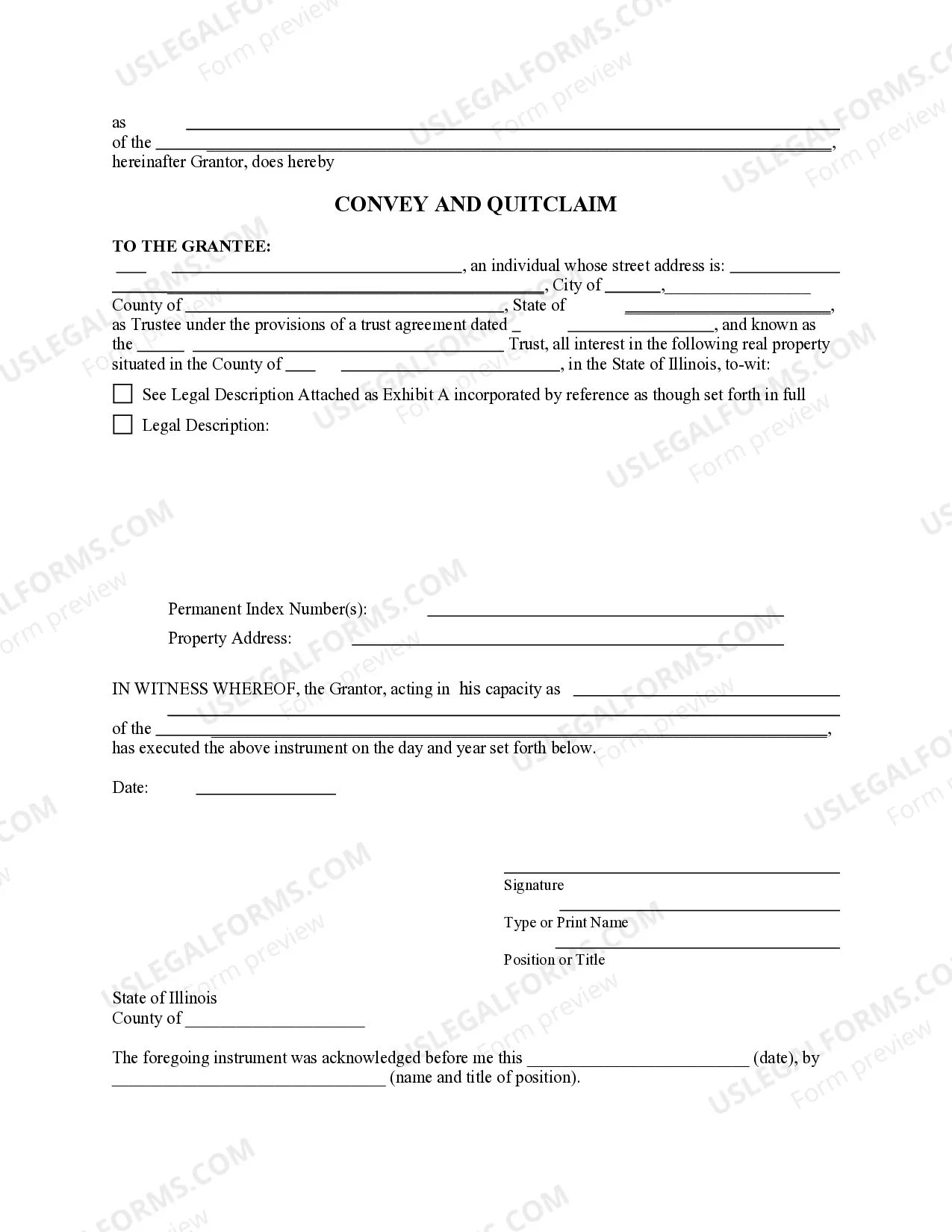

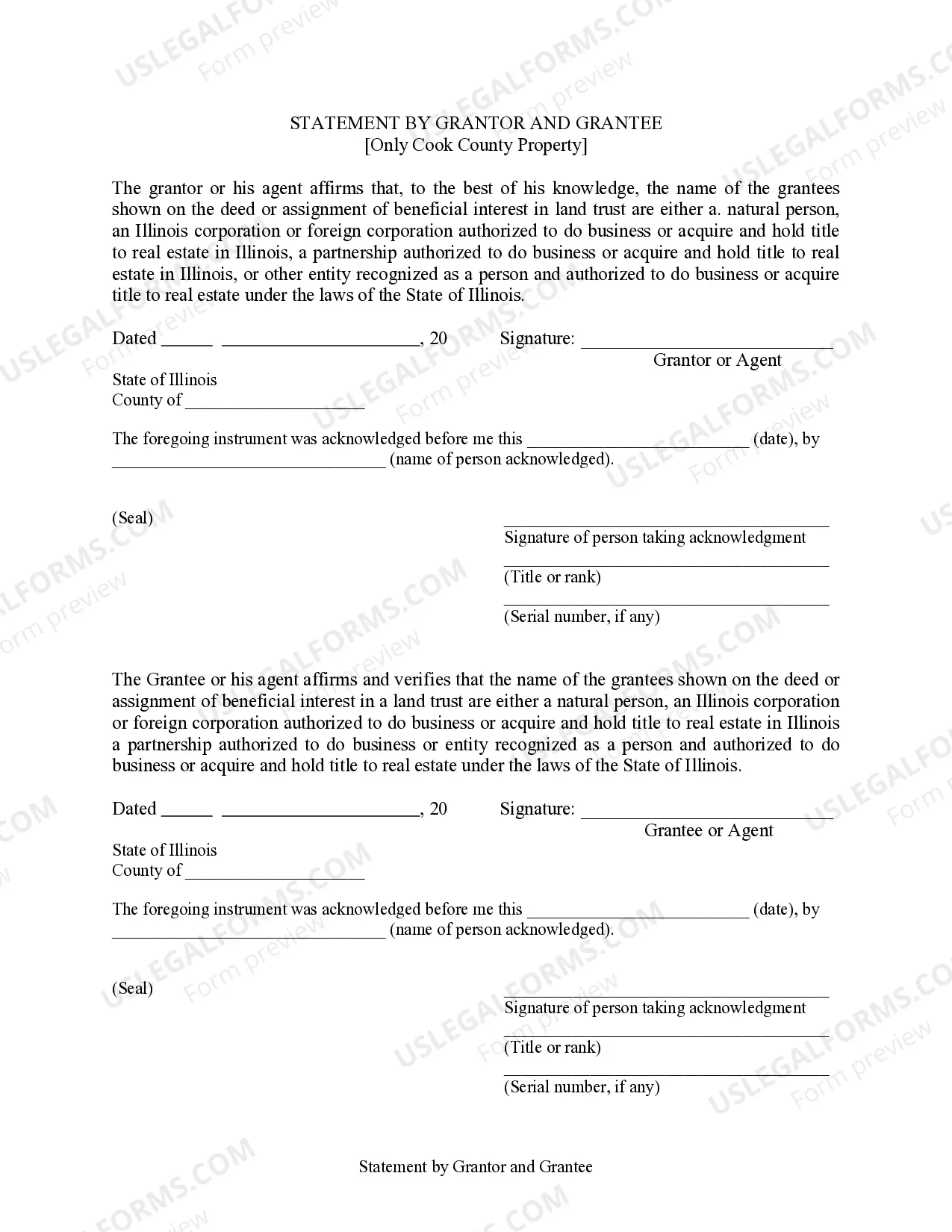

This form is a Quitclaim Deed for an individual Fiduciary as Grantor transferring real property to a Trust as Grantee. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Naperville, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: An Overview In Naperville, Illinois, a Fiduciary Quitclaim from an Individual Fiduciary to a Trust refers to the legal process of transferring ownership of real property from an individual acting as a fiduciary (also known as a trustee) to a trust entity. This transaction ensures that the property is held and managed in accordance with the terms and conditions outlined in the trust agreement. Keywords: Naperville, Illinois, Fiduciary Quitclaim, Individual Fiduciary, Trust Types of Naperville, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: 1. Living Trust Fiduciary Quitclaim: In a living trust arrangement, the individual acting as the fiduciary (trustee) transfers ownership of their property to the trust they have established while they are still alive. The purpose of this transfer is to ensure smooth transfer of property to beneficiaries or to facilitate efficient estate planning. 2. Testamentary Trust Fiduciary Quitclaim: A testamentary trust is established as part of a will and only becomes active upon the death of the person making the will (testator). In this case, the individual serving as the fiduciary (executor) transfers ownership of property to the trust according to the instructions specified in the will. 3. Special Needs Trust Fiduciary Quitclaim: A special needs trust is created for the benefit of an individual with special needs. In situations where the individual acts as their own fiduciary before transitioning to a trust, a fiduciary quitclaim may be necessary to transfer ownership of property to the trust. This facilitates the management of the assets in a manner that preserves eligibility for government benefits. 4. Charitable Trust Fiduciary Quitclaim: Charitable trusts are established to serve charitable purposes. If an individual fiduciary wishes to transfer ownership of property to such a trust for charitable endeavors in Naperville, Illinois, they can do so through a fiduciary quitclaim. This ensures that the property is effectively used for the designated charitable purposes. It is important to consult with legal professionals experienced in Naperville, Illinois, estate planning, and trusts to navigate the intricacies of Fiduciary Quitclaims from an Individual Fiduciary to a Trust. These professionals can provide detailed guidance and ensure compliance with local laws and regulations.Naperville, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: An Overview In Naperville, Illinois, a Fiduciary Quitclaim from an Individual Fiduciary to a Trust refers to the legal process of transferring ownership of real property from an individual acting as a fiduciary (also known as a trustee) to a trust entity. This transaction ensures that the property is held and managed in accordance with the terms and conditions outlined in the trust agreement. Keywords: Naperville, Illinois, Fiduciary Quitclaim, Individual Fiduciary, Trust Types of Naperville, Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust: 1. Living Trust Fiduciary Quitclaim: In a living trust arrangement, the individual acting as the fiduciary (trustee) transfers ownership of their property to the trust they have established while they are still alive. The purpose of this transfer is to ensure smooth transfer of property to beneficiaries or to facilitate efficient estate planning. 2. Testamentary Trust Fiduciary Quitclaim: A testamentary trust is established as part of a will and only becomes active upon the death of the person making the will (testator). In this case, the individual serving as the fiduciary (executor) transfers ownership of property to the trust according to the instructions specified in the will. 3. Special Needs Trust Fiduciary Quitclaim: A special needs trust is created for the benefit of an individual with special needs. In situations where the individual acts as their own fiduciary before transitioning to a trust, a fiduciary quitclaim may be necessary to transfer ownership of property to the trust. This facilitates the management of the assets in a manner that preserves eligibility for government benefits. 4. Charitable Trust Fiduciary Quitclaim: Charitable trusts are established to serve charitable purposes. If an individual fiduciary wishes to transfer ownership of property to such a trust for charitable endeavors in Naperville, Illinois, they can do so through a fiduciary quitclaim. This ensures that the property is effectively used for the designated charitable purposes. It is important to consult with legal professionals experienced in Naperville, Illinois, estate planning, and trusts to navigate the intricacies of Fiduciary Quitclaims from an Individual Fiduciary to a Trust. These professionals can provide detailed guidance and ensure compliance with local laws and regulations.