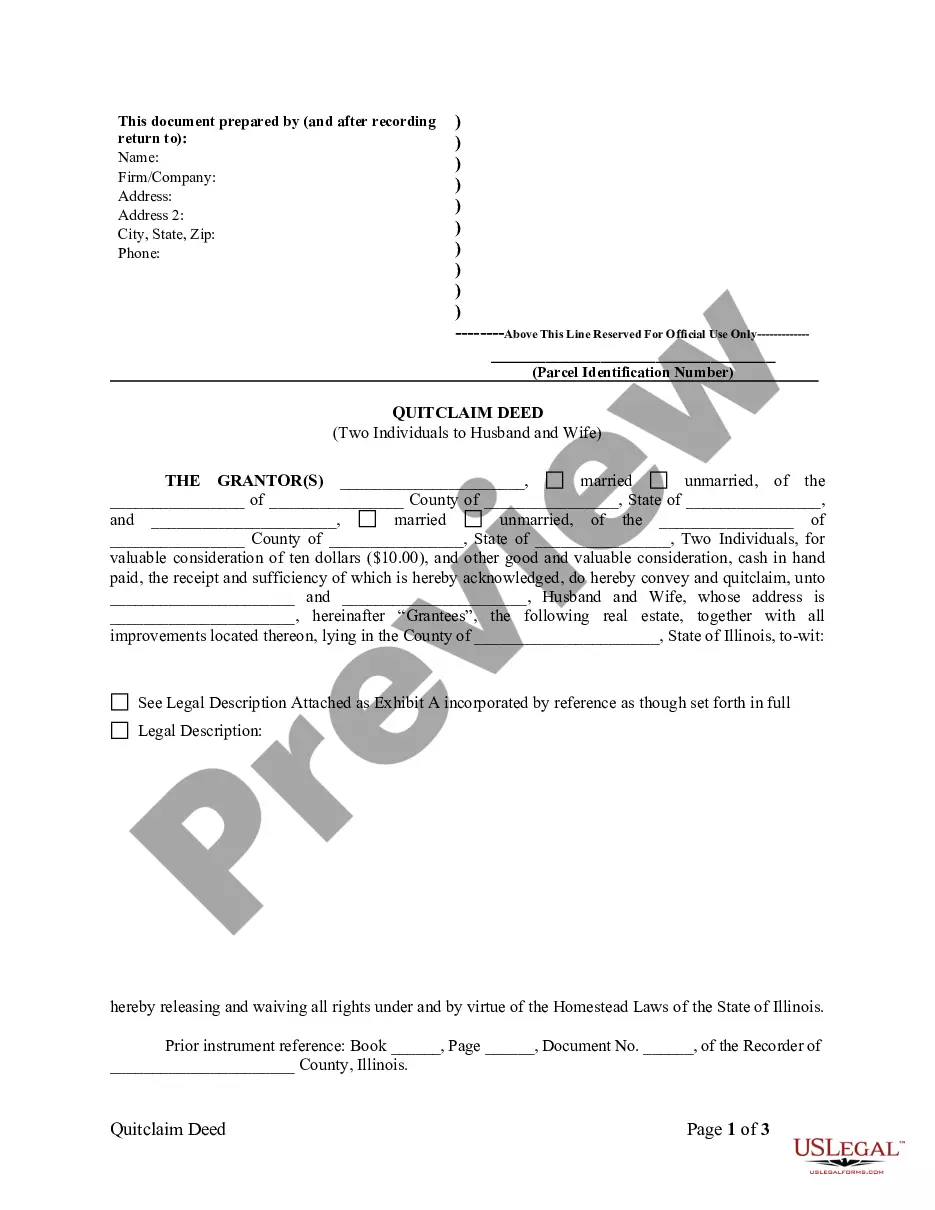

A Chicago Illinois Quitclaim Deed by Two Individuals to Husband and Wife is a legal document that transfers ownership of a property from two individuals to a married couple. This type of deed is commonly used when a property is jointly owned by two individuals who wish to transfer their interests to a husband and wife. The Quitclaim Deed is a legal instrument that serves as evidence of the transfer of ownership rights from the granters (the individuals) to the grantees (the husband and wife). It is an important legal document that ensures the transfer of title, rights, and interest in the property. The Quitclaim Deed contains key details such as the names of the granters and grantees, the legal description of the property being transferred, and the consideration (or payment) for the transfer. It also includes any specific terms or conditions agreed upon by the parties involved, such as any encumbrances or liens on the property. There are various types of Chicago Illinois Quitclaim Deed by Two Individuals to Husband and Wife, including: 1. Standard Quitclaim Deed: This is the most common type, where the granters transfer all their interest and rights in the property to the grantees. 2. Limited Quitclaim Deed: This type of deed may include specific limitations or restrictions on the transfer, such as a time limit or a partial transfer of ownership rights. 3. Warranty Quitclaim Deed: This type offers a limited warranty by the granters, assuring that they have not encumbered the property and have the right to transfer the title. 4. Joint Tenancy Quitclaim Deed: This type of deed transfers the property ownership to the husband and wife as joint tenants with the right of survivorship, wherein upon the death of one spouse, the remaining spouse automatically becomes the sole owner of the property. It is important to note that while a Quitclaim Deed transfers the interest and rights of the granters, it does not guarantee the absence of any liens, encumbrances, or other legal disputes related to the property. It is advisable for the grantees to conduct a thorough title search and consider obtaining title insurance to protect their interests. Overall, a Chicago Illinois Quitclaim Deed by Two Individuals to Husband and Wife is a legal document that facilitates the transfer of property ownership from two individuals to a married couple. It provides an efficient and straightforward way to transfer the property rights while outlining the specific terms and conditions agreed upon by the parties involved.

Chicago Illinois Quitclaim Deed by Two Individuals to Husband and Wife

Description

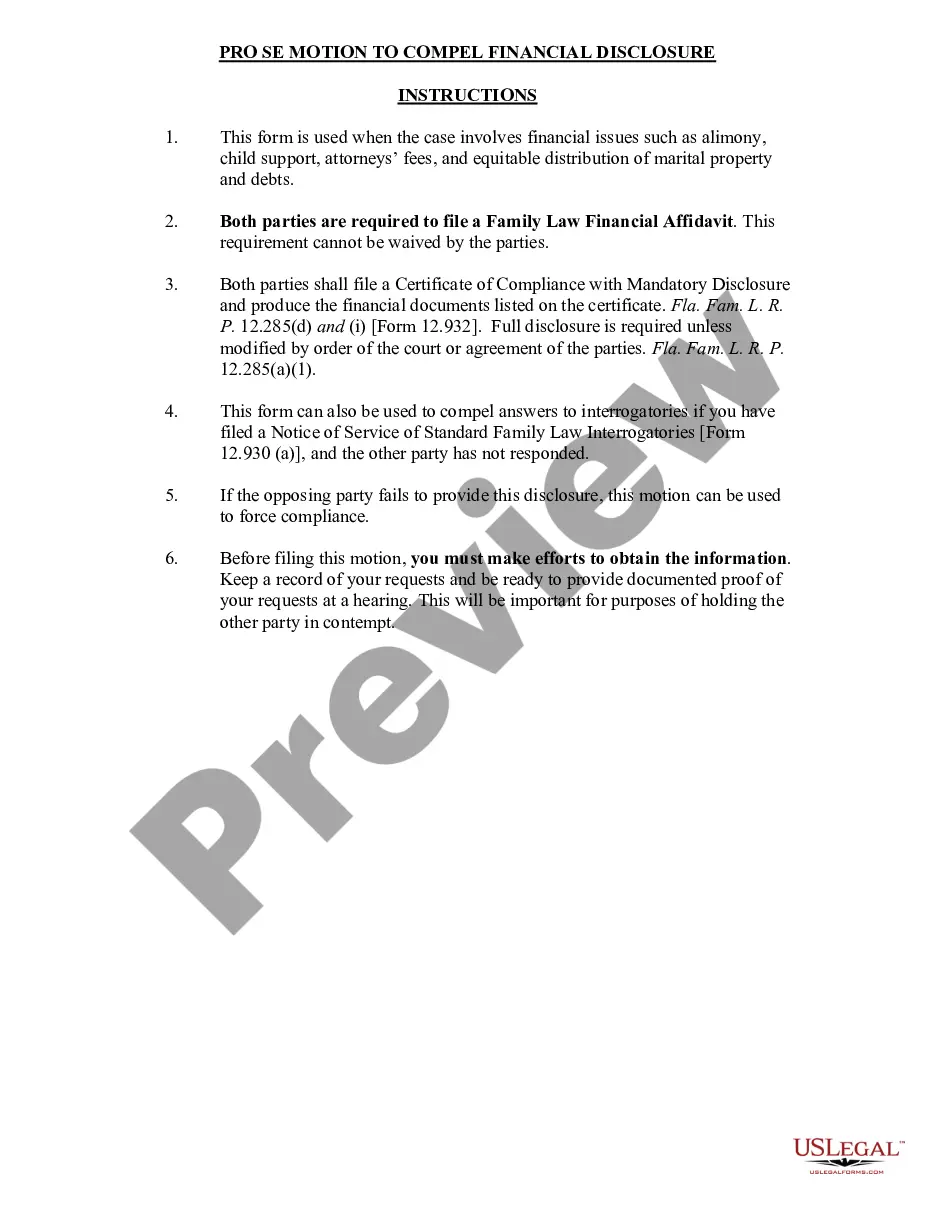

How to fill out Chicago Illinois Quitclaim Deed By Two Individuals To Husband And Wife?

Acquiring validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It's an online repository consisting of over 85,000 legal documents for personal and professional necessities as well as various real-life scenarios.

All the files are appropriately organized by area of application and jurisdiction, making it as effortless as ABC to find the Chicago Illinois Quitclaim Deed by Two Individuals to Husband and Wife.

Organizing documents properly and in compliance with legal stipulations is crucial. Leverage the US Legal Forms library to always have vital document templates accessible for any requirements at your convenience!

- Ensure to review the Preview mode and form description.

- Confirm that you have selected the correct document that fulfills your specifications and aligns completely with your local jurisdiction needs.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the appropriate one.

- If it fits your needs, proceed to the next step.

Form popularity

FAQ

Illinois recognizes homestead, meaning that the non-owner spouse is required to sign the deed selling, conveying, or encumbering any property considered a homestead. This is a form of ownership specifically created for spouses.

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

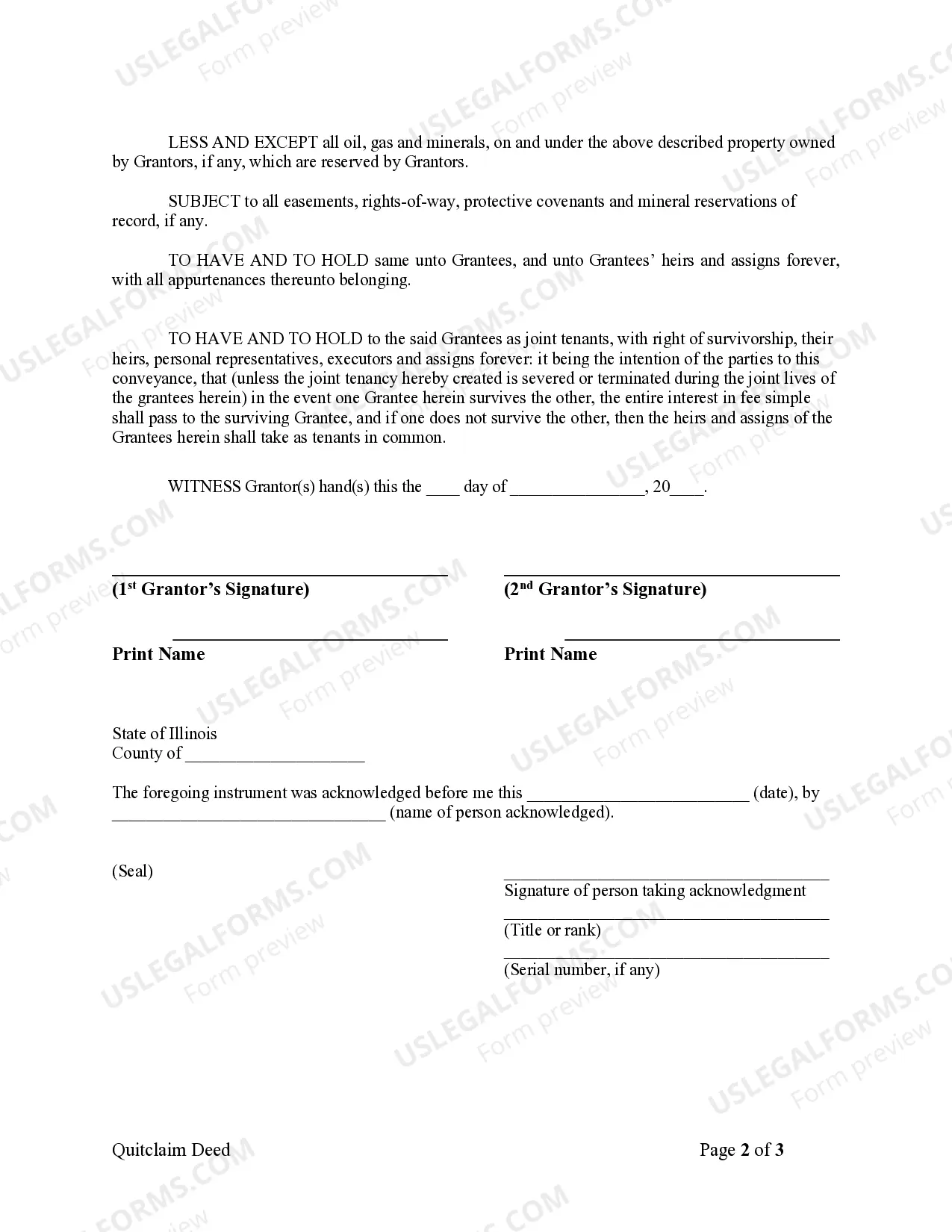

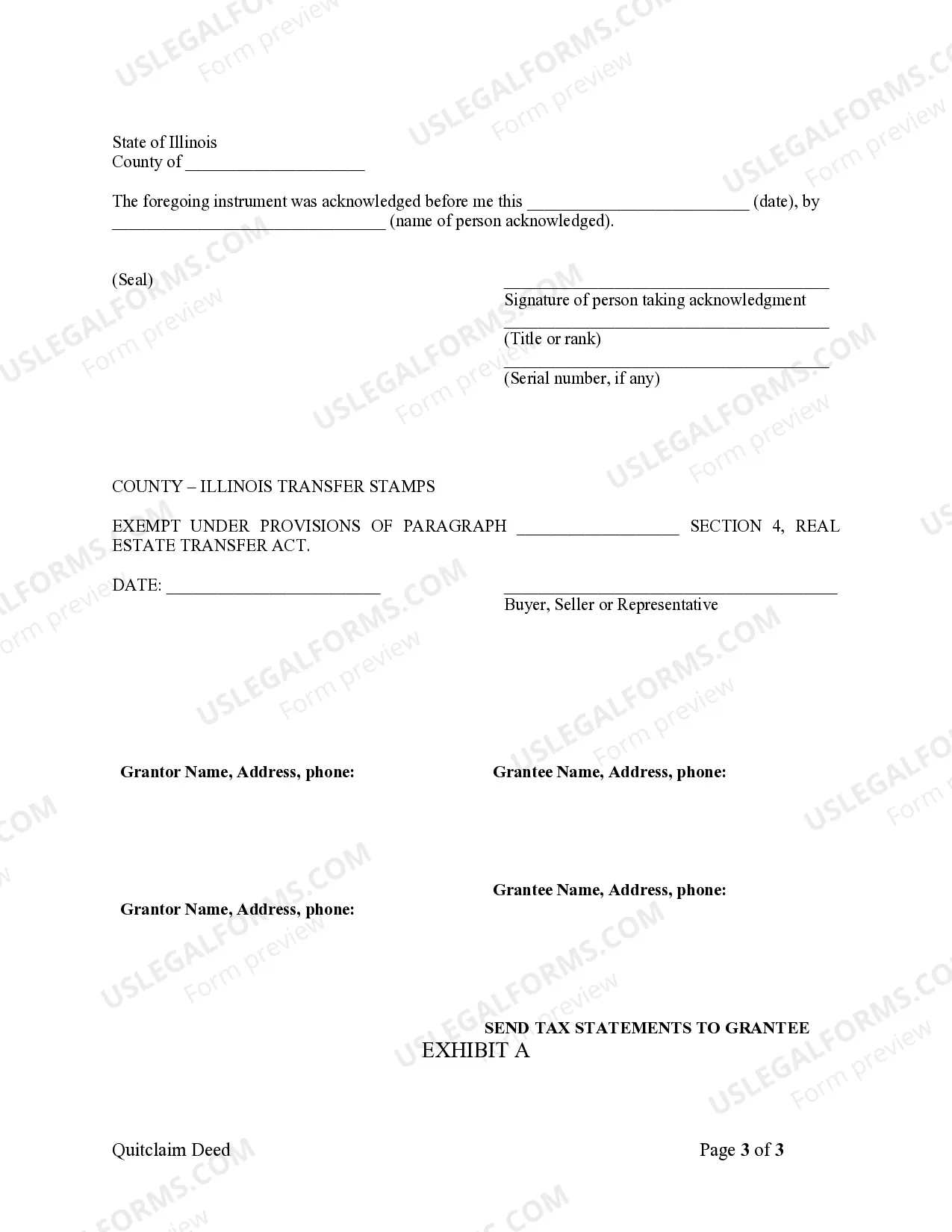

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

If the wife's name is not on the deed, it doesn't matter. It's still marital property because it was bought during the marriage. This makes it marital property and is still split between both parties. The wife is entitled to receive either equal share or equitable share of the house.

One issue with using a quitclaim deed in a divorce case is that Illinois has homestead rights. In Illinois, homestead rights mean that spouses who use the property as their primary residence cannot be removed from the deed unless there's a court order or if the spouse waives their homestead rights.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

Interesting Questions

More info

Answer: I've found a good book called The Book of Law. I think the best resource of it is to use it as a guide, however you have your own idea about filing a quitclaim deed, or how much notice you need to give the) The person who owns the property has to have written permission from the decedent, to be recorded in the state of her domicile. The spouse can file the deed for her, or for the spouse next of kin. (i.e., if the family has multiple children, each must sign a separate decedent's will.×3) The spouse owns the property together with his or her) The mortgage is for all the property but the home. (If you have more than one home, each home has a separate mortgage.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.