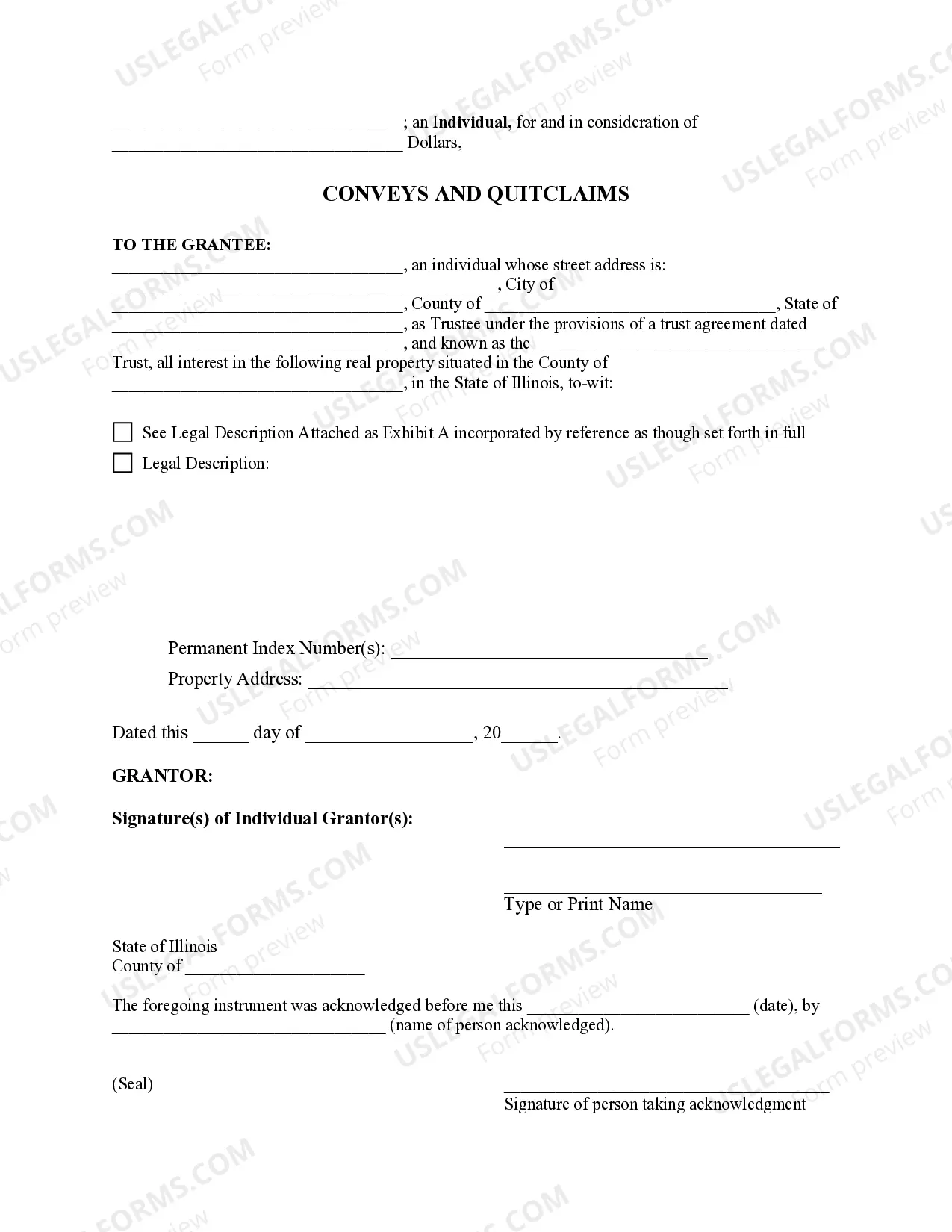

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Joliet Illinois Quitclaim Deed from an Individual to a Trust is a legal document used to transfer ownership of real estate property from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property to a trust for estate planning purposes or to ensure a smooth transfer of assets to beneficiaries. The Joliet Illinois Quitclaim Deed from an Individual to a Trust is a straightforward and efficient method of transferring property. It is important to note that this deed only transfers the interest that the individual holds in the property and does not provide any warranties or guarantees regarding the property's title. There are different types of Joliet Illinois Quitclaim Deeds from an Individual to a Trust, including the Traditional Quitclaim Deed, Enhanced Life Estate Quitclaim Deed, and Special Needs Trust Quitclaim Deed. The Traditional Quitclaim Deed transfers the property from the individual to the trust without any additional provisions or conditions. This type of deed is commonly used when individuals want to transfer their property to a revocable living trust for estate planning purposes. The Enhanced Life Estate Quitclaim Deed, also known as a Lady Bird Deed, allows the individual transferring the property to retain certain rights, such as the ability to live in the property for their lifetime. Upon their passing, the property ownership automatically transfers to the trust without the need for probate. The Special Needs Trust Quitclaim Deed is utilized when the transfer is intended to benefit an individual with special needs. This deed ensures that the property is held in a trust specifically established to provide for the care and support of the person with special needs, without disrupting their eligibility for government aid. By utilizing a Joliet Illinois Quitclaim Deed from an Individual to a Trust, individuals can ensure streamlined transfer of their property to a trust while pursuing their estate planning goals. However, it is essential to consult with a qualified attorney to understand the legal implications and potential tax consequences of such a transfer.