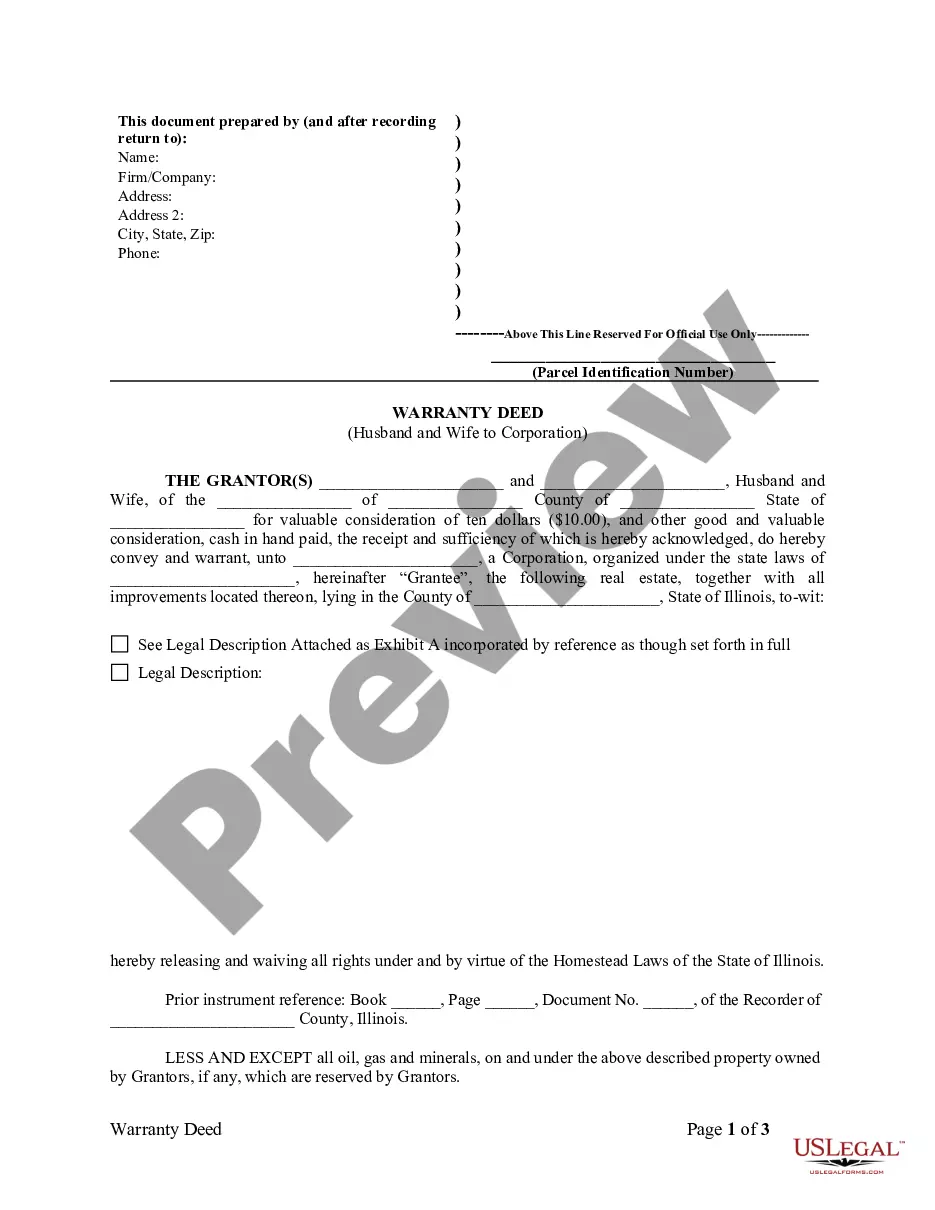

A Cook Illinois Warranty Deed from Husband and Wife to Corporation is a legal document that facilitates the transfer of property ownership from a married couple to a corporate entity, while providing certain guarantees and protections to the buyer. This is a common practice when a husband and wife decide to transfer property assets into a corporation for various reasons, such as tax planning, asset protection, or business restructuring. A Cook Illinois Warranty Deed from Husband and Wife to Corporation ensures that the property being transferred is free from any liens, encumbrances, or claims against it, except those explicitly stated in the deed. This means that the corporation receives a guarantee from the couple that they hold clear and marketable title to the property and have the legal right to transfer it. The deed includes essential details such as the names and marital status of the husband and wife, the name and type of the corporation (such as a limited liability company or a corporation), a legal description of the property being transferred, and the consideration (often monetary) exchanged for the transfer. There are different variations or types of Cook Illinois Warranty Deeds from Husband and Wife to Corporation based on specific circumstances or requirements. These include: 1. General Warranty Deed: This type of deed provides the strongest level of protection, as it warrants the title against any defects that may have arisen before the couple acquired the property. 2. Special Warranty Deed: With a special warranty deed, the couple guarantees the title against defects only during the period they owned the property. This means that the granters are not responsible for any errors or claims that arose prior to their ownership. 3. Quitclaim Deed: In some cases, a quitclaim deed may be used instead of a warranty deed. Unlike a warranty deed, a quitclaim deed offers no warranties or guarantees regarding the title. It simply transfers the couple's interest in the property to the corporation, if any, without making any claims about the ownership status or potential defects. It is important to consult with legal professionals, such as real estate attorneys or title companies, to ensure the appropriate type of Cook Illinois Warranty Deed from Husband and Wife to Corporation is used, based on the specific needs and circumstances of the parties involved. Overall, a Cook Illinois Warranty Deed from Husband and Wife to Corporation is a legally binding document that enables the transfer of property ownership from a married couple to a corporation, providing protection and assurance to the buyer.

Cook Illinois Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Cook Illinois Warranty Deed From Husband And Wife To Corporation?

We always strive to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Cook Illinois Warranty Deed from Husband and Wife to Corporation or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Cook Illinois Warranty Deed from Husband and Wife to Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Cook Illinois Warranty Deed from Husband and Wife to Corporation is suitable for your case, you can choose the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!