Naperville Illinois Quitclaim Deed from Individual to LLC: A Comprehensive Guide A Naperville Illinois Quitclaim Deed from Individual to LLC refers to a legal document transferring property ownership from an individual to a Limited Liability Company (LLC) in the city of Naperville, Illinois. It is important to understand the intricacies of this process, as the transfer of ownership affects both the individual relinquishing their rights and the newly formed LLC acquiring the property. Keywords: Naperville Illinois, Quitclaim Deed, Individual, LLC, property ownership, transfer of ownership, legal document. Types of Naperville Illinois Quitclaim Deeds from Individual to LLC: 1. Standard Naperville Illinois Quitclaim Deed: This is the most commonly used type of Quitclaim Deed in Naperville, Illinois, for transferring property ownership from an individual to an LLC. It involves the individual, referred to as the granter, conveying their interest in the property to the LLC, known as the grantee. 2. Naperville Illinois Quitclaim Deed with Consideration: In some cases, when transferring property ownership to an LLC in Naperville, Illinois, monetary consideration may be involved. This type of Quitclaim Deed includes additional provisions regarding the financial aspects of the transfer, such as the purchase price, payment terms, and any conditions related to the payment. 3. Naperville Illinois Quitclaim Deed for Real Estate Investment: This specific type of Quitclaim Deed is suitable when an individual wishes to transfer property ownership to an LLC for investment purposes. The LLC can then manage, lease, develop, or sell the property as per their investment strategy. This type of Quitclaim Deed often includes provisions related to the specific investment goals and intentions of the LLC. 4. Naperville Illinois Quitclaim Deed for Tax and Liability Purposes: Sometimes, property owners in Naperville, Illinois, choose to transfer ownership to an LLC for tax planning or liability protection reasons. This type of Quitclaim Deed includes provisions focused on the reduction of tax obligations or shielding the individual from personal liability associated with the property. It is crucial to consult with a qualified real estate attorney in Naperville, Illinois, to ensure a smooth and legally valid transfer of property ownership from an individual to an LLC. The attorney will guide both the granter and the grantee through the process, ensuring all legal requirements are met and the necessary paperwork is filed correctly. In conclusion, transferring property ownership from an individual to an LLC in Naperville, Illinois, is a significant legal process requiring a detailed understanding of the various nuances involved. A Naperville Illinois Quitclaim Deed from Individual to LLC should be prepared and executed in accordance with the specific needs and intentions of the parties involved to ensure a seamless transfer of property ownership.

Naperville Illinois Quitclaim Deed from Individual to LLC

Description

How to fill out Naperville Illinois Quitclaim Deed From Individual To LLC?

Are you looking for a reliable and inexpensive legal forms provider to get the Naperville Illinois Quitclaim Deed from Individual to LLC? US Legal Forms is your go-to option.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of particular state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Naperville Illinois Quitclaim Deed from Individual to LLC conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the form is intended for.

- Start the search over in case the form isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Naperville Illinois Quitclaim Deed from Individual to LLC in any available format. You can return to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online for good.

Form popularity

FAQ

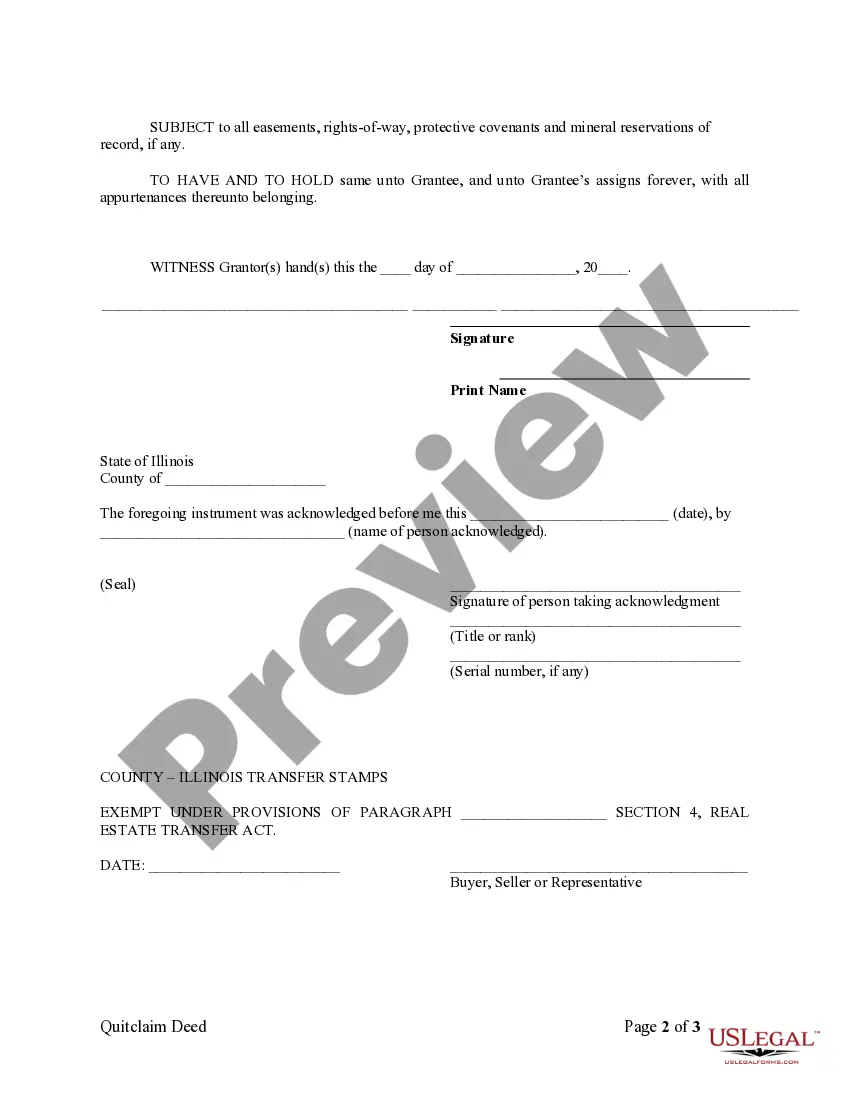

Transferring a deed from an individual to an LLC typically involves completing a Naperville Illinois Quitclaim Deed from Individual to LLC. This document must include details about the property and be signed by the appropriate parties. After completing the deed, filing it with the local authorities finalizes the transfer process.

To place your property in an LLC, you can use a Naperville Illinois Quitclaim Deed from Individual to LLC to legally transfer ownership. This process involves filling out the deed and filing it with the local government. Consulting with a real estate attorney can also provide clarity and ensure that all requirements are met.

You can transfer personal funds to your LLC as part of an investment in the business. This usually involves proper documentation, such as bank statements or contribution agreements. When you use a Naperville Illinois Quitclaim Deed from Individual to LLC for any associated assets, ensure that you thoroughly understand the implications for your financial records.

Yes, you can transfer personal assets to an LLC by completing the appropriate paperwork. A Naperville Illinois Quitclaim Deed from Individual to LLC will simplify this process. Keep in mind that the assets must be correctly valued for both legal and financial reasons.

Transferring assets from personal ownership to your business requires a clear understanding of the legal implications. Using a Naperville Illinois Quitclaim Deed from Individual to LLC allows you to officially move ownership of the assets. It is wise to document this process carefully to avoid confusion in financial reporting and taxation later.

To transfer personal assets to an LLC, you will need to execute a Naperville Illinois Quitclaim Deed from Individual to LLC. This document serves as a formal transfer of ownership. Make sure to keep good records of the transaction for tax purposes, and consult a legal professional if you have questions about your specific situation.

One major disadvantage of a Naperville Illinois Quitclaim Deed from Individual to LLC is that it does not provide guarantee of property title. This means the grantee may not receive full ownership rights, especially if there are existing claims against the property. Additionally, it does not ensure protection for the buyer against defects in title. Therefore, if you consider using a quitclaim deed, it is wise to consult uslegalforms, as they can help you navigate the complexities and protect your interests.

You can prepare a quitclaim deed yourself, but it’s crucial to understand the legal requirements and specifications involved. If you feel confident in your abilities, you may find resources online to assist you. For your Naperville Illinois quitclaim deed from individual to LLC, consider using USLegalForms, which provides templates and guidance to make the process easier.

Transferring a deed from an individual to an LLC typically involves filling out a quitclaim deed form and submitting it to the local recorder's office. You’ll need to include relevant information, such as the property details and the names of the parties involved. To ensure a smooth process for your Naperville Illinois quitclaim deed from individual to LLC, you might consider using platforms like USLegalForms for easy access to the necessary documents.

While it's not a requirement to have a lawyer for filing a quitclaim deed in Illinois, their expertise can be beneficial. A quitclaim deed involves legal documents and state regulations that, if not followed, could cause issues later on. Therefore, for your Naperville Illinois quitclaim deed from individual to LLC, consulting a lawyer might save you time and trouble.