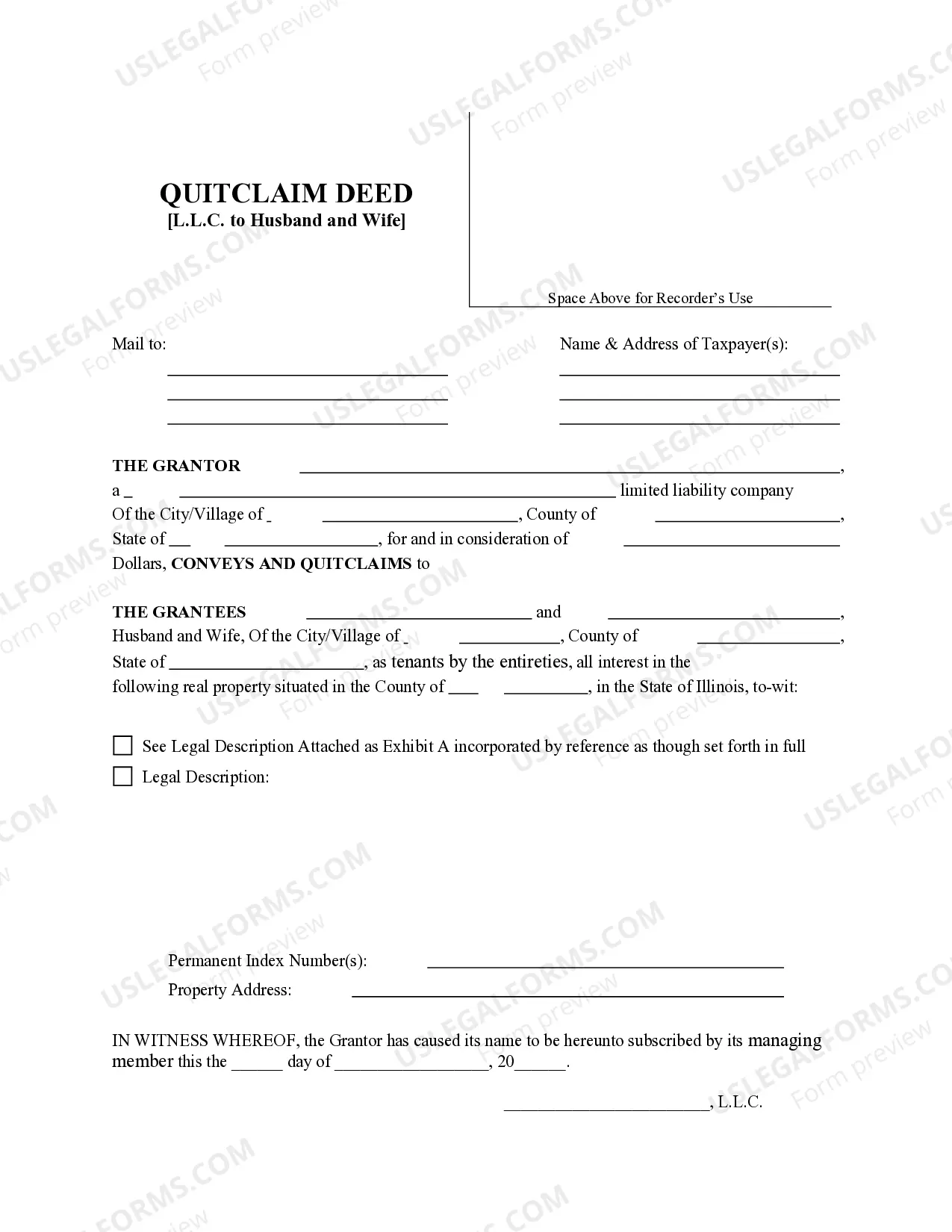

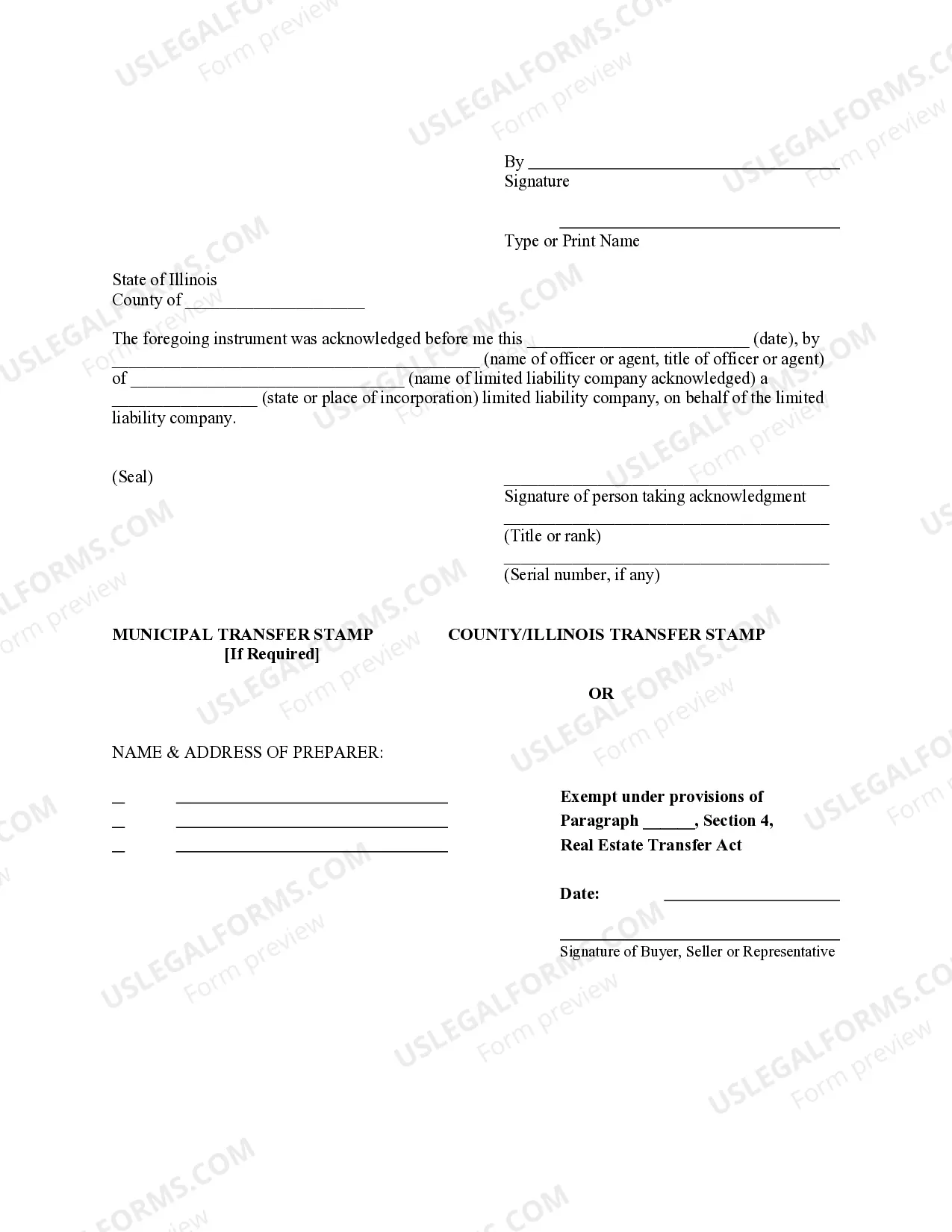

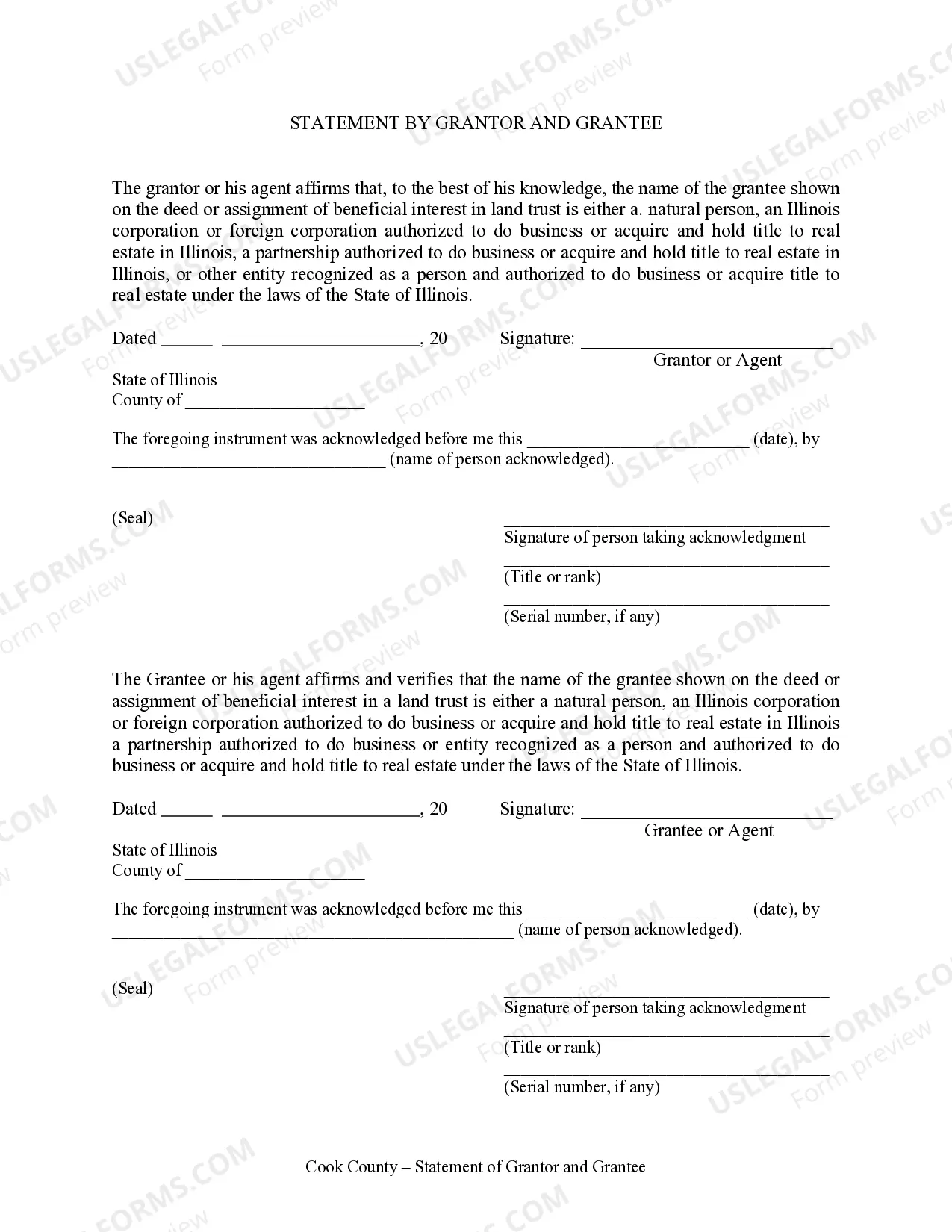

This form is a Quitclaim Deed where the Grantor is a Limited Liability Company and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a legal document used to transfer ownership of a property in Rockford, Illinois, from a limited liability company (LLC) to a married couple. This type of deed allows the LLC, as the granter, to convey any interest it may have in the property to the husband and wife, known as grantees, without making any warranties or guarantees about the property's title. The Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is commonly used in real estate transactions where an LLC wants to transfer a property to a married couple, typically for estate planning or consolidation purposes. It is important to note that this type of deed only transfers the ownership interest held by the LLC and does not guarantee clear title or protect against any liens or encumbrances on the property. Variations of Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife may include: 1. Rockford Illinois Quitclaim Deed with Survivorship — LLC to Husband and Wife: This type of deed ensures that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. It is a common choice for married couples who want to avoid probate and ensure seamless transfer of property upon death. 2. Rockford Illinois Quitclaim Deed with Life Estate — LLC to Husband and Wife: This variation grants the LLC a life estate, meaning they can retain the right to use and occupy the property for life, while transferring the remainder interest to the husband and wife. Upon the death of the LLC, the property's ownership will pass to the grantees without going through probate. 3. Rockford Illinois Quitclaim Deed with Marital Rights — LLC to Husband and Wife: This type of deed is often used in states with community property laws to ensure that the property remains jointly owned by the couple, with each spouse having an equal interest in the property. In the event of divorce or death, this deed protects the ownership rights and interests of both parties. In conclusion, a Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a legal instrument enabling the transfer of property ownership from an LLC to a married couple in Rockford, Illinois. It is crucial to consult a qualified attorney or real estate professional when considering such a transaction to ensure all legal obligations and potential risks are adequately addressed.A Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a legal document used to transfer ownership of a property in Rockford, Illinois, from a limited liability company (LLC) to a married couple. This type of deed allows the LLC, as the granter, to convey any interest it may have in the property to the husband and wife, known as grantees, without making any warranties or guarantees about the property's title. The Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is commonly used in real estate transactions where an LLC wants to transfer a property to a married couple, typically for estate planning or consolidation purposes. It is important to note that this type of deed only transfers the ownership interest held by the LLC and does not guarantee clear title or protect against any liens or encumbrances on the property. Variations of Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife may include: 1. Rockford Illinois Quitclaim Deed with Survivorship — LLC to Husband and Wife: This type of deed ensures that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. It is a common choice for married couples who want to avoid probate and ensure seamless transfer of property upon death. 2. Rockford Illinois Quitclaim Deed with Life Estate — LLC to Husband and Wife: This variation grants the LLC a life estate, meaning they can retain the right to use and occupy the property for life, while transferring the remainder interest to the husband and wife. Upon the death of the LLC, the property's ownership will pass to the grantees without going through probate. 3. Rockford Illinois Quitclaim Deed with Marital Rights — LLC to Husband and Wife: This type of deed is often used in states with community property laws to ensure that the property remains jointly owned by the couple, with each spouse having an equal interest in the property. In the event of divorce or death, this deed protects the ownership rights and interests of both parties. In conclusion, a Rockford Illinois Quitclaim Deed — Limited Liability Company to Husband and Wife is a legal instrument enabling the transfer of property ownership from an LLC to a married couple in Rockford, Illinois. It is crucial to consult a qualified attorney or real estate professional when considering such a transaction to ensure all legal obligations and potential risks are adequately addressed.