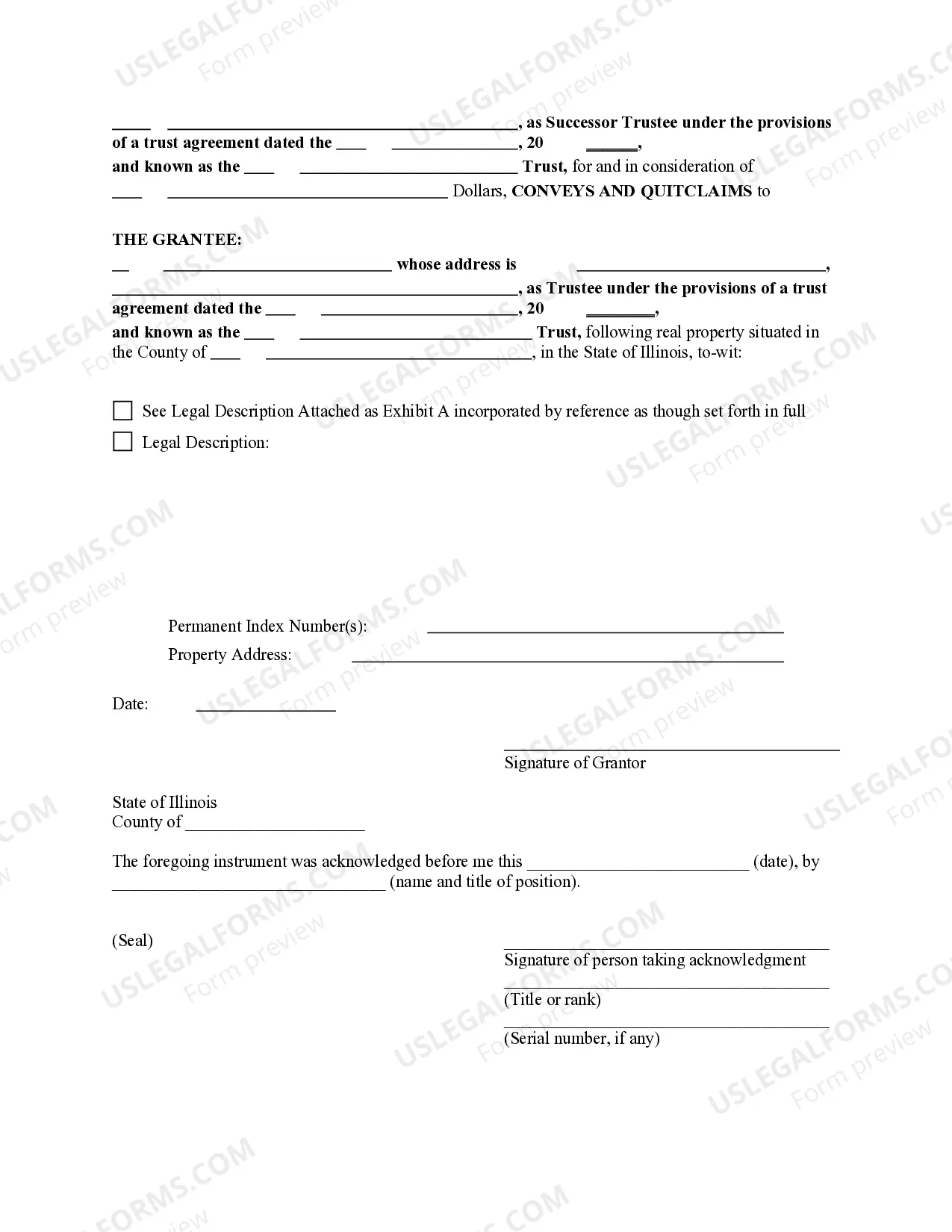

This form is a Quitclaim Deed where the Grantor is a Trust, acting through a Successor Trustee, to a Trust as Grantee. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

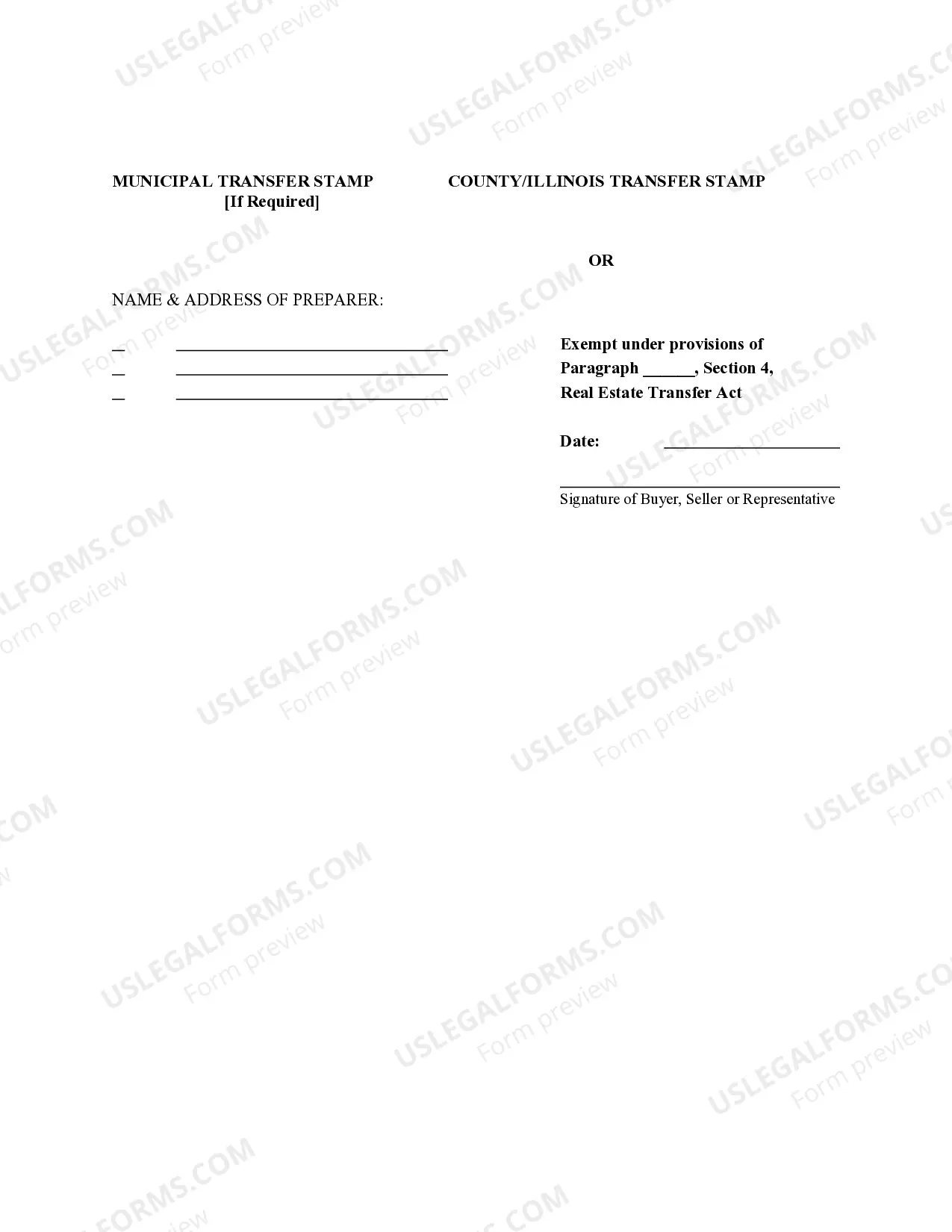

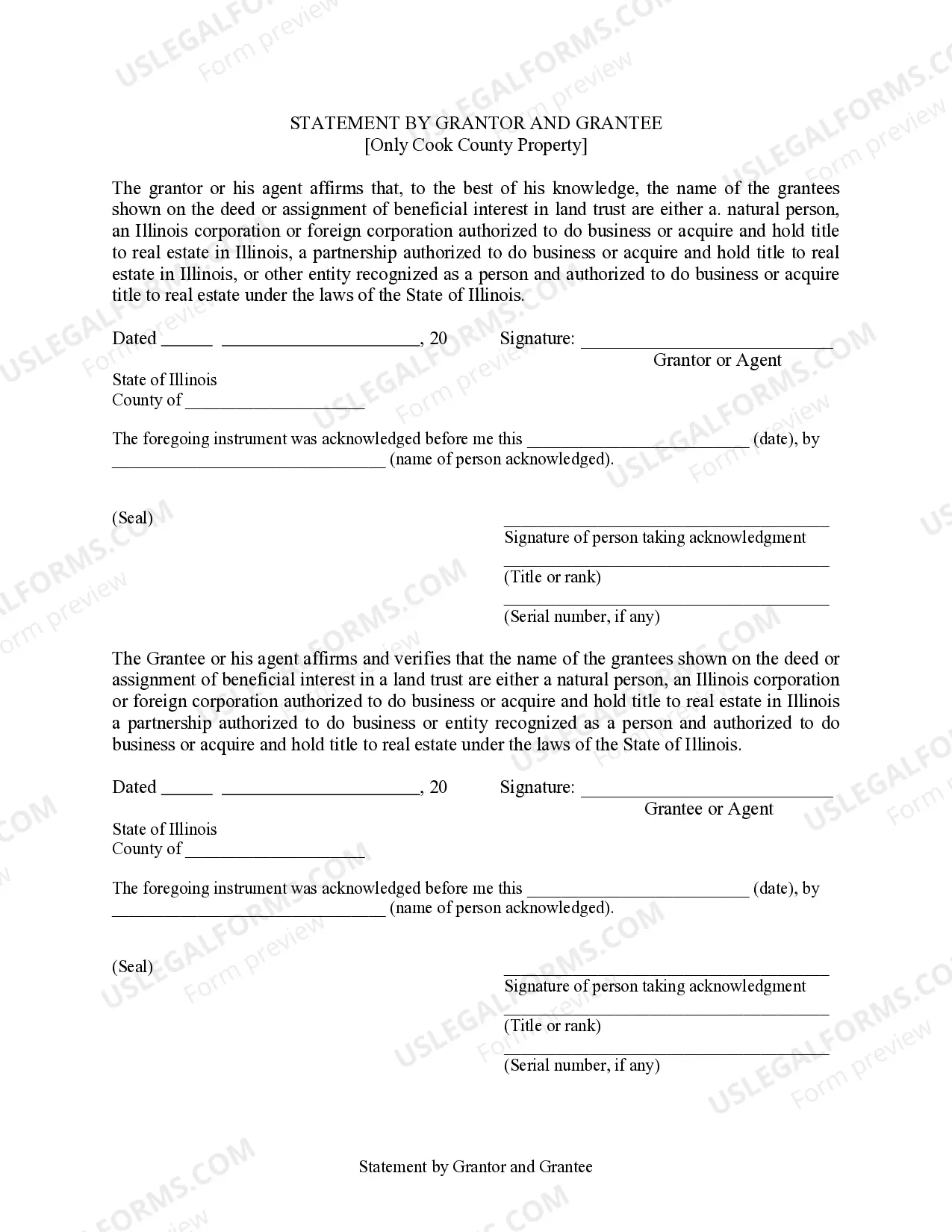

A Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust is a legal instrument used in the transfer of property ownership within a trust arrangement. This document allows a successor trustee to convey ownership of a property from one trust to another using a quitclaim deed, which denotes that the granter (successor trustee) is relinquishing any rights or interest they may have in the property to the grantee (the trust). The Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust must include specific details to accurately transfer property ownership. Some essential elements of this document include: 1. Parties Involved: The document should clearly identify the successor trustee who is acting as the granter, and the trust as the grantee. Their legal names, addresses, and contact information must be mentioned for proper identification. 2. Property Description: Accurate details of the property being transferred using the quitclaim deed must be provided. This includes the address, lot number, boundaries, and any other relevant identifying information. It is essential to be precise to avoid any discrepancies or confusion in the future. 3. Title and Interest: The Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust warrants that the granter has legal authority and ownership rights to convey the property being transferred. It is crucial to verify that the granter is authorized to execute the deed and has the legal capacity to do so. 4. Trust Document Reference: The quitclaim deed should reference the original trust document that governs the arrangement between the granter and grantee. This ensures clear identification and linkage between the trust and the property being transferred. 5. Notarization and Recording: It is essential to have the Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust notarized to confirm the authenticity of the signatures. Additionally, the deed must be recorded with the appropriate county recorder's office or registrar to officially document the property transfer. Variations or types of Joliet Illinois Quitclaim Deeds — Trust, by Successor Trustee, to Trust may include specific circumstances or additional clauses. For instance, there could be a variation when a property is transferred from one trust to another but with restrictions or certain conditions outlined in the deed. These restrictions might limit the use of the property or specify the beneficiaries who may benefit from it. In conclusion, a Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust allows for the transfer of property ownership between trusts. It is crucial to consult with a legal professional experienced in trust and real estate law to ensure the accuracy and validity of the deed, as it has far-reaching implications for property ownership and rights.A Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust is a legal instrument used in the transfer of property ownership within a trust arrangement. This document allows a successor trustee to convey ownership of a property from one trust to another using a quitclaim deed, which denotes that the granter (successor trustee) is relinquishing any rights or interest they may have in the property to the grantee (the trust). The Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust must include specific details to accurately transfer property ownership. Some essential elements of this document include: 1. Parties Involved: The document should clearly identify the successor trustee who is acting as the granter, and the trust as the grantee. Their legal names, addresses, and contact information must be mentioned for proper identification. 2. Property Description: Accurate details of the property being transferred using the quitclaim deed must be provided. This includes the address, lot number, boundaries, and any other relevant identifying information. It is essential to be precise to avoid any discrepancies or confusion in the future. 3. Title and Interest: The Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust warrants that the granter has legal authority and ownership rights to convey the property being transferred. It is crucial to verify that the granter is authorized to execute the deed and has the legal capacity to do so. 4. Trust Document Reference: The quitclaim deed should reference the original trust document that governs the arrangement between the granter and grantee. This ensures clear identification and linkage between the trust and the property being transferred. 5. Notarization and Recording: It is essential to have the Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust notarized to confirm the authenticity of the signatures. Additionally, the deed must be recorded with the appropriate county recorder's office or registrar to officially document the property transfer. Variations or types of Joliet Illinois Quitclaim Deeds — Trust, by Successor Trustee, to Trust may include specific circumstances or additional clauses. For instance, there could be a variation when a property is transferred from one trust to another but with restrictions or certain conditions outlined in the deed. These restrictions might limit the use of the property or specify the beneficiaries who may benefit from it. In conclusion, a Joliet Illinois Quitclaim Deed — Trust, by Successor Trustee, to Trust allows for the transfer of property ownership between trusts. It is crucial to consult with a legal professional experienced in trust and real estate law to ensure the accuracy and validity of the deed, as it has far-reaching implications for property ownership and rights.