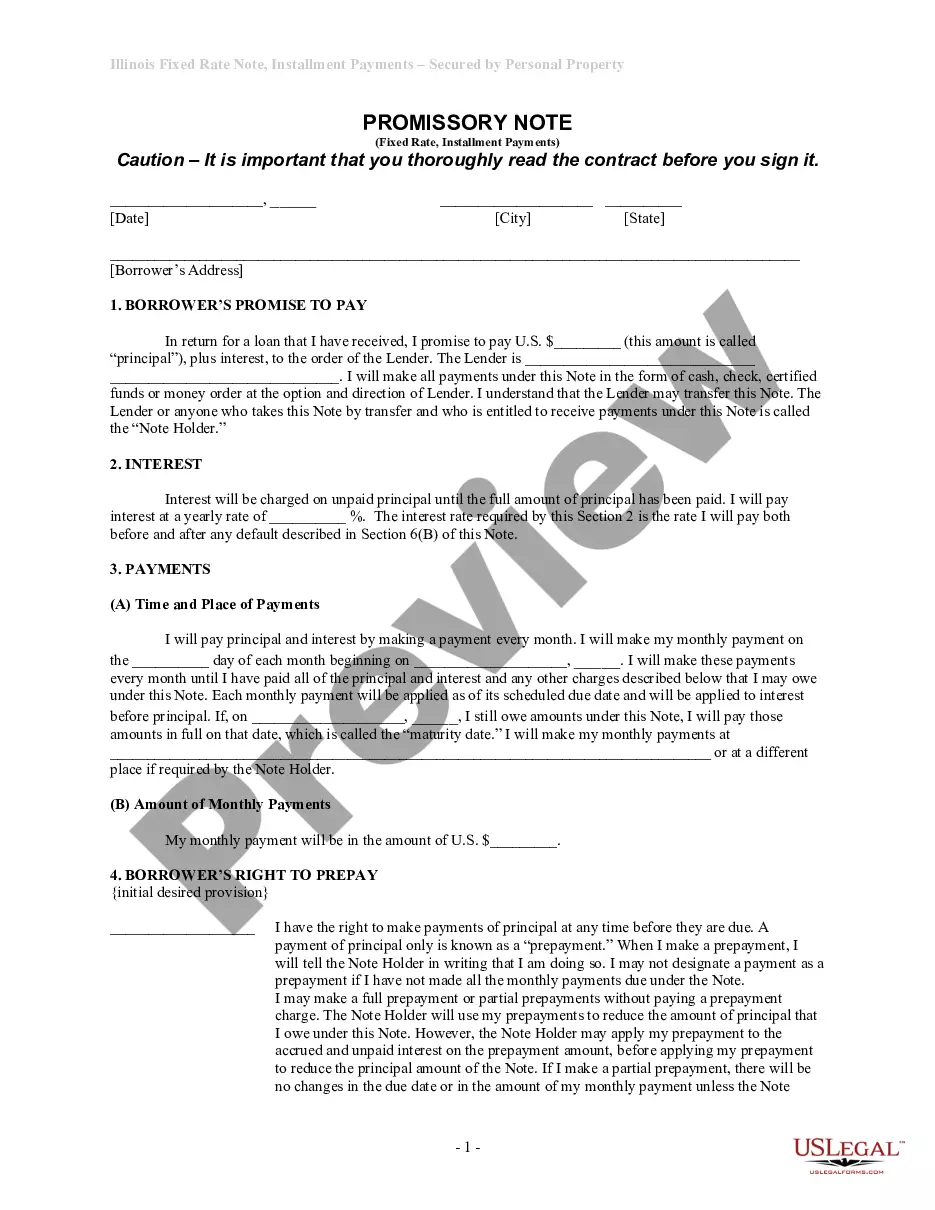

Chicago Illinois Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Illinois Quitclaim Deed By Two Individuals To LLC?

If you’ve previously employed our service, sign in to your account and store the Chicago Illinois Quitclaim Deed by Two Individuals to LLC on your device by hitting the Download button. Ensure your subscription is active. If not, extend it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Browse the description and utilize the Preview feature, if available, to ensure it satisfies your needs. If it doesn’t fit, utilize the Search tab above to discover the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Retrieve your Chicago Illinois Quitclaim Deed by Two Individuals to LLC. Select the file format for your document and save it to your device.

- Complete your document. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

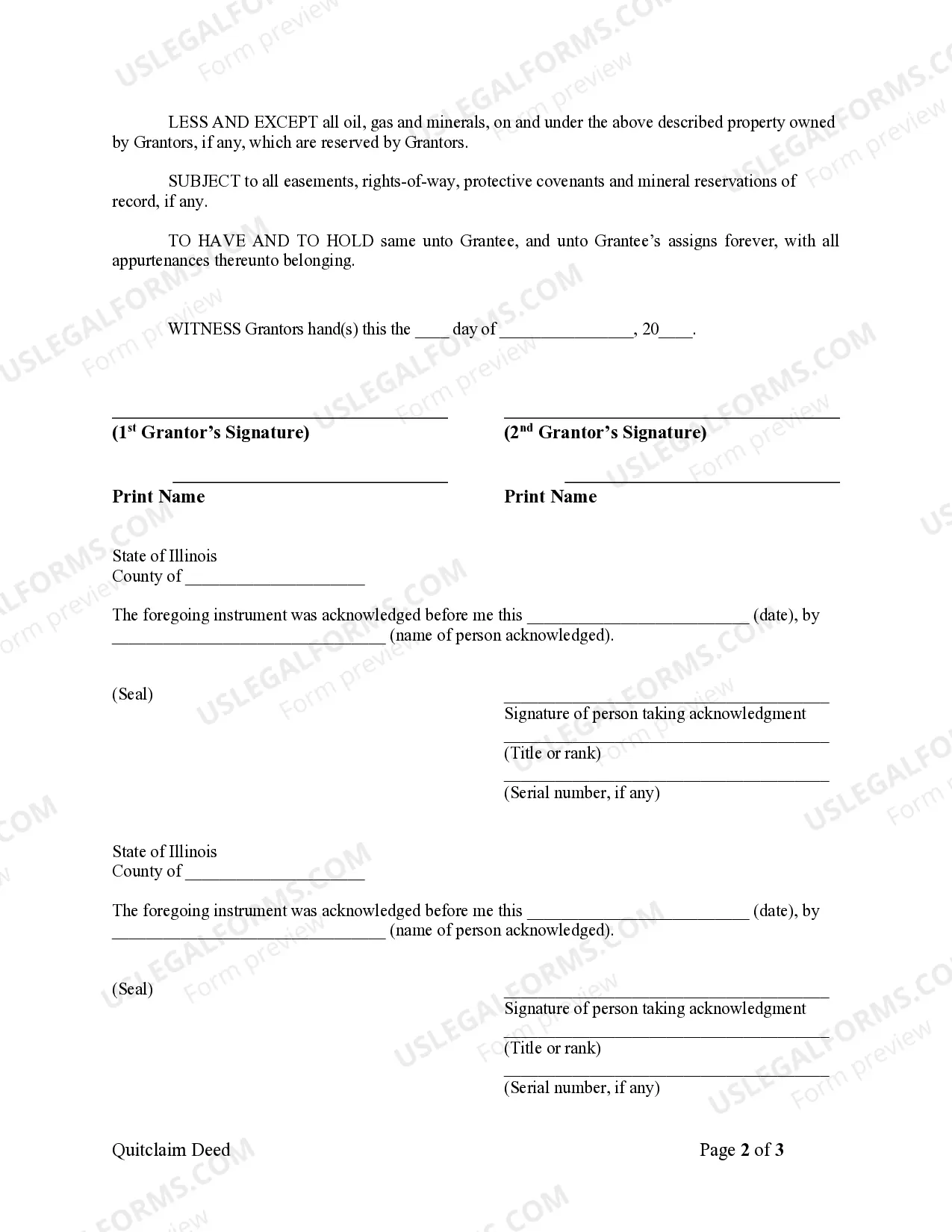

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

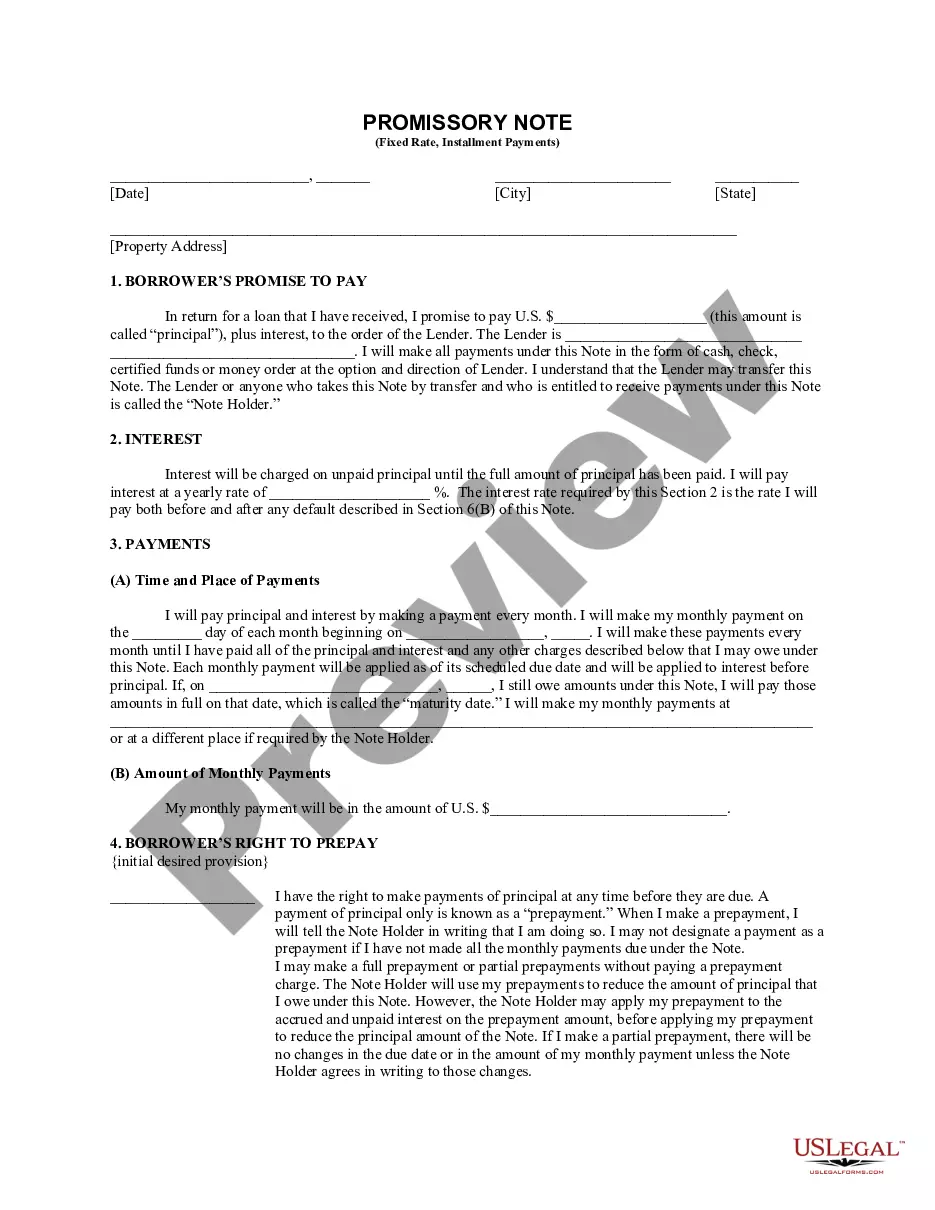

How Do I Transfer Title of a Property From a Person to an LLC? Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

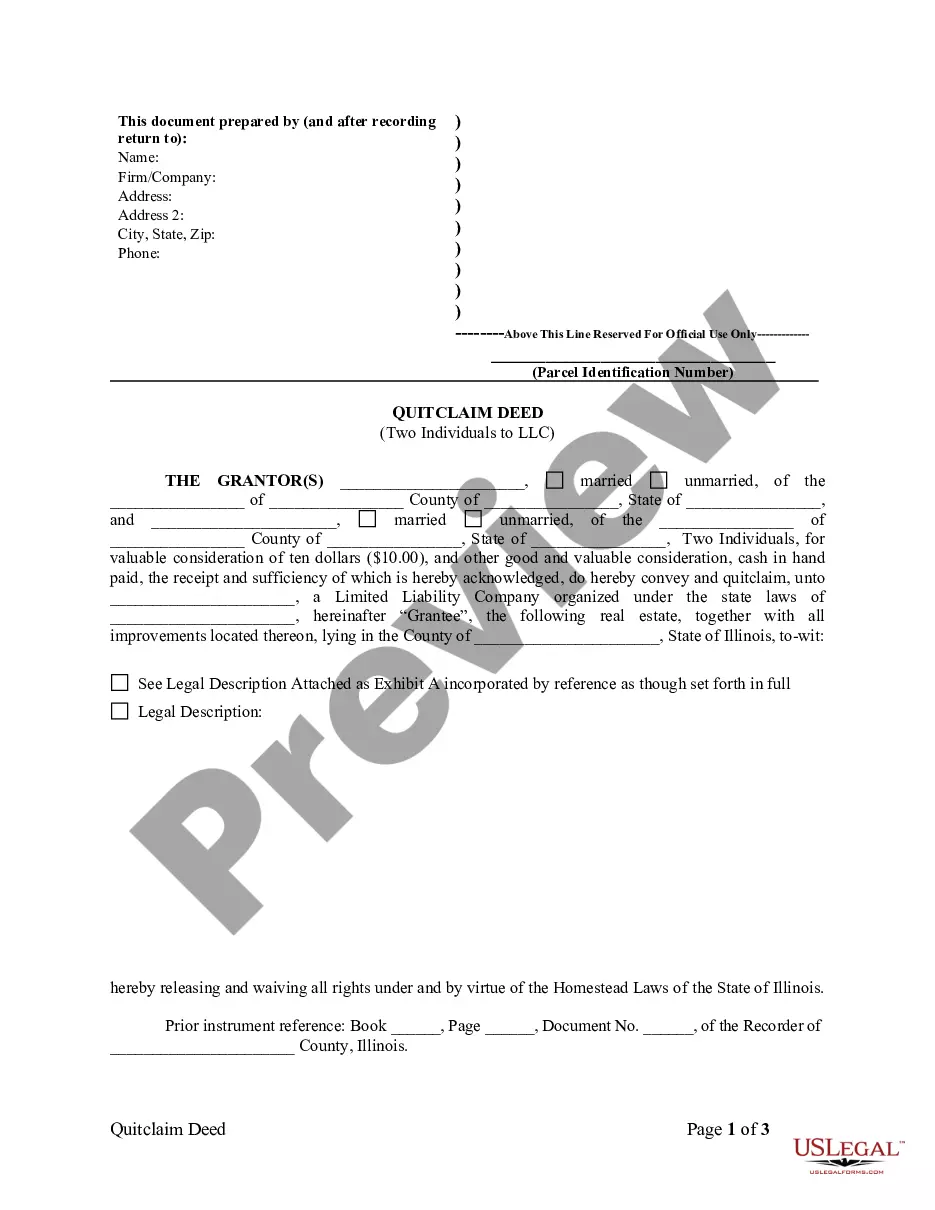

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

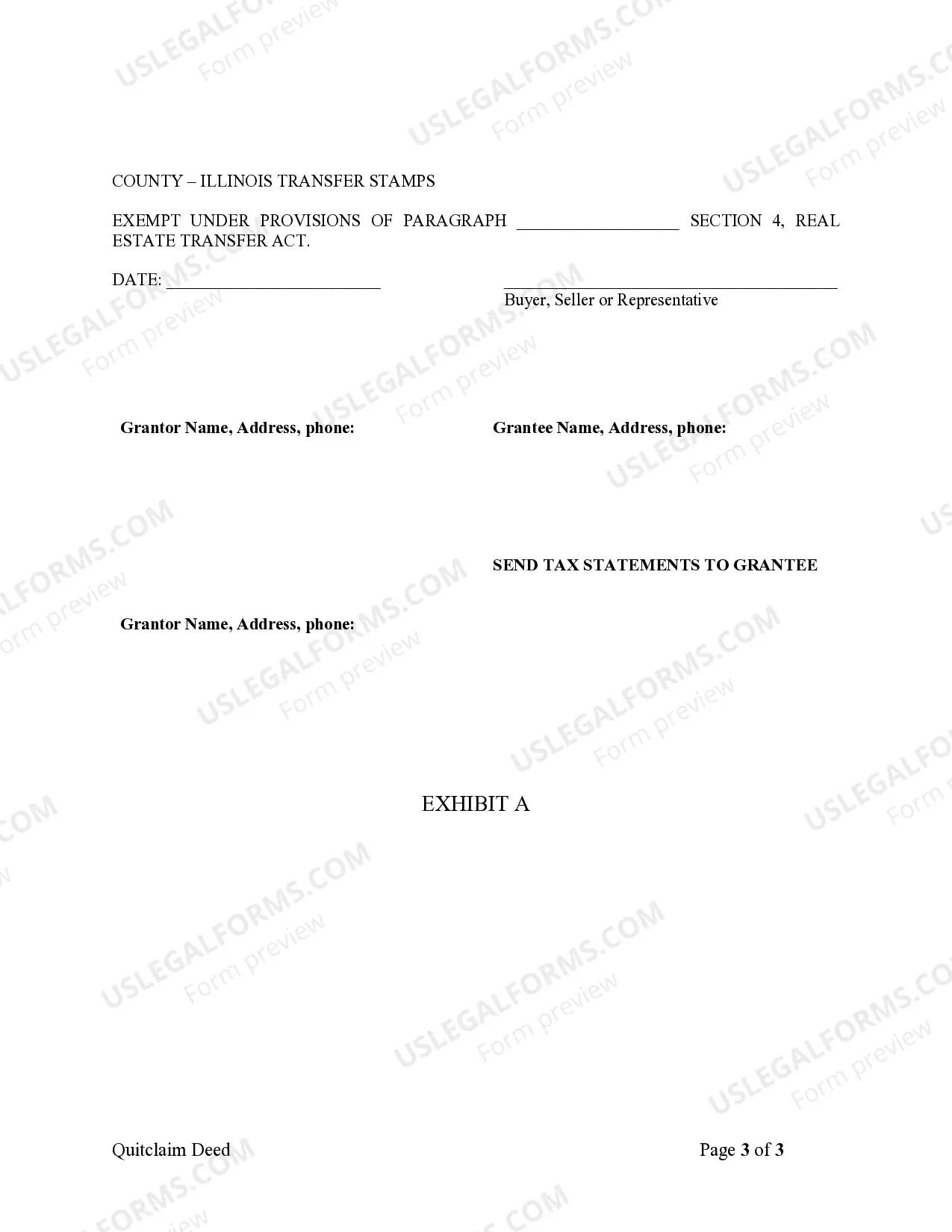

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees. Create a free Illinois Quit Claim Deed in minutes with our professional document builder.