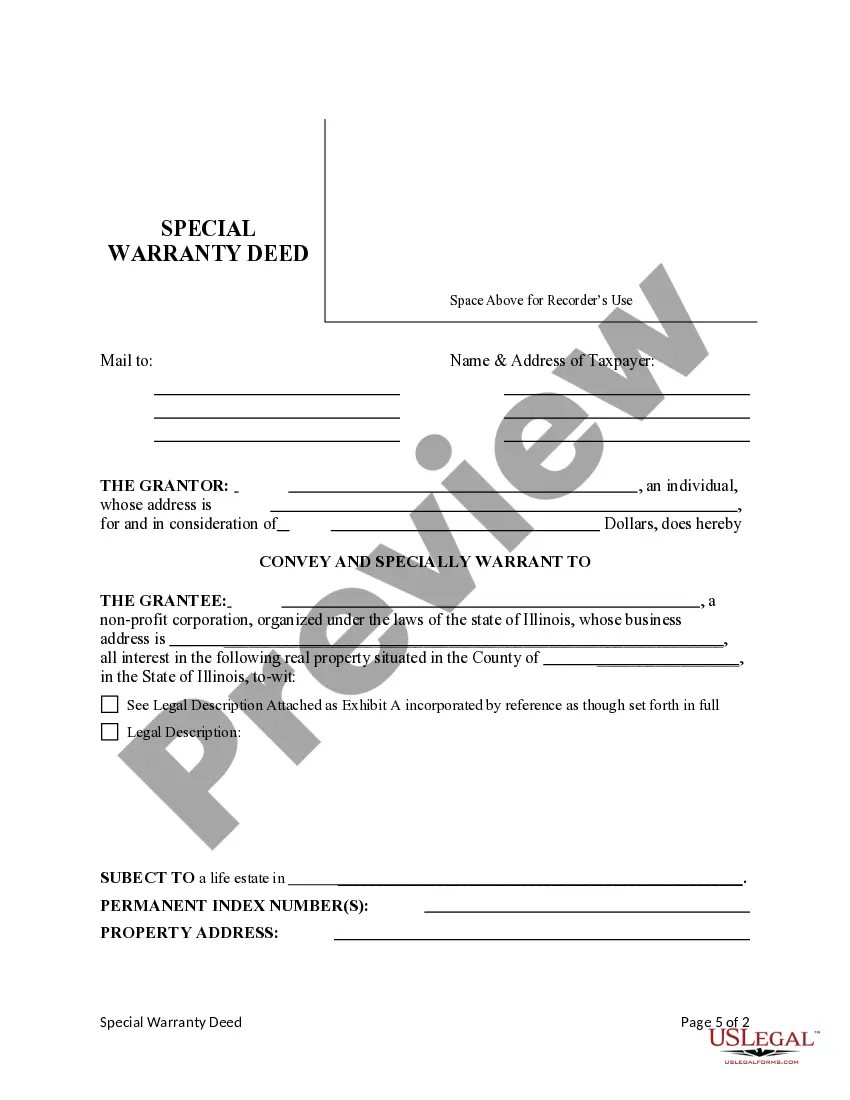

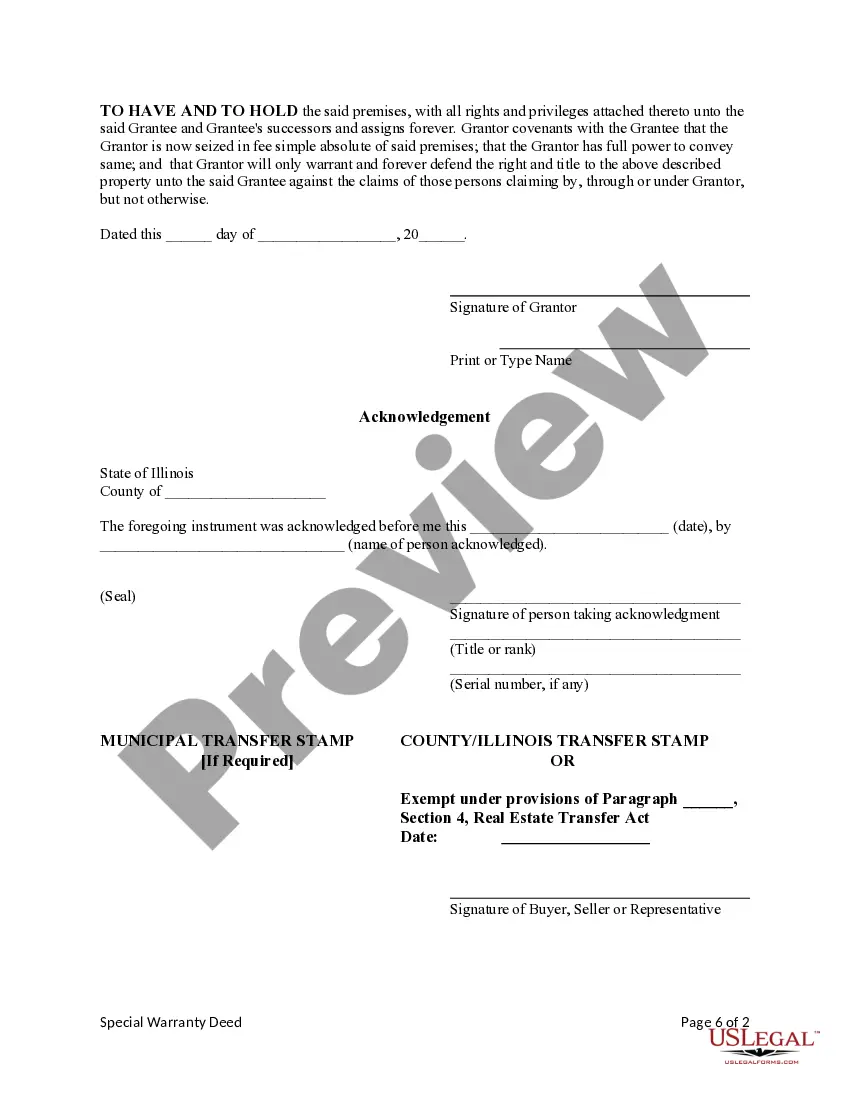

This form is a Special Warranty Deed where the Grantor is an individual and the Grantee is a non-profit corporation. Grantor conveys and specially warrants the described property to the Grantee subject to a reserved life estate. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved LIfe Estate

Description

How to fill out Illinois Special Warranty Deed From An Individual Grantor To Non-Profit Corporation As Grantee With Reserved LIfe Estate?

If you’ve previously employed our service, Log In to your account and download the Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to obtain your file.

You have indefinite access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Verify you’ve located an appropriate document. Review the summary and utilize the Preview feature, if available, to confirm it satisfies your needs. If it does not suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate. Choose the file type for your document and store it onto your device.

- Finalize your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Yes, you can file an Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate yourself. However, it’s important to ensure that you understand all the legal requirements and procedures involved. Failing to do so may result in delays or complications. Using a service like US Legal Forms can help streamline the process by providing you with the necessary forms and guidance.

A special warranty deed indicates that the seller conveys ownership to the buyer for the time they held the title. It signifies that the seller has the right to sell but does not guarantee the absence of prior issues. Thus, while an Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate serves as proof of current ownership, it is vital to conduct a title search for complete assurance.

Yes, you can sell a house that is under a special warranty deed, but there are considerations. Buyers often weigh the risks associated with this type of deed, particularly regarding previous ownership claims. If you hold an Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate, ensure you're transparent with potential buyers about the deed's limitations.

The safest type of deed is generally the warranty deed, which provides the buyer with the most protection. A warranty deed guarantees that the seller holds clear title to the property and will defend against any claims. In contrast, an Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate offers more limited assurances. Buyers should assess their needs and risks when choosing a deed type.

A special warranty deed offers limited protection for the buyer compared to other deed types. It typically covers the period when the seller held title, which means any issues that arose before their ownership are not covered. Therefore, while not inherently bad, caution is needed when dealing with an Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate. Always consider conducting thorough research and confirm any potential title issues.

Acquiring a special warranty deed involves drafting or obtaining the deed document and having it signed by the grantor. You can use a professional service or platform like uslegalforms to access templates and instructions for creating the Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate. Always ensure it's properly documented and filed with the local authorities for it to be legally enforceable.

To obtain a warranty deed in Illinois, you will need to draft the deed using the correct legal format and language. Consider consulting an attorney or using resources such as uslegalforms to ensure accuracy. Once prepared, submit the Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate to your local county recorder's office for official recording.

A reserved life estate deed allows the grantor to retain the right to use and occupy the property during their lifetime, while transferring ownership to another party, such as a non-profit corporation. This means that upon the grantor's passing, the property automatically goes to the grantee without going through probate. Such arrangements create a secure pathway for asset transfer, especially in the context of the Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate.

A special warranty deed provides limited protection, typically covering only the period during which the grantor owned the property. This deed is favorable for non-profit corporations, as it reduces liability and emphasizes the grantor's assurances regarding ownership. The Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate is particularly beneficial in protecting the interests of all parties involved.

You can obtain a special warranty deed by working with a real estate professional or an attorney who understands the Elgin Illinois Special Warranty Deed from an Individual Grantor to Non-Profit Corporation as Grantee with Reserved Life Estate. They will guide you through the process and prepare the necessary documents. Additionally, platforms like uslegalforms can provide templates and resources to simplify your task.