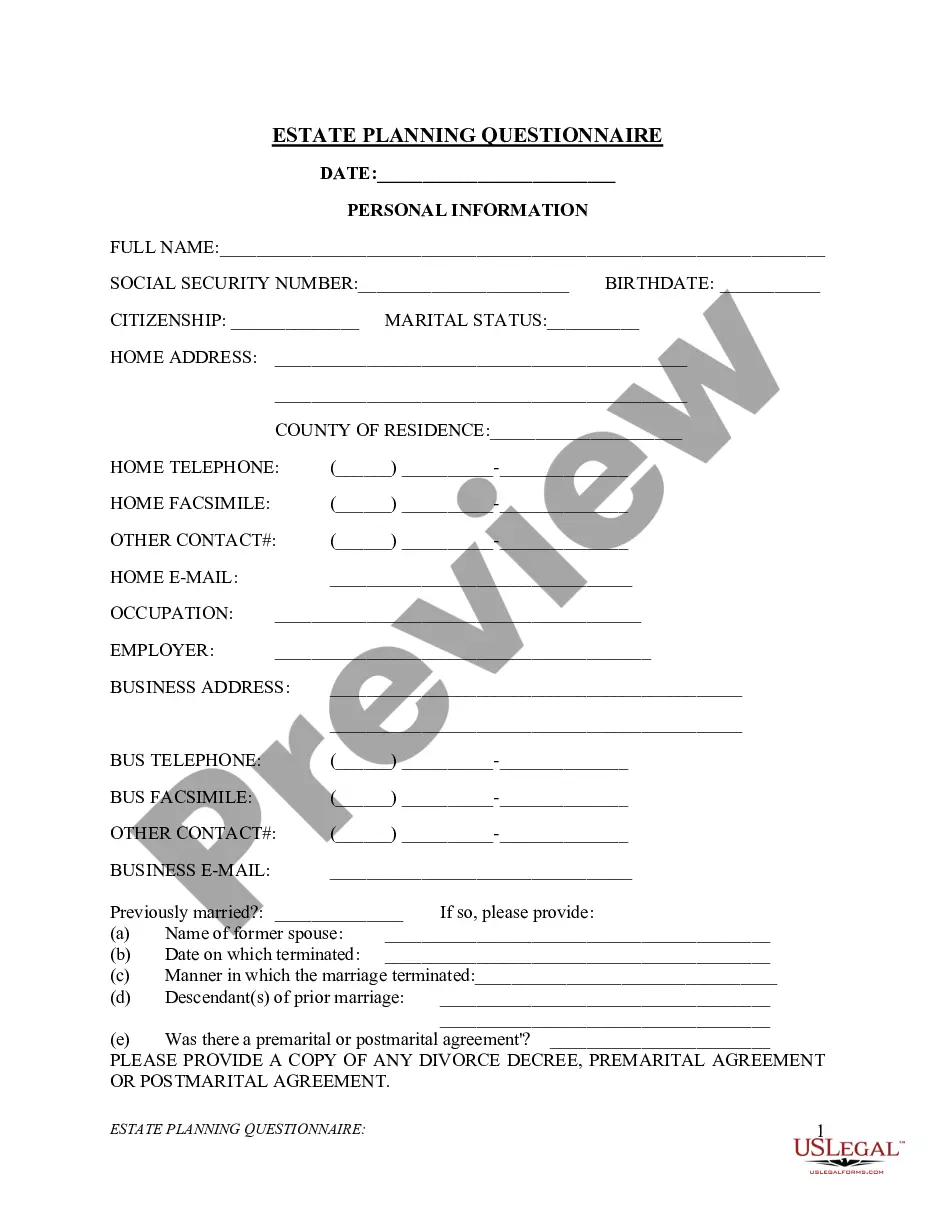

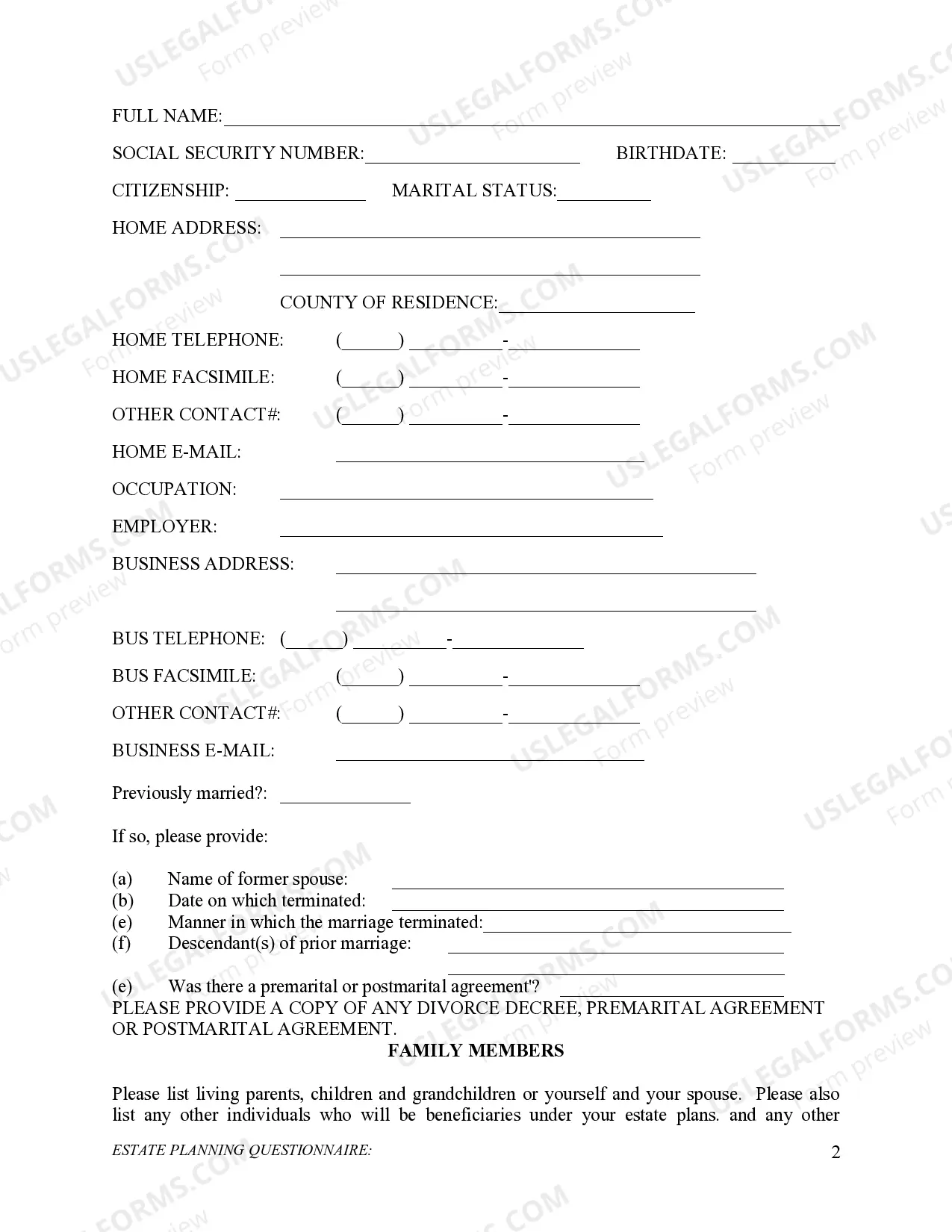

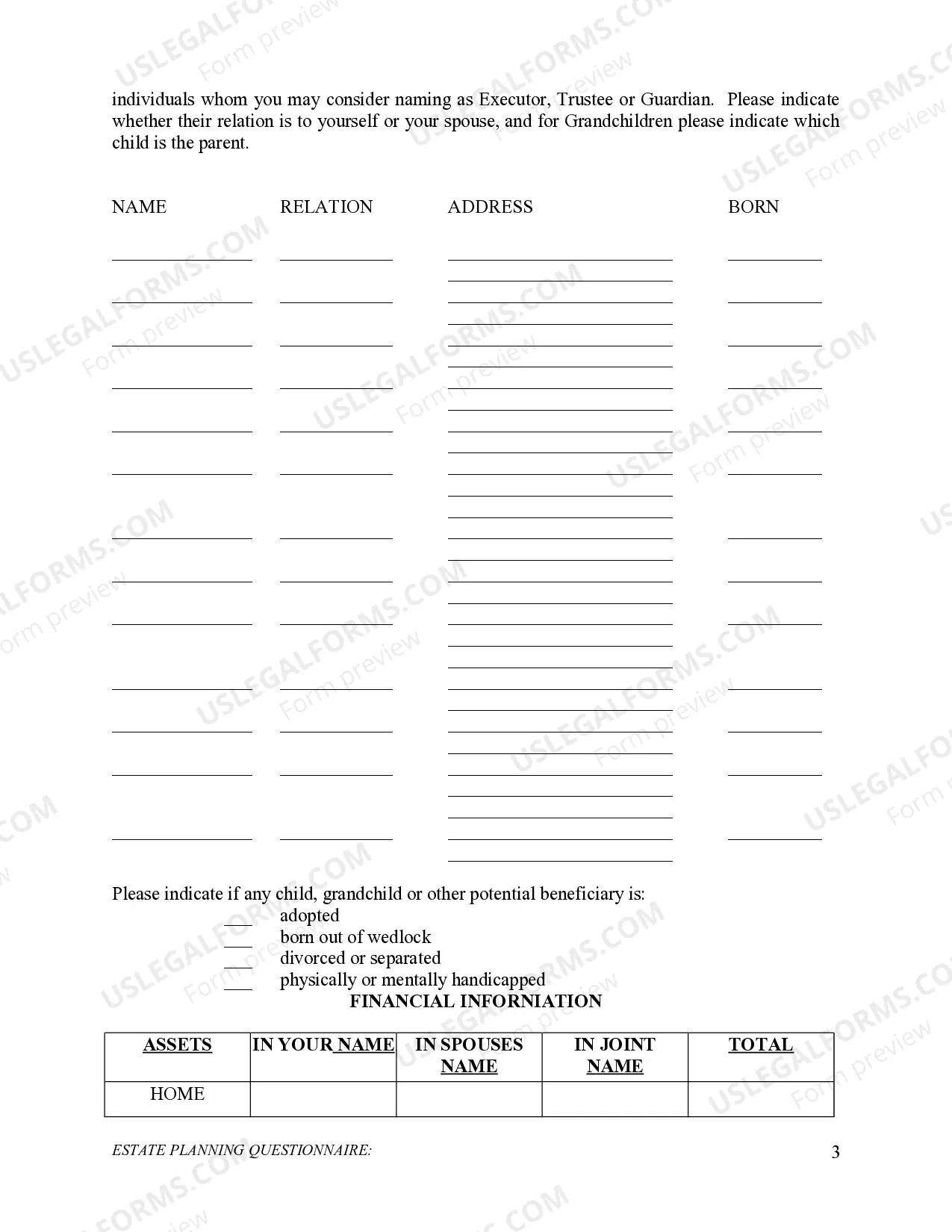

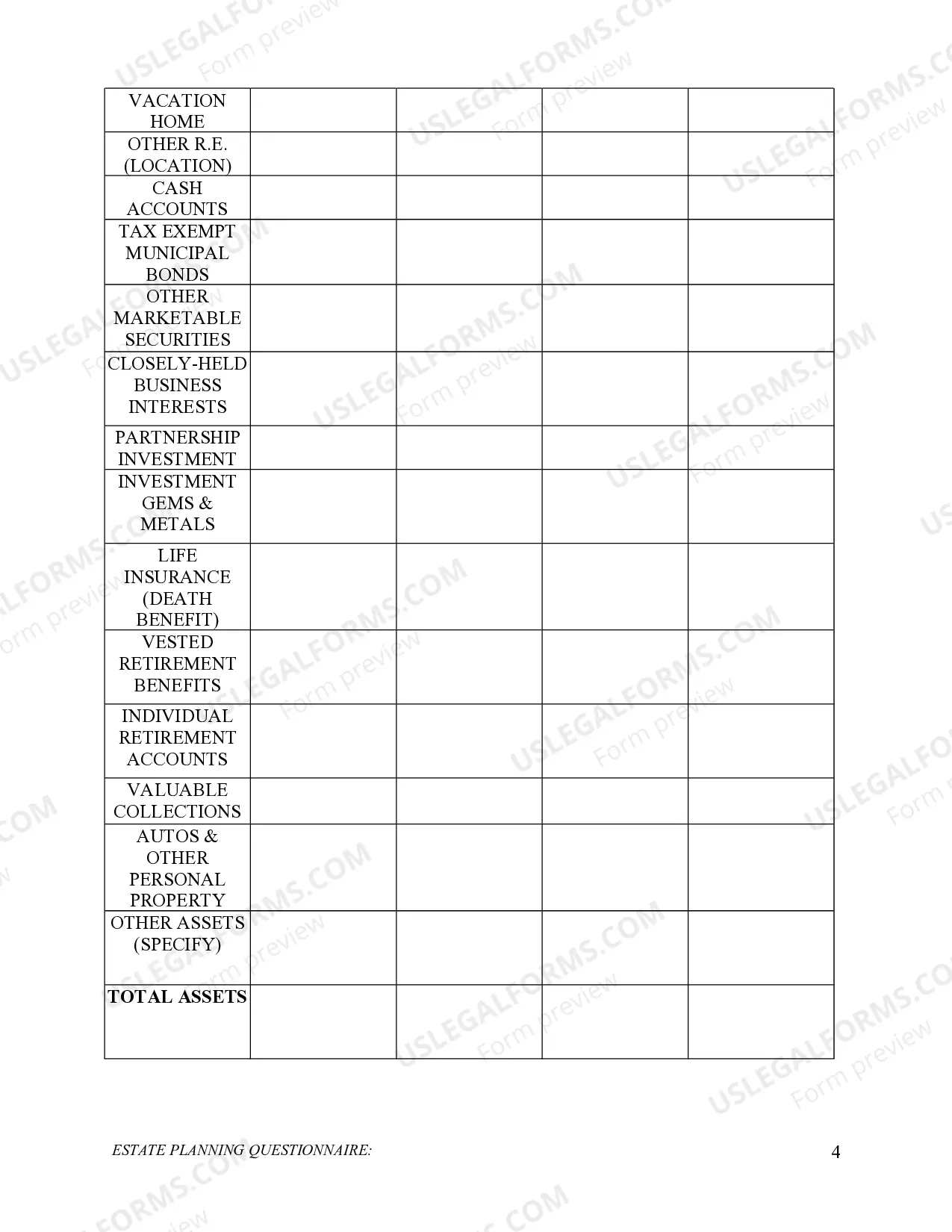

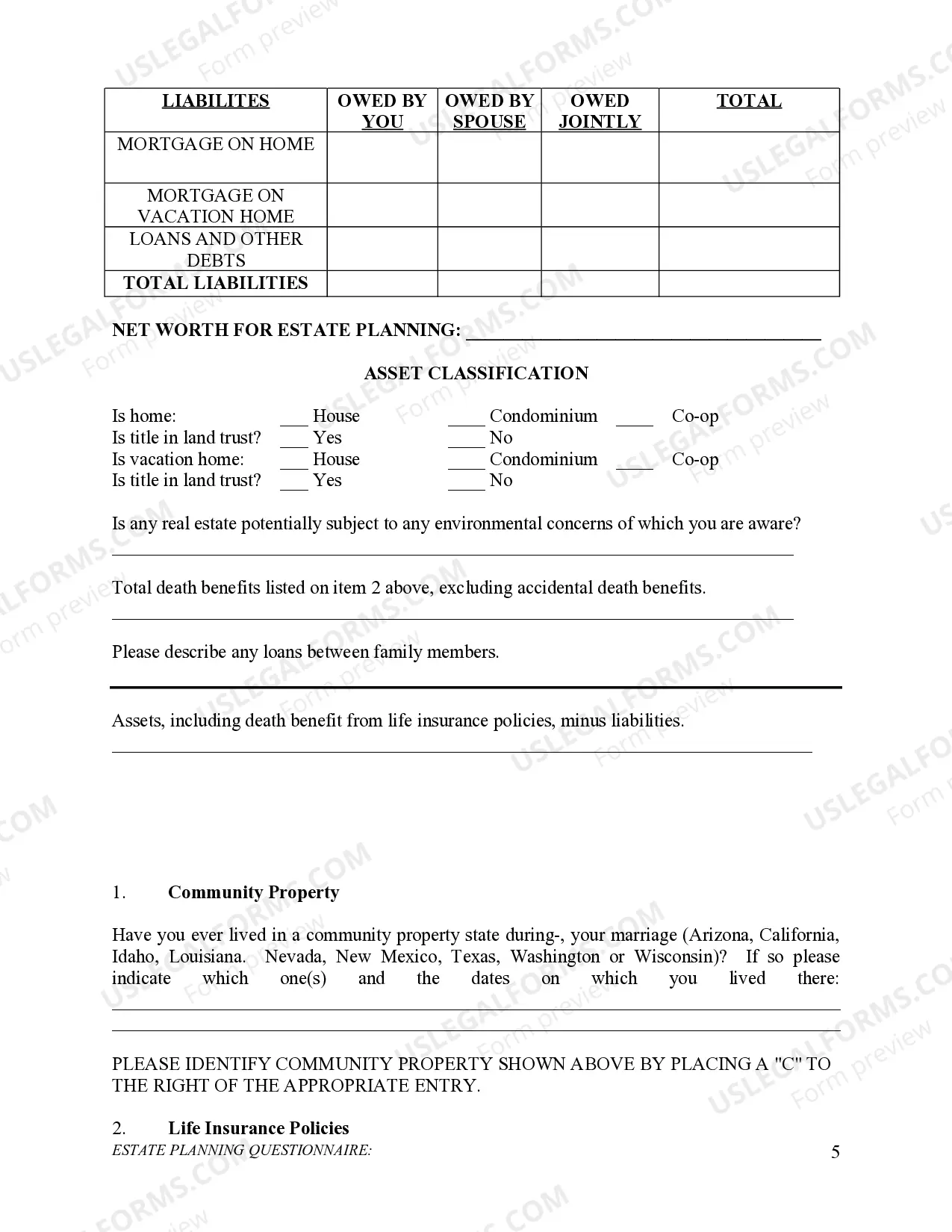

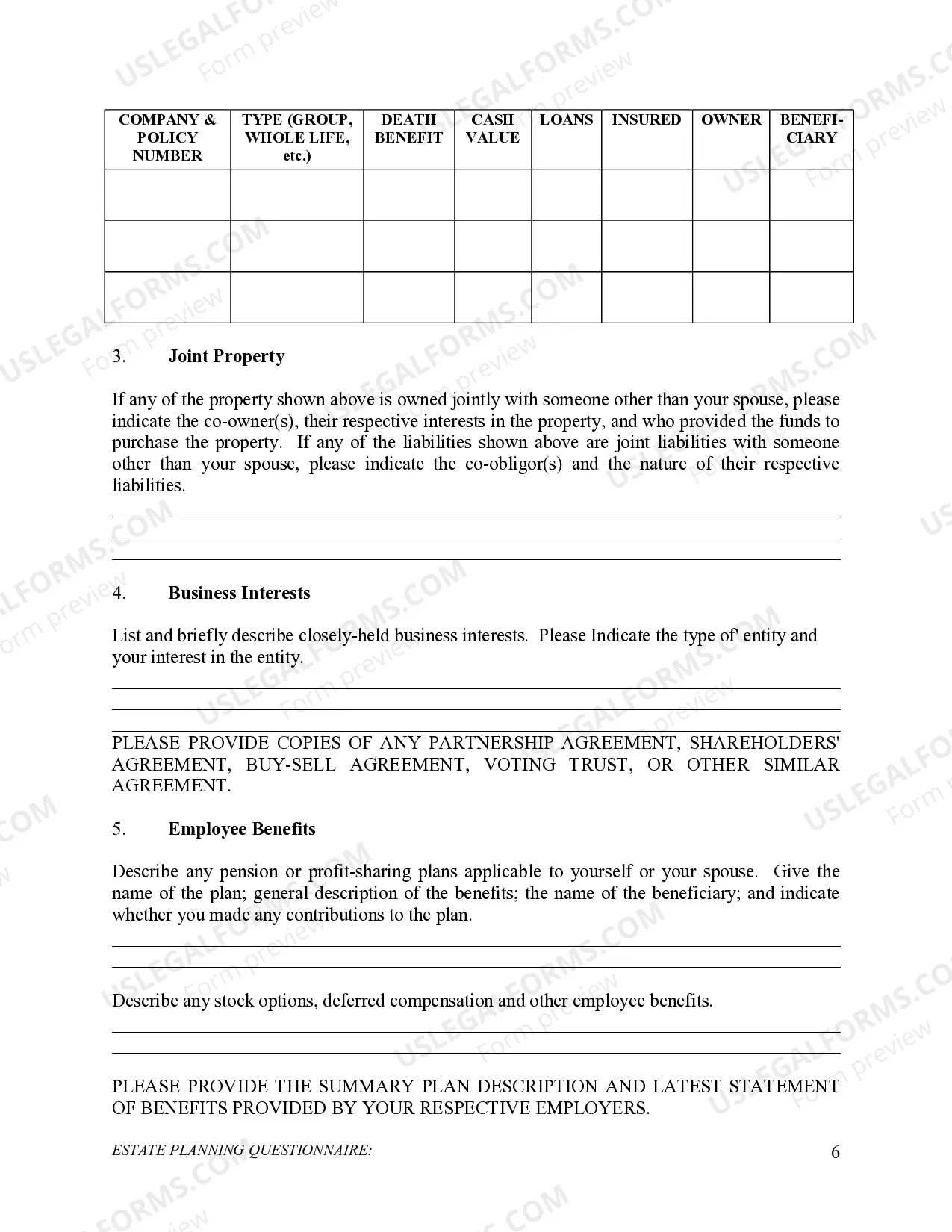

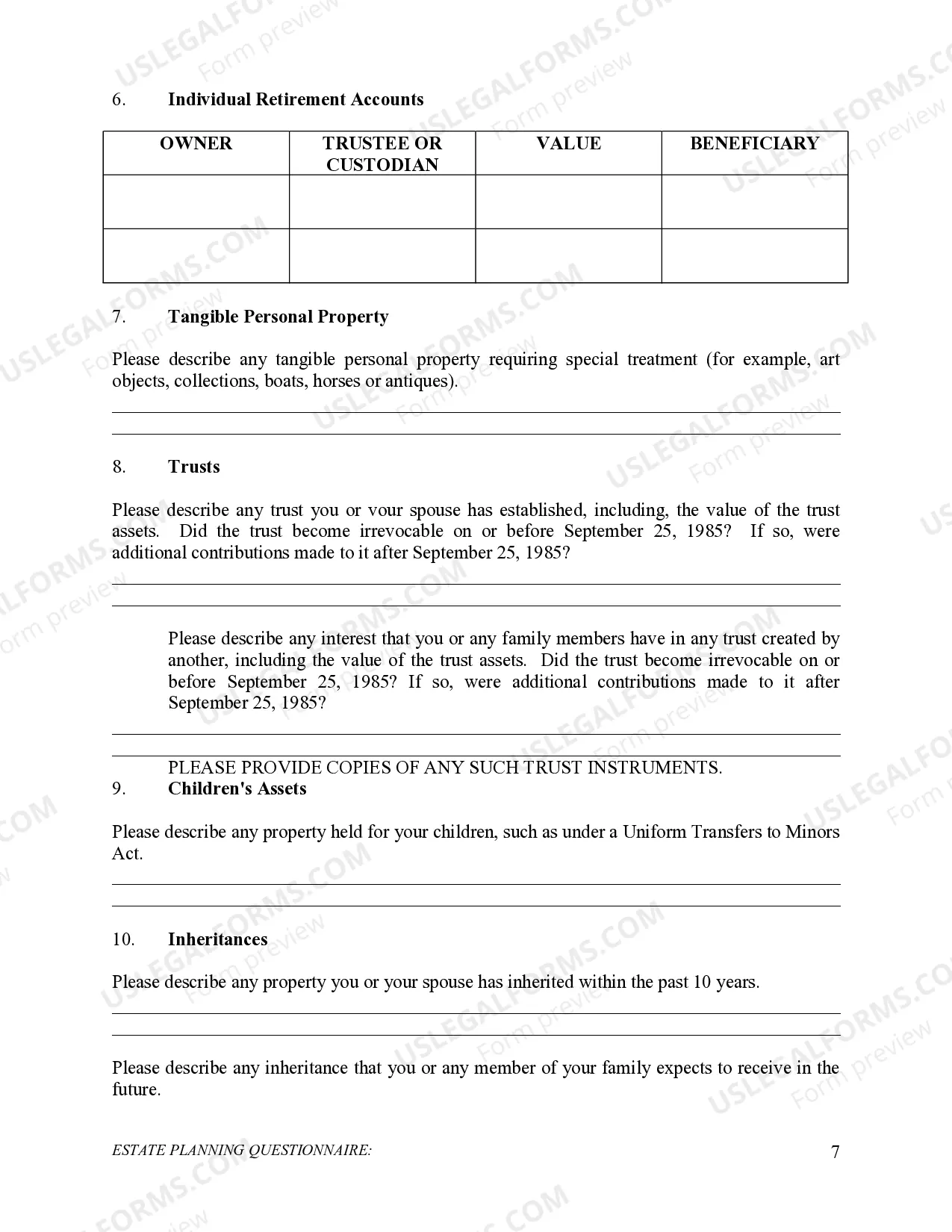

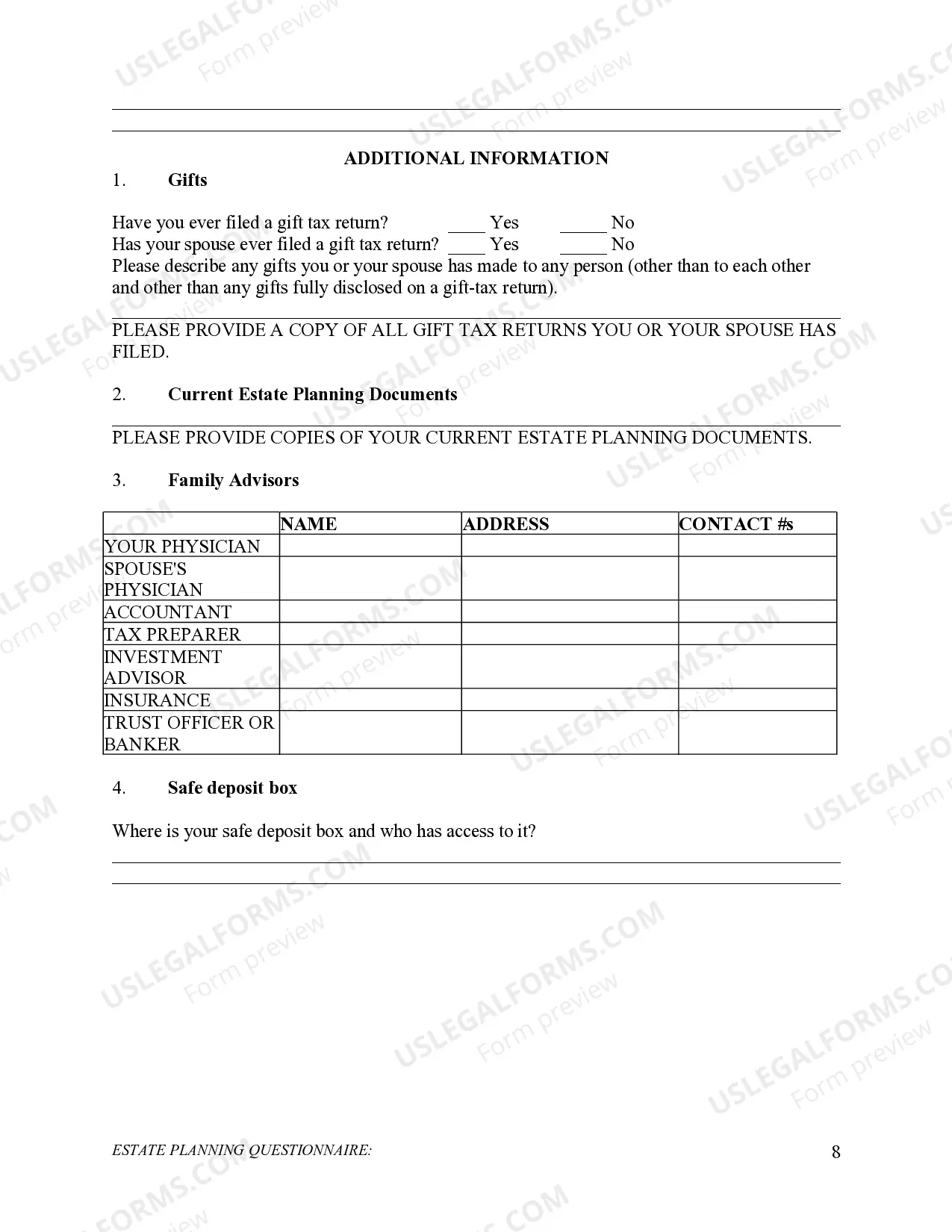

The Cook Illinois Estate Planning Questionnaire is a comprehensive and essential tool used in the estate planning process. It is designed to gather crucial information pertaining to an individual's assets, liabilities, preferences, and wishes in order to draft a personalized estate plan. This questionnaire serves as a structured document that helps attorneys and estate planners in Cook County, Illinois, to understand the specific needs and goals of their clients. By providing detailed information about one's financial and personal circumstances, the questionnaire lays the groundwork for developing an effective estate plan that aligns with the client's objectives. The Cook Illinois Estate Planning Questionnaire typically covers various aspects of an individual's life, including the identification of family members, important contacts, and beneficiaries. It seeks to gather information regarding the individual's assets, such as real estate, bank accounts, investments, and business interests. Additionally, it delves into liabilities, such as mortgages, loans, and debts, which are crucial for determining the overall estate value. In terms of personal preferences and wishes, the questionnaire addresses issues related to guardianship for minor children or dependents, healthcare directives, and powers of attorney. It also explores preferences for distributing assets and designating beneficiaries, whether it be through wills, trusts, or other estate planning instruments. Moreover, the Cook Illinois Estate Planning Questionnaire takes into account tax planning considerations, aiming to minimize potential tax liabilities through strategies like gifting, charitable donations, or establishing trusts. While there may not be specific types of Cook Illinois Estate Planning Questionnaire, different versions may exist for particular demographics or customized for different estate planning structures. However, regardless of any variations, the goal remains the same — to gather comprehensive information and preferences to create a tailored estate plan. In conclusion, the Cook Illinois Estate Planning Questionnaire is a vital tool for individuals seeking to plan their estates in Cook County, Illinois. By providing detailed information about assets, liabilities, personal preferences, and family dynamics, it enables attorneys and estate planners to devise an effective estate plan that protects their clients' interests and ensures a smooth transition of wealth. Whether it is a simple will or a complex trust arrangement, this questionnaire plays a fundamental role in the overall estate planning process.

Cook Illinois Estate Planning Questionnaire

Description

How to fill out Cook Illinois Estate Planning Questionnaire?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Cook Illinois Estate Planning Questionnaire or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Cook Illinois Estate Planning Questionnaire adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Cook Illinois Estate Planning Questionnaire is suitable for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!