This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an incorporated association. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Chicago Illinois Quitclaim Deed - Individual to an Unincorporated Association.

Description

How to fill out Illinois Quitclaim Deed - Individual To An Unincorporated Association.?

If you are looking for a legitimate form template, it’s hard to select a more convenient platform than the US Legal Forms site – one of the most extensive online collections.

With this collection, you can obtain thousands of form examples for business and personal use categorized by types and states, or keywords.

Using our premium search feature, finding the latest Chicago Illinois Quitclaim Deed - Individual to an Unincorporated Association is as simple as 1-2-3.

Receive the template. Choose the file format and download it to your device.

Make changes. Complete, alter, print, and sign the obtained Chicago Illinois Quitclaim Deed - Individual to an Unincorporated Association.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Chicago Illinois Quitclaim Deed - Individual to an Unincorporated Association is to Log In to your account and press the Download button.

- If you are using US Legal Forms for the first time, just adhere to the directions below.

- Ensure you have selected the form you require. Review its description and utilize the Preview feature to view its content. If it doesn’t meet your needs, employ the Search box at the top of the page to find the suitable document.

- Confirm your choice. Click on the Buy now button. After that, choose your desired subscription plan and enter your information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

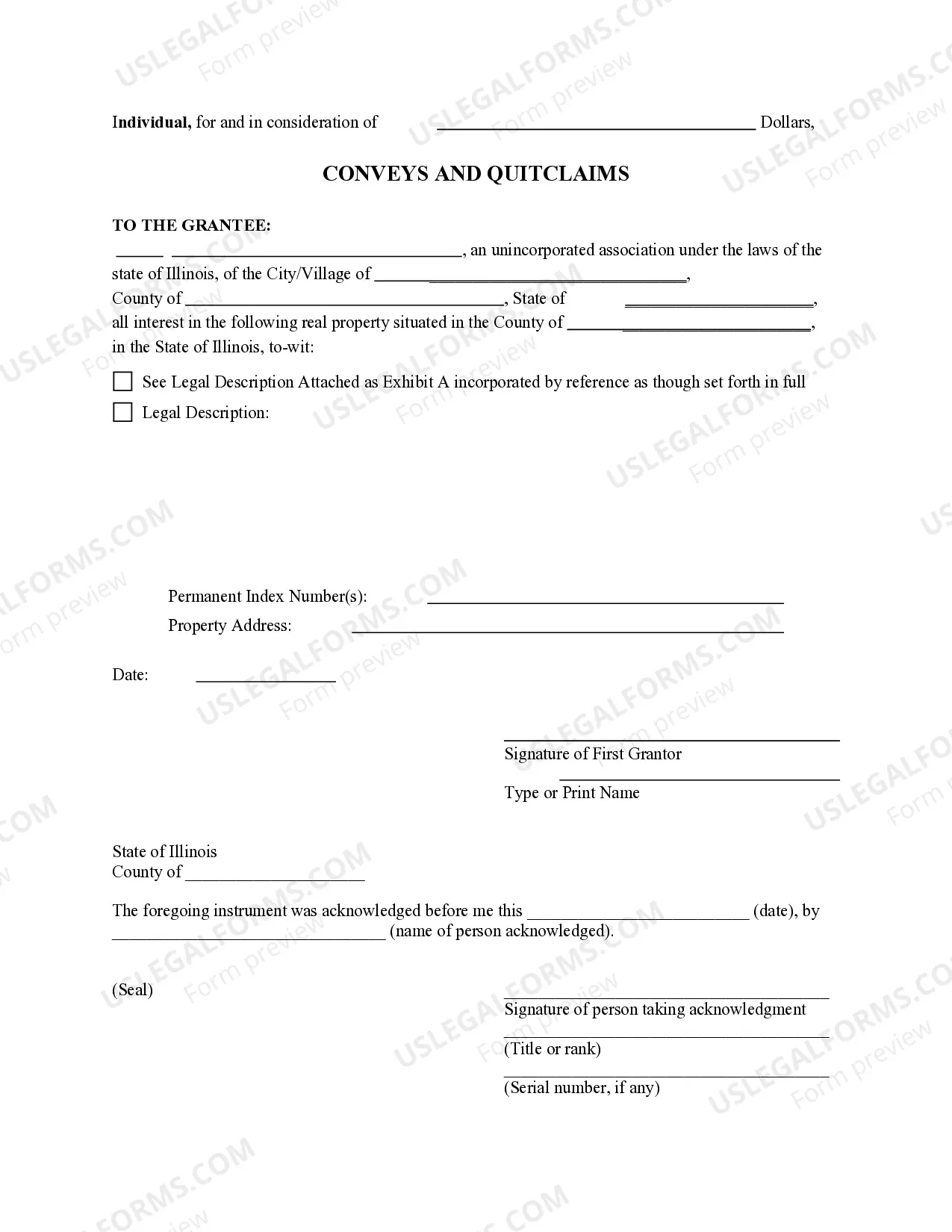

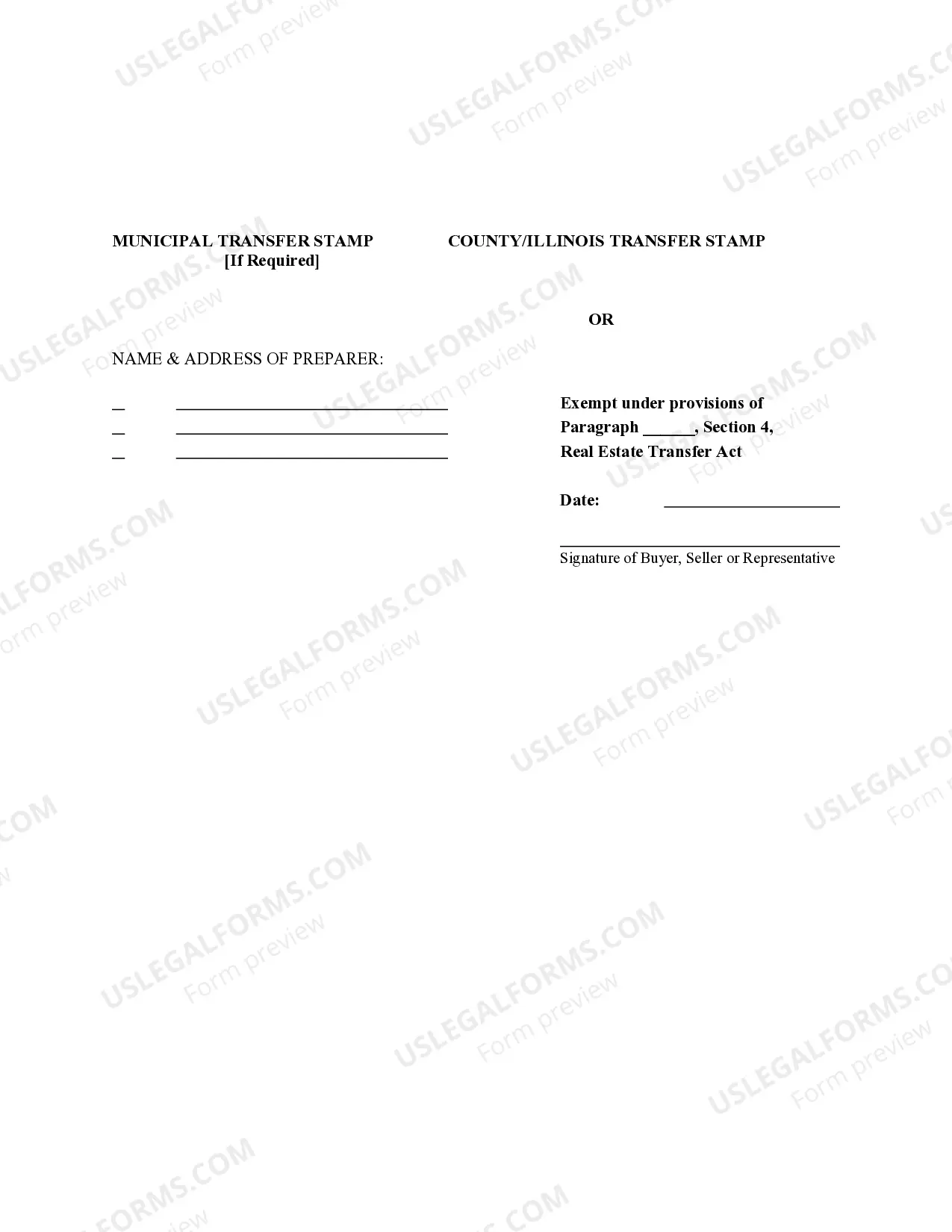

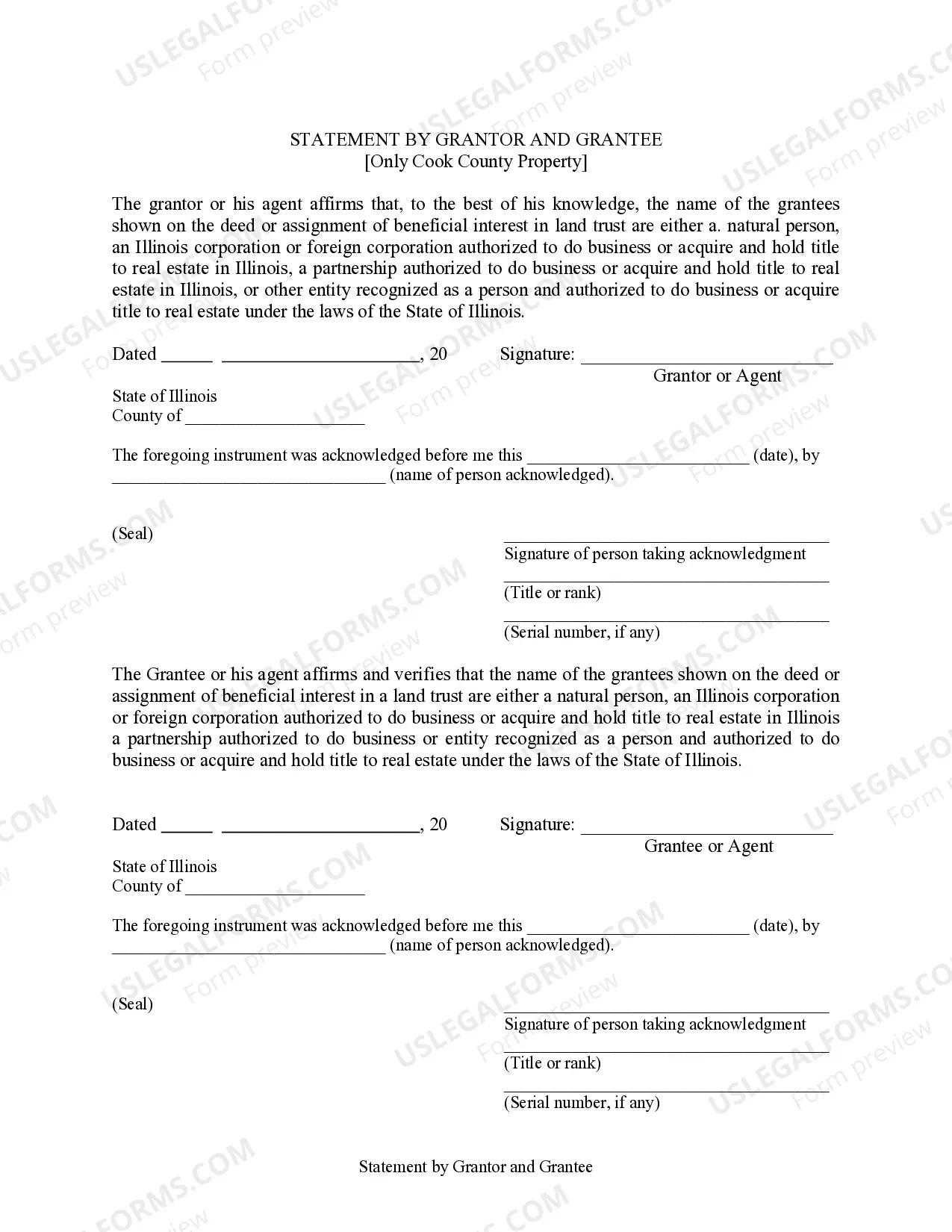

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees. Create a free Illinois Quit Claim Deed in minutes with our professional document builder.

Recording ? The quitclaim deed must be recorded in the County Recorder's Office where the real estate is located (See County List). Signing (765 ILCS 5/20) ? A quit claim deed in the State of Illinois is required to be signed with a notary public present before being recorded.

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.