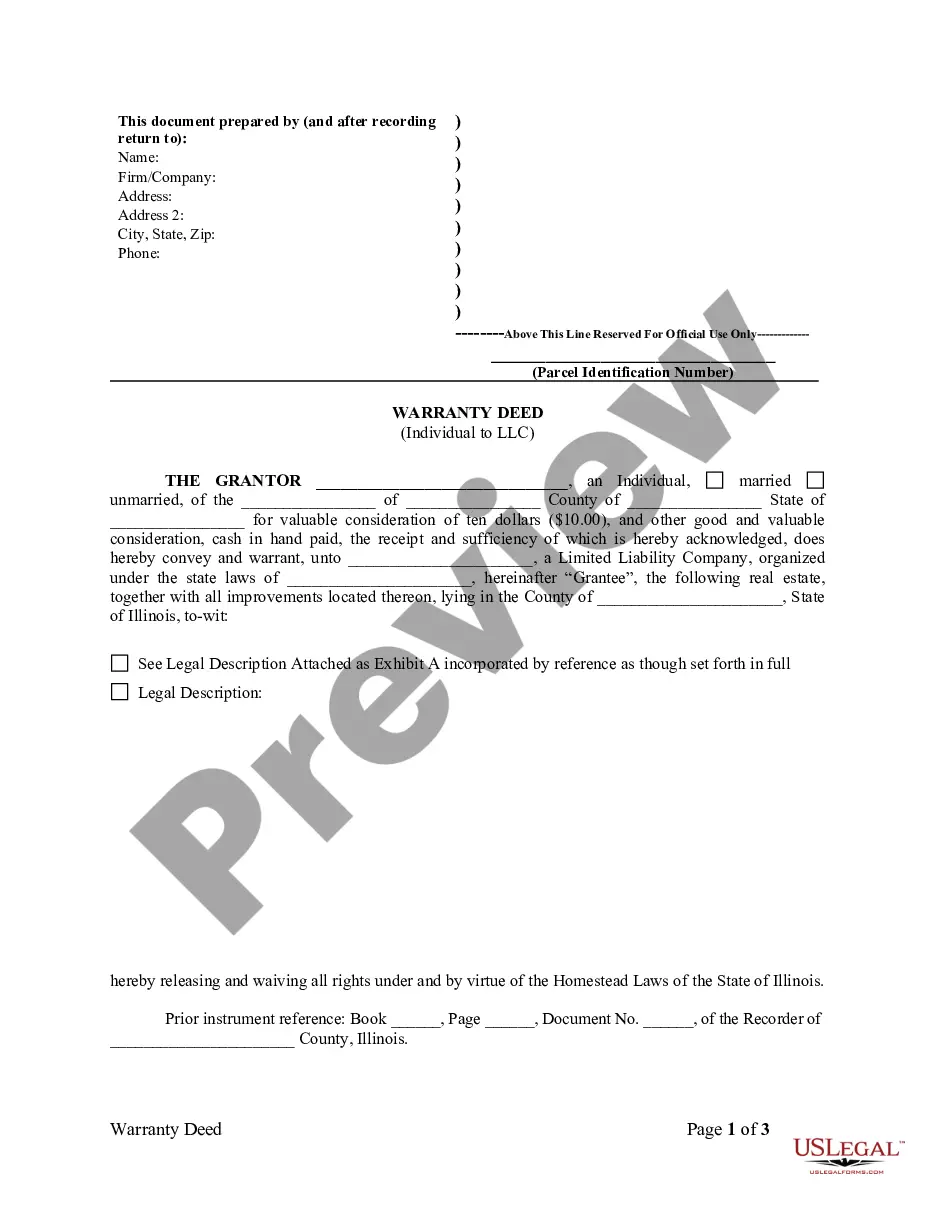

Chicago Illinois Warranty Deed from Individual to LLC

Description

How to fill out Illinois Warranty Deed From Individual To LLC?

Regardless of the societal or occupational standing, completing law-related documents is an unfortunate requirement in today’s work environment.

Too frequently, it’s nearly impossible for individuals lacking any legal training to create such documents from the beginning, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms becomes beneficial.

Confirm that the form you have selected is tailored to your area since the laws of one region may not apply to another.

Examine the form and read a brief description (if available) of the circumstances the document can be used for.

- Our service offers a vast collection with more than 85,000 ready-to-utilize state-specific forms that are suitable for virtually any legal matter.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to save time by using our DIY forms.

- Whether you require the Chicago Illinois Warranty Deed from Individual to LLC or any other documentation that is appropriate for your state or region, with US Legal Forms, everything is at your disposal.

- Here’s how to obtain the Chicago Illinois Warranty Deed from Individual to LLC in mere minutes using our reliable service.

- If you are already an existing user, feel free to Log In to your account to access the suitable form.

- However, if you are new to our platform, be sure to follow these instructions prior to downloading the Chicago Illinois Warranty Deed from Individual to LLC.

Form popularity

FAQ

How Do I Transfer Title of a Property From a Person to an LLC? Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

How do I obtain a copy of my deed or other recorded document? You can request a copy from our office in person, by mail, fax, phone or email. If your request is by phone or fax you will need to pay with a credit card. Please call our office at 847-377-2575 if you wish to place an order.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

765 ILCS 5/28. 55 ILCS 5/3-5018 details the fees that the recorder can charge for this service. Although a deed does not have to be recorded to be a valid conveyance, there are practical reasons for recording a deed.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

How Do I Get a Warranty Deed in Illinois? In most cases, property owners turn to a real estate attorney to complete a warranty deed in the state of Illinois. While warranty deeds can be created on your own, they must comply with legal requirements and include the necessary language to make them official.

Must contain the name of the person giving (Grantor) and the person receiving (Grantee). Must state in the document that you are conveying/granting/quitclaiming the property. Must have the correct property identification ? usually the legal description or at least the property address.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.