A Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership rights of a property from a married couple to a Limited Liability Company (LLC). This type of deed is commonly used when a couple wishes to transfer the property to their LLC for asset protection or business purposes. By executing this deed, the couple conveys their ownership interests in the property, without making any warranties about the title or any potential liens or encumbrances on the property. One type of Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is the Joint Tenancy with Right of Survivorship (TWOS). In this case, the couple holds equal shares of the property and if one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share. This type of deed is often chosen by couples who want to ensure a smooth transfer of ownership in case of death. Another variation is the Tenancy by the Entirety (THE) Quitclaim Deed. This type of deed is only available to married couples and provides the highest level of asset protection. It offers protection against individual creditors and ensures that both spouses have equal ownership rights in the property. The purpose of this Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is to establish the LLC as the new owner of the property. By doing so, the couple can separate their personal liability from the property, as the LLC will now be responsible for any legal obligations or liabilities associated with it. The process of creating a Rockford Illinois Quitclaim Deed from Husband and Wife to LLC begins by drafting the necessary legal document. The deed should clearly state the names of the couple, their intention to transfer the property to the LLC, and the description of the property being transferred, including the legal description, address, and any relevant parcel numbers. It is important to have the deed properly notarized and recorded in the appropriate county office to ensure its legal validity. Overall, a Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is an effective legal tool for married couples looking to transfer ownership of a property to their LLC for various reasons, such as asset protection, business planning, or estate planning. It is crucial to consult with an experienced real estate attorney or legal professional to ensure that all necessary steps and requirements are met in accordance with Illinois state laws.

Rockford Illinois Quitclaim Deed from Husband and Wife to LLC

State:

Illinois

City:

Rockford

Control #:

IL-09-77

Format:

Word;

Rich Text

Instant download

Description

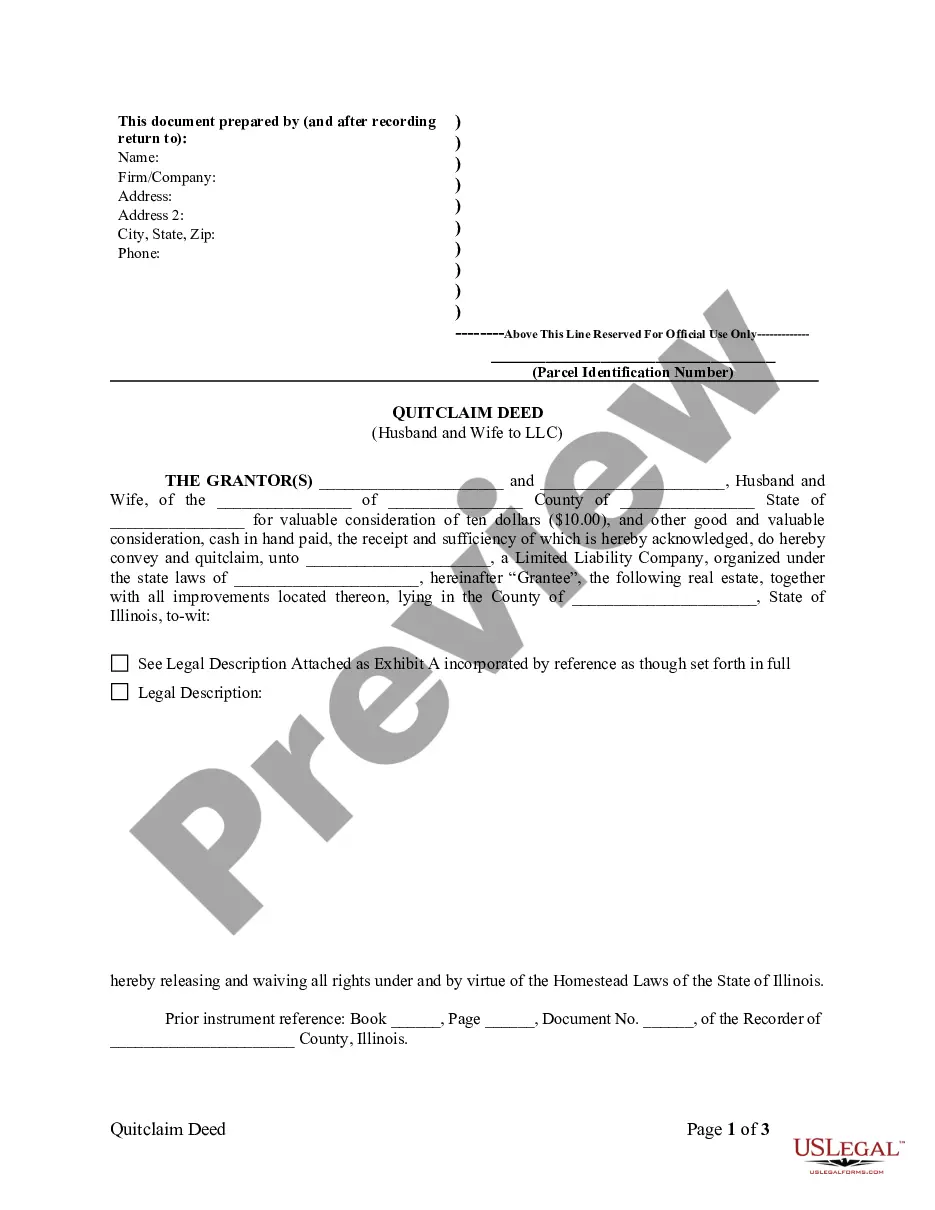

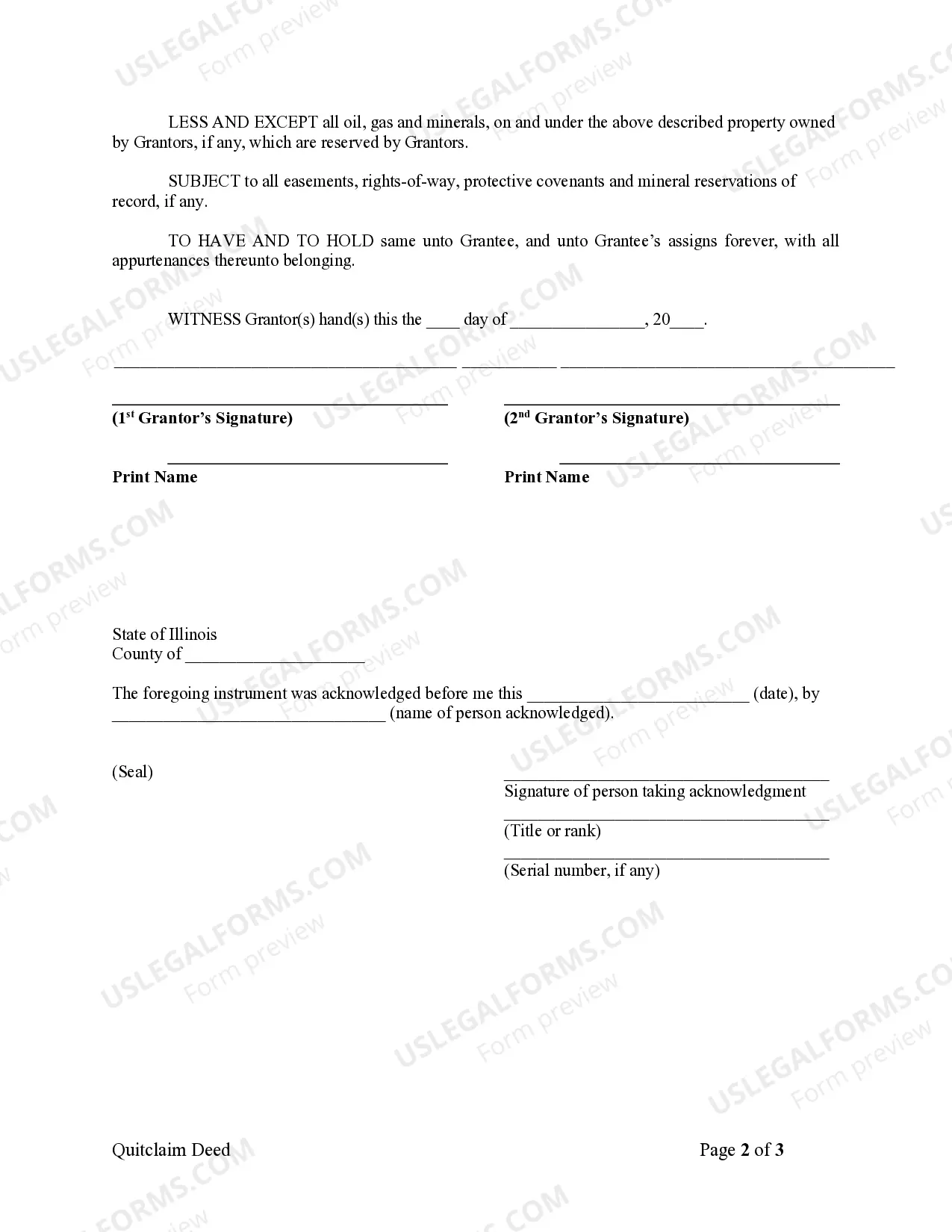

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the ownership rights of a property from a married couple to a Limited Liability Company (LLC). This type of deed is commonly used when a couple wishes to transfer the property to their LLC for asset protection or business purposes. By executing this deed, the couple conveys their ownership interests in the property, without making any warranties about the title or any potential liens or encumbrances on the property. One type of Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is the Joint Tenancy with Right of Survivorship (TWOS). In this case, the couple holds equal shares of the property and if one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share. This type of deed is often chosen by couples who want to ensure a smooth transfer of ownership in case of death. Another variation is the Tenancy by the Entirety (THE) Quitclaim Deed. This type of deed is only available to married couples and provides the highest level of asset protection. It offers protection against individual creditors and ensures that both spouses have equal ownership rights in the property. The purpose of this Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is to establish the LLC as the new owner of the property. By doing so, the couple can separate their personal liability from the property, as the LLC will now be responsible for any legal obligations or liabilities associated with it. The process of creating a Rockford Illinois Quitclaim Deed from Husband and Wife to LLC begins by drafting the necessary legal document. The deed should clearly state the names of the couple, their intention to transfer the property to the LLC, and the description of the property being transferred, including the legal description, address, and any relevant parcel numbers. It is important to have the deed properly notarized and recorded in the appropriate county office to ensure its legal validity. Overall, a Rockford Illinois Quitclaim Deed from Husband and Wife to LLC is an effective legal tool for married couples looking to transfer ownership of a property to their LLC for various reasons, such as asset protection, business planning, or estate planning. It is crucial to consult with an experienced real estate attorney or legal professional to ensure that all necessary steps and requirements are met in accordance with Illinois state laws.

Free preview

How to fill out Rockford Illinois Quitclaim Deed From Husband And Wife To LLC?

If you’ve already used our service before, log in to your account and download the Rockford Illinois Quitclaim Deed from Husband and Wife to LLC on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Rockford Illinois Quitclaim Deed from Husband and Wife to LLC. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!