Lieu of Foreclosure, understanding the credit implications is crucial for planning your financial future. Being proactive about rebuilding your credit can help you move past this situation.

A lender does not have to accept a Joliet Illinois Warranty Deed in Lieu of Foreclosure, as acceptance depends on their policies and the borrower's situation. It's important for homeowners to communicate openly with their lenders regarding financial difficulties and the potential for a deed in lieu. If accepted, this option can help both parties avoid the lengthy foreclosure process. Using tools from US Legal Forms can assist in preparing necessary documents to present to your lender.

To process a Joliet Illinois Warranty Deed in Lieu of Foreclosure, the property owner must first consult with their lender to discuss eligibility. Once an agreement is reached, you’ll need to complete the required paperwork, including the deed itself. Afterward, submit the documents to your local county recorder’s office for official recording. US Legal Forms offers a straightforward way to navigate the paperwork involved in this process.

Executing a Joliet Illinois Warranty Deed in Lieu of Foreclosure starts with a mutual agreement between the homeowner and the lender. Both parties must agree on the terms, and the homeowner should prepare the deed document. It’s crucial to have the deed signed in front of a notary, followed by filing it with the county office. Consider utilizing platforms like US Legal Forms for reliable templates and guidance throughout the process.