Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession In the state of Illinois, when a person passes away without a will (intestate), their property passes to their heirs through a legal process called intestate succession. However, it is possible for a potential heir to renounce or disclaim their right to inherit the property. This is known as the Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession. Renunciation and disclaimer are legal actions taken by a potential heir to refuse or give up their right to inherit property from a deceased person. In Elgin, Illinois, this renunciation and disclaimer process is governed by the Illinois Probate Act. By renouncing their right to inherit, a potential heir is stating that they do not wish to receive the property or any benefits associated with it. This can be done for various reasons, such as wanting to avoid the responsibility and liabilities that come with owning the property or if the potential heir believes that it would be more beneficial for the property to go to someone else. The Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that needs to be filed with the appropriate court. This document clearly states the heir's intention to renounce or disclaim their interest in the property. It must include the deceased person's name, the potential heir's name, and a statement renouncing any rights to the property. It is important to note that there are different types of renunciations and disclaimers that can be made in Elgin, Illinois. These include: 1. Partial Renunciation: In some cases, a potential heir may only wish to renounce their right to a portion of the property. This could be due to concerns about the property's condition, ongoing maintenance costs, or other specific reasons. 2. Conditional Renunciation: A potential heir may choose to renounce their right to inherit the property under certain conditions or circumstances. For example, they may renounce their right if certain debts or taxes associated with the property are not paid off. 3. Renunciation with a Request for Alternative Distribution: In this case, the potential heir renounces their right to inherit the property but requests that the property be distributed to a specific person or organization instead. This allows the potential heir to ensure that the property goes to someone they believe would benefit from it more. It is crucial for anyone considering renouncing or disclaiming their right to inherit property received by intestate succession in Elgin, Illinois, to consult with an experienced attorney. This will ensure that the process is done correctly and in compliance with the Illinois Probate Act. In summary, the Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession allows potential heirs to renounce or disclaim their right to inherit property from a deceased person. Different types of renunciations and disclaimers include partial renunciation, conditional renunciation, and renunciation with a request for alternative distribution. Consulting with a qualified attorney is essential to navigate this legal process properly.

Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession

Description

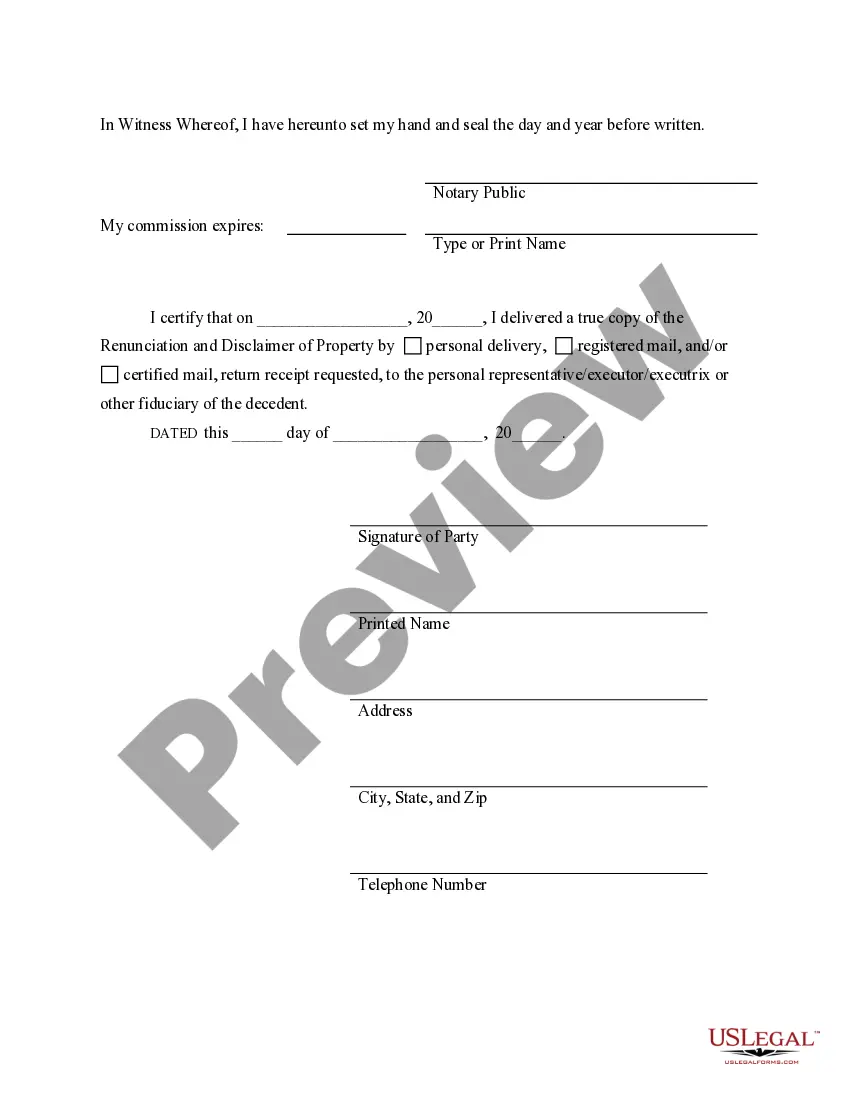

How to fill out Elgin Illinois Renunciation And Disclaimer Of Property Received By Intestate Succession?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for attorney services that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of an attorney. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Elgin Illinois Renunciation and Disclaimer of Property received by Intestate Succession would work for you, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!