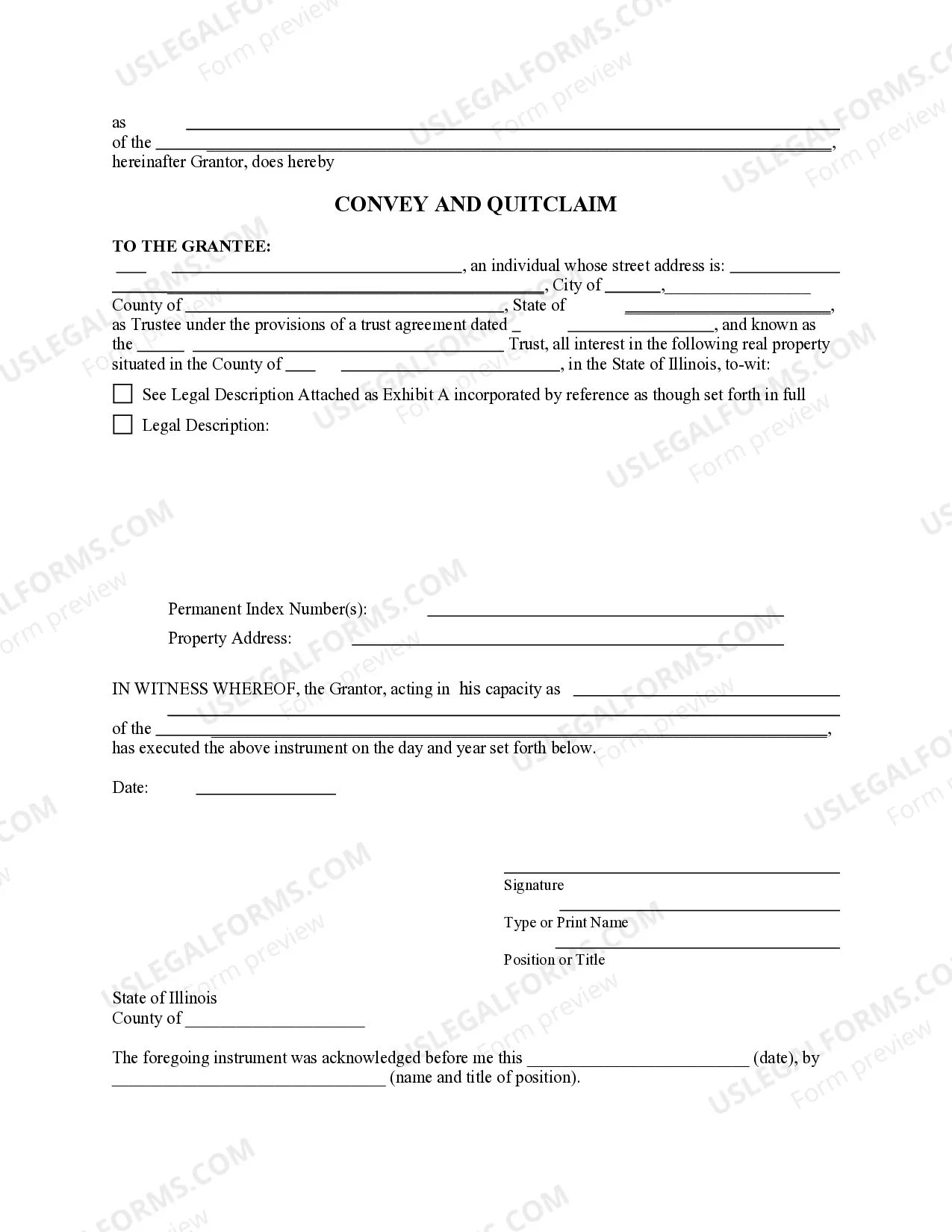

This form is a Quitclaim Deed for an individual Fiduciary as Grantor transferring real property to a Trust as Grantee. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Rockford Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust refers to a legally binding document that facilitates the transfer of property ownership rights from an individual fiduciary to a trust entity in the city of Rockford, Illinois. This action is conducted to establish a clear and recognized legal relationship between the individual fiduciary, who holds the property, and the trust, which becomes the new owner. The term "fiduciary" represents a person or entity who is entrusted with the responsibility to manage and administer assets or property on behalf of another party, known as the beneficiary. The Rockford Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust serves several purposes. It enables the transfer of property to a trust, ensuring assets are managed and protected for the benefit of the designated beneficiaries. Additionally, it allows the fiduciary to relinquish ownership rights, ensuring that the trust assumes full legal control over the property. By utilizing a quitclaim deed, the fiduciary guarantees that they possess the legal authority to convey the property to the trust, thus securing the trust's ownership rights. There are different types of Rockford Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust, each tailored to specific circumstances or purposes: 1. Revocable Living Trust Quitclaim: This type of quitclaim is used when an individual fiduciary wishes to transfer ownership of a property to a revocable living trust. A revocable living trust allows the fiduciary to maintain control over the trust during their lifetime, while providing a smooth transition of assets upon their death. 2. Irrevocable Trust Quitclaim: In situations where the individual fiduciary intends to transfer property to an irrevocable trust, an irrevocable trust quitclaim is utilized. This type of trust cannot be altered or revoked without the consent of the beneficiaries, ensuring property protection and long-term asset management. 3. Testamentary Trust Quitclaim: A testamentary trust quitclaim is executed when the transfer of property to a trust is carried out as a provision within a will or testament. This type of trust becomes effective upon the individual fiduciary's death, ensuring that the property is distributed according to their wishes. 4. Special Needs Trust Quitclaim: When a fiduciary needs to transfer ownership of a property to a trust designed to support the special needs of a beneficiary, a special needs trust quitclaim is utilized. This type of trust safeguards the beneficiary's eligibility for governmental benefits while providing for their long-term financial stability. In conclusion, the Rockford Illinois Fiduciary Quitclaim from an Individual Fiduciary to a Trust represents a crucial legal mechanism for the transfer of property ownership to a trust entity. It allows the fiduciary to relinquish their rights while ensuring the proper management and protection of assets for the benefit of the designated beneficiaries. With various types of Rockford Illinois Fiduciary Quitclaim suited to different circumstances, individuals can choose the approach that aligns with their specific needs and objectives.