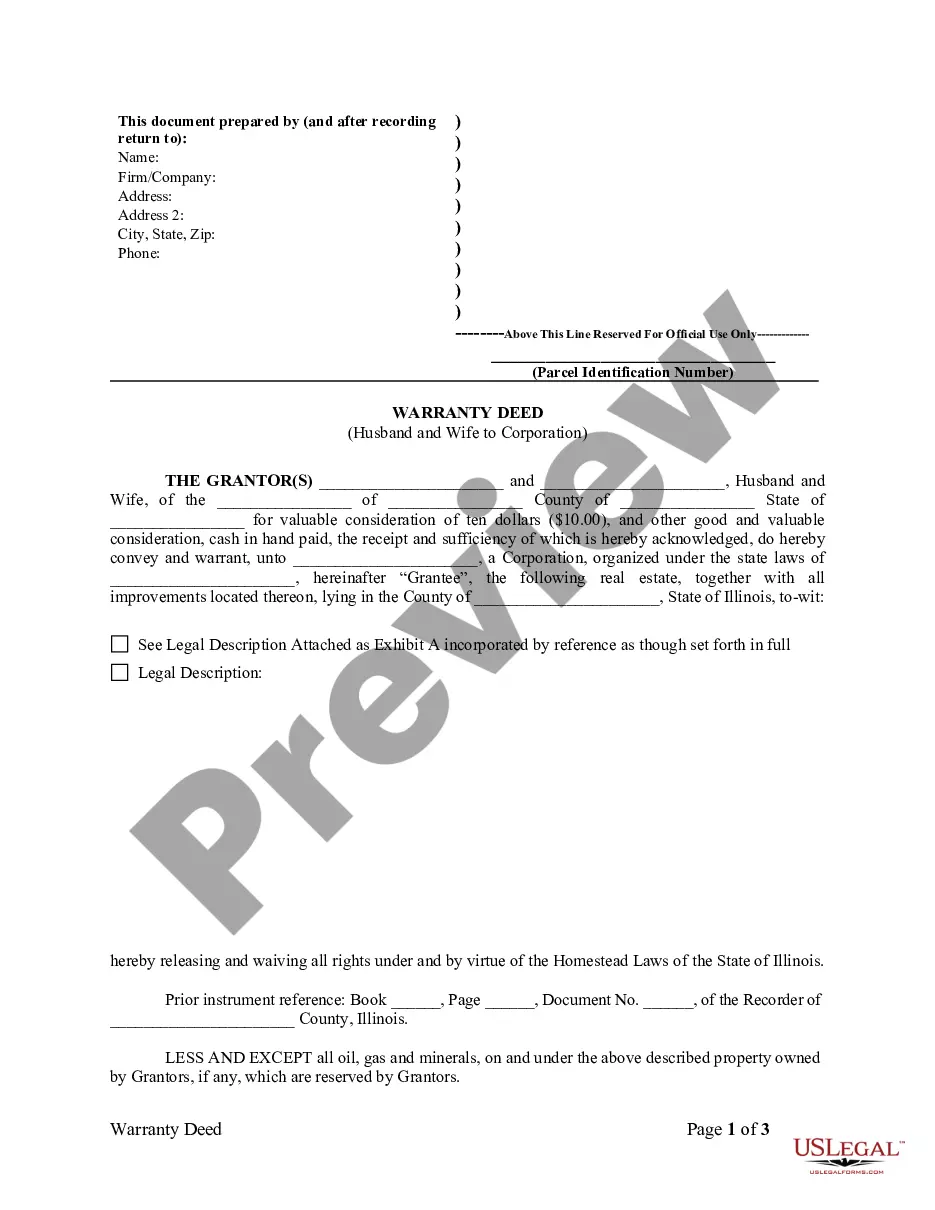

Title: Understanding Elgin Illinois Warranty Deed from Husband and Wife to Corporation Introduction: In Elgin, Illinois, a warranty deed refers to a legal document used to transfer ownership of real estate from a husband and wife to a corporation. This process ensures a clear transfer of property rights, while providing certain guarantees and protections to the corporation buying the property. This article aims to provide a detailed description of Elgin Illinois Warranty Deed from Husband and Wife to Corporation, exploring its types and significant components. 1. Traditional Elgin Illinois Warranty Deed from Husband and Wife to Corporation: The traditional Elgin Illinois Warranty Deed from Husband and Wife to Corporation is a legally binding document that assures the corporation receiving the property that the married couple has a clear title and rightful ownership of the real estate being transferred. It guarantees that the property is free from any undisclosed liens, claims, or encumbrances, thereby safeguarding the interests of the corporation. 2. Limited Elgin Illinois Warranty Deed from Husband and Wife to Corporation: Another type of Elgin Illinois Warranty Deed is the limited warranty deed. This variant ensures that the couple transferring the property guarantees the title against any encumbrances occurring during their ownership. Unlike the traditional warranty deed, it does not provide coverage against potential issues arising from prior ownership. 3. Components of an Elgin Illinois Warranty Deed from Husband and Wife to Corporation: a) Identification: The deed begins by identifying the husband and wife, the corporation, and the property being transferred. This includes their full legal names, marital status, and the property's legal description. b) Warranty Covenants: The husband and wife guarantee that they are the lawful owners of the property, with the legal capacity to sell and transfer the title. They affirm that the property is free from any undisclosed encumbrances, except as specifically mentioned in the deed. c) Consideration: This section specifies the agreed upon monetary consideration for the property transfer, which the corporation pays to the husband and wife. d) Certifications: The deed must be properly notarized and signed by both the husband and wife, in the presence of witnesses. Additionally, a corporate representative must sign the document on behalf of the corporation. e) Recording: To make the transfer of ownership legally binding and publicly known, the deed should be recorded with the county where the property is located. Keywords: Elgin Illinois, warranty deed, husband and wife, corporation, property transfer, ownership, liens, encumbrances, limited warranty deed, traditional warranty deed, legal document, legal description, warranty covenants, consideration, notarized, recording. Conclusion: The Elgin Illinois Warranty Deed from Husband and Wife to Corporation, whether in its traditional or limited form, serves as a vital legal mechanism for transferring property ownership. By guaranteeing a clear title, absence of undisclosed encumbrances, and offering legal protection, this document ensures a smooth and secure transaction for both the transferor couple and the acquiring corporation. It is essential to follow the necessary procedures and enlist the assistance of legal professionals to comply with the specific requirements when engaging in such property transfers in Elgin, Illinois.

Elgin Illinois Warranty Deed from Husband and Wife to Corporation

Description

How to fill out Elgin Illinois Warranty Deed From Husband And Wife To Corporation?

Benefit from the US Legal Forms and get instant access to any form sample you need. Our helpful platform with thousands of templates allows you to find and obtain almost any document sample you need. You can export, fill, and certify the Elgin Illinois Warranty Deed from Husband and Wife to Corporation in just a matter of minutes instead of surfing the Net for several hours searching for the right template.

Using our collection is a great way to raise the safety of your document submissions. Our experienced lawyers regularly review all the documents to make certain that the templates are relevant for a particular region and compliant with new laws and polices.

How can you get the Elgin Illinois Warranty Deed from Husband and Wife to Corporation? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you look at. Furthermore, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Find the template you need. Ensure that it is the template you were seeking: verify its name and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the file. Indicate the format to get the Elgin Illinois Warranty Deed from Husband and Wife to Corporation and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the web. We are always ready to help you in any legal process, even if it is just downloading the Elgin Illinois Warranty Deed from Husband and Wife to Corporation.

Feel free to benefit from our form catalog and make your document experience as straightforward as possible!