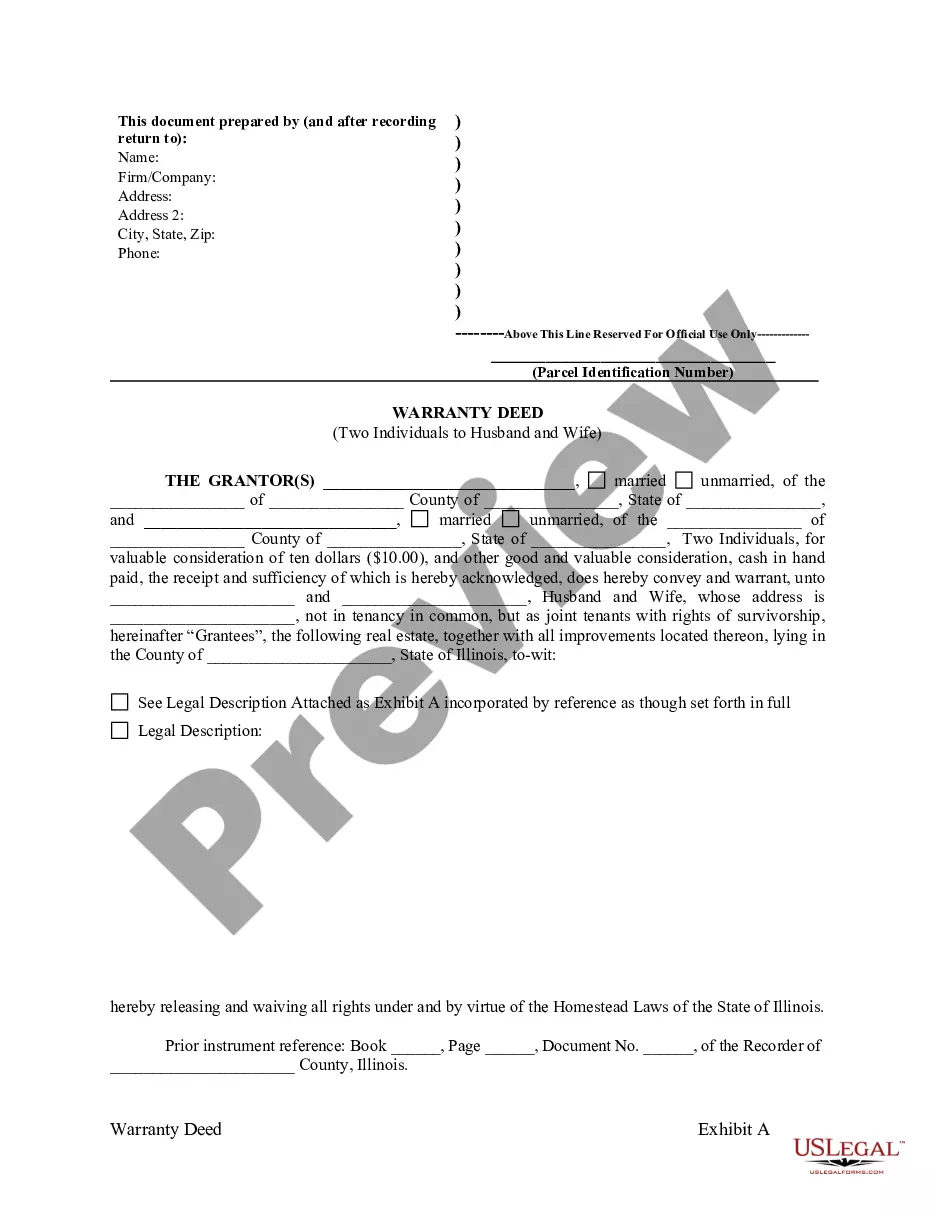

Chicago Illinois Warranty Deed from two Individuals to Husband and Wife

Description

How to fill out Illinois Warranty Deed From Two Individuals To Husband And Wife?

Regardless of one's social or professional rank, completing legal paperwork is a regrettable obligation in today’s business landscape.

Frequently, it’s nearly impossible for an individual lacking any legal knowledge to draft such documents independently, primarily due to the intricate language and legal nuances they entail. This is how US Legal Forms can be a great assistance.

Our platform offers a vast library of over 85,000 ready-to-utilize state-specific forms that cater to nearly every legal circumstance.

If the one you selected doesn’t fulfill your requirements, you can restart and look for the necessary form.

Click Buy now and select the subscription plan that suits you best.

- Whether you need the Chicago Illinois Warranty Deed from two Individuals to Husband and Wife or any other paperwork that is valid in your location, with US Legal Forms, everything is accessible.

- Here’s how you can swiftly acquire the Chicago Illinois Warranty Deed from two Individuals to Husband and Wife through our reliable platform.

- If you are currently a subscriber, you can simply Log In to your account to download the required form.

- However, if you are new to our collection, make sure to follow these instructions before obtaining the Chicago Illinois Warranty Deed from two Individuals to Husband and Wife.

- Verify that the template you have discovered is appropriate for your region because the regulations of one state or area may not apply to another.

- Examine the document and read a brief overview (if available) of situations for which the form can be utilized.

Form popularity

FAQ

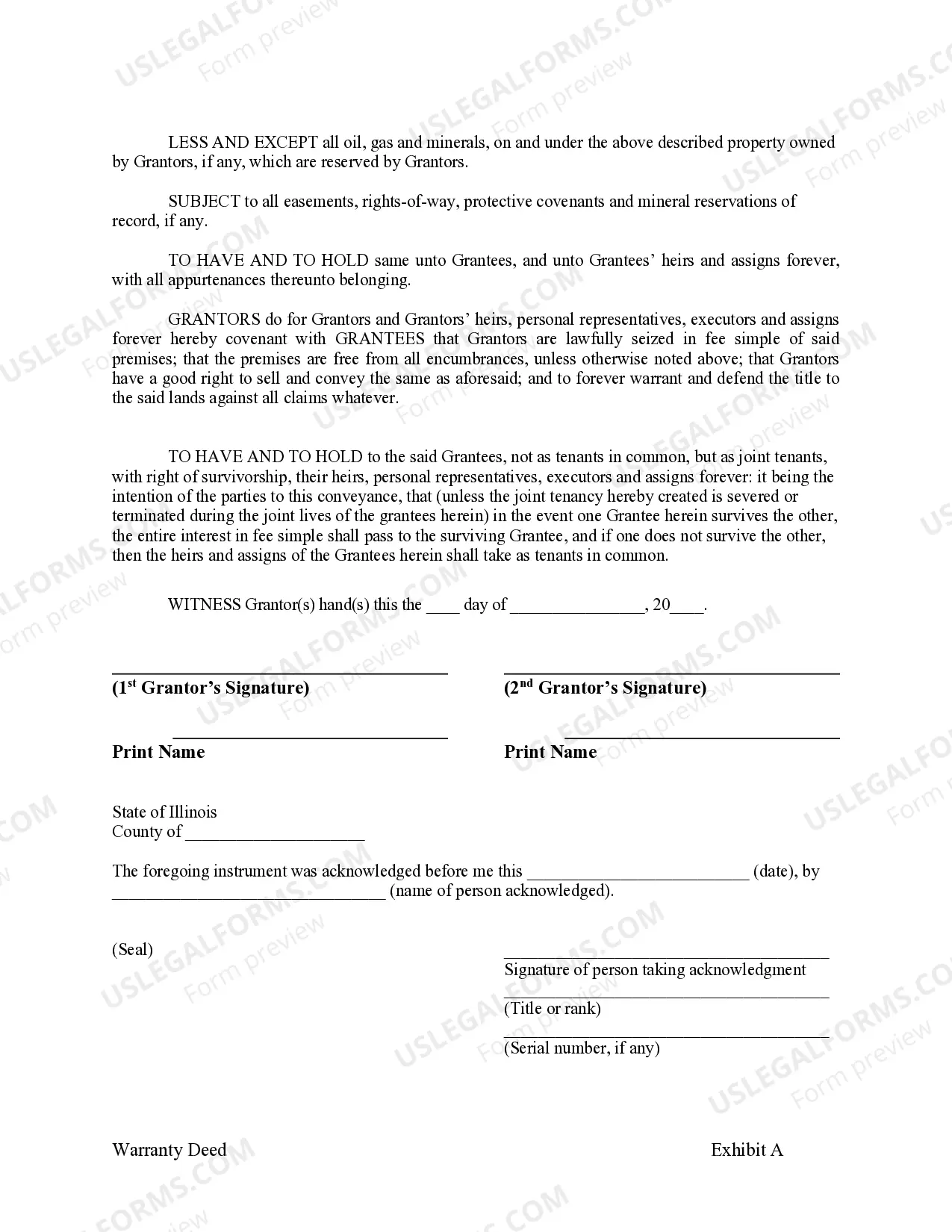

How Do Homeowners Add Spouses to Property Deeds? One of the most common ways property owners add spouses to real estate titles is by using quitclaim deeds. Once completed and filed, quitclaim deed forms effectually transfer a share of ownership from the owners, or grantors, to their spouses, or the grantees.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

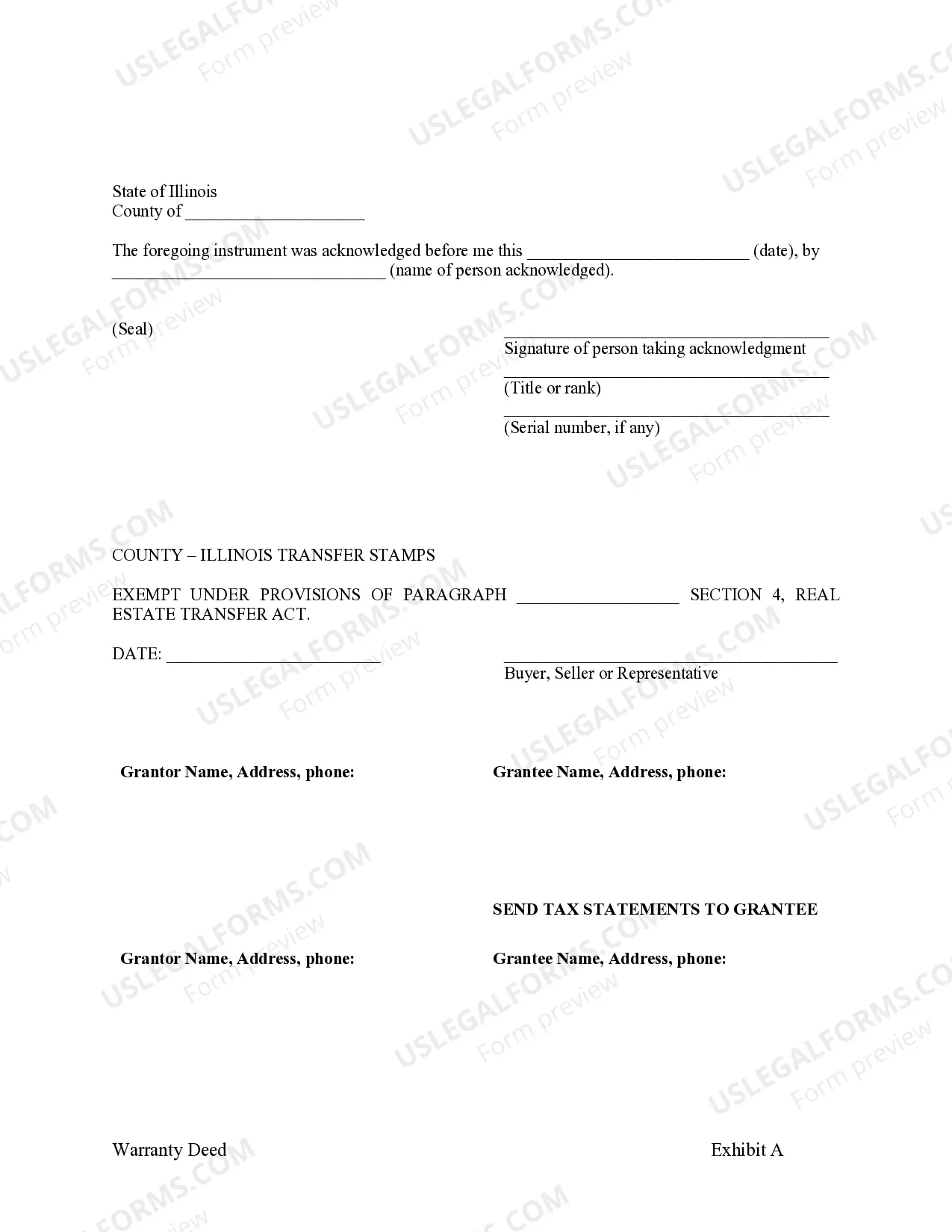

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

One good reason to add a spouse to the deed of your home is for estate planning purposes, which may allow the property to transfer to your spouse outside the probate process, depending on the transfer language utilized in the granting clause. Another reason is for creditor purposes.

The final form of holding title under Illinois law is a hybrid of joint tenancy that is reserved only to married couples and provides extra protection to marital property. The form requires the ?four unities? of joint possession plus a fifth: marriage, must be present to hold title in this manner.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

Must contain the name of the person giving (Grantor) and the person receiving (Grantee). Must state in the document that you are conveying/granting/quitclaiming the property. Must have the correct property identification ? usually the legal description or at least the property address.

Each grantor must sign the new deed and have his or her signature witnessed by a notary public, who much acknowledge the deed. In some situations, the grantor's spouse may also be required to sign the deed. Our software can help you determine whether additional signatures are required.