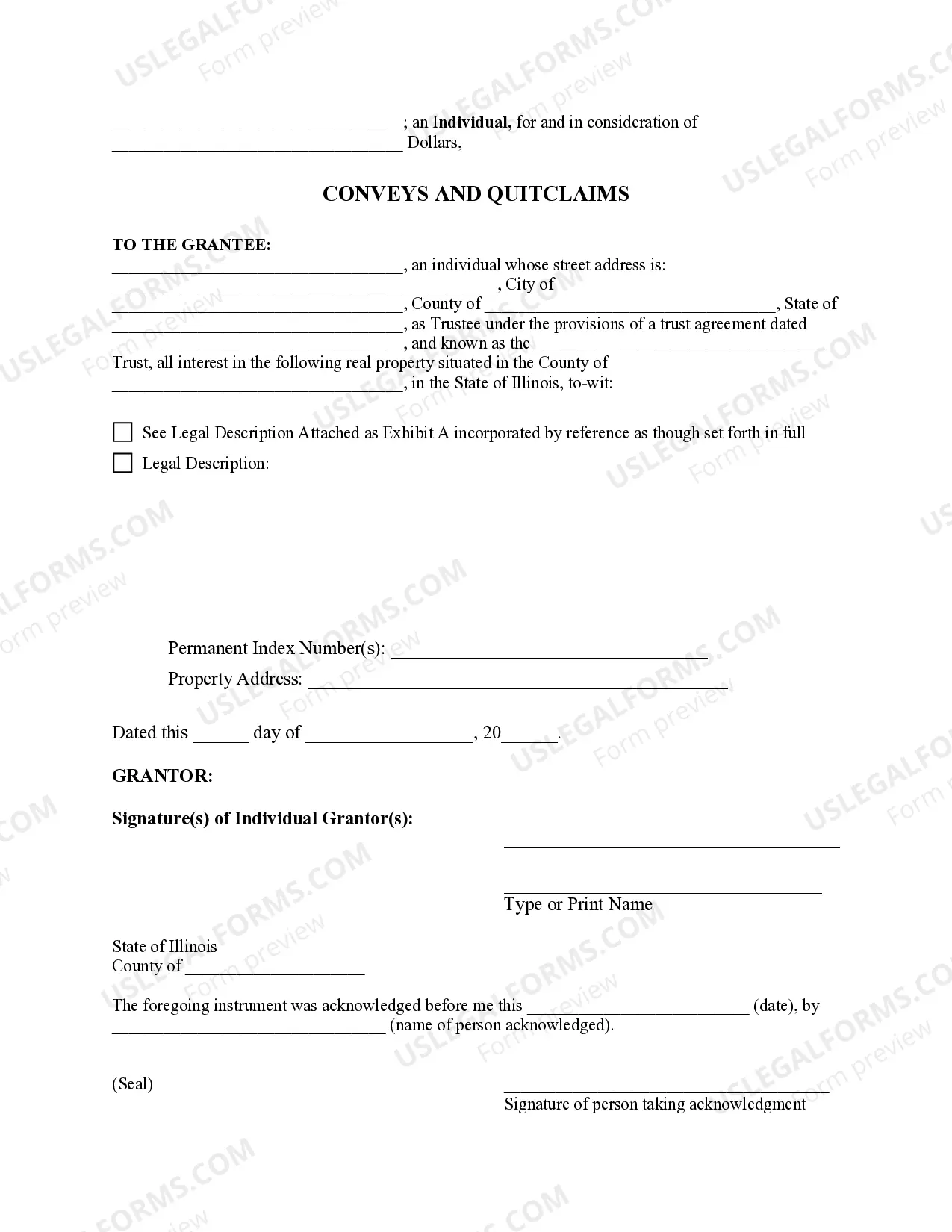

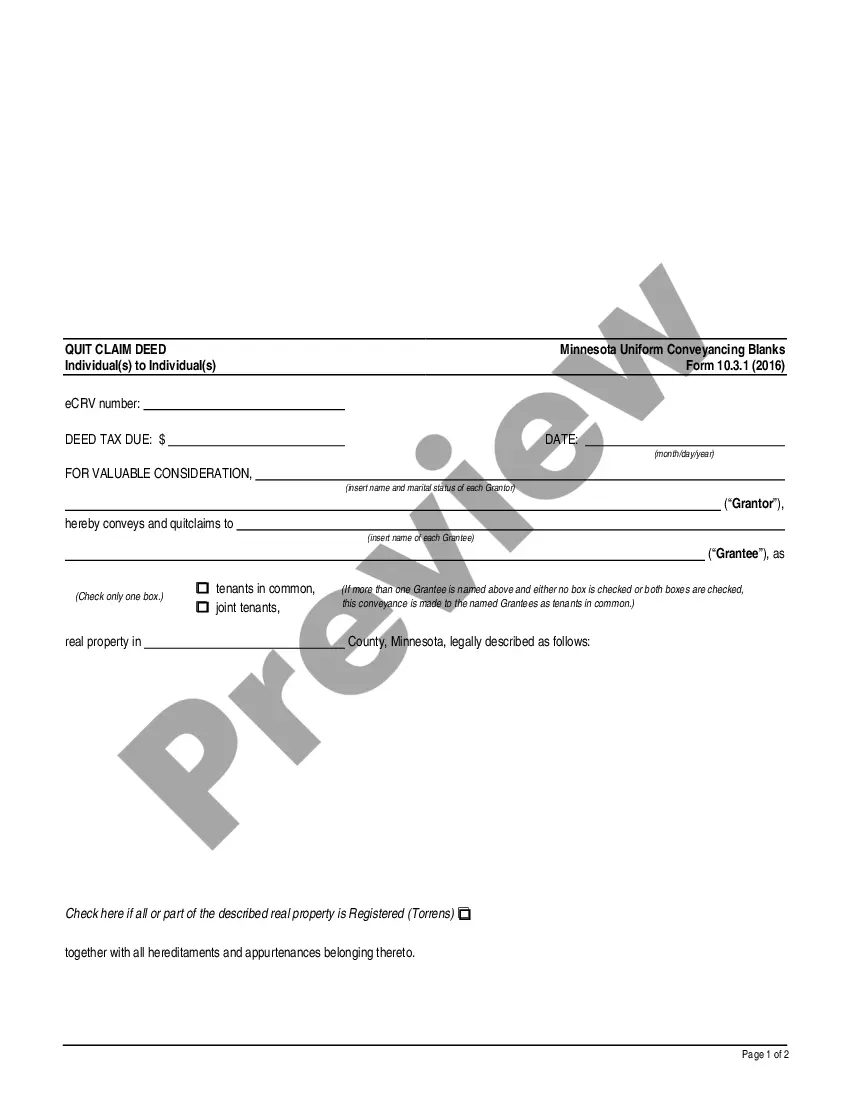

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

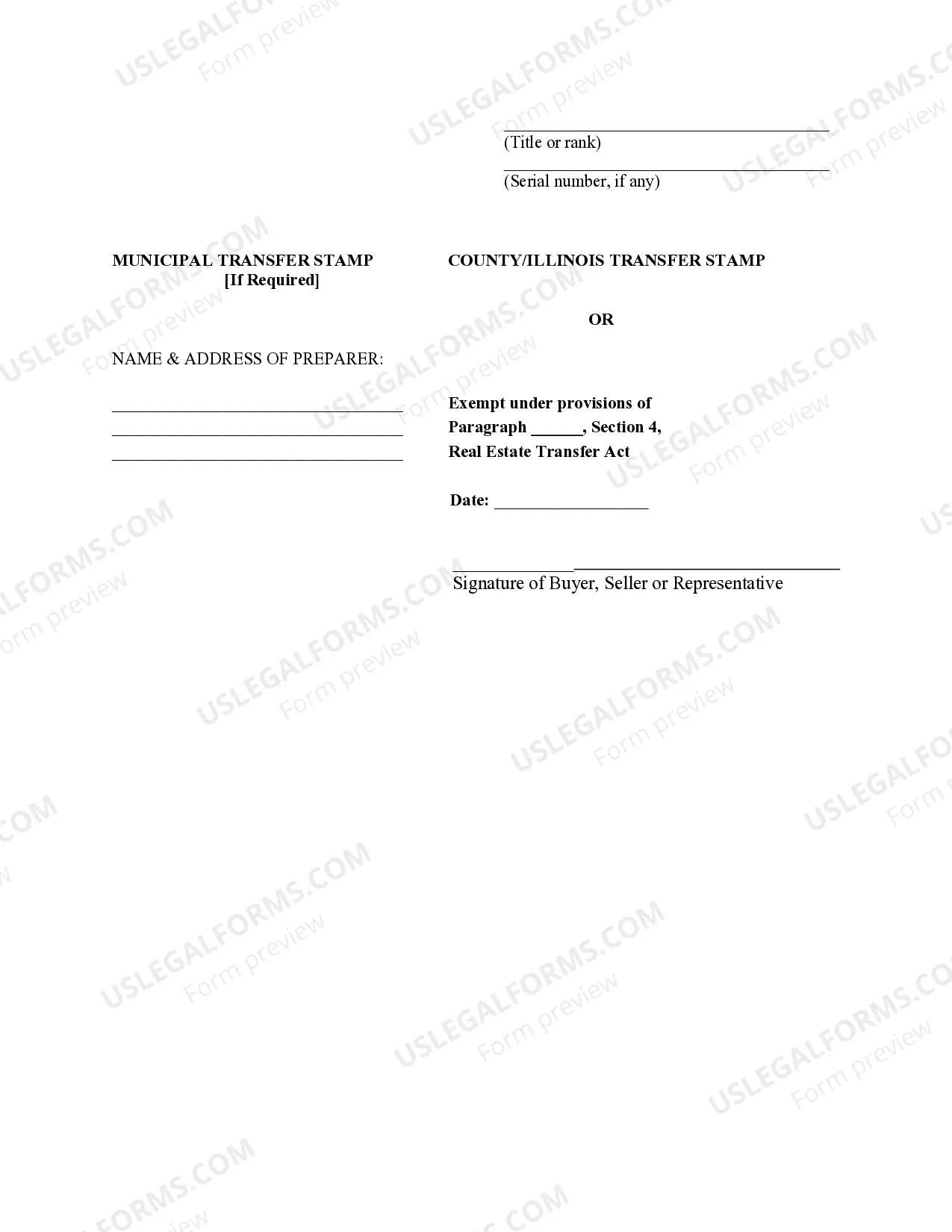

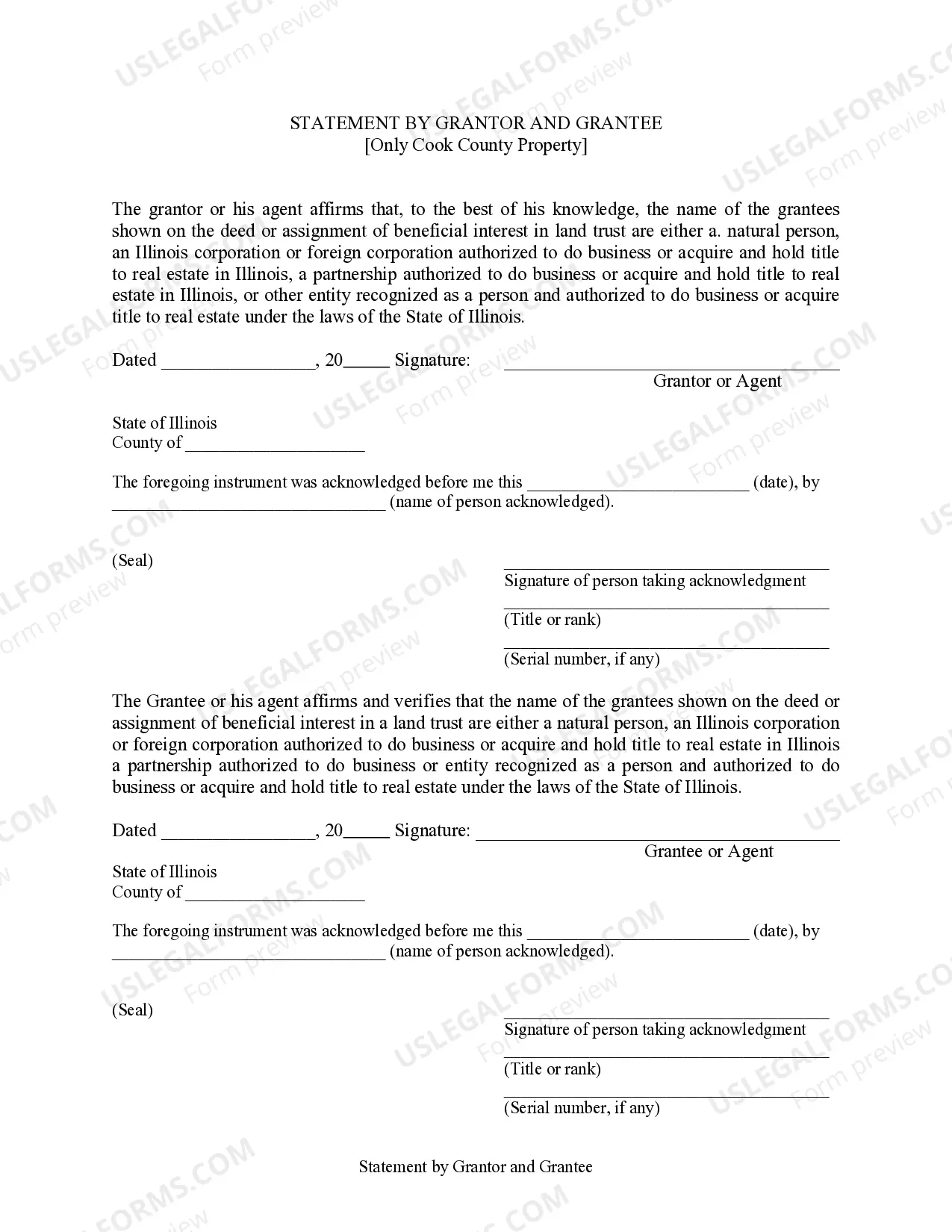

A Cook Illinois Quitclaim Deed from an Individual to a Trust is a legal document used to transfer ownership of a property from an individual to a trust in Cook County, Illinois. This type of deed is commonly used when an individual decides to transfer the ownership of their property to a trust, which may be created for estate planning or asset protection purposes. The process of transferring the property involves the individual, known as the granter, executing the Quitclaim Deed to convey their ownership interest to the trust, known as the grantee. This deed serves as a legally binding instrument that relinquishes any rights or claims the individual may have had on the property and transfers them to the trust. The Cook Illinois Quitclaim Deed from an Individual to a Trust grants the trust full ownership and control over the property, allowing the trust to manage, sell, or transfer the property as per its terms and provisions. Once the deed is properly executed, it must be recorded with the Cook County Recorder of Deeds to provide notice to the public of the change in ownership. Different types of Cook Illinois Quitclaim Deeds from an Individual to a Trust may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is commonly used when individuals want to transfer their property to a revocable living trust, which allows them to maintain control and manage the property during their lifetime. The granter can revoke or amend the trust if needed, and upon their death, the property will seamlessly pass to the designated beneficiaries or trustee. 2. Irrevocable Trust Quitclaim Deed: In contrast to a revocable trust, an irrevocable trust cannot be easily amended or revoked once established. By utilizing this type of deed, the granter permanently transfers ownership of the property to the irrevocable trust, which can have estate tax advantages and provide asset protection. The granter gives up control and ownership rights over the property, but it can offer long-term benefits in terms of estate planning and protecting the property from creditors. 3. Special Needs Trust Quitclaim Deed: This type of deed is applicable when the individual has a beneficiary with special needs who may require government benefits or assistance programs. By transferring the property to a special needs trust, the granter can ensure that the beneficiary's eligibility for such programs is not compromised, as the property is no longer considered a personal asset. In summary, a Cook Illinois Quitclaim Deed from an Individual to a Trust is a legal mechanism used to transfer property ownership from an individual to a trust. This process offers several types of deeds, such as the revocable living trust quitclaim deed, irrevocable trust quitclaim deed, and special needs trust quitclaim deed, each serving specific estate planning or asset protection purposes. Proper execution and recording of the deed are crucial to legally establish the transfer and provide notice to interested parties.