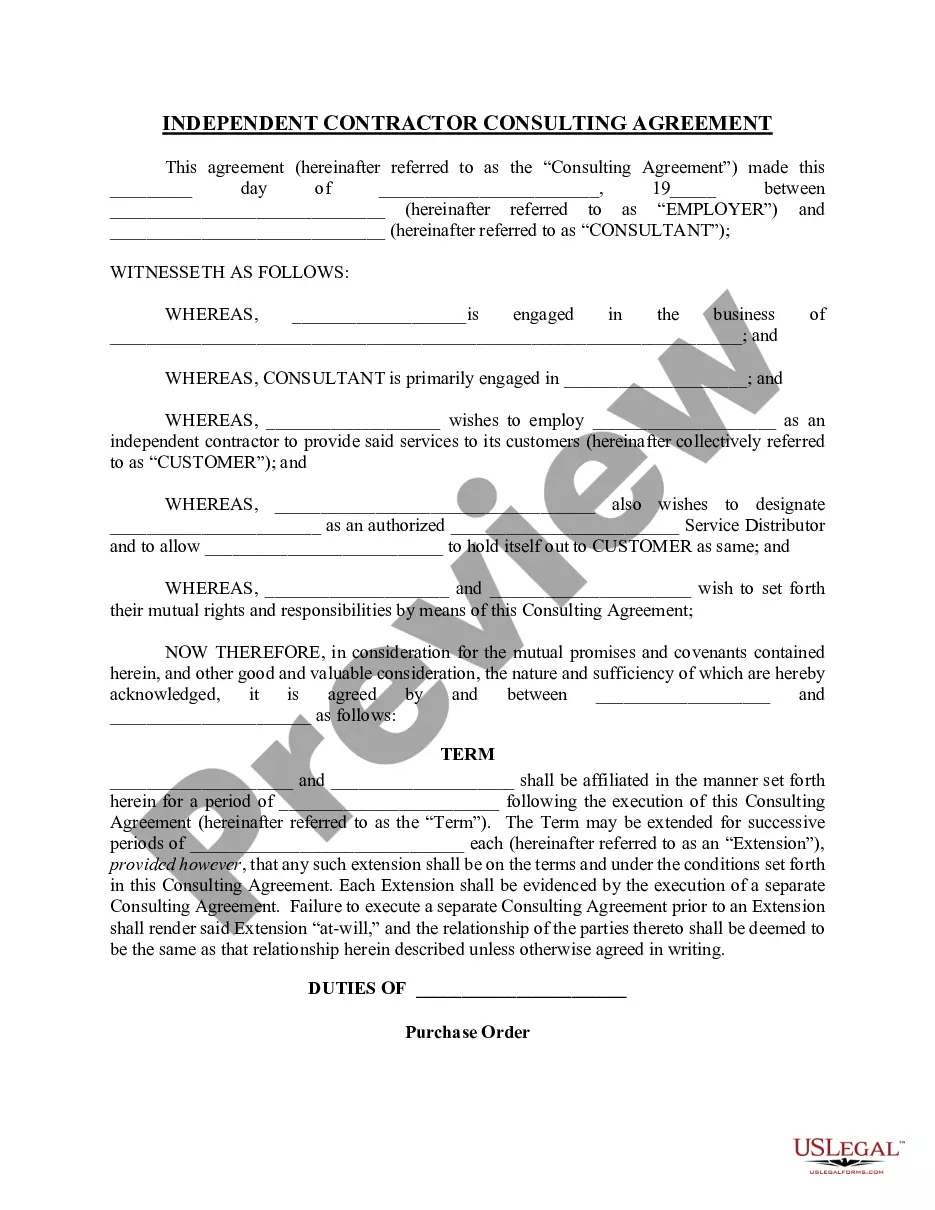

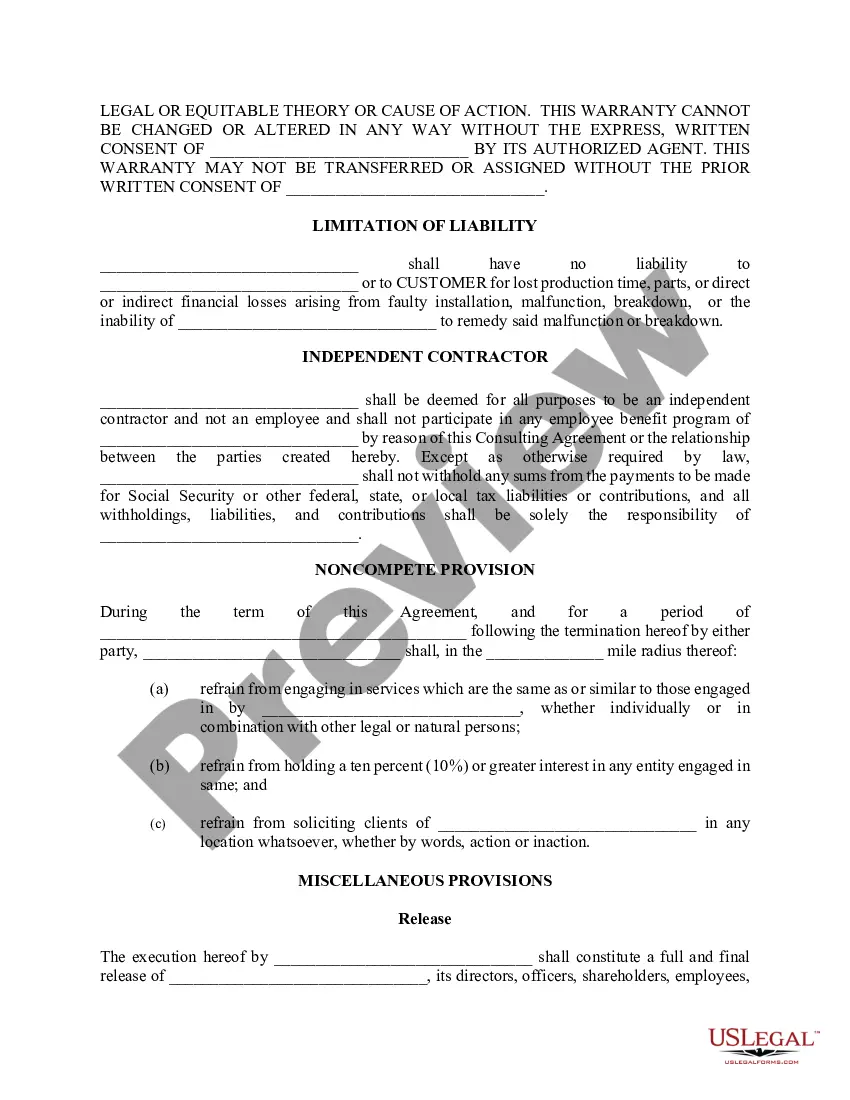

The Cook Illinois Self-Employed Independent Contractor Agreement is a legally binding contract between Cook Illinois Corporation and a self-employed individual who wishes to provide services as an independent contractor. This agreement outlines the terms and conditions under which the independent contractor will perform their services for Cook Illinois. Keywords: Cook Illinois, Self-Employed, Independent Contractor Agreement, contract, services This agreement is commonly used by Cook Illinois when engaging self-employed individuals for various services such as transportation, maintenance, or other specialized tasks. It is essential to have a clear and well-defined agreement in place to ensure the rights and responsibilities of both parties are protected. The Cook Illinois Self-Employed Independent Contractor Agreement typically includes the following key elements: 1. Parties: It identifies the involved parties, namely Cook Illinois Corporation and the independent contractor, providing their full legal names and addresses. 2. Scope of Work: This section outlines the specific services to be rendered by the independent contractor, including any details about duration, location, and nature of the work. 3. Compensation: The agreement highlights the payment terms and details such as the agreed-upon rate, payment frequency, and any additional expenses or reimbursements. 4. Independent Contractor Relationship: It clarifies that the independent contractor is not an employee of Cook Illinois but rather a self-employed individual responsible for their own taxes, insurance, and liabilities. 5. Confidentiality and Non-Disclosure: This section ensures that the independent contractor maintains the confidentiality of any proprietary information or trade secrets they may come into contact with during the engagement. 6. Intellectual Property: It outlines any ownership rights or restrictions regarding intellectual property developed or used during the contract period. 7. Termination: The agreement includes provisions for termination, specifying the conditions under which either party may end the contract and any notice period required. 8. Indemnification and Liability: This section addresses the responsibilities of each party in case of any disputes, claims, or damages arising from the services performed. Different types of Cook Illinois Self-Employed Independent Contractor Agreements may exist depending on the specific nature of the services being provided. For instance, if Cook Illinois engages independent contractors for transportation services, there might be a separate agreement that governs the use of vehicles, insurance requirements, and safety protocols. Overall, the Cook Illinois Self-Employed Independent Contractor Agreement is a vital document that establishes the relationship between Cook Illinois Corporation and independent contractors, ensuring clarity and protection for both parties involved. It is essential to seek legal advice when drafting or reviewing such agreements to ensure compliance with applicable laws and regulations. Keywords: Cook Illinois, Self-Employed, Independent Contractor Agreement, contract, services, transportation, maintenance, specialized tasks, legally binding, terms and conditions, engagement, rights and responsibilities, parties, scope of work, compensation, independent contractor relationship, confidentiality, non-disclosure, intellectual property, termination, indemnification, liability, disputes, claims, damages, vehicles, insurance requirements, safety protocols, legal advice, compliance, applicable laws, regulations.

Cook Self Employed

Description

How to fill out Cook Illinois Self-Employed Independent Contractor Agreement?

Benefit from the US Legal Forms and obtain immediate access to any form sample you need. Our helpful website with a large number of documents simplifies the way to find and get virtually any document sample you need. You are able to download, fill, and sign the Cook Illinois Self-Employed Independent Contractor Agreement in a matter of minutes instead of browsing the web for several hours seeking the right template.

Utilizing our library is a wonderful way to increase the safety of your form submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the forms are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Cook Illinois Self-Employed Independent Contractor Agreement? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction below:

- Open the page with the form you require. Ensure that it is the form you were looking for: verify its name and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Choose the format to obtain the Cook Illinois Self-Employed Independent Contractor Agreement and revise and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and trustworthy document libraries on the web. Our company is always ready to assist you in any legal process, even if it is just downloading the Cook Illinois Self-Employed Independent Contractor Agreement.

Feel free to take advantage of our platform and make your document experience as convenient as possible!