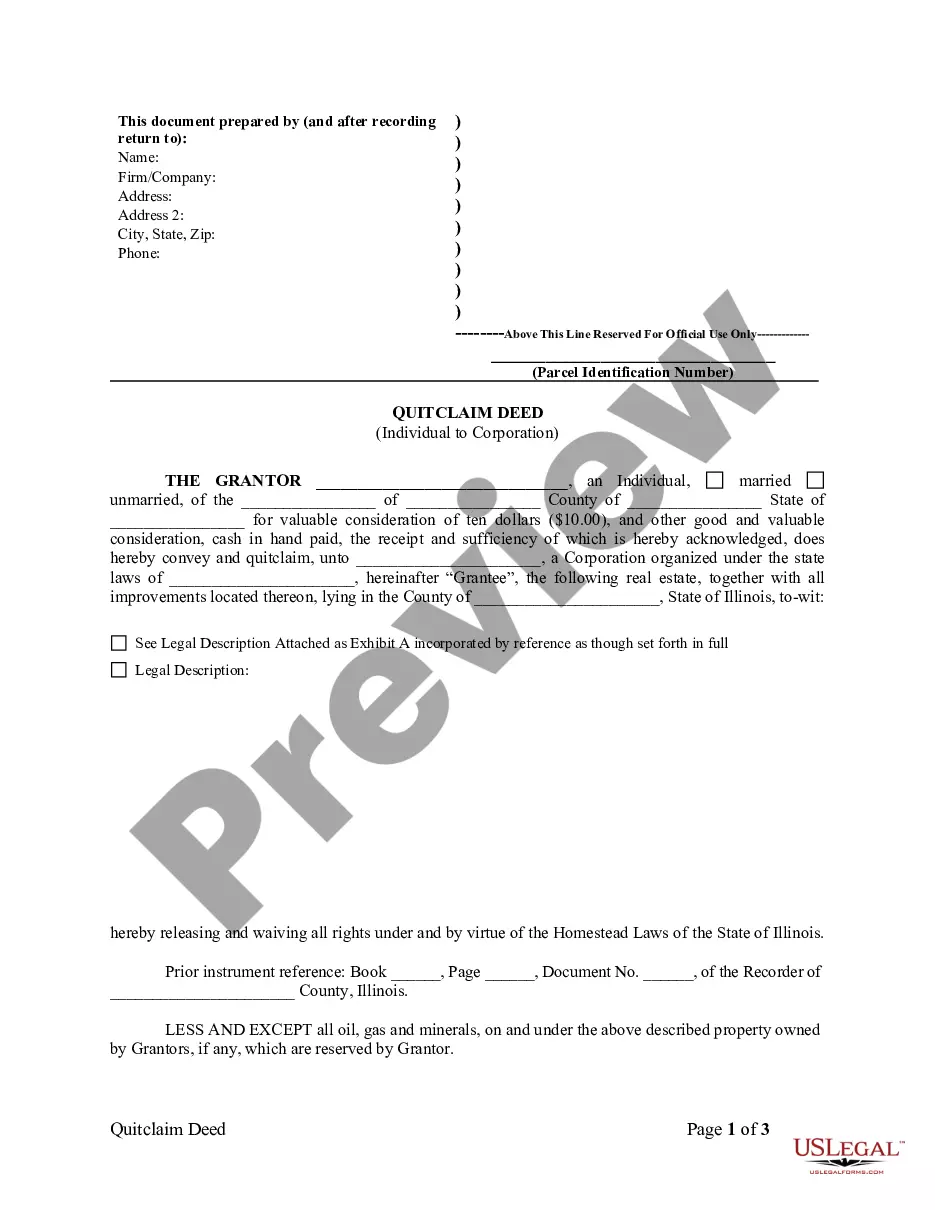

A Cook Illinois Quitclaim Deed from an Individual to a Corporation refers to a legal document that transfers ownership of real estate or property located within the Cook County, Illinois jurisdiction, from an individual to a corporation. This type of deed is commonly utilized when an individual wishes to transfer their personal property or real estate to a business entity or corporation they are involved with. The Cook Illinois Quitclaim Deed serves as a legal instrument to expedite the transfer of property ownership. By executing this deed, the individual (also known as the granter) relinquishes all claims, ownership rights, and interests they have over the property in favor of the corporation (also known as the grantee). It is important to note that this type of deed does not provide any guarantees or warranties regarding the property's title. There are several variations of Cook Illinois Quitclaim Deeds from an Individual to a Corporation, depending on the specific circumstances of the transfer. These variations include: 1. Voluntary Transfer: This type of Quitclaim Deed occurs when an individual willingly transfers their property to a corporation in which they have vested interests, such as transferring the property to a newly formed corporation or an existing one. 2. Asset Allocation: In cases where an individual is incorporating their personal assets into their corporation, an Asset Allocation Quitclaim Deed may be employed. This type of deed transfers certain specific assets, including real estate, from the individual to the corporation, often for tax or operational reasons. 3. Corporate Restructuring: In instances where a corporation undergoes a restructuring, such as a merger or acquisition, a Cook Illinois Quitclaim Deed can be utilized to transfer ownership of property from an individual to the acquiring or resulting corporation. 4. Estate Planning: Some individuals may use a Cook Illinois Quitclaim Deed as part of their estate planning process, enabling them to transfer property or real estate to their corporation or business entity in anticipation of future succession or inheritance. In conclusion, a Cook Illinois Quitclaim Deed from an Individual to a Corporation is a legally binding document that facilitates the transfer of ownership of property located within Cook County, Illinois, from an individual to a corporation. Its various types and applications cater to different scenarios, including voluntary transfers, asset allocation, corporate restructuring, and estate planning. It is imperative to consult with legal professionals, such as real estate attorneys, to ensure compliance with all applicable laws and regulations when engaging in such property transfers.

Cook Illinois Quitclaim Deed from Individual to Corporation

Description

How to fill out Cook Illinois Quitclaim Deed From Individual To Corporation?

Are you looking for a reliable and inexpensive legal forms provider to get the Cook Illinois Quitclaim Deed from Individual to Corporation? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Cook Illinois Quitclaim Deed from Individual to Corporation conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is good for.

- Restart the search if the form isn’t good for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Cook Illinois Quitclaim Deed from Individual to Corporation in any available format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online once and for all.

Form popularity

FAQ

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

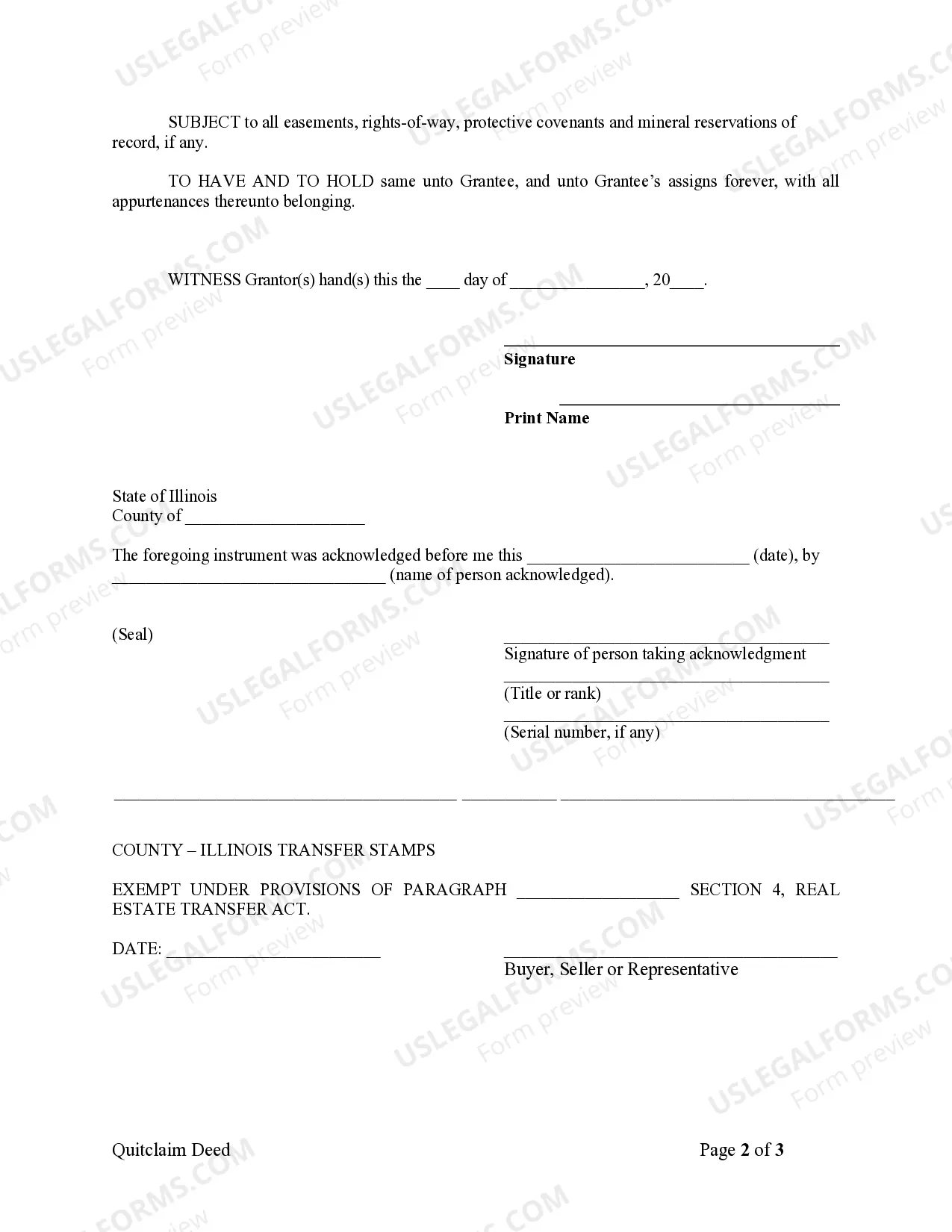

Recording ? The quitclaim deed must be recorded in the County Recorder's Office where the real estate is located (See County List). Signing (765 ILCS 5/20) ? A quit claim deed in the State of Illinois is required to be signed with a notary public present before being recorded.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

Visit one of the Cook County Recorder of Deeds offices. Offices are located in downtown Chicago, Bridgeview, Markham, Skokie, Rolling Meadows, and Maywood. Give the deed to the clerk and ask for it to be ?recorded.? Recording a deed means to file it.

Interesting Questions

More info

The person or individuals giving up those title rights or rights in possession. The deed is called a quitclaim when it gives the person giving it up some ownership, and a warranty of title when it gives ownership of the property to the other person or persons. A warranty deed is a legal title that identifies land and gives the property's titleholder the right to possession. The name of the original owner, the name of the quitclaim, the date it was given to, the title number and the address where the title is to be recorded. The warranty deed is an important legal document. In many cases, it helps the person giving it up to avoid paying property taxes or penalties associated with the property. A quit claim deed is a legal document used in many circumstances when a person gives up ownership or possession of real property, or transfers ownership to someone other than themselves. A person may give up (waive or disclaim) ownership of a physical asset, such as land, furniture or inventory.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.