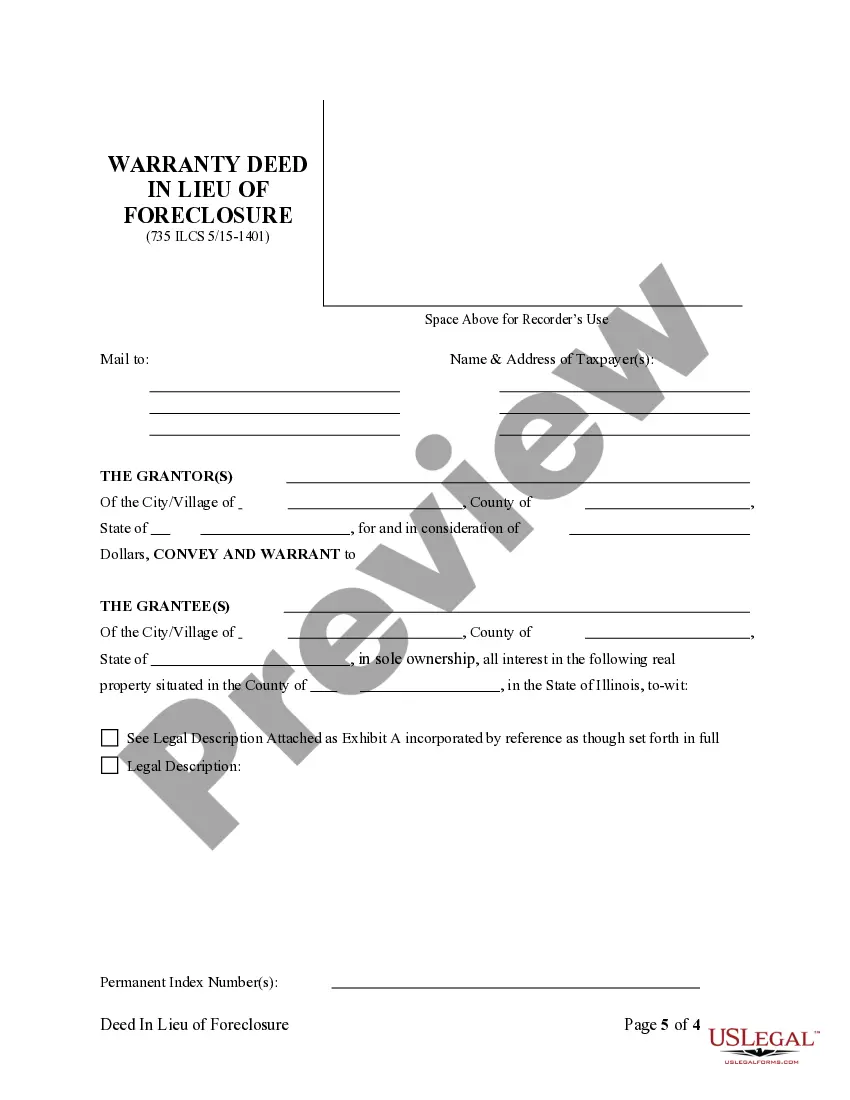

This form is a Warranty Deed where the grantor(s) transfer all interest in the real property to the grantee(s) in lieu or in place of foreclosure. This deed complies with all state statutory laws.

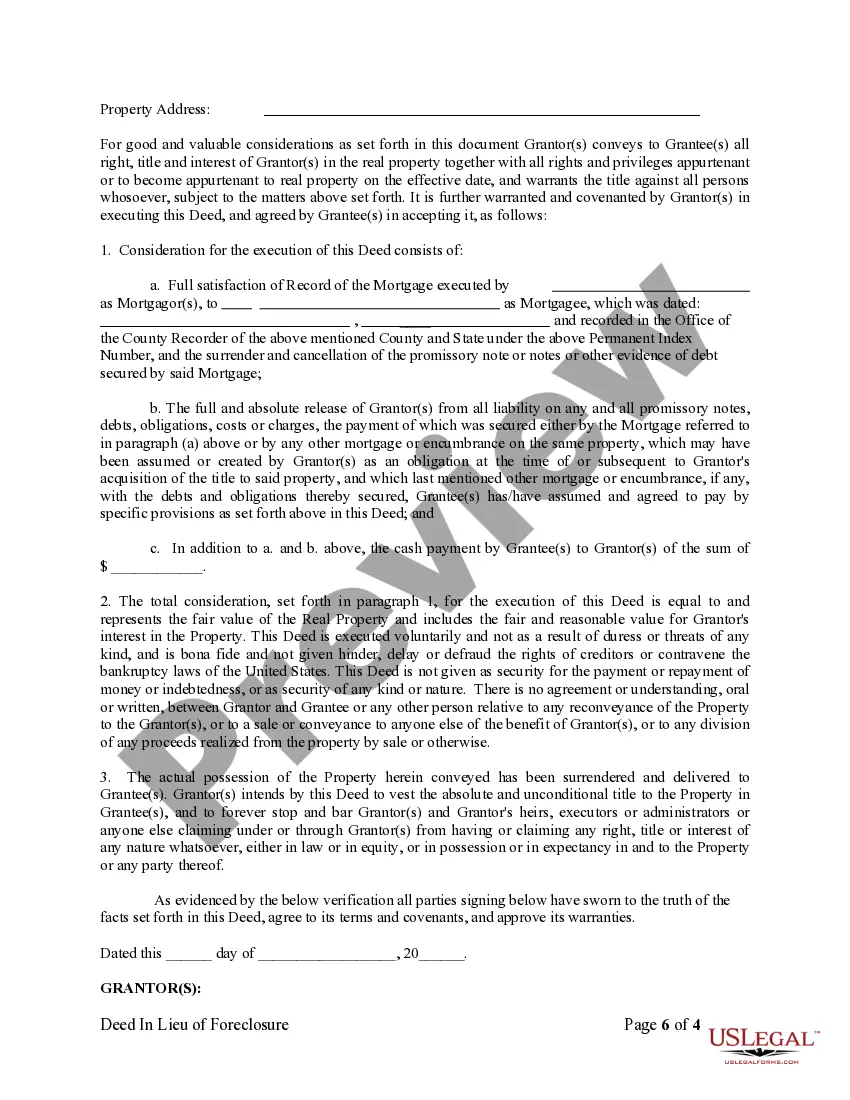

Rockford Illinois Warranty Deed in Lieu of Foreclosure is a legal document that serves as an alternative to foreclosure when a homeowner is unable to meet their mortgage obligations. It transfers ownership of the property to the lender or mortgage holder, releasing the homeowner from any further obligations associated with the mortgage. In Rockford, Illinois, there are two common types of Warranty Deed in Lieu of Foreclosure: 1. Full-Warranty Deed in Lieu of Foreclosure: This type of deed provides the lender with full possession and ownership of the property. It guarantees that the property is free from any encumbrances or claims, and the lender assumes all rights and responsibilities associated with the property. 2. Limited-Warranty Deed in Lieu of Foreclosure: Unlike the full-warranty deed, this type of deed does not provide the same level of guarantees regarding the property's title. It means that the lender assumes ownership with certain limitations or exceptions. These limitations may include claims or encumbrances that were previously existing on the property. The process of executing a Rockford Illinois Warranty Deed in Lieu of Foreclosure begins with the homeowner and the lender mutually agreeing to pursue this alternative instead of foreclosure. The homeowner voluntarily transfers the property title to the lender, and in return, the lender agrees to release the homeowner from any further mortgage obligations. To initiate the process, both parties must enter into a written agreement outlining the terms and conditions of the deed in lieu of foreclosure. This agreement should clearly state the property address, the outstanding loan balance, and any additional provisions or considerations. Once the agreement is established, it is essential to seek legal advice and assistance to ensure all necessary documentation is prepared correctly. The lender may require various documents, including the warranty deed, a hardship letter explaining the homeowner's inability to fulfill the mortgage obligations, financial statements, and any other supporting documents deemed necessary. It's important to note that pursuing a Warranty Deed in Lieu of Foreclosure can have significant implications for the homeowner's credit history and future ability to obtain credit. It is advisable to consult with a financial advisor or credit counselor to fully understand the potential consequences of proceeding with this option. In summary, a Rockford Illinois Warranty Deed in Lieu of Foreclosure is a legal instrument that transfers property ownership from a homeowner to a lender, releasing the homeowner from further mortgage obligations. The two common types of deeds are the full-warranty deed, which guarantees a clean title transfer, and the limited-warranty deed, which may have certain limitations or exceptions. Seeking professional guidance is crucial to navigate the process effectively and consider the potential ramifications.Rockford Illinois Warranty Deed in Lieu of Foreclosure is a legal document that serves as an alternative to foreclosure when a homeowner is unable to meet their mortgage obligations. It transfers ownership of the property to the lender or mortgage holder, releasing the homeowner from any further obligations associated with the mortgage. In Rockford, Illinois, there are two common types of Warranty Deed in Lieu of Foreclosure: 1. Full-Warranty Deed in Lieu of Foreclosure: This type of deed provides the lender with full possession and ownership of the property. It guarantees that the property is free from any encumbrances or claims, and the lender assumes all rights and responsibilities associated with the property. 2. Limited-Warranty Deed in Lieu of Foreclosure: Unlike the full-warranty deed, this type of deed does not provide the same level of guarantees regarding the property's title. It means that the lender assumes ownership with certain limitations or exceptions. These limitations may include claims or encumbrances that were previously existing on the property. The process of executing a Rockford Illinois Warranty Deed in Lieu of Foreclosure begins with the homeowner and the lender mutually agreeing to pursue this alternative instead of foreclosure. The homeowner voluntarily transfers the property title to the lender, and in return, the lender agrees to release the homeowner from any further mortgage obligations. To initiate the process, both parties must enter into a written agreement outlining the terms and conditions of the deed in lieu of foreclosure. This agreement should clearly state the property address, the outstanding loan balance, and any additional provisions or considerations. Once the agreement is established, it is essential to seek legal advice and assistance to ensure all necessary documentation is prepared correctly. The lender may require various documents, including the warranty deed, a hardship letter explaining the homeowner's inability to fulfill the mortgage obligations, financial statements, and any other supporting documents deemed necessary. It's important to note that pursuing a Warranty Deed in Lieu of Foreclosure can have significant implications for the homeowner's credit history and future ability to obtain credit. It is advisable to consult with a financial advisor or credit counselor to fully understand the potential consequences of proceeding with this option. In summary, a Rockford Illinois Warranty Deed in Lieu of Foreclosure is a legal instrument that transfers property ownership from a homeowner to a lender, releasing the homeowner from further mortgage obligations. The two common types of deeds are the full-warranty deed, which guarantees a clean title transfer, and the limited-warranty deed, which may have certain limitations or exceptions. Seeking professional guidance is crucial to navigate the process effectively and consider the potential ramifications.