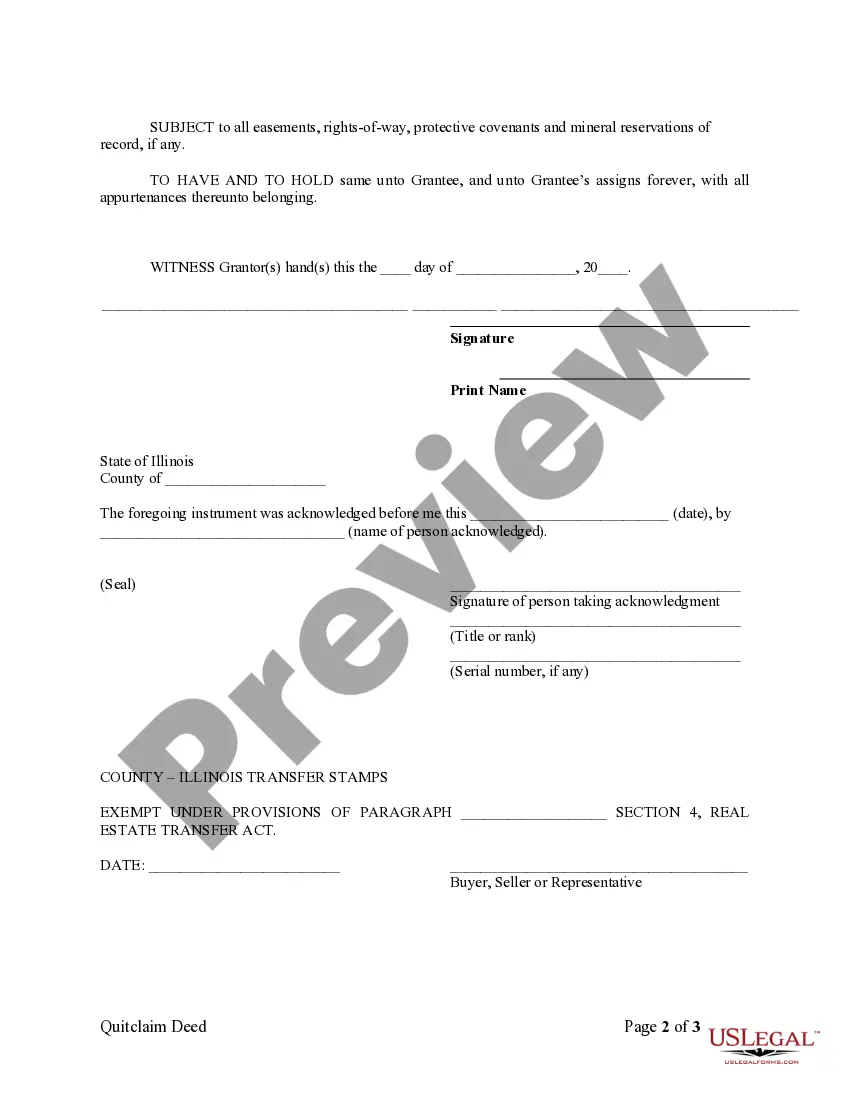

A Rockford Illinois Quitclaim Deed from Individual to LLC is a legal document that transfers ownership of real property from an individual to a limited liability company (LLC) located in Rockford, Illinois. This type of deed is used when an individual, referred to as the granter, wants to convey their interest in a property to an LLC, referred to as the grantee. The Rockford Illinois Quitclaim Deed from Individual to LLC serves as a relinquishment of the individual's rights, title, and interest in the property, with no guarantee of the extent or validity of the granter's interest. It essentially declares that the granter is transferring whatever ownership they have in the property to the LLC, without making any warranties or representations about the property's legal status. By executing this deed, the granter acknowledges that they are voluntarily and without coercion transferring their interest in the property to the LLC. It's crucial for both parties involved to ensure that they fully understand the implications of this type of deed and seek legal advice if necessary. There may be different variations or specifics of Rockford Illinois Quitclaim Deeds from Individual to LLC, depending on specific circumstances or requirements. These variations could include: 1. Standard Rockford Illinois Quitclaim Deed from Individual to LLC: This is the most common type of deed used for transferring property in Rockford, Illinois. It includes the necessary language and provisions to effectuate a transfer of ownership from an individual to an LLC. 2. Tax-Related Rockford Illinois Quitclaim Deed from Individual to LLC: This type of quitclaim deed may be used when the transfer of property has tax implications, such as in cases of inheritance, gifting, or tax planning strategies. It may require additional documentation or information to comply with relevant tax laws. 3. Bank-Owned Rockford Illinois Quitclaim Deed from Individual to LLC: This type of quitclaim deed is specific to properties owned by banks or other financial institutions. It may have additional clauses or requirements due to the unique nature of these transactions. It's important to note that each transaction involving a quitclaim deed should be tailored to meet the specific needs and requirements of the involved parties. Consulting with a real estate attorney or legal professional experienced in Rockford, Illinois real estate laws is crucial to ensure accuracy and compliance with all legal obligations.

Rockford Illinois Quitclaim Deed from Individual to LLC

Description

How to fill out Rockford Illinois Quitclaim Deed From Individual To LLC?

If you are searching for a valid form, it’s difficult to find a more convenient service than the US Legal Forms website – one of the most extensive online libraries. With this library, you can find a huge number of document samples for business and personal purposes by types and states, or key phrases. With the advanced search function, getting the newest Rockford Illinois Quitclaim Deed from Individual to LLC is as easy as 1-2-3. Furthermore, the relevance of each and every file is verified by a team of professional attorneys that on a regular basis check the templates on our platform and revise them based on the most recent state and county regulations.

If you already know about our system and have a registered account, all you need to receive the Rockford Illinois Quitclaim Deed from Individual to LLC is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have found the sample you need. Read its explanation and utilize the Preview feature to see its content. If it doesn’t suit your needs, use the Search option at the top of the screen to get the needed record.

- Affirm your decision. Select the Buy now button. After that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Indicate the format and download it on your device.

- Make changes. Fill out, revise, print, and sign the obtained Rockford Illinois Quitclaim Deed from Individual to LLC.

Every single form you save in your user profile does not have an expiration date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to get an extra duplicate for modifying or printing, you can return and download it once again anytime.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Rockford Illinois Quitclaim Deed from Individual to LLC you were seeking and a huge number of other professional and state-specific samples on a single platform!