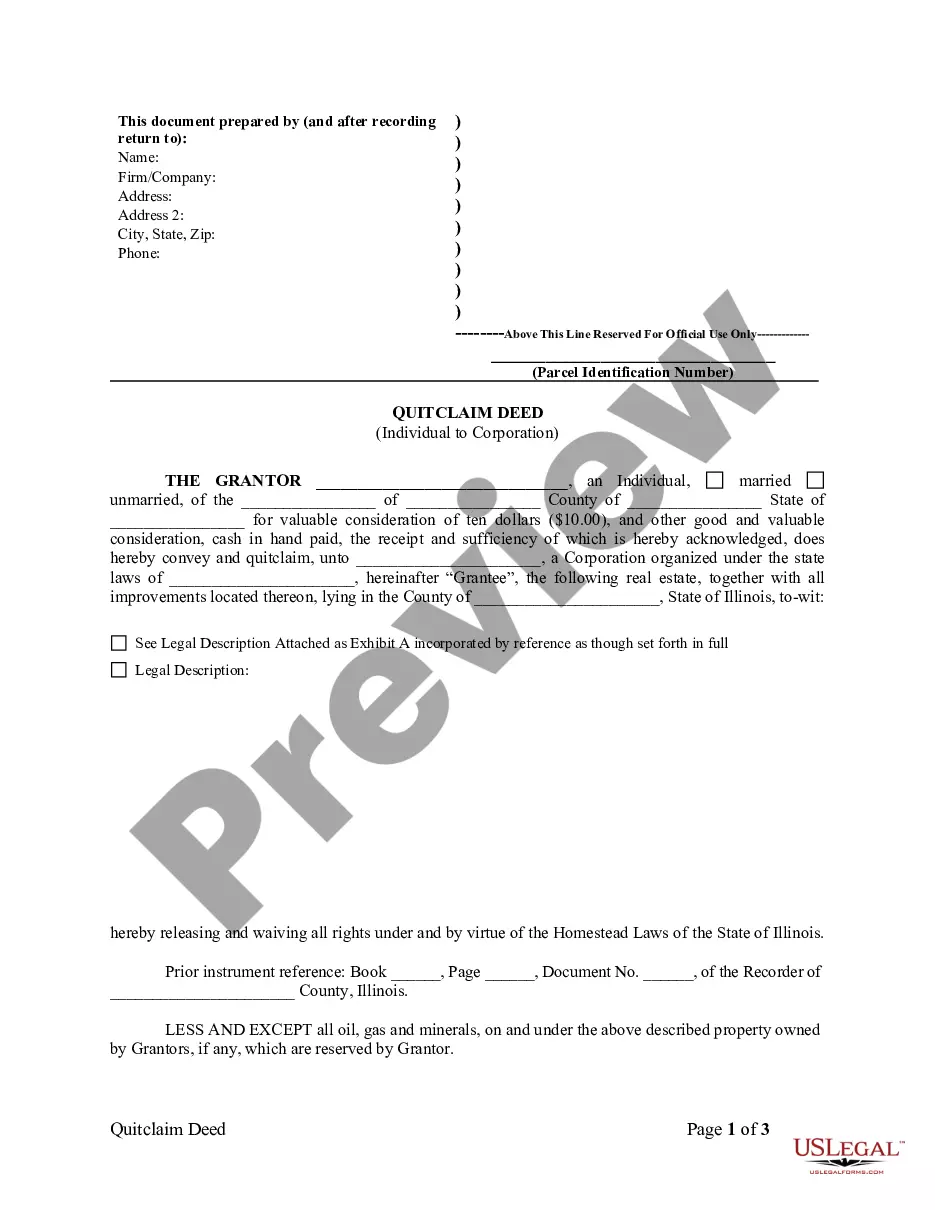

A Chicago Illinois Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of real estate from an individual, referred to as the granter, to a corporation, known as the grantee. This type of deed is commonly used when an individual wants to transfer ownership of a property they own to a corporation they are associated with. The main purpose of a quitclaim deed is to legally release any interest or claim the granter may have on the property. This means that unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties regarding the property's title. Key terms associated with a Chicago Illinois Quitclaim Deed from Individual to Corporation include: 1. Granter: The individual who currently holds ownership of the property and is transferring it to the corporation. 2. Grantee: The corporation that will receive ownership of the property. 3. Consideration: The amount of money or other value exchanged between the granter and grantee for the transfer of ownership. 4. Legal description: A detailed description of the property being transferred, including its boundaries, lot numbers, and any other necessary geographic identifiers. 5. Notary Public: A public official authorized to witness the signing of legal documents, including deeds, and affix their official seal. 6. Recording: Once the quitclaim deed is executed (signed by the granter and notarized), it must be filed with the Cook County Recorder of Deeds in Chicago, Illinois. This step ensures that the transfer of ownership is officially recorded in public records. 7. Corporate Bylaws: The governing rules and procedures adopted by the corporation, which may dictate how the corporation handles the transfer of ownership and real estate acquisition. There may be different variations of the Chicago Illinois Quitclaim Deed from Individual to Corporation, based on specific circumstances or requirements. Some examples may include: 1. Individual to Corporation — Transfer of Owned Property: When an individual who personally owns a property wants to transfer it to a corporation they are affiliated with. 2. Individual to Corporation — Transfer of Inherited Property: In cases where an individual inherits real estate and decides to transfer ownership to a corporation they are associated with. 3. Individual to Corporation — Transfer in Business Merger or Acquisition: When a company undergoes a merger or acquisition, an individual may use a quitclaim deed to transfer property ownership from themselves to the acquiring corporation. 4. Individual to Corporation — Consolidation of Assets: In situations where an individual wants to consolidate multiple properties they own into a corporation, a quitclaim deed can be used to transfer ownership to the corporation. 5. Individual to Corporation — Restructuring of Ownership: If an individual wants to restructure their personal assets, including real estate holdings, into a corporate entity for financial or legal reasons, a quitclaim deed can facilitate the transfer of property. It is essential to consult an attorney or real estate professional when drafting or executing a Chicago Illinois Quitclaim Deed from Individual to Corporation to ensure compliance with local laws and regulations and to address any specific circumstances or considerations that may apply.

Chicago Illinois Quitclaim Deed from Individual to Corporation

Description

How to fill out Illinois Quitclaim Deed From Individual To Corporation?

Are you in need of a trustworthy and cost-effective provider of legal documents to obtain the Chicago Illinois Quitclaim Deed transferring ownership from an Individual to a Corporation? US Legal Forms is the ideal option for you.

Whether you need a straightforward contract to establish rules for living together with your partner or a compilation of forms to facilitate your divorce process through the judiciary, we have everything you need. Our platform offers over 85,000 current legal document samples for both personal and business requirements. All the templates we provide are not generic; they are tailored to meet the distinct needs of specific states and regions.

To obtain the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please remember that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first time visiting our site? No problem. You can create an account in just a few minutes, but first, please ensure you do the following.

Now you can set up your account. After that, choose a subscription plan and move forward with the payment. Once your payment is processed, download the Chicago Illinois Quitclaim Deed from Individual to Corporation in any available file format. You can return to the website anytime and redownload the document at no extra cost.

Locating contemporary legal forms has never been simpler. Try US Legal Forms today, and put an end to wasting your precious time trying to understand legal documents online.

- Verify if the Chicago Illinois Quitclaim Deed transferring from Individual to Corporation is compliant with the laws of your state and locality.

- Review the specifics of the form (if available) to understand for whom and what the document is suitable.

- Restart your search if the form does not match your unique circumstances.

Form popularity

FAQ

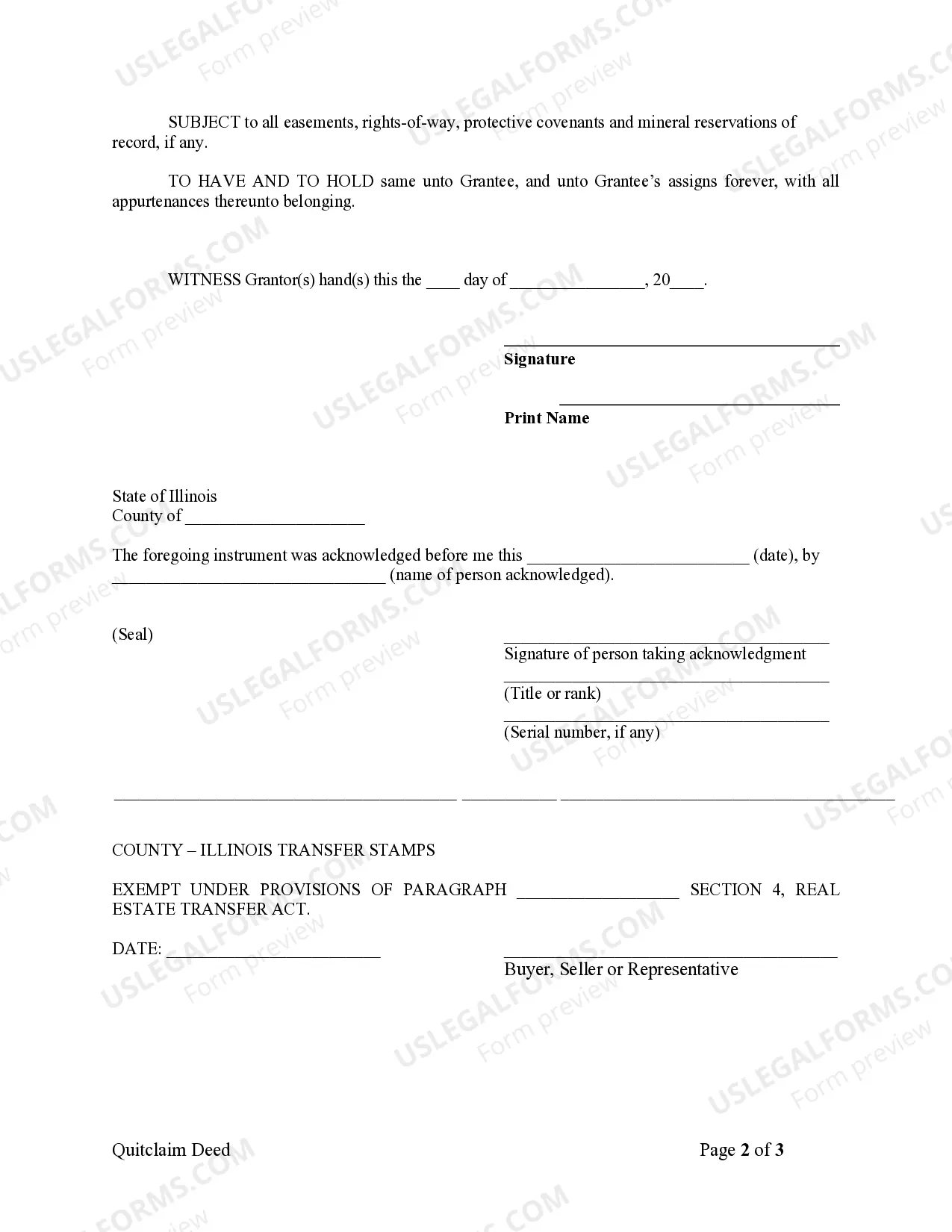

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

Must contain the name of the person giving (Grantor) and the person receiving (Grantee). Must state in the document that you are conveying/granting/quitclaiming the property. Must have the correct property identification ? usually the legal description or at least the property address.

To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees. Create a free Illinois Quit Claim Deed in minutes with our professional document builder.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

Signing (765 ILCS 5/20) ? A quit claim deed in the State of Illinois is required to be signed with a notary public present before being recorded.

Interesting Questions

More info

Please note it may take 1-2 days to see your results. You do NOT need to go through the “Submit” button before submitting, if your name is not there it means you filled out the correct form, and we're still processing your request. Once the Illinois form is completed, or you need to update your information, you'll receive an email confirming that your form is approved for processing. Please note, there are certain restrictions to this. You must have an Illinois address to request a title and cannot be on an inactive registry unless you are a buyer and need to file a title transfer (not a seller)! If you need help getting a divorce, you'll need to contact us! You may be able to obtain title to your Illinois property using a divorce or separate property court proceeding.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.