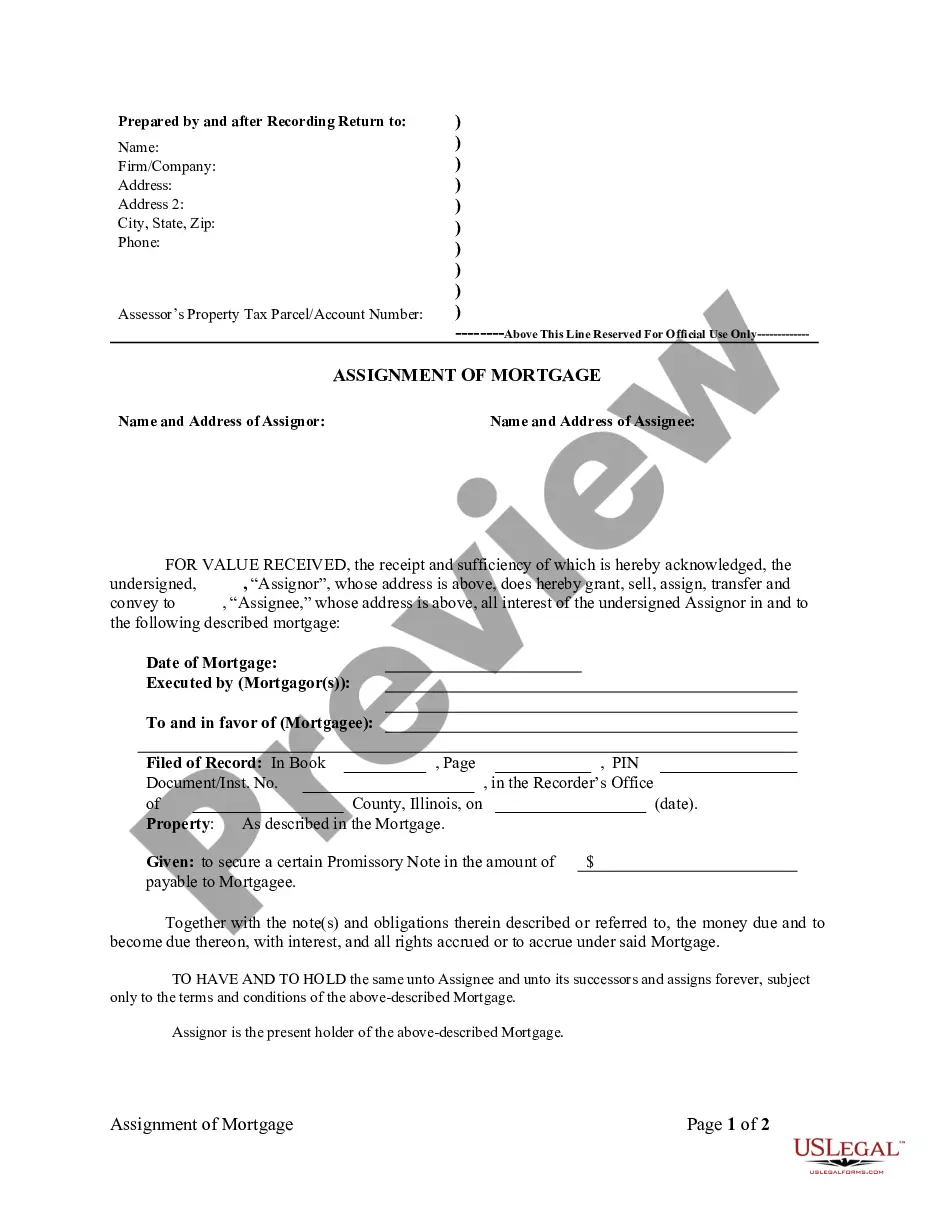

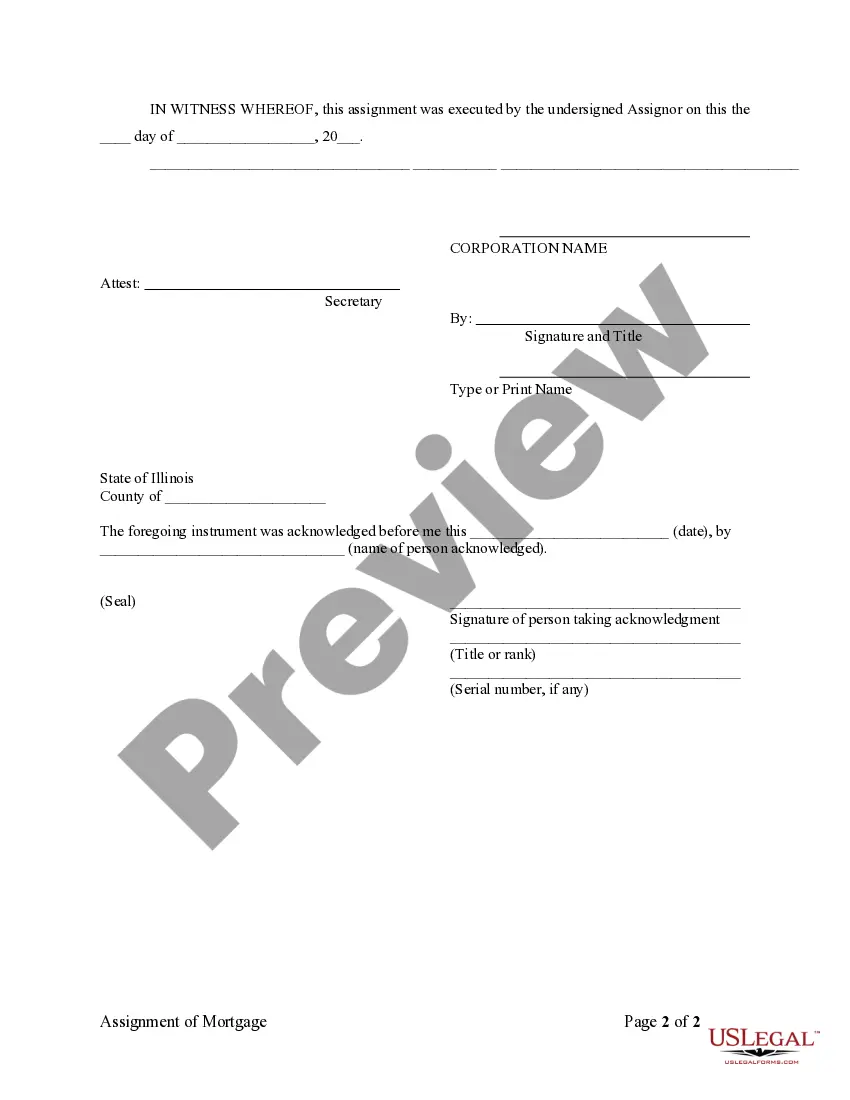

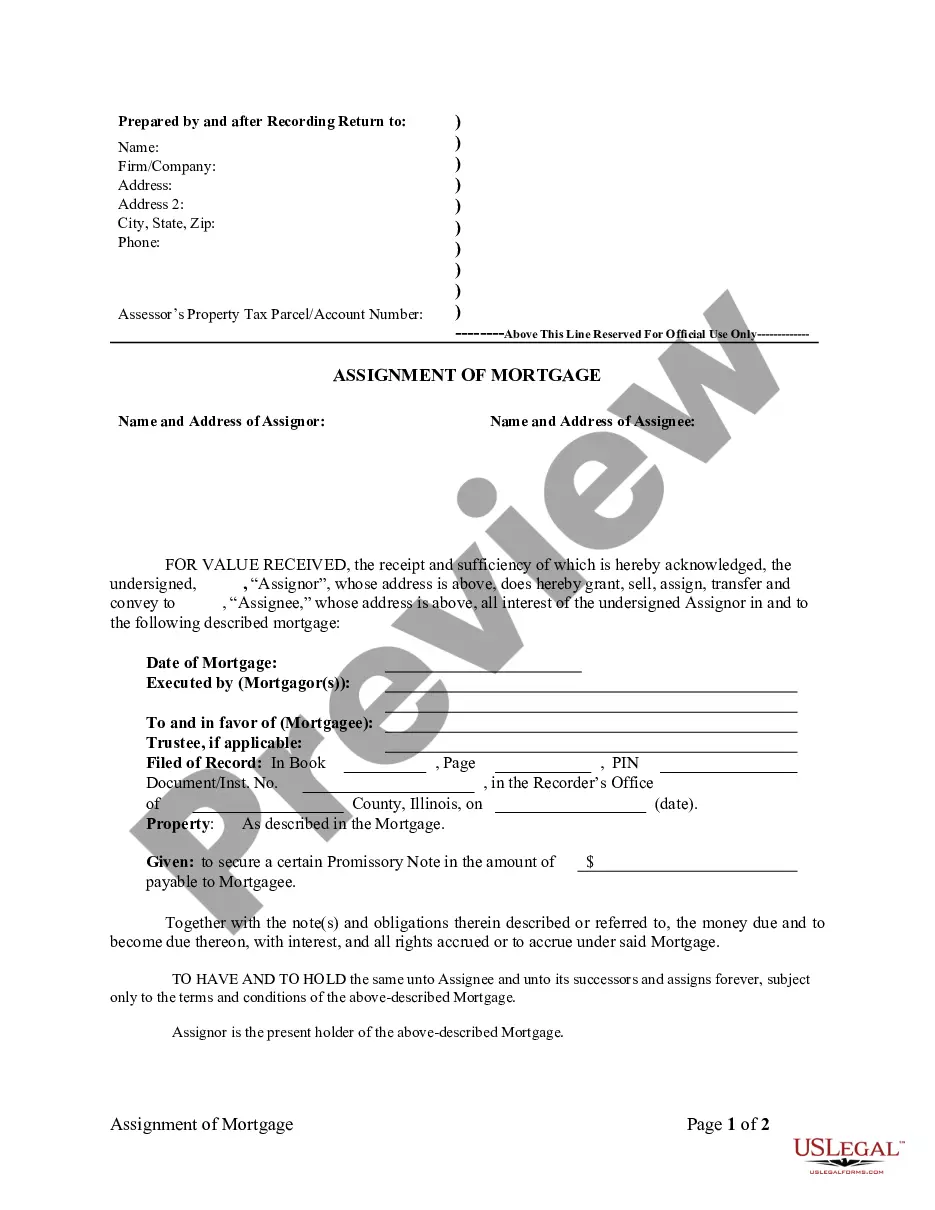

Title: Understanding Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder Introduction: In Rockford, Illinois, an Assignment of Mortgage by a Corporate Mortgage Holder is a legal document that allows a mortgage lender to transfer the mortgage debt to another party. This article will provide a detailed description of this assignment, including its purpose, process, and potential types. Keywords: Rockford Illinois, Assignment of Mortgage, Corporate Mortgage Holder, transfer mortgage debt, legal document, purpose, process, types. 1. Purpose of Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder: The primary purpose of an Assignment of Mortgage by a Corporate Mortgage Holder in Rockford, Illinois, is to transfer the rights and responsibilities of a mortgage loan from one lender to another. This is often done to streamline the mortgage servicing process or to enable lenders to sell or assign the loan to other financial institutions. 2. Process of Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder: The process of assigning a mortgage by a corporate mortgage holder involves the following steps: a. Agreement: The existing mortgage holder and the intended assignee must enter into a legally binding agreement to transfer the mortgage. This agreement outlines the terms, conditions, and obligations related to the assignment. b. Preparation of Assignment Document: A comprehensive assignment document is prepared by legal professionals, including all relevant details such as the borrower's name, property address, original mortgage terms, and the new mortgage holder's information. c. Execution and Recording: Once the assignment document is finalized, it must be signed by both parties and notarized. Then, it is recorded in the county recorder's office where the property is located to make it a matter of public record. d. Notice to Borrower: The borrower is informed about the assignment, notifying them about the change in the mortgage holder. They are instructed to make future mortgage payments to the new holder instead of the original. 3. Types of Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder: There can be several variations of the Assignment of Mortgage in Rockford, Illinois, based on the circumstances and parties involved. Some common types include: a. Whole Loan Transfer: This type of assignment involves the complete transfer of an existing mortgage loan, including all rights, interests, and obligations, to a new corporate mortgage holder. b. Partial Assignment: In some cases, a mortgage lender may assign a specific percentage or portion of the mortgage loan to another entity, while retaining ownership of the remaining portion. c. Servicing Rights Assignment: Mortgage lenders may also assign the rights to service the loan (i.e., collect payments, manage escrow, etc.) to a third-party service, while retaining the ownership of the loan itself. d. Mortgage-Backed Securities Assignment: In this type of assignment, multiple mortgages are packaged together and sold to investors as mortgage-backed securities, allowing lenders to raise funds for additional lending activities. Conclusion: Understanding the Rockford Illinois Assignment of Mortgage by a Corporate Mortgage Holder is crucial for borrowers, lenders, and all parties involved in real estate transactions. This legal process facilitates the transfer of mortgage rights and obligations, enabling lenders to manage their loan portfolios effectively.

Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Rockford Illinois Assignment Of Mortgage By Corporate Mortgage Holder?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Rockford Illinois Assignment of Mortgage by Corporate Mortgage Holder would work for you, you can select the subscription plan and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!