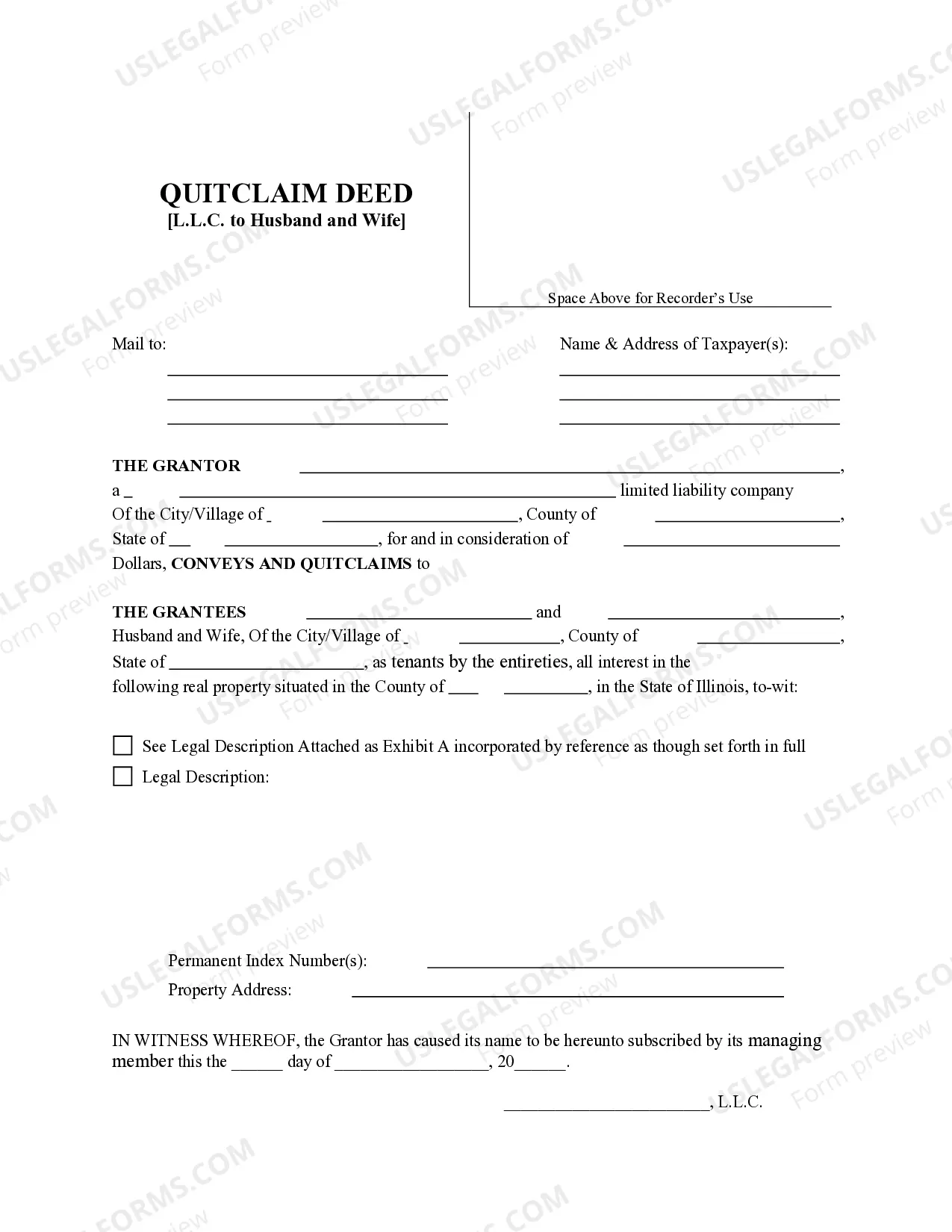

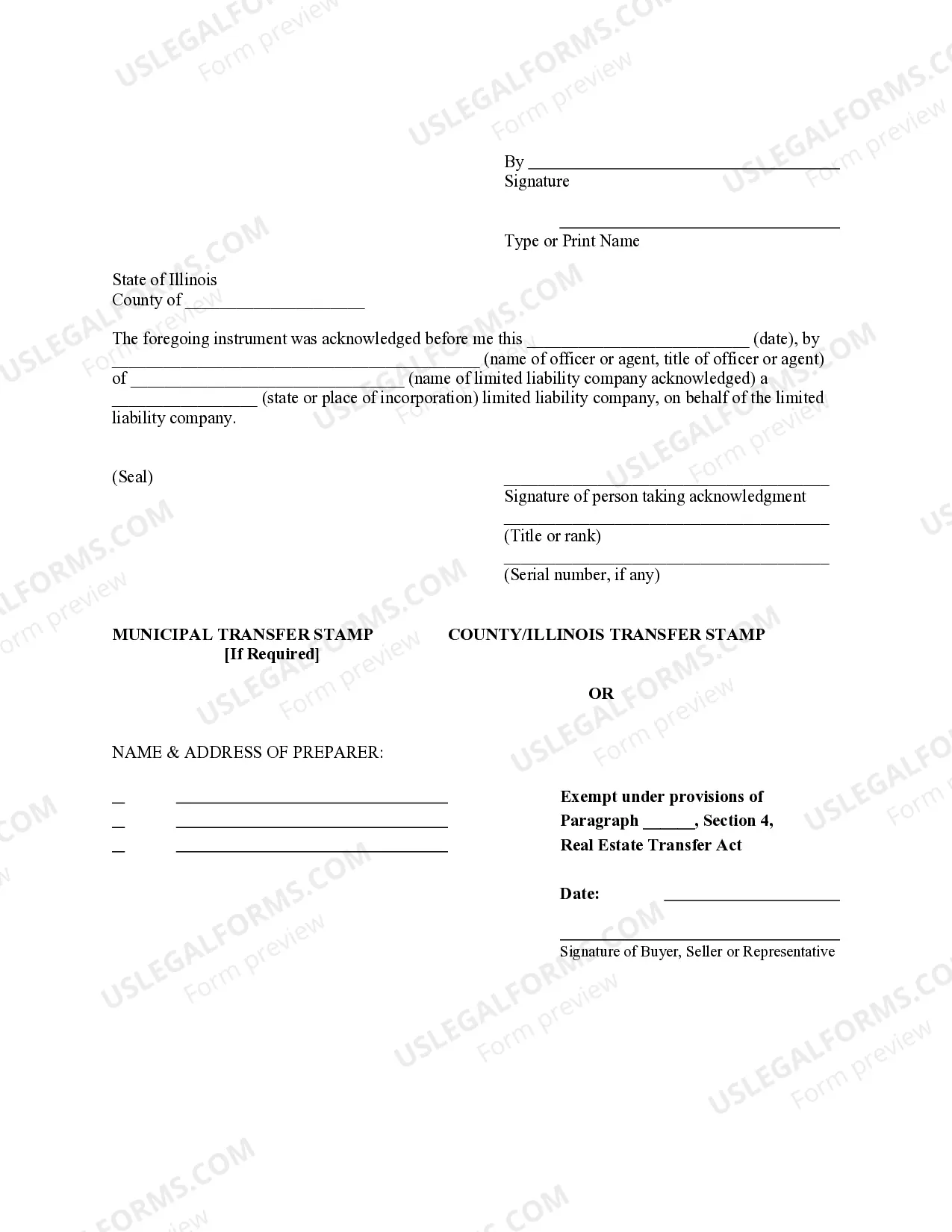

This form is a Quitclaim Deed where the Grantor is a Limited Liability Company and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

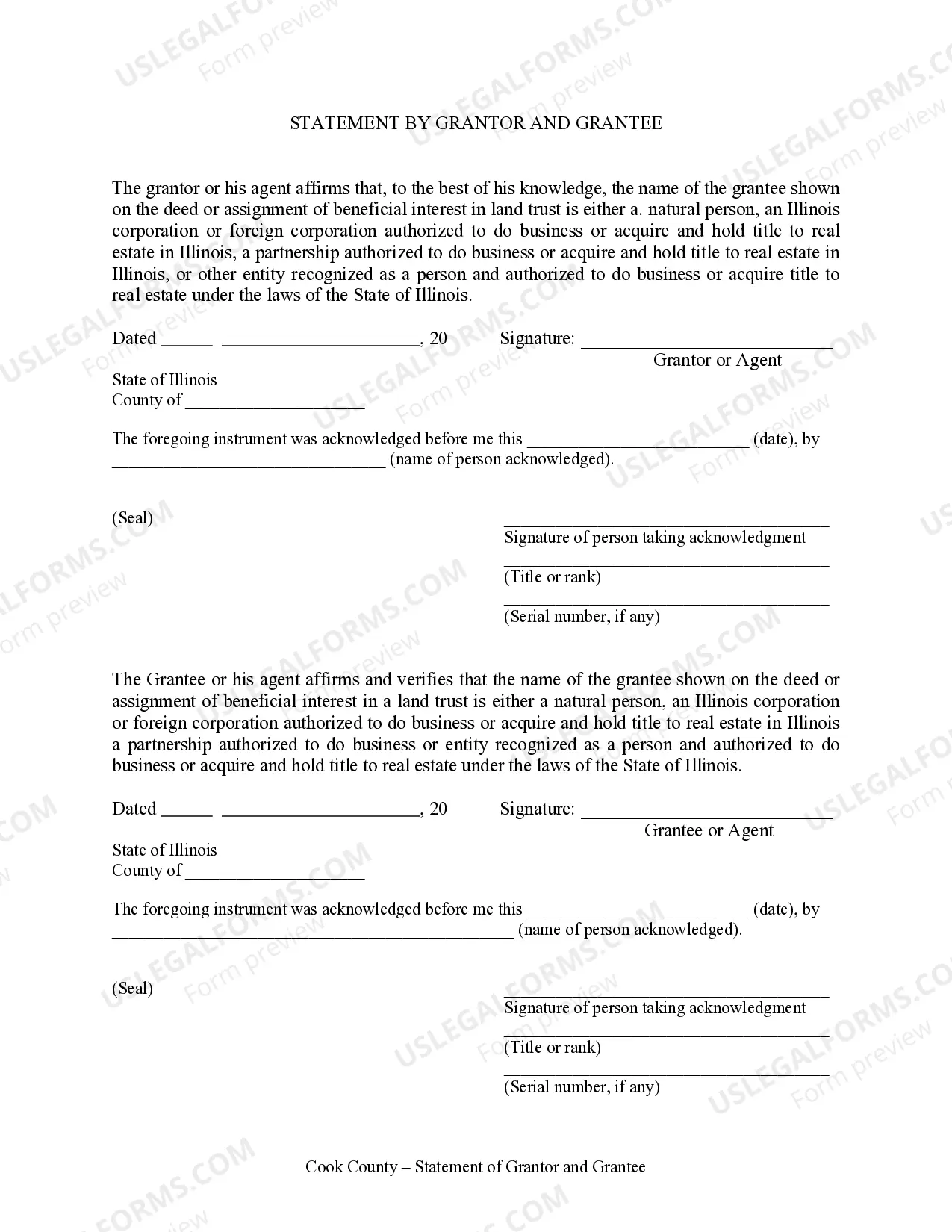

An Elgin Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a legal document used to transfer ownership of a property from a limited liability company (LLC) to a married couple. This type of deed is commonly used when the property is owned by an LLC and the owners of the LLC, who are a husband and wife, wish to hold the property in their personal names. The process of completing an Elgin Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife involves several important steps. Firstly, the LLC must agree to transfer the property through a legally binding resolution or an amendment to the LLC's operating agreement. This resolution or amendment would reflect the intention to transfer the property to the husband and wife as individuals. Once the LLC has approved the transfer, a formal Quitclaim Deed must be prepared. This deed explicitly states that the LLC is transferring all of its interest in the property to the husband and wife, and it includes the legal description of the property, as well as any relevant information about encumbrances or liens. It is important to note that when transferring property from an LLC to individuals, the husband and wife should consult an attorney to ensure the proper legal steps are followed. Additionally, the deed should be signed by a member or authorized representative of the LLC, and notarized to make it legally valid. While the Elgin Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a specific document tailored for this purpose, it's worth mentioning that there could be variations or alternate versions of quitclaim deeds depending on the specific circumstances or requirements of the individuals involved. Some possible variations include: 1. Elgin Illinois Quitclaim Deed — Married Couple to LLC: This type of deed allows a married couple to transfer the ownership of a property from their personal names to an LLC they own. 2. Elgin Illinois Quitclaim Deed — Husband and Wife to Husband and Wife: In situations where a husband and wife wish to alter the way they hold ownership of a property, this type of deed allows for a transfer of ownership between the spouses. 3. Elgin Illinois Quitclaim Deed — LLC to LLC: If there is a change in ownership structure or if a new LLC is formed, this type of deed can be used to transfer a property from one LLC to another. In conclusion, the Elgin Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a specific legal document that facilitates the transfer of property ownership from an LLC to a married couple. It is crucial to consult with a qualified attorney to ensure the correct steps are followed and to address any specific circumstances that may require additional legal considerations.