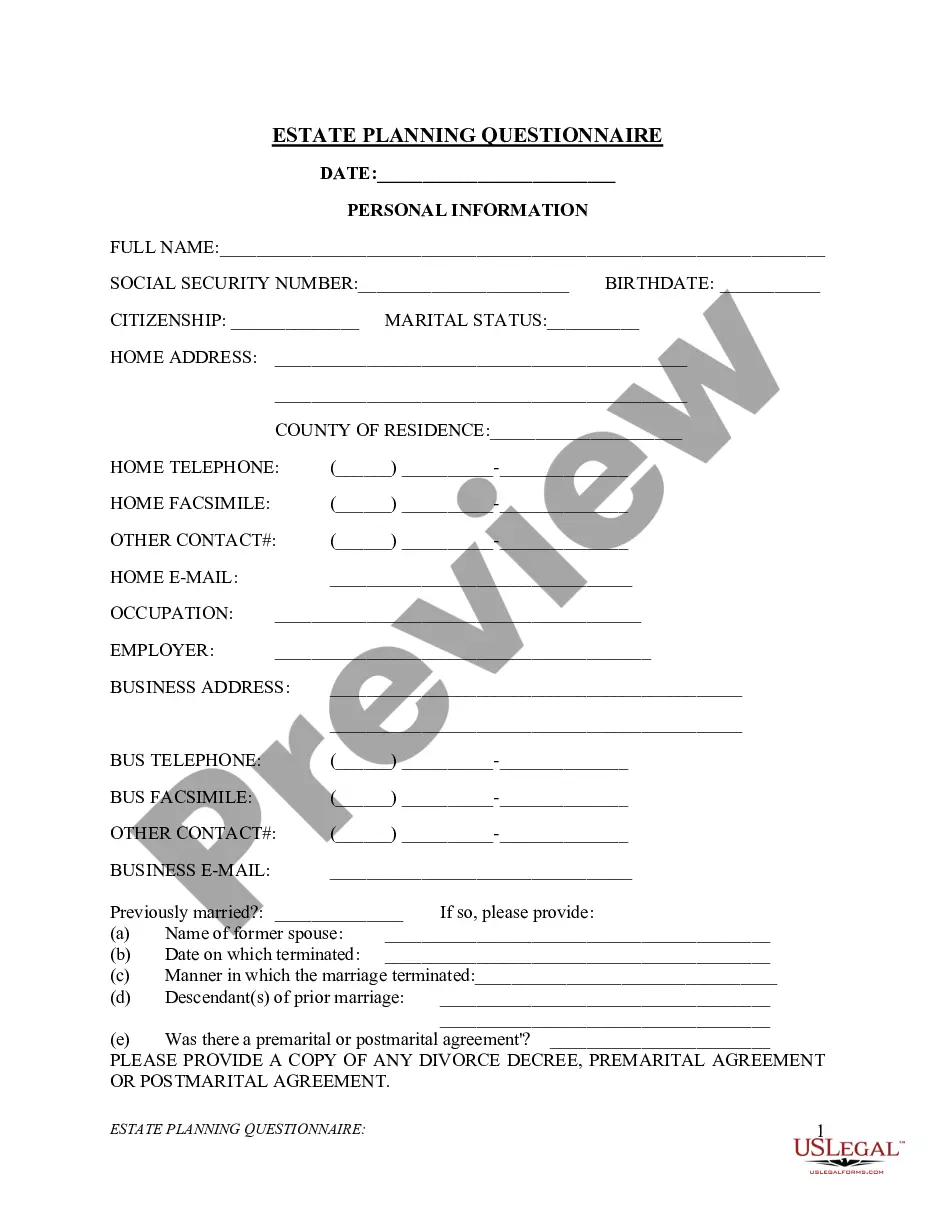

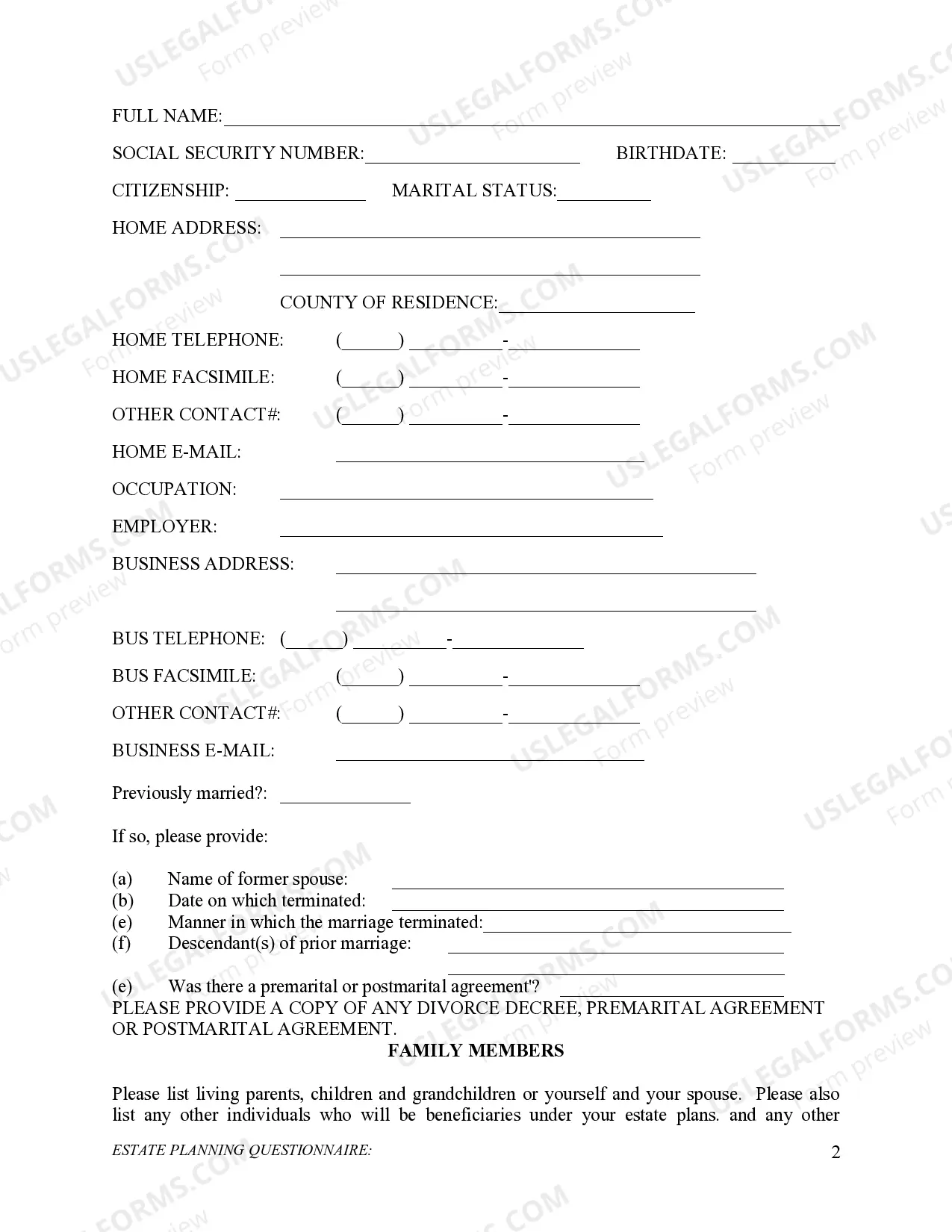

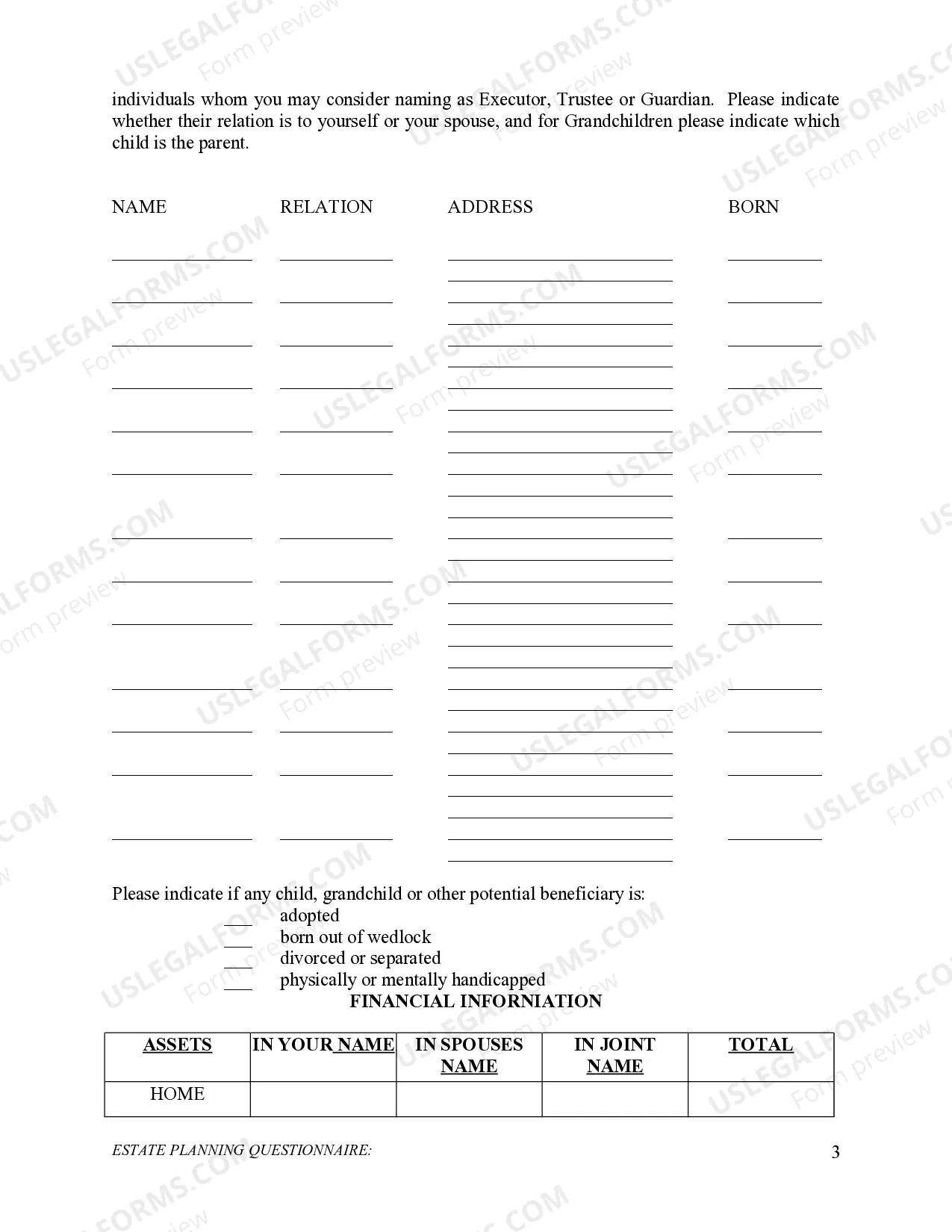

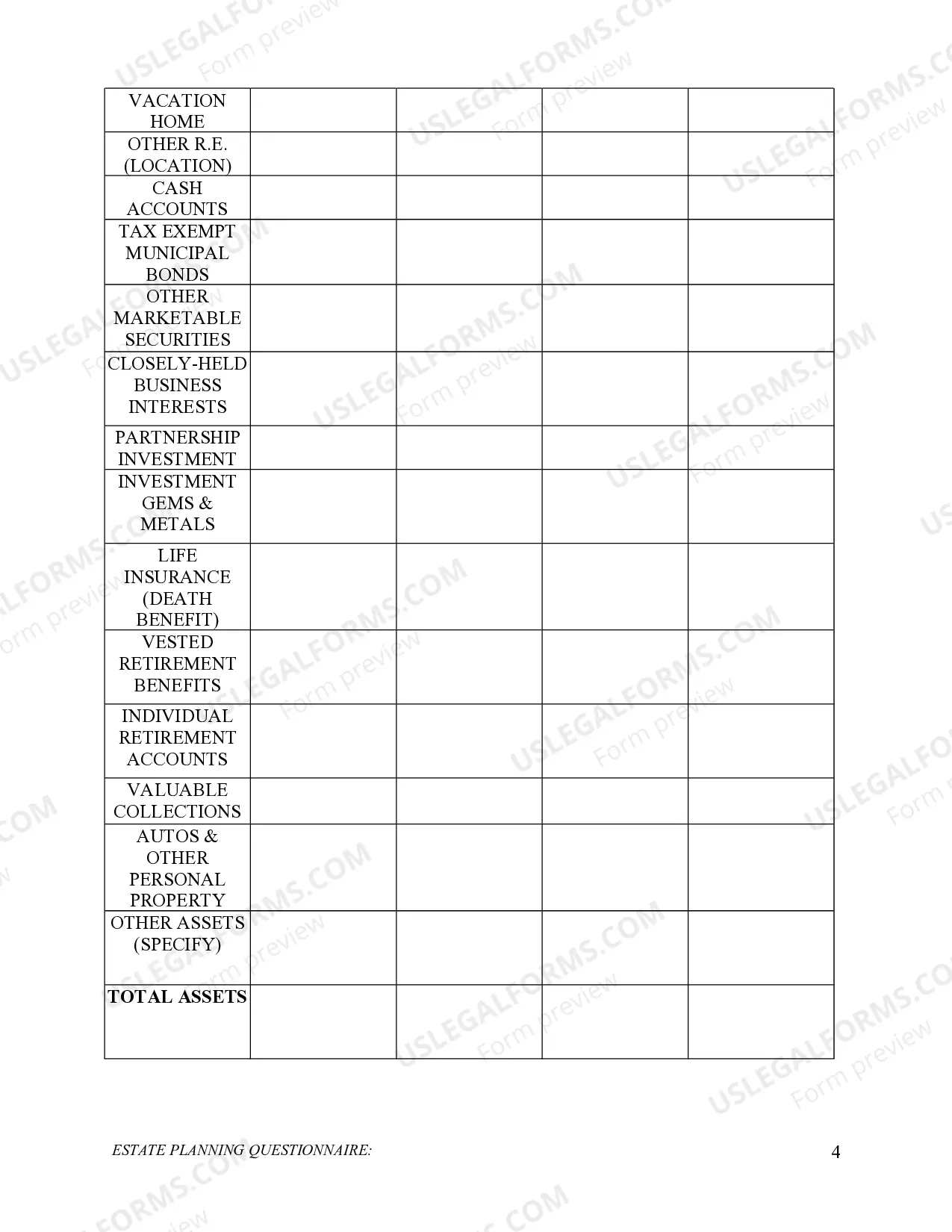

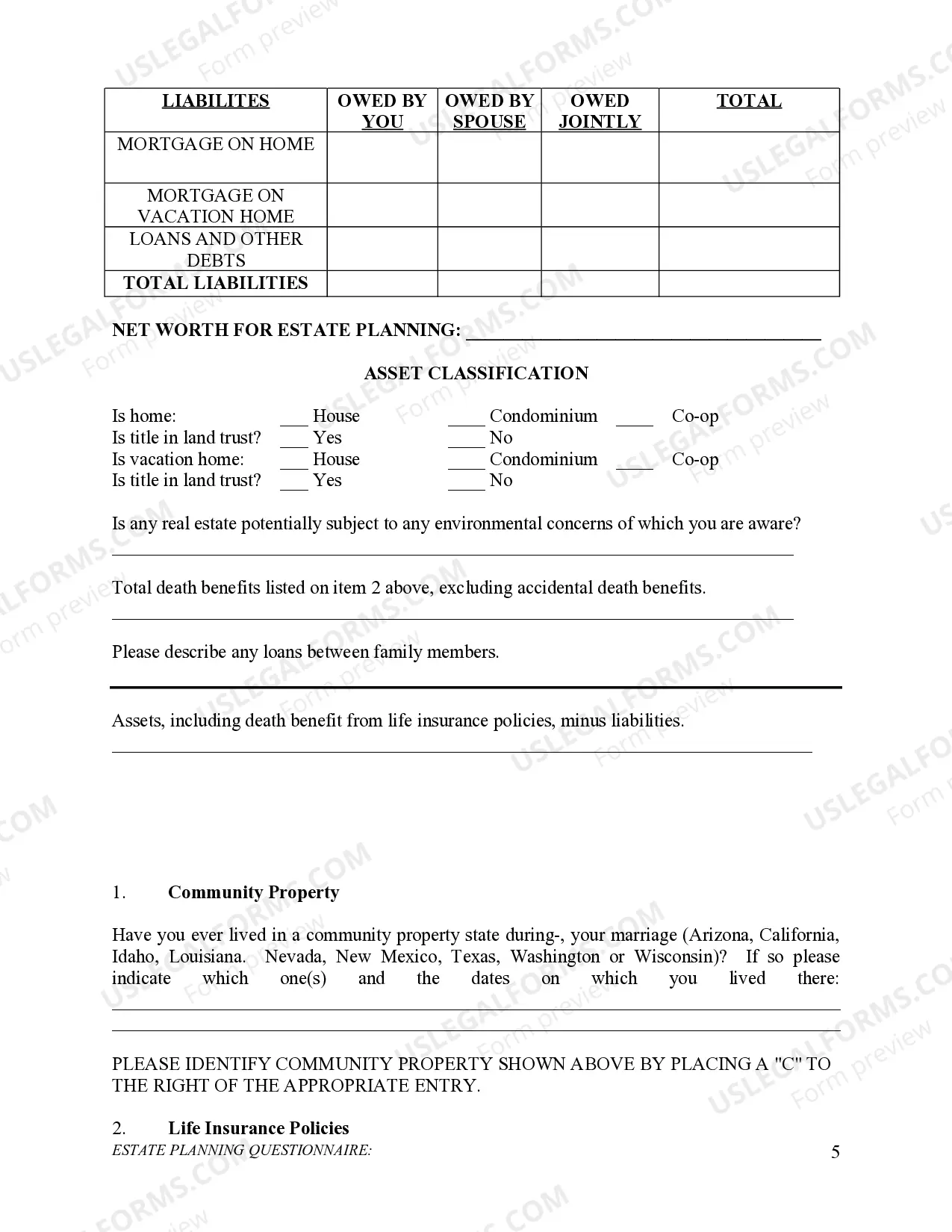

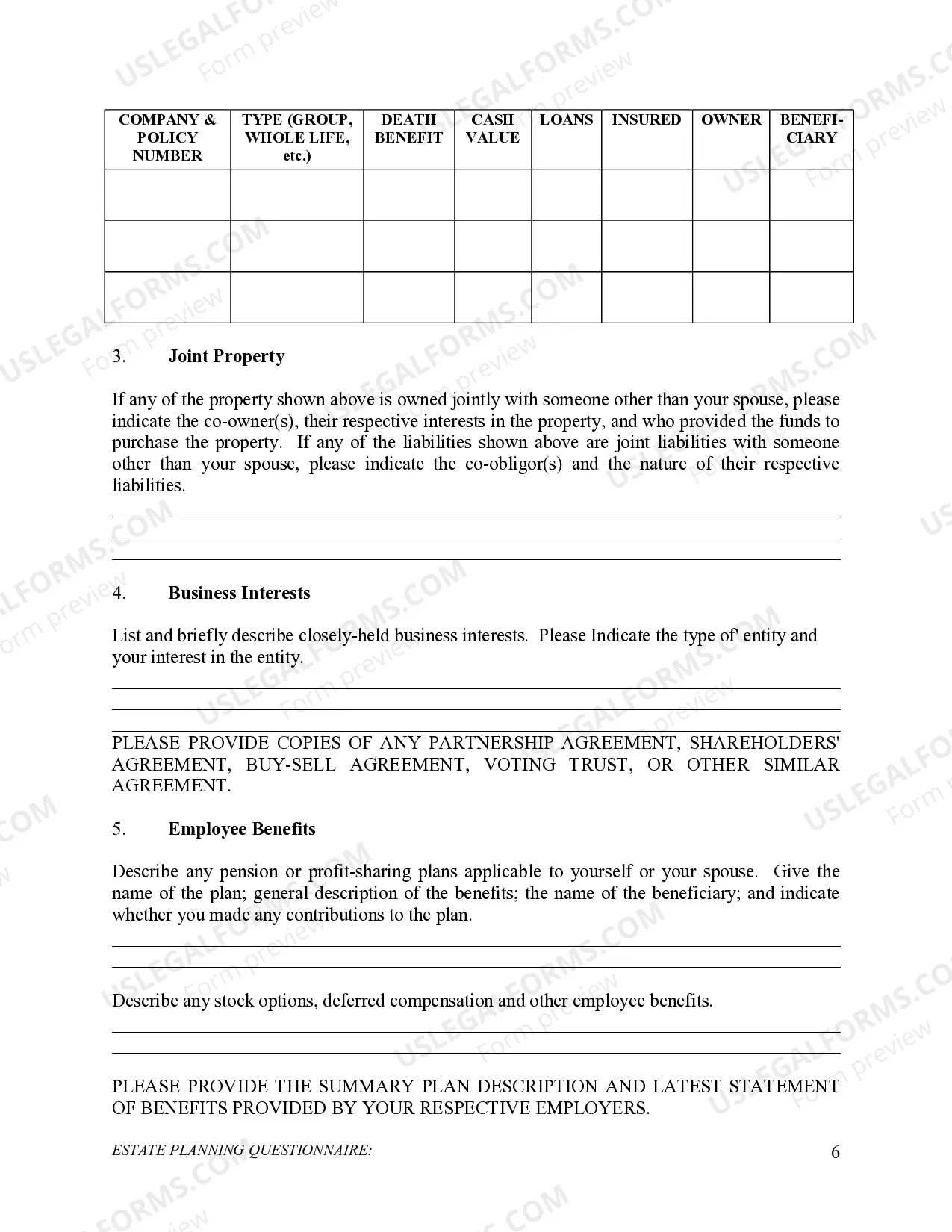

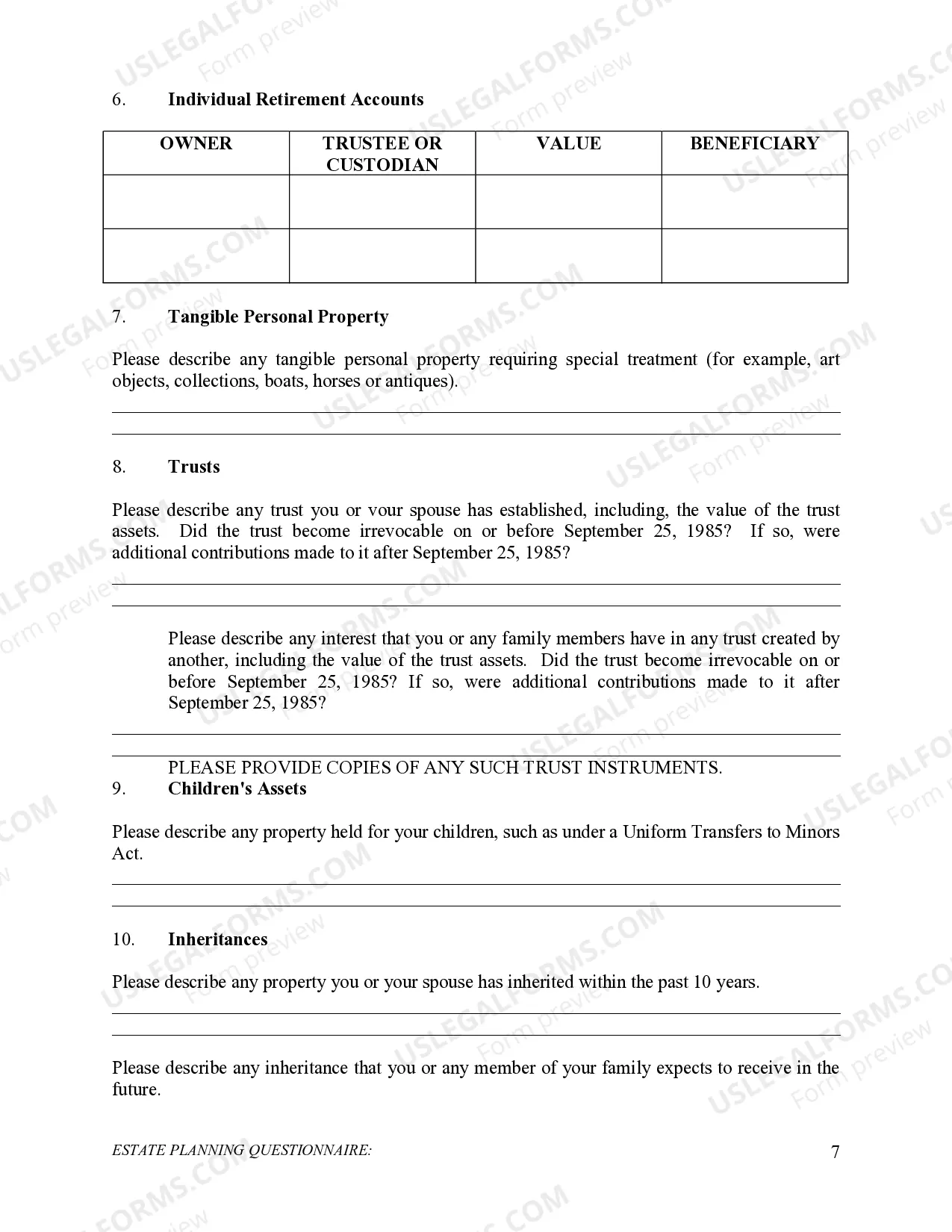

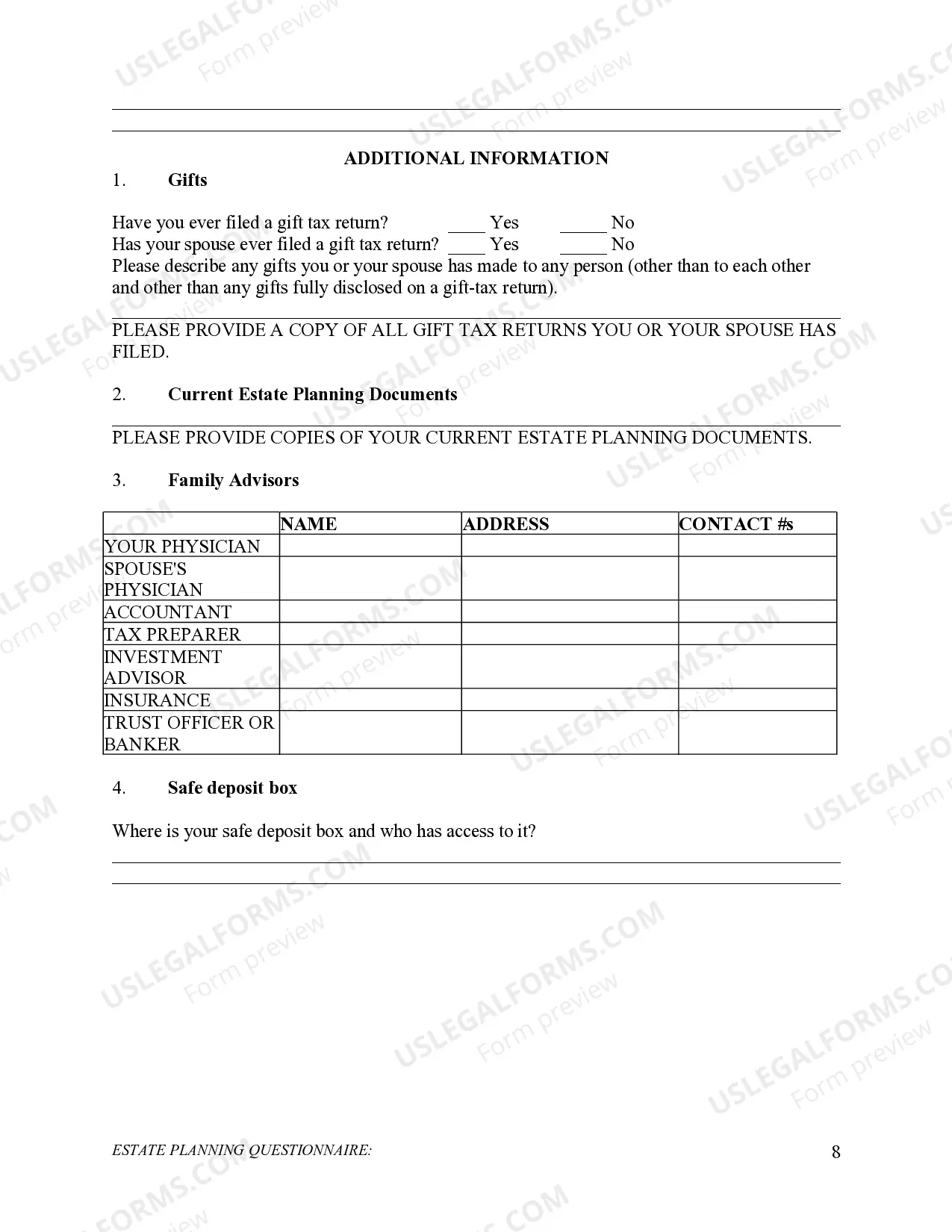

The Chicago Illinois Estate Planning Questionnaire is a comprehensive document designed to collect important information about an individual's personal and financial affairs in order to create an effective estate plan. This questionnaire serves as a crucial tool for individuals seeking to establish a clear and legally binding plan for the distribution of their assets upon their death. This questionnaire typically includes a wide range of questions that revolve around various aspects of an individual's life. It covers details such as personal information (name, address, marital status, etc.), family members and beneficiaries, financial accounts and investments, real estate properties and other assets, outstanding debts and liabilities, insurance policies, retirement and pension plans, as well as any existing wills or trusts. Moreover, the Chicago Illinois Estate Planning Questionnaire may also address specific concerns and goals of the individual, such as charitable giving, healthcare directives, and funeral arrangements. This allows the individual to communicate their preferences and wishes to their loved ones and ensures these wishes are carried out in the event of their incapacitation or death. Different types of Chicago Illinois Estate Planning Questionnaires may exist to cater to specific needs and situations. For example, there could be questionnaires tailored for young adults or newlyweds who are starting to accumulate assets. Similarly, there might be questionnaires designed specifically for retirees or individuals with complex financial portfolios. These variations in questionnaires enable individuals to address their unique circumstances and devise an estate plan that is customized to their needs. Overall, the Chicago Illinois Estate Planning Questionnaire is an essential tool in the estate planning process. By gathering detailed information and preferences, it helps individuals and their chosen estate planning attorneys create comprehensive and efficient estate plans that align with their wishes, protect their assets, minimize taxes, and provide peace of mind for themselves and their loved ones.

Chicago Illinois Estate Planning Questionnaire

Description

How to fill out Chicago Illinois Estate Planning Questionnaire?

If you are searching for a valid form, it’s impossible to choose a more convenient place than the US Legal Forms website – one of the most comprehensive libraries on the internet. With this library, you can find thousands of templates for company and individual purposes by categories and regions, or keywords. Using our advanced search function, discovering the newest Chicago Illinois Estate Planning Questionnaire is as elementary as 1-2-3. Furthermore, the relevance of each and every file is confirmed by a team of expert attorneys that regularly review the templates on our platform and update them according to the newest state and county demands.

If you already know about our system and have an account, all you should do to get the Chicago Illinois Estate Planning Questionnaire is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you require. Look at its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to get the proper record.

- Confirm your decision. Click the Buy now button. Following that, select your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Pick the format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the acquired Chicago Illinois Estate Planning Questionnaire.

Every form you save in your account has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you need to get an additional copy for enhancing or printing, you can come back and download it once again at any moment.

Take advantage of the US Legal Forms professional collection to gain access to the Chicago Illinois Estate Planning Questionnaire you were seeking and thousands of other professional and state-specific samples on one website!