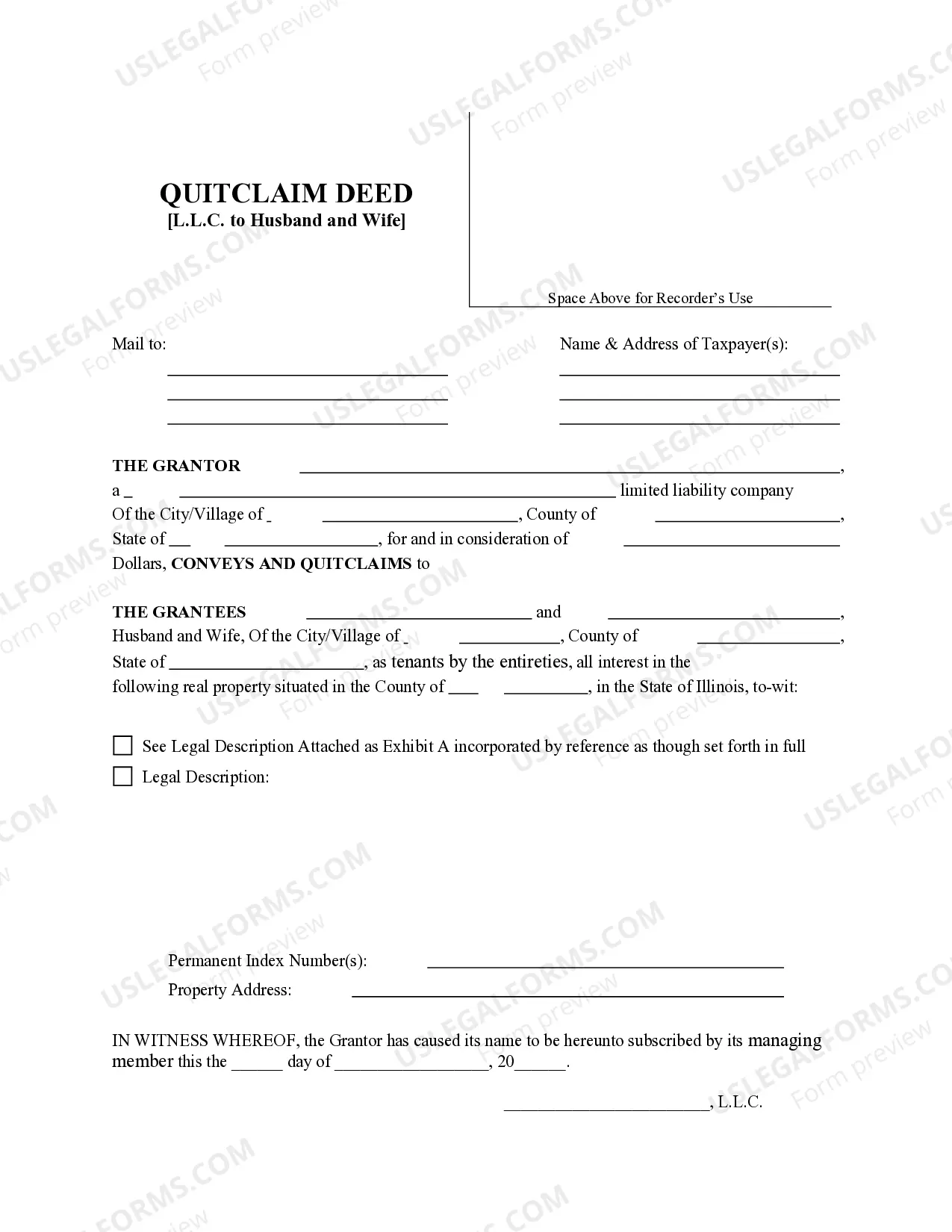

This form is a Quitclaim Deed where the Grantor is a Limited Liability Company and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Chicago Illinois Quitclaim Deed - Limited Liability Company to Husband and Wife

Description

How to fill out Illinois Quitclaim Deed - Limited Liability Company To Husband And Wife?

Regardless of social or professional standing, filling out legal documents is a regrettable requirement in today's working environment.

Frequently, it’s nearly unfeasible for an individual without any legal schooling to create such forms from the ground up, primarily because of the intricate jargon and legal subtleties they include.

This is where US Legal Forms steps in to help.

Confirm the form you have located is applicable to your location since the laws of one state or region do not apply to another state or area.

Review the document and examine a brief summary (if available) of situations where the document can be utilized.

- Our platform boasts an extensive library with over 85,000 ready-to-use state-specific forms suitable for nearly any legal matter.

- US Legal Forms also serves as an invaluable resource for associates or legal advisors looking to save time by utilizing our DIY forms.

- Whether you need the Chicago Illinois Quitclaim Deed - Limited Liability Company to Husband and Wife or any other document that is valid in your area, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Chicago Illinois Quitclaim Deed - Limited Liability Company to Husband and Wife in just minutes using our reliable platform.

- If you are already a subscriber, you can go ahead to Log In to your account and access the required form.

- However, if you are new to our library, make sure to follow these actions before acquiring the Chicago Illinois Quitclaim Deed - Limited Liability Company to Husband and Wife.

Form popularity

FAQ

If the wife's name is not on the deed, it doesn't matter. It's still marital property because it was bought during the marriage. This makes it marital property and is still split between both parties. The wife is entitled to receive either equal share or equitable share of the house.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

The Illinois quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

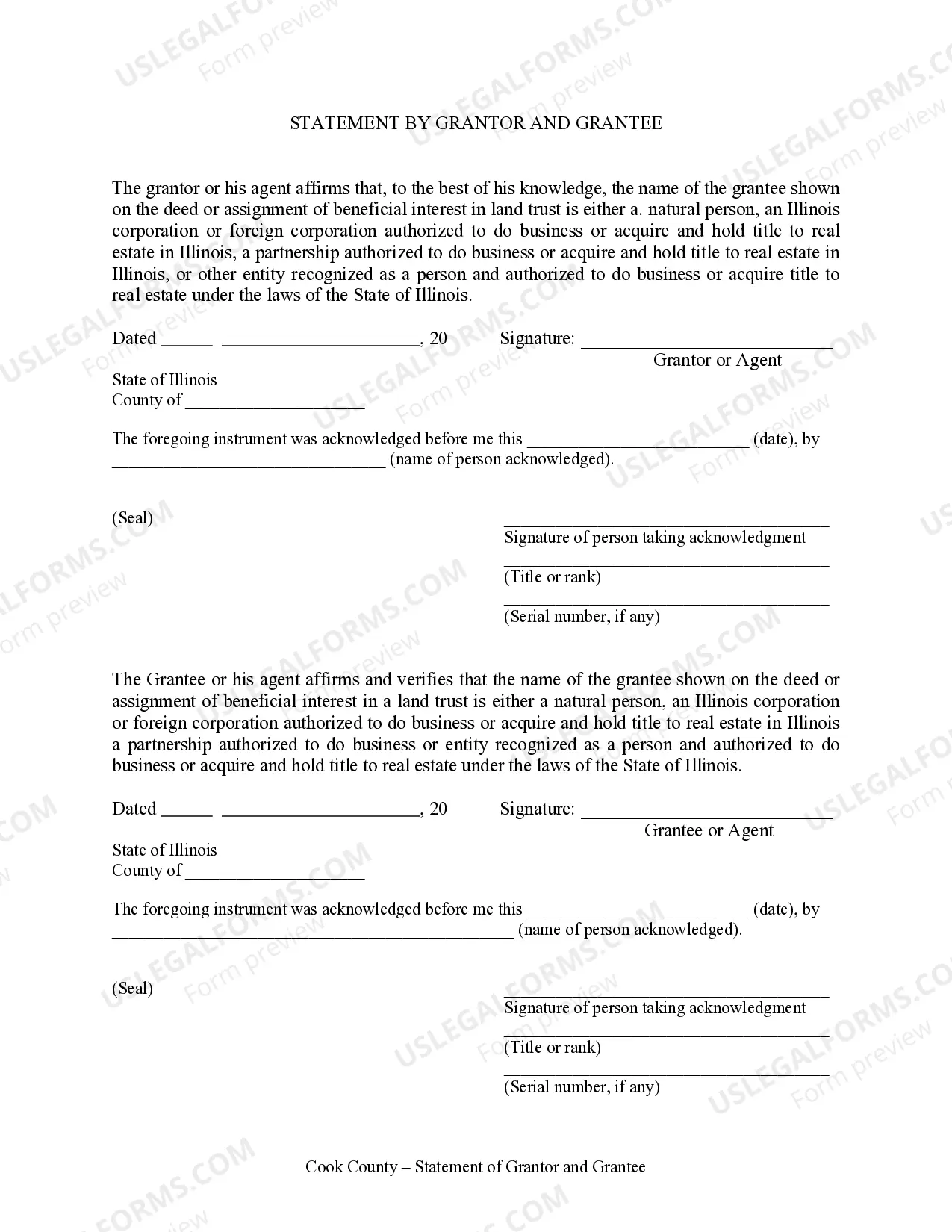

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

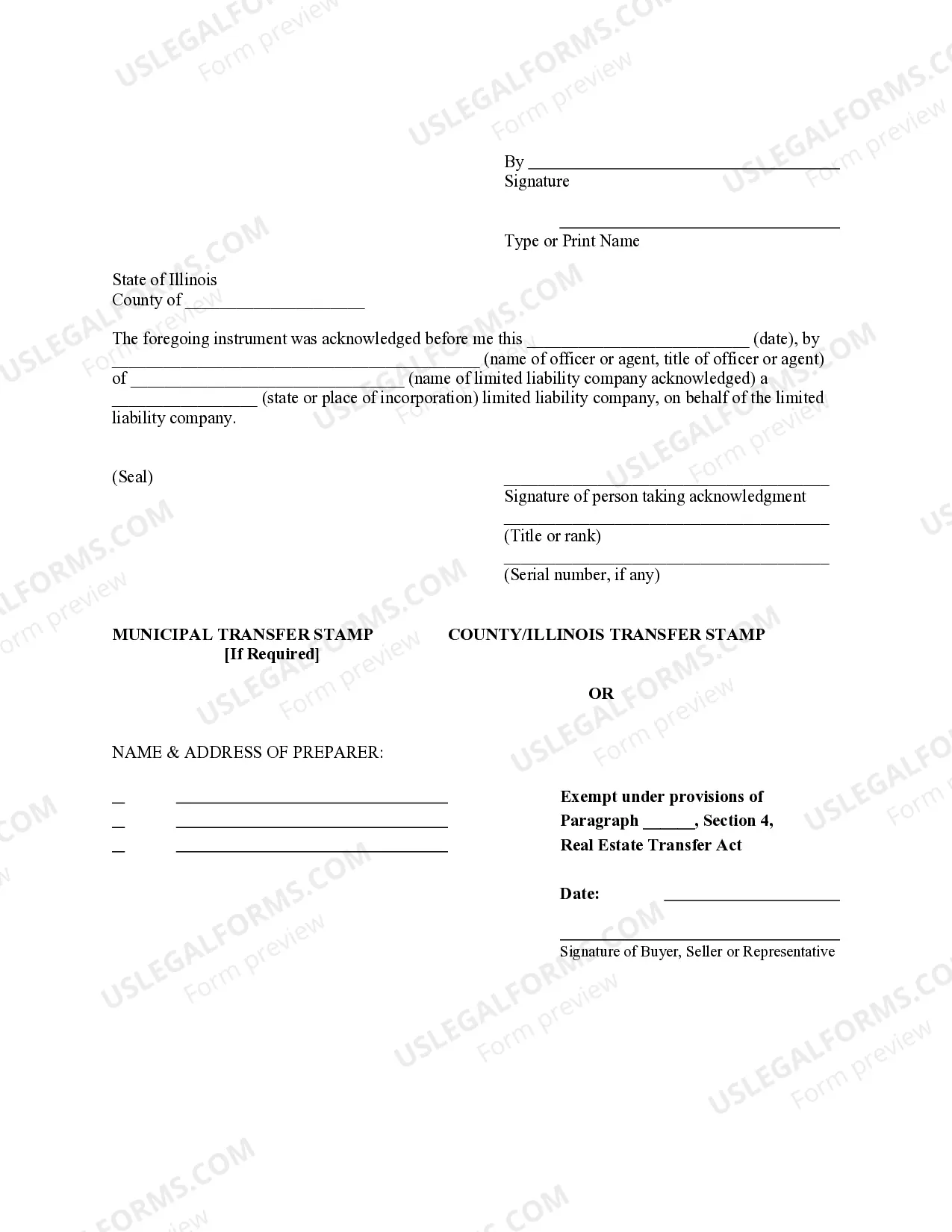

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

One issue with using a quitclaim deed in a divorce case is that Illinois has homestead rights. In Illinois, homestead rights mean that spouses who use the property as their primary residence cannot be removed from the deed unless there's a court order or if the spouse waives their homestead rights.