Chicago Illinois Quitclaim Deed from Individual to LLC

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the materials are appropriately categorized by area of application and jurisdictional zones, making the search for the Chicago Illinois Quitclaim Deed from Individual to LLC as quick and straightforward as possible.

Maintaining organized documentation that complies with legal standards holds substantial significance. Utilize the US Legal Forms database to always have crucial document templates readily available for any of your needs!

- Verify the Preview mode and document description.

- Ensure you have selected the right one that aligns with your requirements and meets your local jurisdiction stipulations.

- Look for an alternative template if necessary.

- If you detect any discrepancies, use the Search tab above to locate the correct one.

- If it fits your needs, proceed to the following step.

Form popularity

FAQ

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

In a limited liability company (LLC), the company is a separated legal person from its owners (referred to as ?members?). The legal entity itself has the same right to acquire property in another state as one of its individual members.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

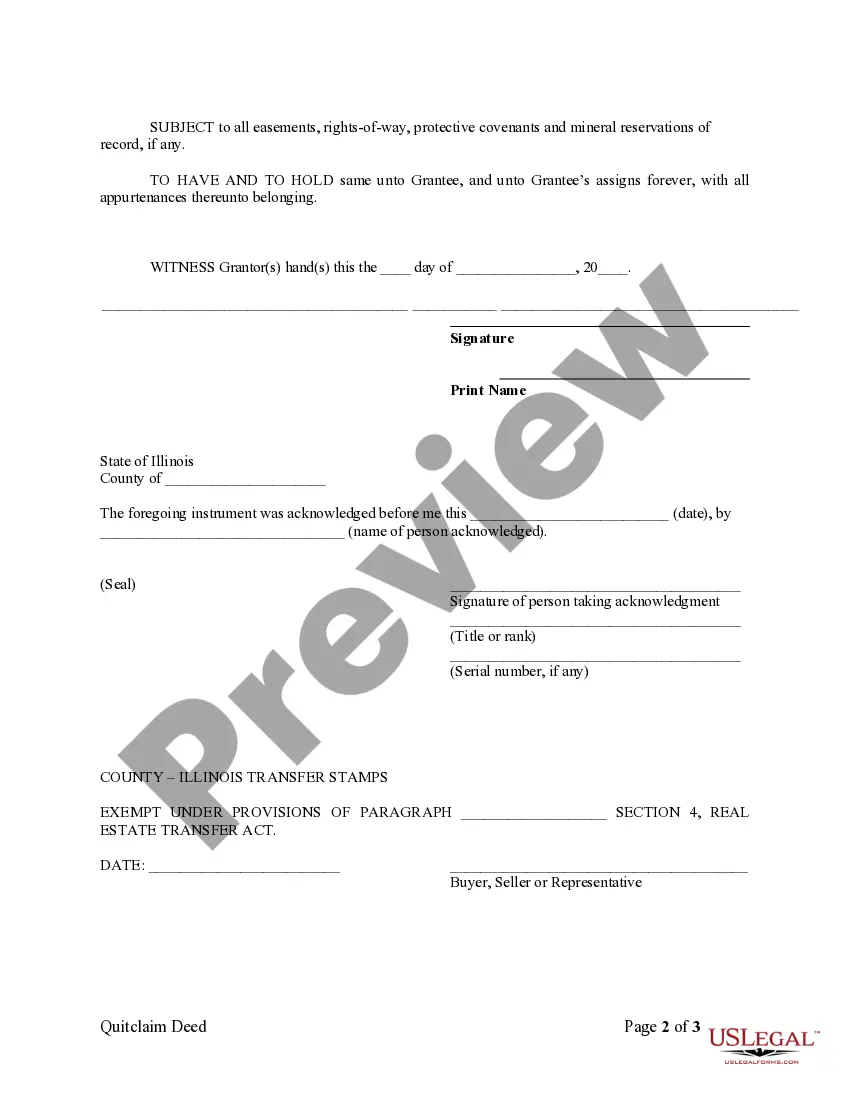

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

How Do I Transfer Title of a Property From a Person to an LLC? Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.