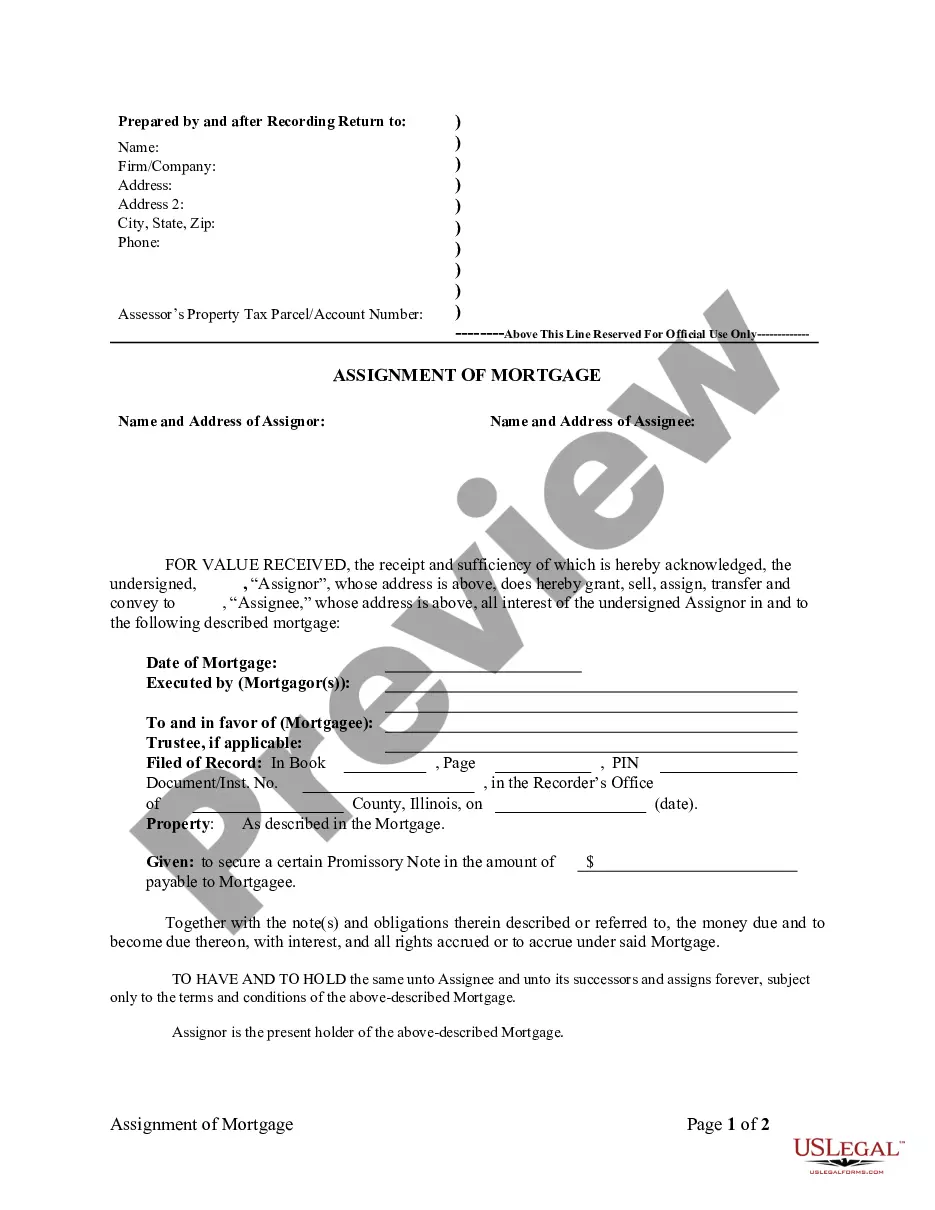

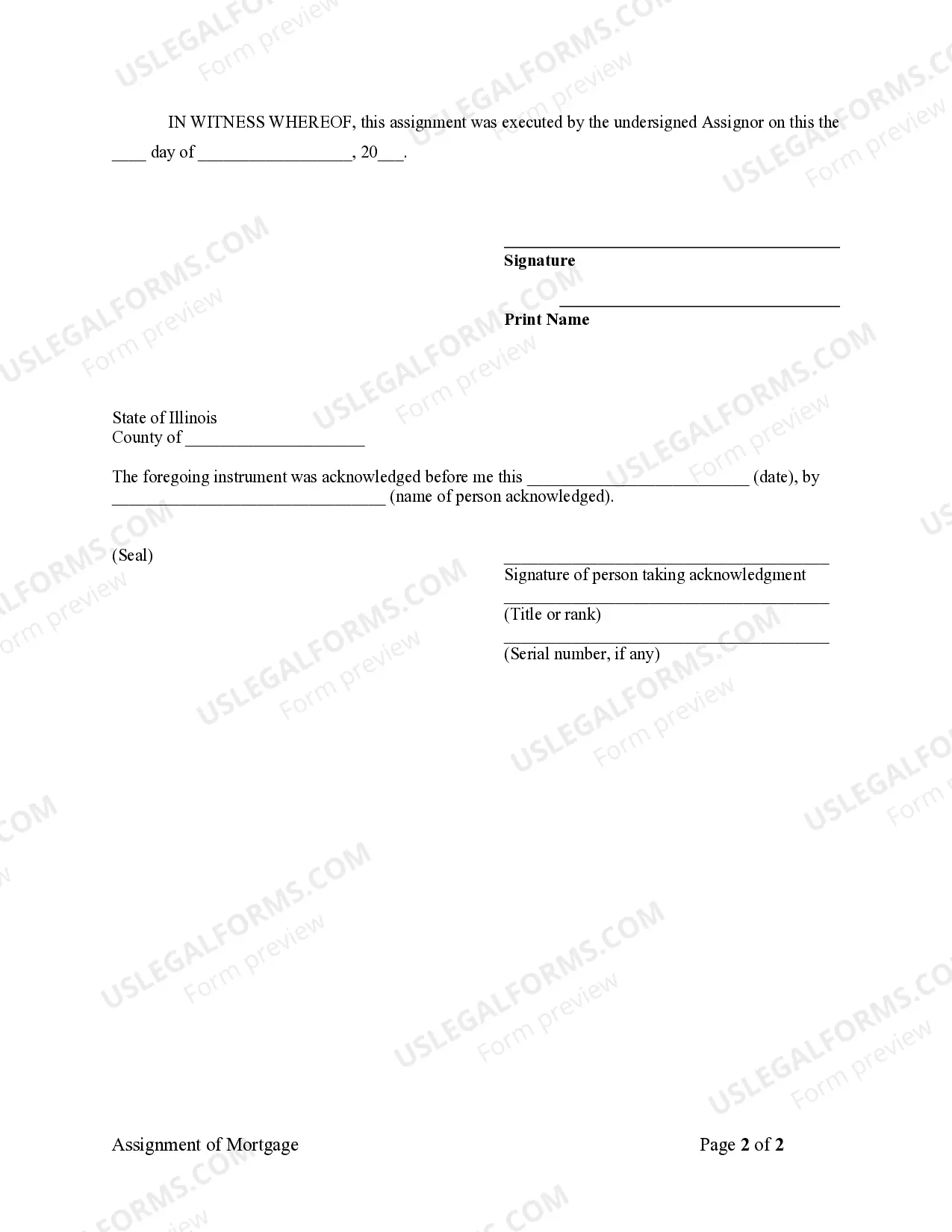

The Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder refers to the legal process by which a mortgage holder (individual or entity) transfers their rights and interests in a mortgage loan to another party. This type of assignment occurs when the original lender or mortgage holder decides to assign their rights to a different individual or entity, allowing them to collect the payments and enforce the terms of the loan. There are various types of Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder, including: 1. Voluntary Assignment: This occurs when the mortgage holder willingly transfers their rights and interests to another party. It can be done for various reasons, such as when the original lender wants to sell the mortgage to another investor or when the mortgage holder wants to assign the mortgage to a family member or business partner. 2. Forced Assignment: In some cases, the assignment of mortgage may be involuntary. This typically happens when a homeowner is unable to make mortgage payments, leading to foreclosure proceedings. As a result, the mortgage holder may assign the mortgage to a different entity, such as a bank or investor, which will then assume the responsibility of collecting payments and seeking foreclosure if necessary. 3. Partial Assignment: This type of assignment occurs when the mortgage holder transfers only a portion of their interest in the mortgage. For example, they may assign a percentage of the mortgage to another party while retaining partial ownership. This can be done for various reasons, such as risk mitigation or to raise additional funds. 4. Assignment of Mortgage with Assumption: In some cases, the mortgage holder may assign the mortgage to a new borrower who agrees to assume the responsibilities of the loan, including making payments and complying with the terms. This type of assignment, known as "subject to" assignment, allows the original borrower to transfer their rights and obligations to the new borrower while remaining liable in some cases. 5. Assignment of Mortgage with Novation: Novation occurs when the original borrower is entirely released from their obligations, and a new borrower assumes the mortgage fully. This process typically includes the creation of a new mortgage contract between the lender and the new borrower, effectively replacing the original agreement. It's essential to note that each type of Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder may have specific legal requirements and implications. Therefore, both the mortgage holder and the assignee should seek legal counsel to ensure compliance with applicable laws and regulations.

Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Joliet Illinois Assignment Of Mortgage By Individual Mortgage Holder?

Benefit from the US Legal Forms and have immediate access to any form you want. Our useful website with thousands of document templates simplifies the way to find and obtain almost any document sample you need. You can save, fill, and certify the Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder in a few minutes instead of surfing the Net for hours trying to find the right template.

Utilizing our library is a great way to increase the safety of your record submissions. Our professional legal professionals on a regular basis review all the records to ensure that the templates are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder? If you have a subscription, just log in to the account. The Download button will appear on all the samples you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Find the template you need. Make certain that it is the form you were looking for: check its name and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Choose the format to get the Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder and modify and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and trustworthy template libraries on the internet. We are always ready to assist you in any legal case, even if it is just downloading the Joliet Illinois Assignment of Mortgage by Individual Mortgage Holder.

Feel free to make the most of our service and make your document experience as straightforward as possible!