Title: Understanding Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation Description: In Elgin, Illinois, a quitclaim deed from a husband and wife to a corporation is a legal document commonly used to transfer property ownership rights from a married couple to a corporation. This article provides a detailed description of what an Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation entails, offering valuable insights into its purpose, process, and types. Keywords: Elgin Illinois, quitclaim deed, husband and wife, corporation, transfer of property ownership, legal document 1. Purpose of an Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation: This deed serves as a means for a married couple to transfer their property ownership rights to a corporation. It is often used when the spouses want to incorporate their property into a business entity or transfer property ownership for asset protection or estate planning purposes. 2. Process of an Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation: To execute this type of transfer, the husband and wife must fill out and sign a quitclaim deed form, effectively relinquishing their interests, rights, and claims to the property. The completed form must then be notarized and recorded with the appropriate county clerk's office for legal validity. 3. Types of Elgin Illinois Quitclaim Deeds from Husband and Wife to a Corporation: a) Elgin Illinois Statutory Quitclaim Deed: This is the most common type and is governed by Illinois state laws, providing a straightforward method for transferring a property's ownership rights. b) Elgin Illinois Enhanced Life Estate Quitclaim Deed: Also known as a "Lady Bird Deed," this type of deed allows the spouse(s) to retain a life estate in the property while conveying the remainder interest to a corporation, ensuring continued ownership and avoiding probate. 4. Benefits of an Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation: i) Asset Protection: Transferring property to a corporation provides an additional layer of liability protection, shielding personal assets from potential legal claims or business-related obligations. ii) Improved Business Structure: By incorporating the property, a business gains better organization, potential tax advantages, and separates personal and business assets for accounting and legal purposes. iii) Estate Planning: Such a transfer can facilitate the smooth transfer of a property's ownership, minimizing complexities during probate and simplifying inheritance for heirs. The Elgin Illinois Quitclaim Deed from Husband and Wife to a Corporation plays an important role in legally transitioning property ownership from married individuals to a corporation. Understanding its purpose, process, and different types can help individuals make informed decisions when considering such transfers.

Elgin Illinois Quitclaim Deed from Husband and Wife to Corporation

Description

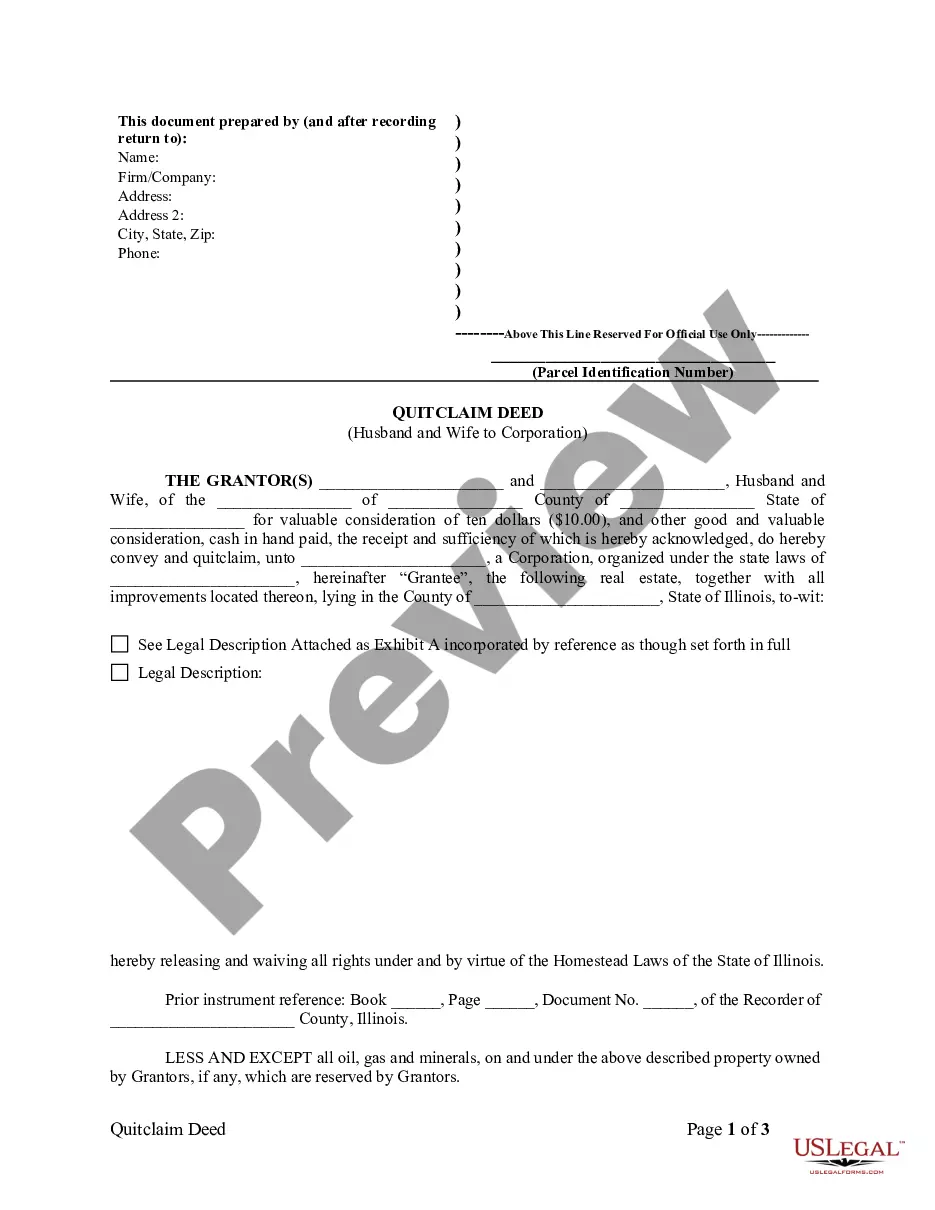

How to fill out Elgin Illinois Quitclaim Deed From Husband And Wife To Corporation?

If you are looking for a relevant form, it’s difficult to choose a better service than the US Legal Forms site – probably the most comprehensive libraries on the web. With this library, you can get a large number of templates for organization and personal purposes by types and regions, or keywords. Using our high-quality search option, finding the most up-to-date Elgin Illinois Quitclaim Deed from Husband and Wife to Corporation is as easy as 1-2-3. Moreover, the relevance of each file is verified by a group of professional attorneys that regularly check the templates on our website and revise them according to the latest state and county demands.

If you already know about our system and have an account, all you should do to get the Elgin Illinois Quitclaim Deed from Husband and Wife to Corporation is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the sample you want. Check its information and make use of the Preview option to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to get the proper document.

- Affirm your decision. Click the Buy now button. After that, select your preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the template. Select the file format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Elgin Illinois Quitclaim Deed from Husband and Wife to Corporation.

Every single template you save in your user profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to receive an additional version for editing or creating a hard copy, you can come back and export it once more at any time.

Make use of the US Legal Forms extensive library to gain access to the Elgin Illinois Quitclaim Deed from Husband and Wife to Corporation you were seeking and a large number of other professional and state-specific samples on one platform!