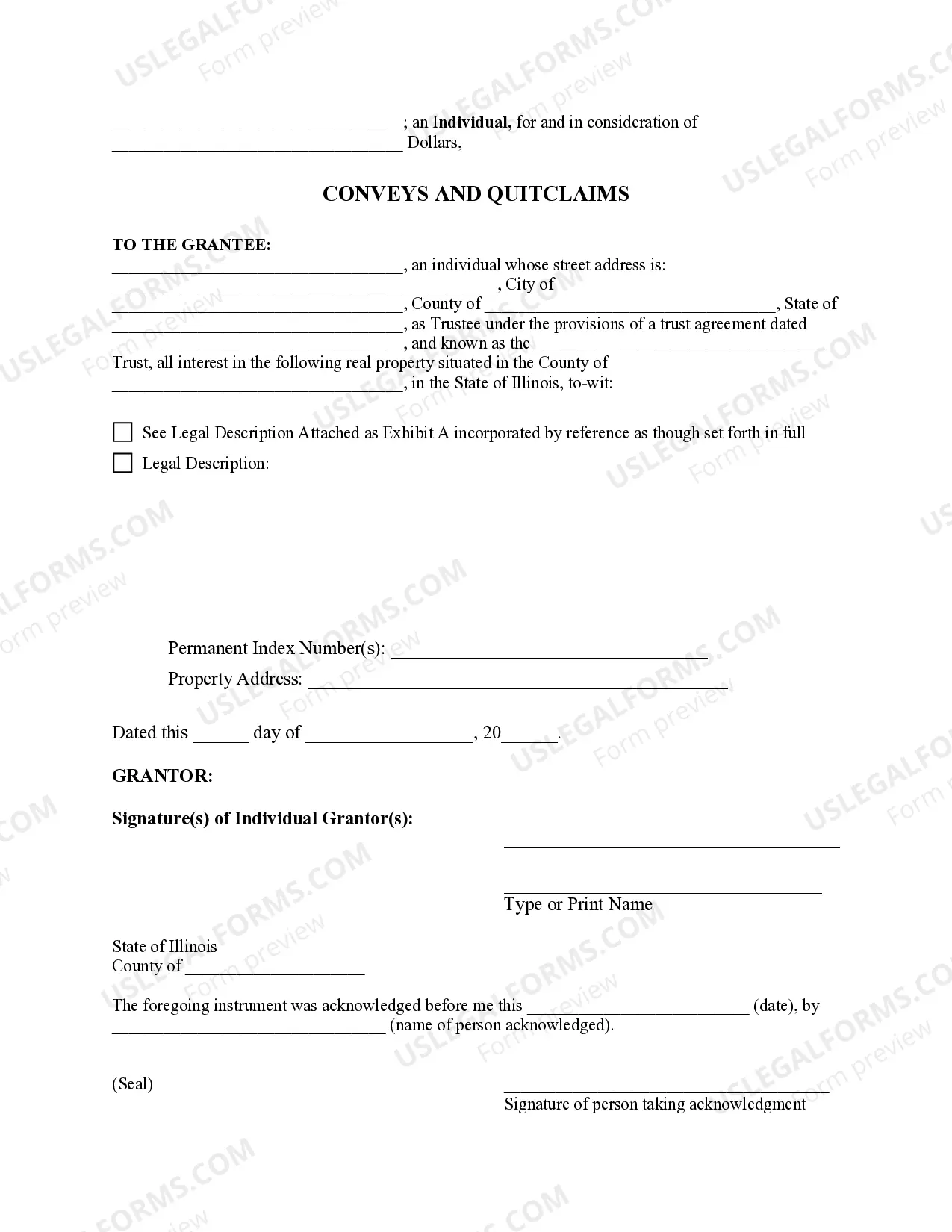

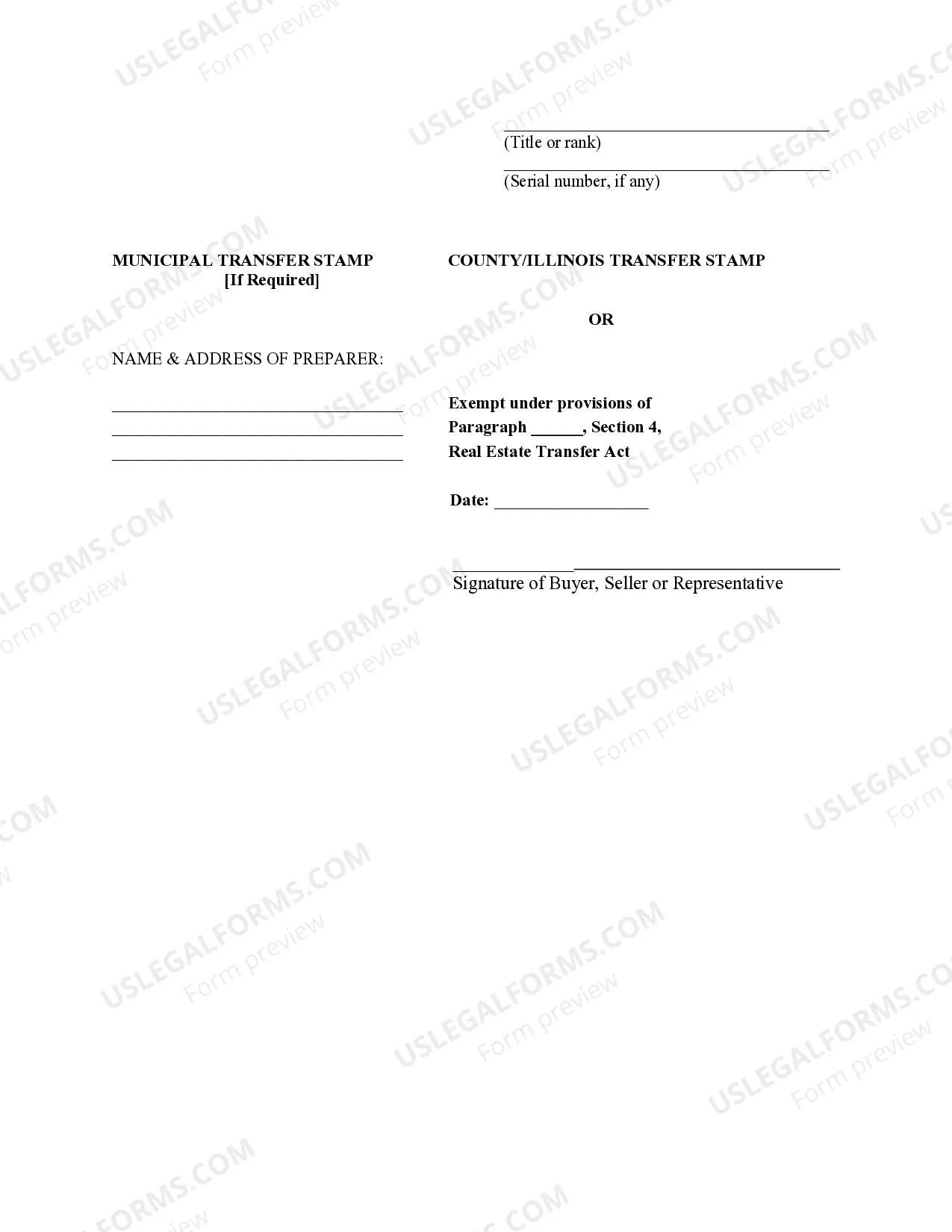

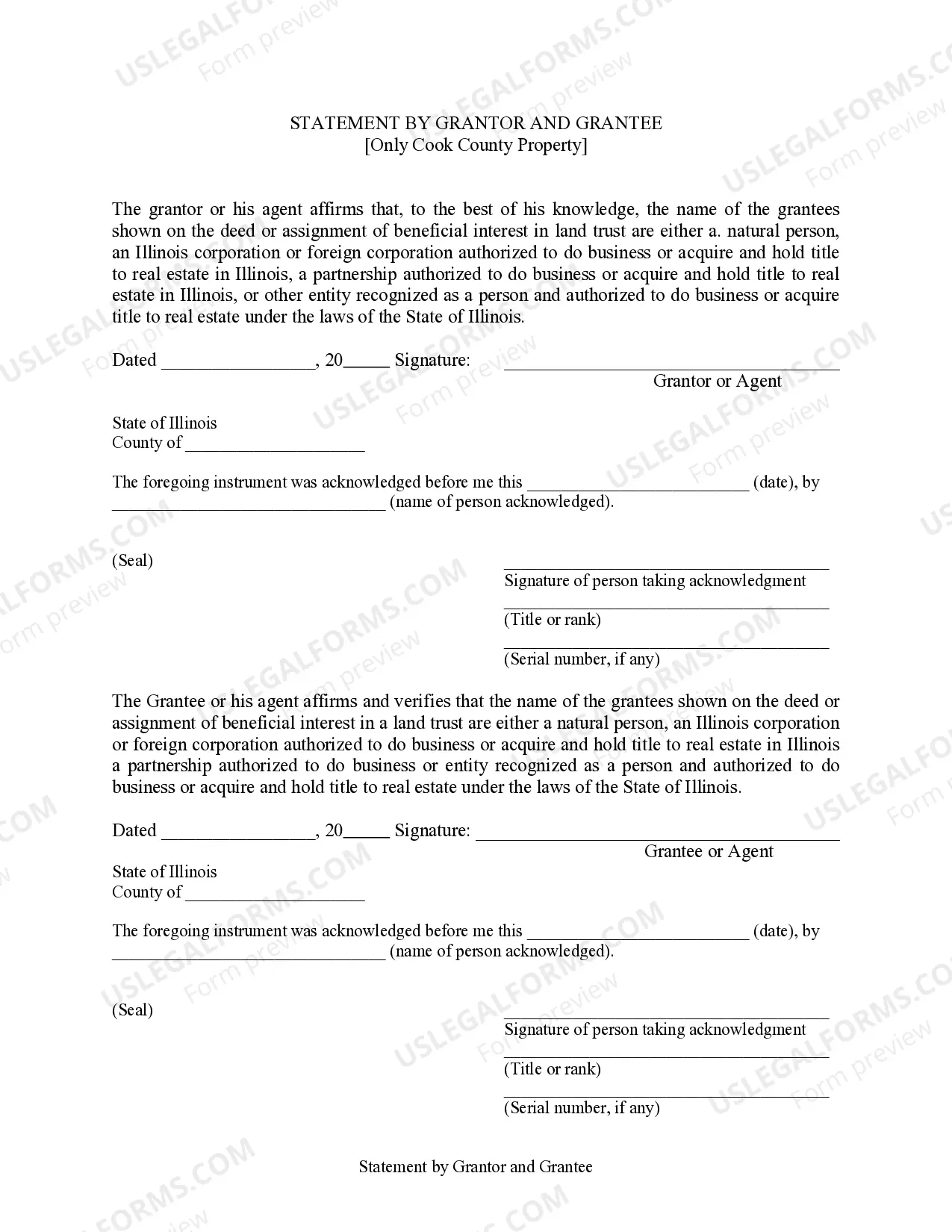

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used to transfer ownership or interest in a property from one party to another. In Rockford, Illinois, a quitclaim deed specifically refers to the transfer of ownership from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property into a trust for various reasons, such as estate planning, asset protection, or avoiding probate. The Rockford Illinois Quitclaim Deed from an Individual to a Trust is a straightforward process that involves the granter (the individual transferring the property) and the trustee (the person responsible for managing the trust). The granter signs the deed, indicating their intent to transfer their ownership rights to the trustee, and then files the deed with the appropriate county office, usually the County Recorder's office or the Registrar of Deeds. By executing a quitclaim deed, the individual essentially gives up any claims or interest they may have had in the property, transferring it to the trust and its beneficiaries. It's important to note that a quitclaim deed does not guarantee that the property is free of liens or other encumbrances. It solely transfers whatever interest the granter has in the property at the time of the transfer. Some common types of Rockford Illinois Quitclaim Deed from an Individual to a Trust include: 1. Individual to Revocable Living Trust: This type of quitclaim deed is often used for estate planning purposes, allowing the individual to transfer ownership of their property to a revocable living trust while maintaining control and the ability to make changes to the trust during their lifetime. 2. Individual to Irrevocable Trust: An irrevocable trust is a type of trust that usually cannot be modified or revoked without the consent of all parties involved. Transferring ownership through a quitclaim deed to an irrevocable trust can provide asset protection and potential tax benefits. 3. Individual to Special Needs Trust: Special needs trusts are created to support individuals with disabilities while preserving their eligibility for government benefits. By transferring property ownership through a quitclaim deed, an individual can ensure that their loved one with special needs will have access to necessary resources while maintaining their eligibility for assistance programs. It's crucial to consult with an attorney or real estate professional experienced in trust law and Illinois real estate regulations when considering a Rockford Illinois Quitclaim Deed from an Individual to a Trust. They can provide guidance on the best type of trust to choose, ensure a proper transfer, and address any potential legal complexities or considerations specific to individual circumstances.