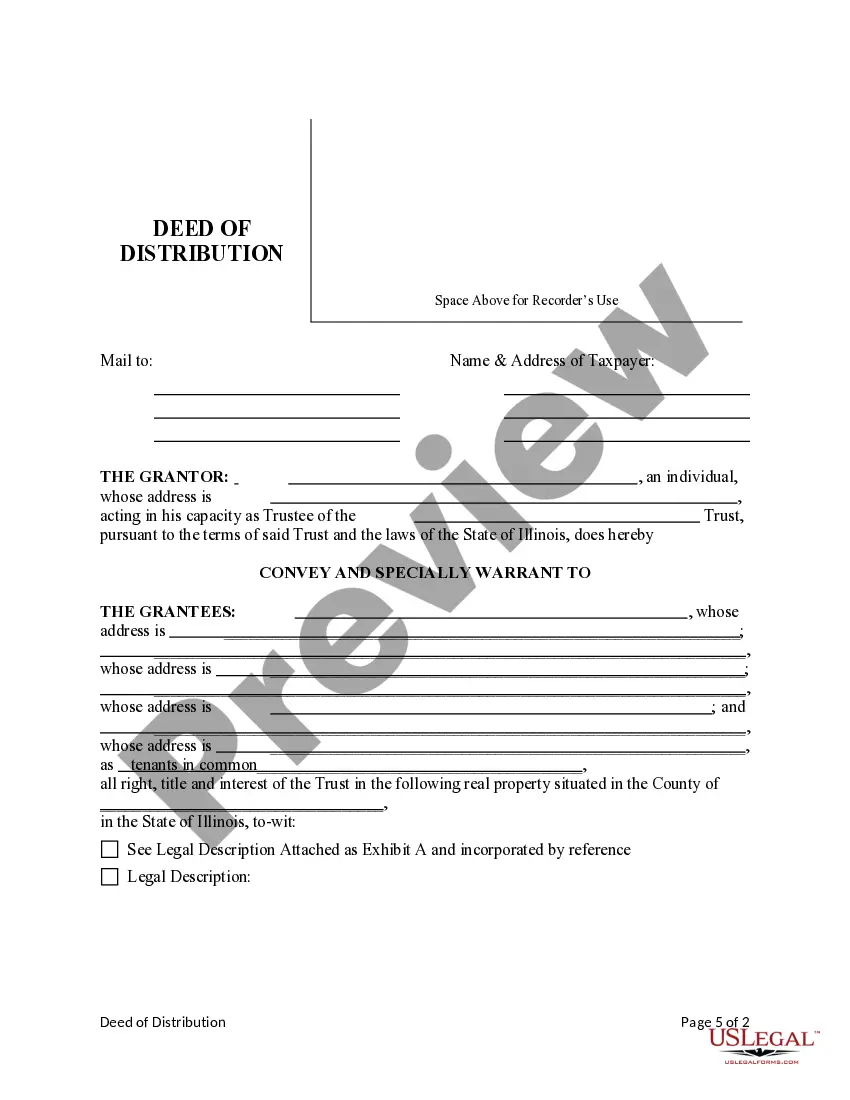

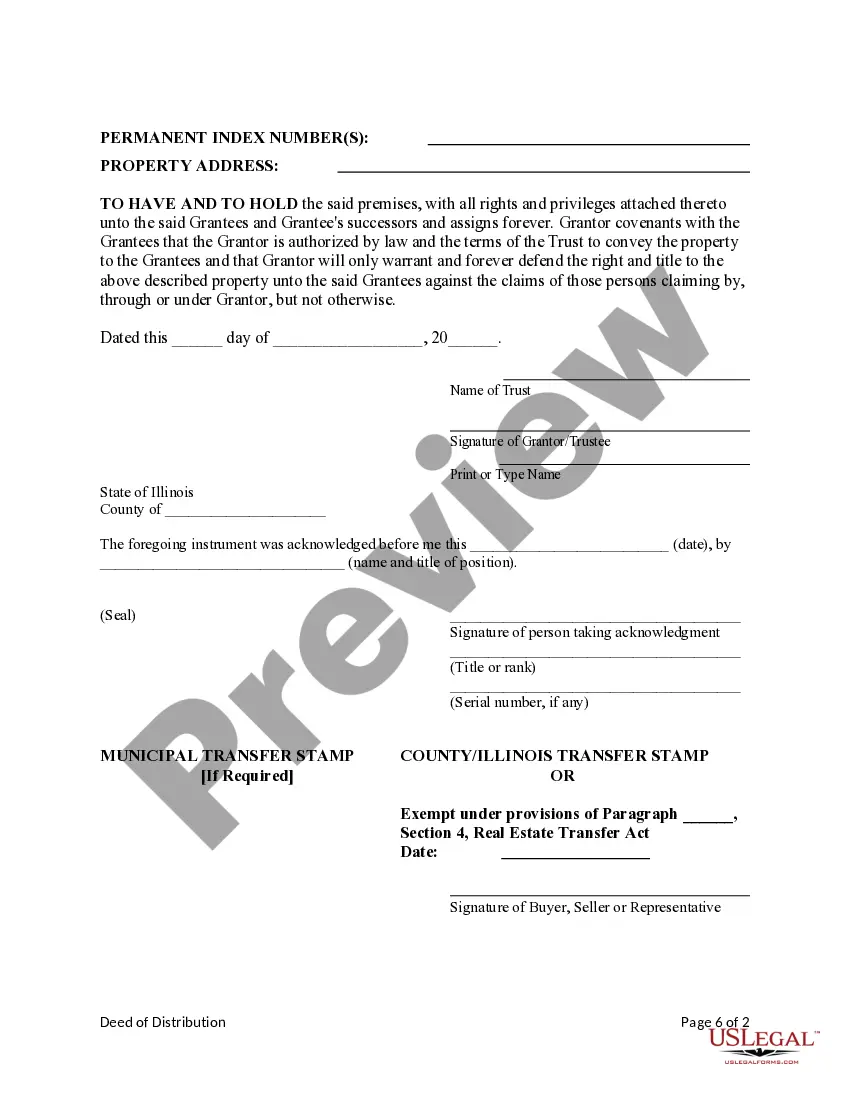

This form is a Deed of Distribution for use by an individual acting as Trustee of a Trust and transferring real property to four individuals. Grantor conveys and specially warrants the described property to the Grantees. This deed complies with all state statutory laws.

The Cook Illinois Deed of Distribution from Trust to Four Individuals is a legal document that facilitates the transfer of ownership and distribution of assets held in trust to four specific individuals. This deed is commonly used in Cook County, Illinois, and it ensures the proper allocation of trust assets to the intended beneficiaries. This deed serves as a crucial instrument in estate planning and asset management, allowing trustees to execute the final wishes of the trust or. The document outlines the terms, conditions, and specific details of the distribution process, ensuring a transparent and lawful transfer of assets. The Cook Illinois Deed of Distribution from Trust to Four Individuals typically includes several important sections. It identifies the trust or, the beneficiaries, and the trustee responsible for asset distribution. The document also specifies the nature and value of the assets involved in the distribution. Additionally, this deed may differentiate between different types of assets, such as real estate properties, financial investments, personal belongings, or any other assets outlined in the trust. Each beneficiary's share and entitlement to these assets will be clearly defined in the document. It is essential to mention that there are different types of Cook Illinois Deed of Distribution from Trust to Four Individuals, which can vary based on specific circumstances. These may include: 1. Life Estate Cook Illinois Deed of Distribution: This type of deed grants beneficiaries ownership of real estate or other assets for the duration of their lifetime. Upon their death, the property reverts to the trust or passes on to other designated beneficiaries. 2. Trust Termination Cook Illinois Deed of Distribution: This type of deed is used when the trust is dissolved or terminated. It outlines the distribution of assets to the identified beneficiaries according to the trust or's wishes. 3. Specific Asset Cook Illinois Deed of Distribution: In cases where the trust holds various types of assets, this deed specifies the distribution of a particular asset or group of assets to the four individuals mentioned. 4. Residuary Cook Illinois Deed of Distribution: If there are remaining or residual assets in the trust after specific distributions have been made, this deed outlines the fair and equitable allocation of those assets to the four individuals mentioned. Overall, the Cook Illinois Deed of Distribution from Trust to Four Individuals is a crucial legal document that ensures the proper transfer of trust assets to specified beneficiaries. It provides clarity, legality, and transparency in asset distribution, allowing the trust or's wishes to be accurately executed.