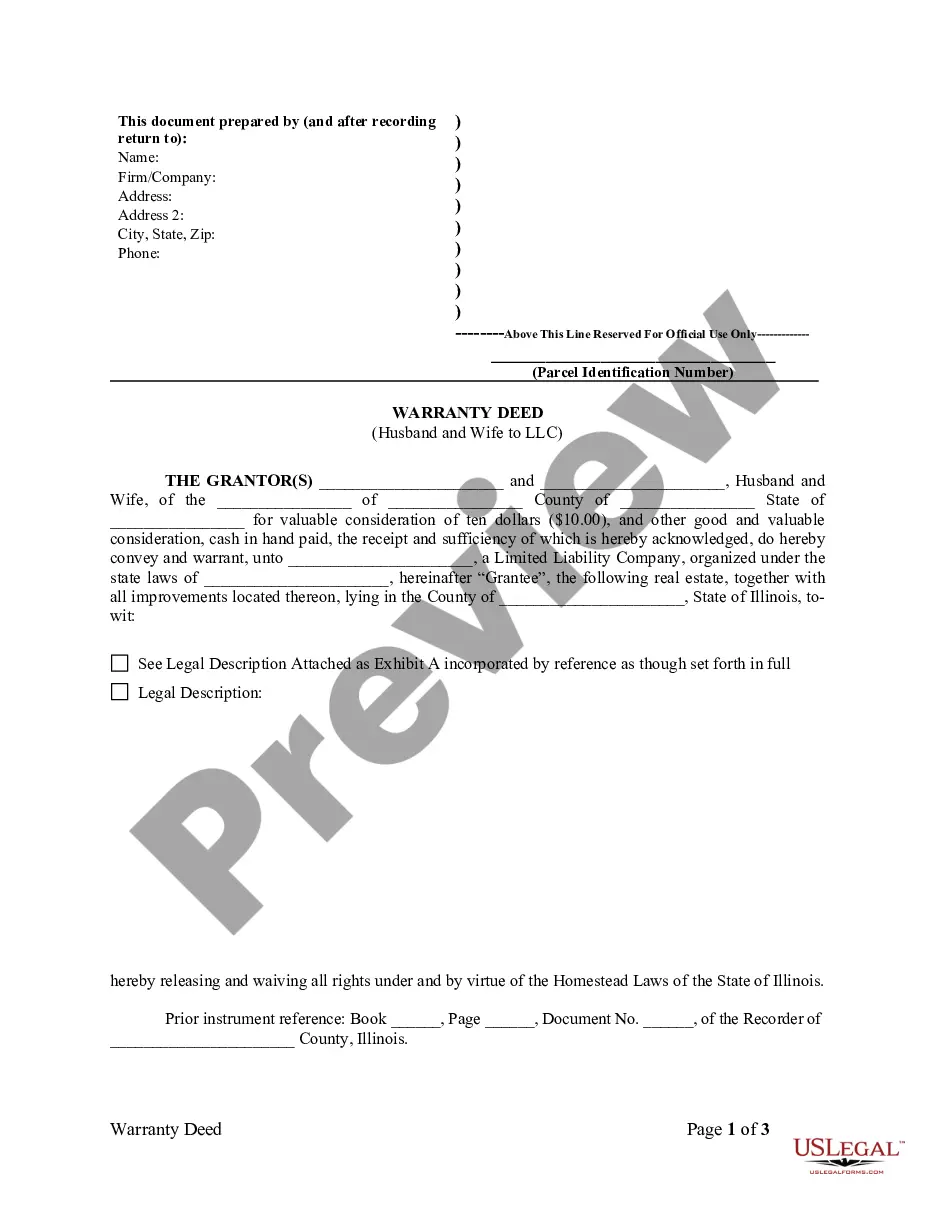

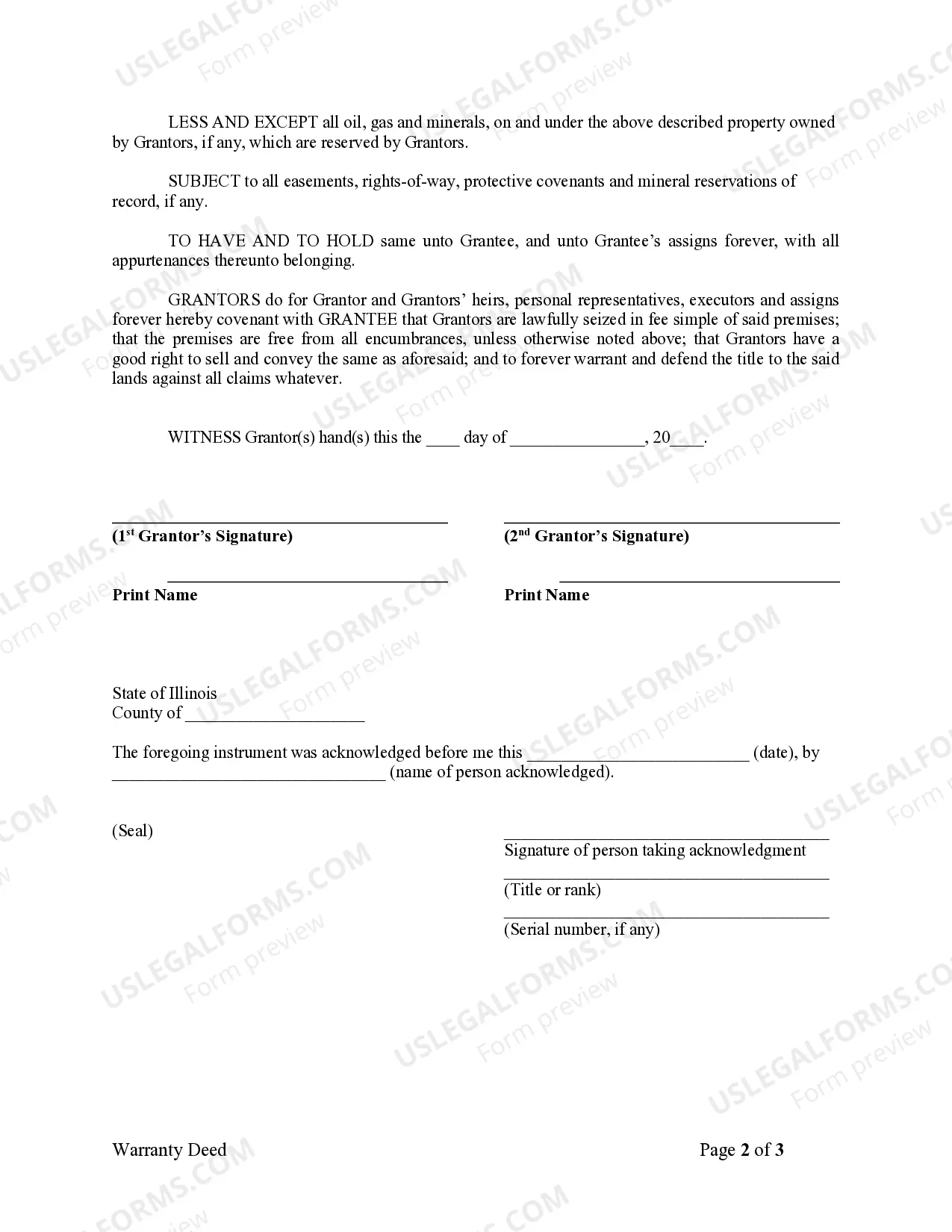

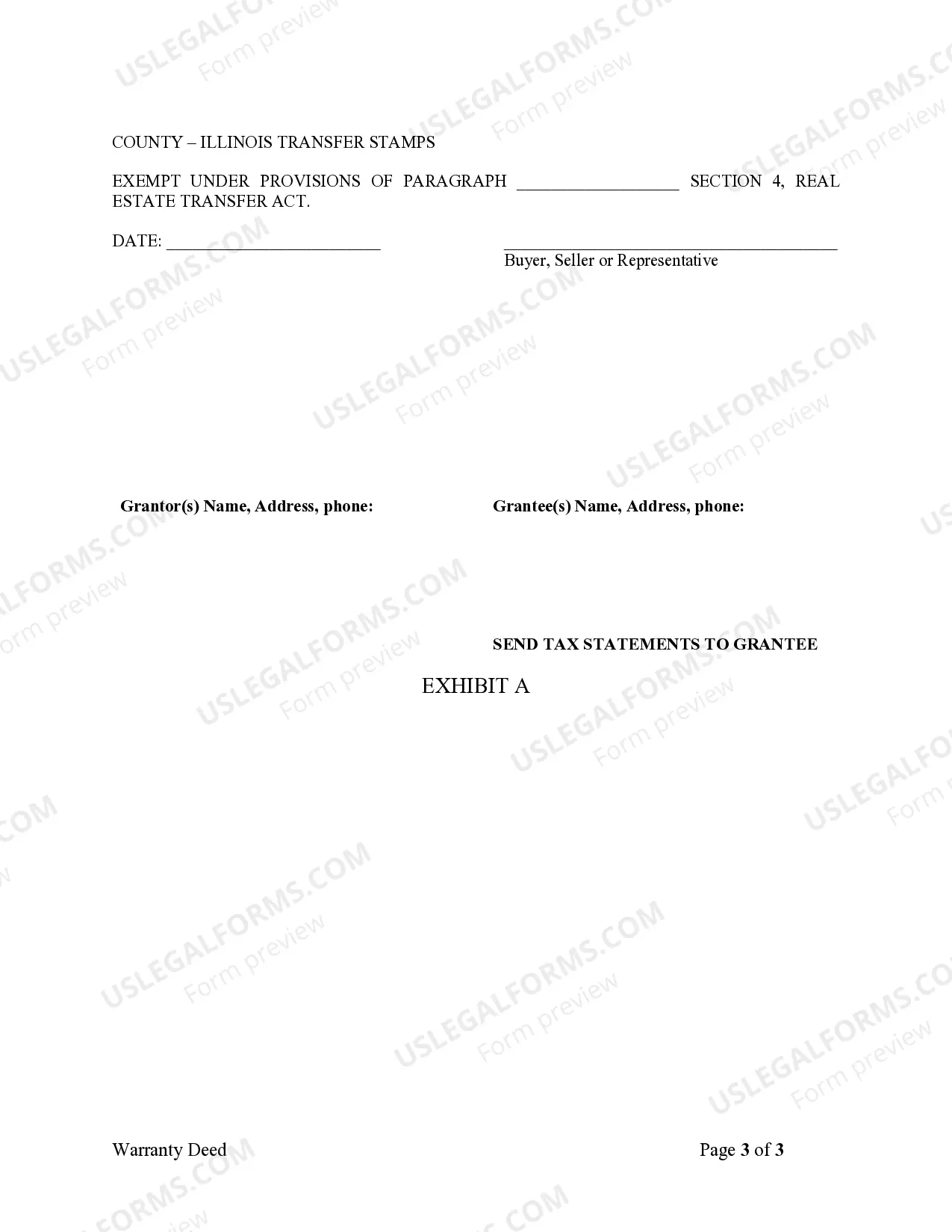

A Naperville Illinois Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a Limited Liability Company (LLC) in Naperville, Illinois, while providing a warranty of title to the LLC. This process allows the couple to transfer the property to their LLC, providing liability protection and potential tax benefits. In Naperville, Illinois, there are two primary types of Warranty Deeds from Husband and Wife to LLC that individuals commonly use. These include: 1. General Warranty Deed: A General Warranty Deed offers the highest level of protection for the buyer (the LLC) by guaranteeing that the property is free from any defects or claims, both prior to and during the ownership of the husband and wife. It ensures that the LLC receives full title to the property, and if any issues arise later, the LLC may have legal recourse against the couple. 2. Special Warranty Deed: A Special Warranty Deed, also known as a Limited Warranty Deed, provides a more limited warranty compared to a General Warranty Deed. It guarantees that the husband and wife have not allowed any defects to occur during their ownership of the property but does not cover any issues that might have existed before their ownership. In this case, if any hidden faults or claims arise from the previous ownership, the LLC may not be protected. During the process of transferring property through a Naperville Illinois Warranty Deed from Husband and Wife to LLC, several relevant keywords come into play: — Naperville: Refers to the city where the property and legal transaction is taking place. — Illinois: Specifies the state where the property is located, and where the legal document complies with state laws and regulations. — Warranty Deed: Describes the type of legal document being utilized for the property transfer, indicating the obligation of the husband and wife to guarantee the title to the LLC. — Husband and Wife: Identifies the current owners of the property who are transferring ownership to the LLC. — Limited Liability Company (LLC): Represents the entity that will become the new owner of the property, often chosen for its liability protection and potential tax advantages. — Property Ownership Transfer: References the action of transferring ownership from the individuals to the LLC, representing a change in legal title. — Liability Protection: Denotes the limited liability provided by the LLC structure, shielding the personal assets of the husband and wife from potential legal actions against the property. — Tax Benefits: Points towards potential tax advantages associated with owning property under an LLC, such as pass-through taxation or deductions. — Legal Document: Emphasizes the importance of having a proper, legally binding document that accurately represents the transfer of property ownership. Note: It is crucial to consult with a qualified attorney or real estate professional when dealing with Warranty Deeds and property transfers to ensure compliance with local regulations and to fully understand the implications of such transactions.

Naperville Illinois Warranty Deed from Husband and Wife to LLC

Description

How to fill out Naperville Illinois Warranty Deed From Husband And Wife To LLC?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney services that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Naperville Illinois Warranty Deed from Husband and Wife to LLC or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Naperville Illinois Warranty Deed from Husband and Wife to LLC adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Naperville Illinois Warranty Deed from Husband and Wife to LLC is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!