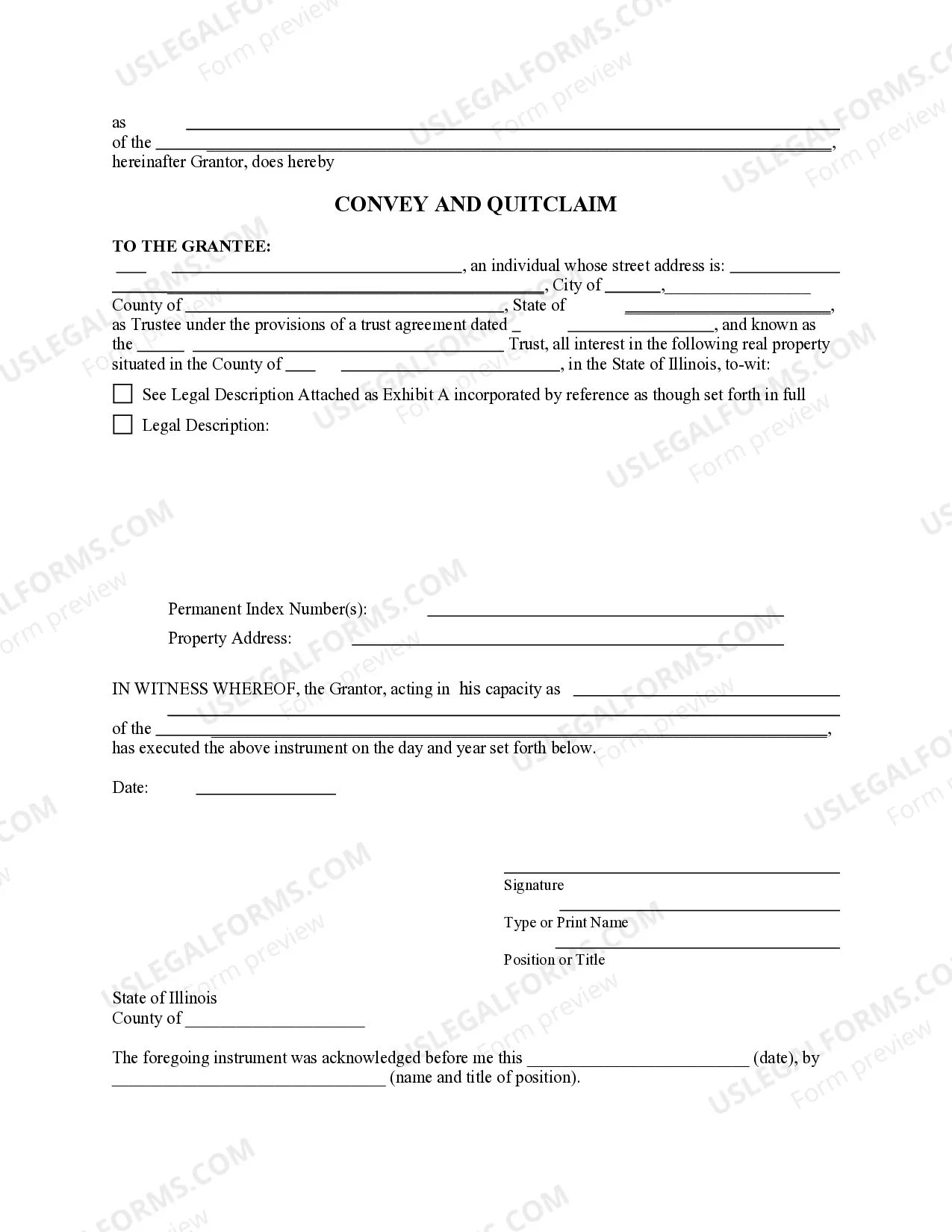

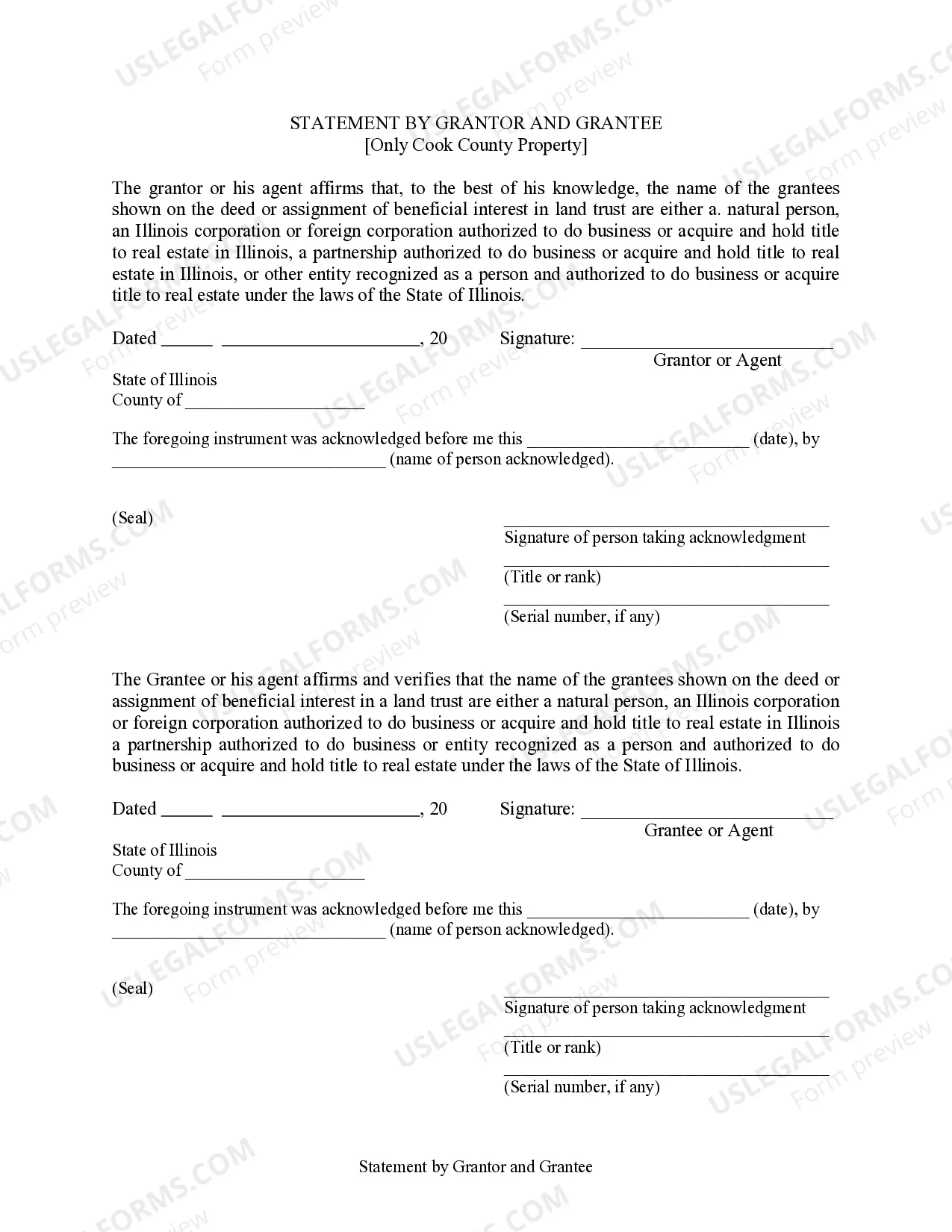

This form is a Quitclaim Deed for an individual Fiduciary as Grantor transferring real property to a Trust as Grantee. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: A Comprehensive Overview In Elgin, Illinois, a Fiduciary Quitclaim from an Individual Fiduciary to a Trust is a legal document that facilitates the transfer of property or assets from an individual fiduciary to a trust. This transfer ensures proper management and distribution of assets, in adherence to the trust's provisions and objectives. A fiduciary quitclaim is typically used when an individual fiduciary, such as a trustee or an executor, holds property that needs to be transferred to a trust. By executing this quitclaim, the fiduciary relinquishes their legal ownership rights and transfers ownership to the trust. Keywords: Elgin, Illinois, Fiduciary Quitclaim, Individual Fiduciary, Trust, Property, Assets, Transfer, Management, Distribution, Provisions, Objectives, Executor, Legal Ownership Rights Different Types of Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: 1. Real Estate Fiduciary Quitclaim: This type of fiduciary quitclaim is used when the asset being transferred to the trust includes real estate properties such as residential homes, commercial buildings, or undeveloped land. 2. Financial Assets Fiduciary Quitclaim: When the fiduciary possesses financial assets like bank accounts, stocks, bonds, or investment portfolios, a financial asset fiduciary quitclaim is executed to transfer ownership and control to the trust. 3. Personal Property Fiduciary Quitclaim: In cases when the fiduciary holds personal property that needs to be transferred to the trust, such as artwork, jewelry, vehicles, or any other valuable possessions, a personal property fiduciary quitclaim is utilized. 4. Business Assets Fiduciary Quitclaim: If the fiduciary is responsible for managing or representing a business and intends to transfer ownership of business assets, including real estate, equipment, intellectual property, or contracts, a business asset fiduciary quitclaim is implemented. It is important to remember that a Fiduciary Quitclaim from an Individual Fiduciary to a Trust should be prepared and executed with the assistance of an experienced legal professional well-versed in estate planning and trust administration. This ensures compliance with all applicable laws and regulations, and the smooth transfer of assets to the trust while safeguarding the interests of all parties involved. Keywords: Real Estate, Financial Assets, Personal Property, Business Assets, Estate Planning, Trust Administration, Legal Professional, Compliance, Laws and Regulations, Transfer of Assets, Smooth Process, Safeguarding, Interests, Parties Involved. In conclusion, an Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust is a crucial legal document that enables the transfer of various types of assets from an individual fiduciary to a trust. Whether it involves real estate properties, financial assets, personal belongings, or business assets, the fiduciary quitclaim ensures a well-organized and legally-compliant asset transfer process in accordance with the trust's provisions and objectives.Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: A Comprehensive Overview In Elgin, Illinois, a Fiduciary Quitclaim from an Individual Fiduciary to a Trust is a legal document that facilitates the transfer of property or assets from an individual fiduciary to a trust. This transfer ensures proper management and distribution of assets, in adherence to the trust's provisions and objectives. A fiduciary quitclaim is typically used when an individual fiduciary, such as a trustee or an executor, holds property that needs to be transferred to a trust. By executing this quitclaim, the fiduciary relinquishes their legal ownership rights and transfers ownership to the trust. Keywords: Elgin, Illinois, Fiduciary Quitclaim, Individual Fiduciary, Trust, Property, Assets, Transfer, Management, Distribution, Provisions, Objectives, Executor, Legal Ownership Rights Different Types of Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: 1. Real Estate Fiduciary Quitclaim: This type of fiduciary quitclaim is used when the asset being transferred to the trust includes real estate properties such as residential homes, commercial buildings, or undeveloped land. 2. Financial Assets Fiduciary Quitclaim: When the fiduciary possesses financial assets like bank accounts, stocks, bonds, or investment portfolios, a financial asset fiduciary quitclaim is executed to transfer ownership and control to the trust. 3. Personal Property Fiduciary Quitclaim: In cases when the fiduciary holds personal property that needs to be transferred to the trust, such as artwork, jewelry, vehicles, or any other valuable possessions, a personal property fiduciary quitclaim is utilized. 4. Business Assets Fiduciary Quitclaim: If the fiduciary is responsible for managing or representing a business and intends to transfer ownership of business assets, including real estate, equipment, intellectual property, or contracts, a business asset fiduciary quitclaim is implemented. It is important to remember that a Fiduciary Quitclaim from an Individual Fiduciary to a Trust should be prepared and executed with the assistance of an experienced legal professional well-versed in estate planning and trust administration. This ensures compliance with all applicable laws and regulations, and the smooth transfer of assets to the trust while safeguarding the interests of all parties involved. Keywords: Real Estate, Financial Assets, Personal Property, Business Assets, Estate Planning, Trust Administration, Legal Professional, Compliance, Laws and Regulations, Transfer of Assets, Smooth Process, Safeguarding, Interests, Parties Involved. In conclusion, an Elgin, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust is a crucial legal document that enables the transfer of various types of assets from an individual fiduciary to a trust. Whether it involves real estate properties, financial assets, personal belongings, or business assets, the fiduciary quitclaim ensures a well-organized and legally-compliant asset transfer process in accordance with the trust's provisions and objectives.