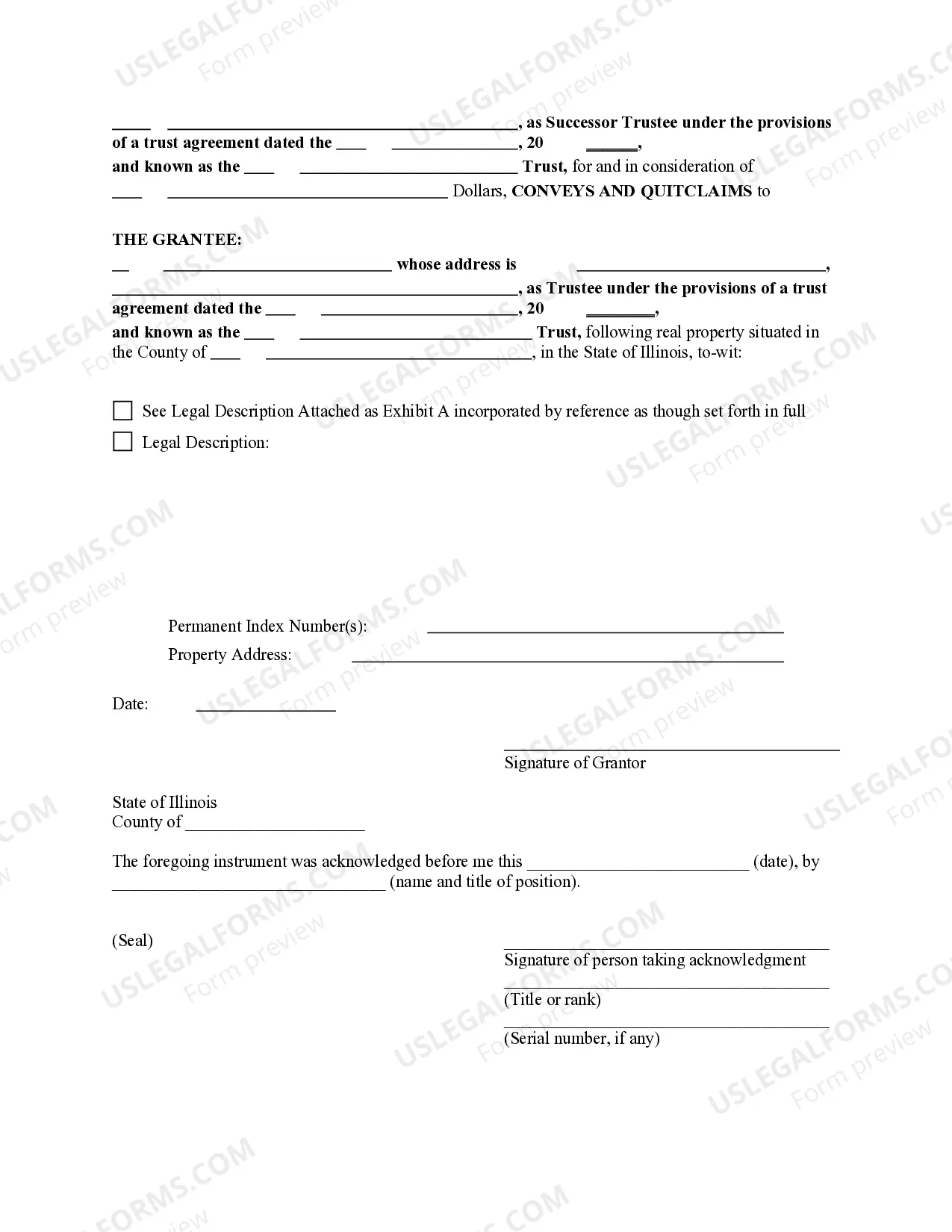

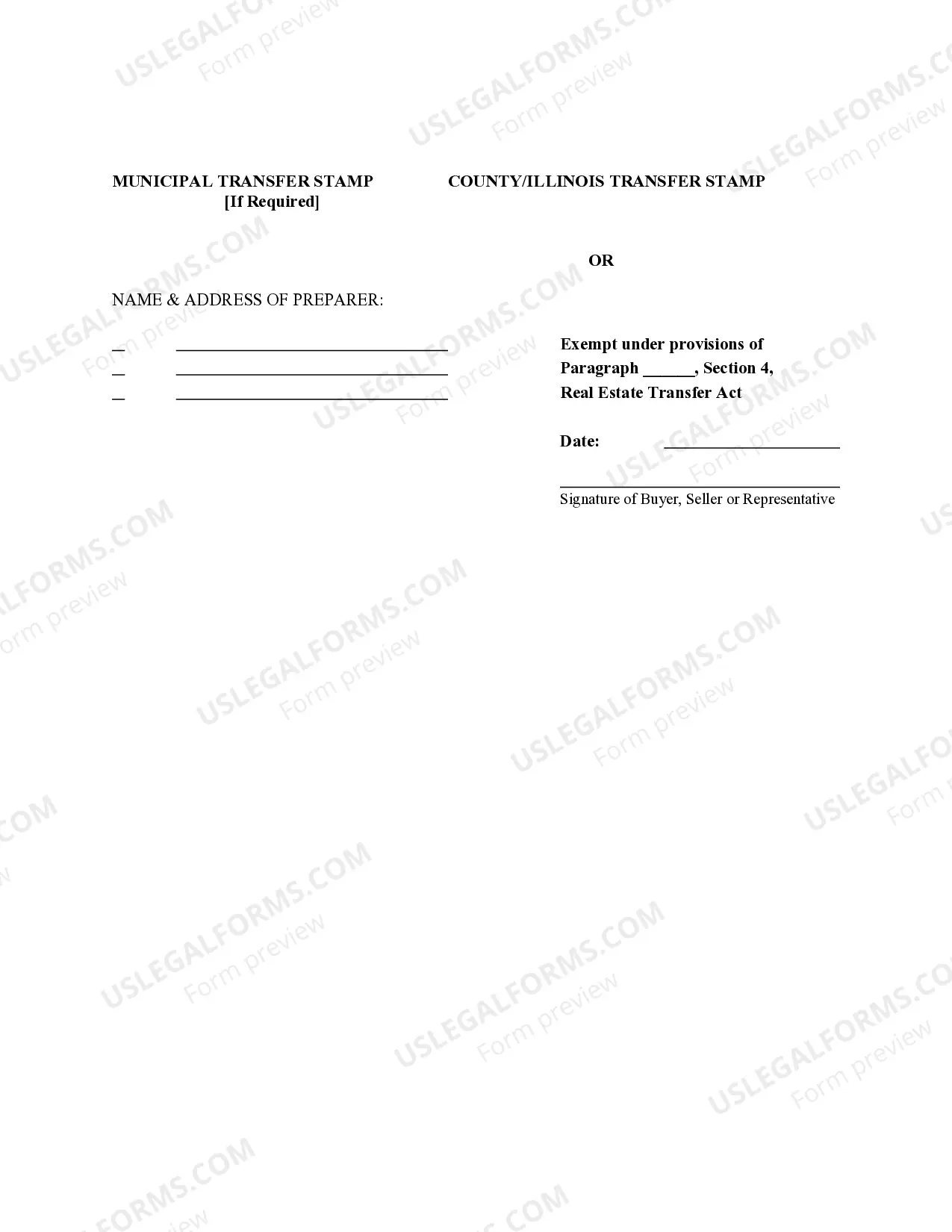

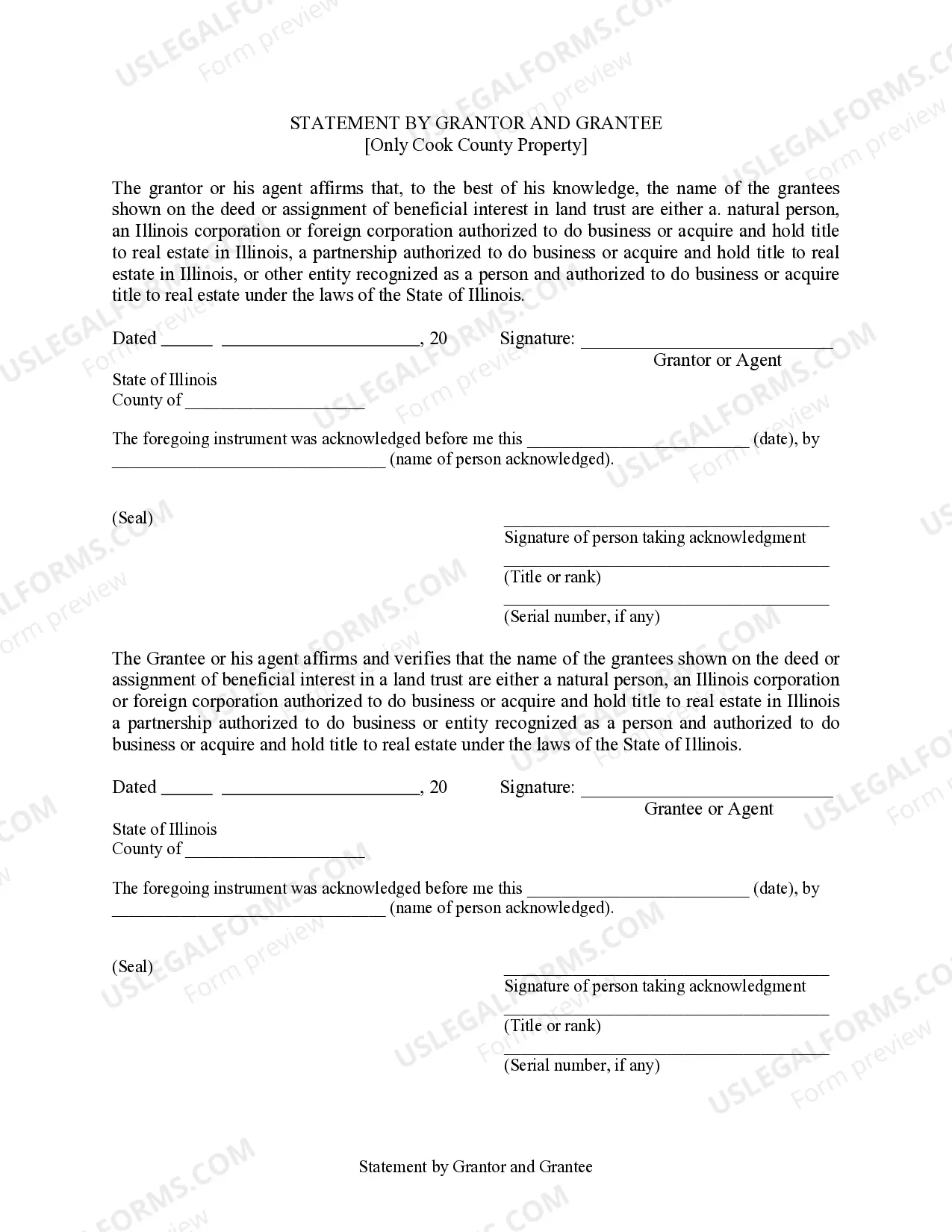

This form is a Quitclaim Deed where the Grantor is a Trust, acting through a Successor Trustee, to a Trust as Grantee. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Rockford Illinois Quitclaim Deed is a legal document that transfers ownership of a property from a granter (successor trustee) to a trust. It is typically used to transfer real estate assets into a trust, ensuring smooth succession and estate planning. The trust holds ownership of the property, managed by the trustee for the benefit of the beneficiaries. This type of deed is crucial in estate planning to avoid probate, minimize taxes, and maintain privacy. It allows the granter to transfer their interest in a property into a trust, ensuring that the property passes directly to the trust upon their death, rather than going through the probate process. The Quitclaim Deed — Trust, by Successor Trustee, to Trust is a specific type of quitclaim deed used in Rockford, Illinois. It transfers ownership of a property held by a successor trustee into a trust structure. This helps ensure that the property's interest remains within the trust, allowing for seamless management by the trustee and providing necessary legal protection. Additionally, there might be variations or related deeds under this category. They may include: 1. Warranty Deed — Trust, by Successor Trustee, to Trust: This deed guarantees clear title to the property and provides additional protection to the trust against any potential claims. 2. Special Warranty Deed — Trust, by Successor Trustee, to Trust: This type of deed offers limited protection to the trust, guaranteeing only that the granter/successor trustee hasn't done anything to encumber the property. 3. Grant Deed — Trust, by Successor Trustee, to Trust: Similar to a quitclaim deed, but with an implied promise that the granter/successor trustee holds clear title to the property and has not transferred it to anyone else. 4. Beneficiary Deed — Trust, by Successor Trustee, to Trust: This type of deed designates a successor trustee to automatically transfer the property into the trust upon the granter's death, bypassing the probate process. In Rockford, Illinois, using a Quitclaim Deed — Trust, by Successor Trustee, to Trust offers a reliable means of transferring property into a trust structure, enabling efficient estate planning, and protecting the interests of both the granter and beneficiaries. It is crucial to consult with an experienced attorney or legal professional to ensure proper execution and to choose the most appropriate type of deed for individual circumstances.A Rockford Illinois Quitclaim Deed is a legal document that transfers ownership of a property from a granter (successor trustee) to a trust. It is typically used to transfer real estate assets into a trust, ensuring smooth succession and estate planning. The trust holds ownership of the property, managed by the trustee for the benefit of the beneficiaries. This type of deed is crucial in estate planning to avoid probate, minimize taxes, and maintain privacy. It allows the granter to transfer their interest in a property into a trust, ensuring that the property passes directly to the trust upon their death, rather than going through the probate process. The Quitclaim Deed — Trust, by Successor Trustee, to Trust is a specific type of quitclaim deed used in Rockford, Illinois. It transfers ownership of a property held by a successor trustee into a trust structure. This helps ensure that the property's interest remains within the trust, allowing for seamless management by the trustee and providing necessary legal protection. Additionally, there might be variations or related deeds under this category. They may include: 1. Warranty Deed — Trust, by Successor Trustee, to Trust: This deed guarantees clear title to the property and provides additional protection to the trust against any potential claims. 2. Special Warranty Deed — Trust, by Successor Trustee, to Trust: This type of deed offers limited protection to the trust, guaranteeing only that the granter/successor trustee hasn't done anything to encumber the property. 3. Grant Deed — Trust, by Successor Trustee, to Trust: Similar to a quitclaim deed, but with an implied promise that the granter/successor trustee holds clear title to the property and has not transferred it to anyone else. 4. Beneficiary Deed — Trust, by Successor Trustee, to Trust: This type of deed designates a successor trustee to automatically transfer the property into the trust upon the granter's death, bypassing the probate process. In Rockford, Illinois, using a Quitclaim Deed — Trust, by Successor Trustee, to Trust offers a reliable means of transferring property into a trust structure, enabling efficient estate planning, and protecting the interests of both the granter and beneficiaries. It is crucial to consult with an experienced attorney or legal professional to ensure proper execution and to choose the most appropriate type of deed for individual circumstances.