A Chicago Illinois Promissory Note is a legally binding document that outlines the terms and conditions under which one party (the borrower) agrees to repay a loan to another party (the lender). It serves as evidence of the borrower's promise to repay the loan amount along with any accrued interest according to the specified repayment schedule. There are several types of Promissory Notes that may be used in Chicago, Illinois, depending on the purpose and nature of the loan: 1. Secured Promissory Note: This type of note is backed by collateral, such as real estate, vehicles, or other valuable assets. In the event that the borrower defaults on the loan, the lender can seize the collateral to recover the unpaid debt. 2. Unsecured Promissory Note: Unlike the secured note, an unsecured promissory note is not backed by collateral. Therefore, if the borrower defaults, the lender may have limited options to recover the loan amount. 3. Demand Promissory Note: This note is payable on the lender's demand, meaning that the lender can request repayment of the loan at any time, without specifying a specific date or term for the loan. 4. Installment Promissory Note: This type of note requires the borrower to repay the loan in fixed installments over a defined period, typically with specified interest rates. 5. Balloon Promissory Note: This note involves making smaller periodic payments throughout the loan term, with a large final payment due at the end of the term. This final "balloon" payment usually covers the remaining principal and any outstanding interest. When drafting a Chicago Illinois Promissory Note, it is essential to include key elements such as the loan amount, interest rate (if applicable), repayment terms, payment schedule, late payment penalties, and conditions for default. Both parties must sign and date the document to validate its enforceability. Obtaining legal advice from a professional or utilizing pre-approved templates for specific loan agreements can ensure compliance with Chicago and Illinois state laws regarding Promissory Notes.

Chicago Note Purchase

Category:

State:

Illinois

City:

Chicago

Control #:

IL-17074-MH

Format:

Word;

Rich Text

Instant download

Description chicago note template

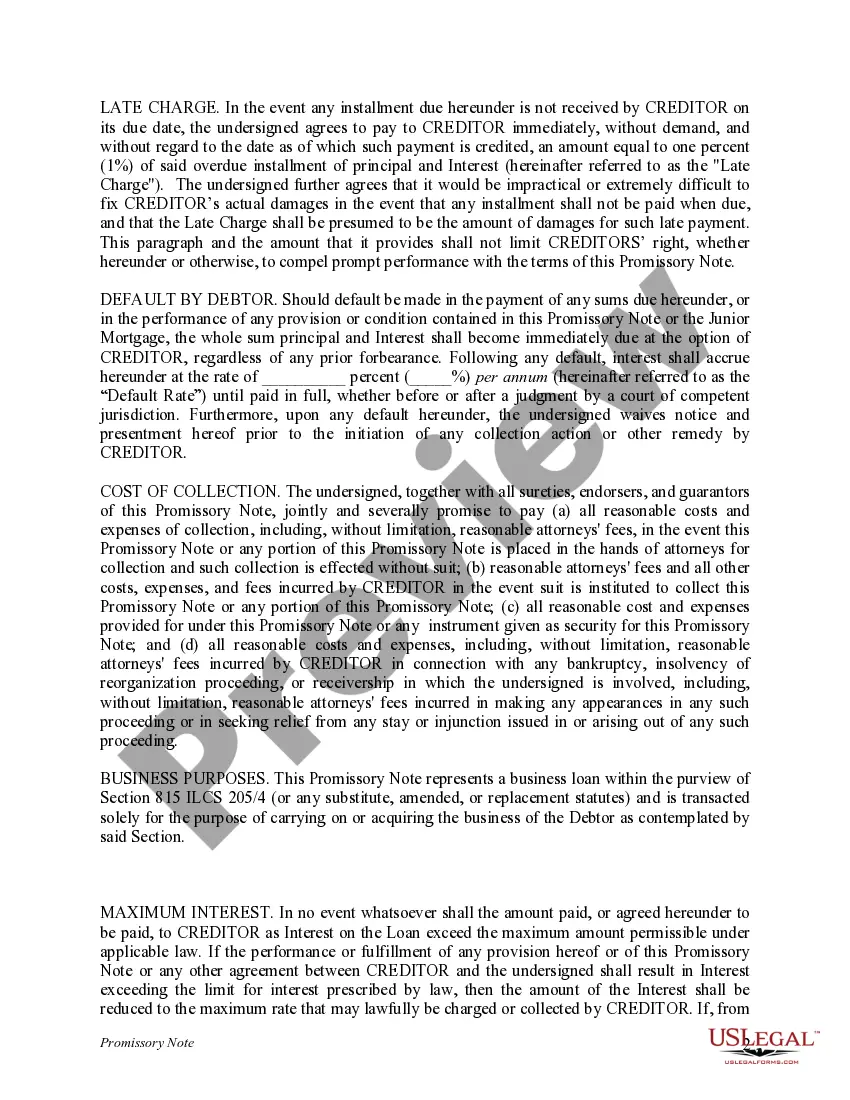

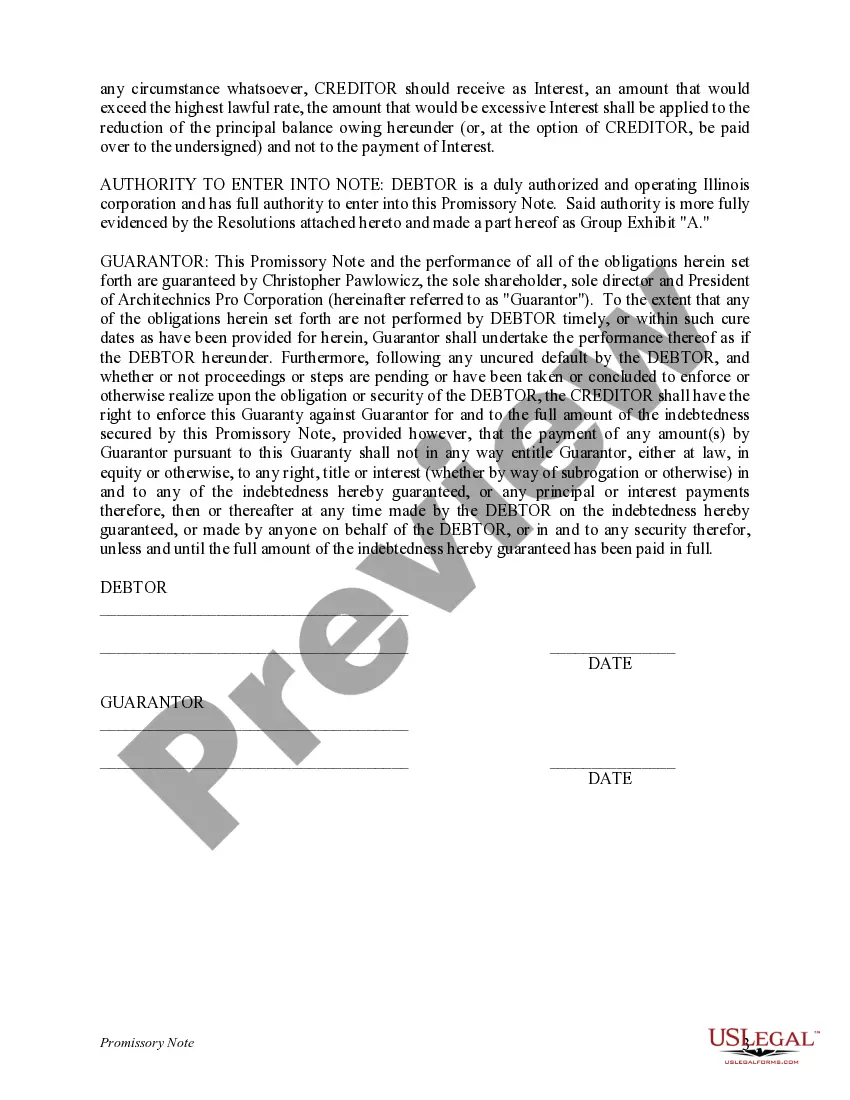

This form is a promissory note. See preview below.

A Chicago Illinois Promissory Note is a legally binding document that outlines the terms and conditions under which one party (the borrower) agrees to repay a loan to another party (the lender). It serves as evidence of the borrower's promise to repay the loan amount along with any accrued interest according to the specified repayment schedule. There are several types of Promissory Notes that may be used in Chicago, Illinois, depending on the purpose and nature of the loan: 1. Secured Promissory Note: This type of note is backed by collateral, such as real estate, vehicles, or other valuable assets. In the event that the borrower defaults on the loan, the lender can seize the collateral to recover the unpaid debt. 2. Unsecured Promissory Note: Unlike the secured note, an unsecured promissory note is not backed by collateral. Therefore, if the borrower defaults, the lender may have limited options to recover the loan amount. 3. Demand Promissory Note: This note is payable on the lender's demand, meaning that the lender can request repayment of the loan at any time, without specifying a specific date or term for the loan. 4. Installment Promissory Note: This type of note requires the borrower to repay the loan in fixed installments over a defined period, typically with specified interest rates. 5. Balloon Promissory Note: This note involves making smaller periodic payments throughout the loan term, with a large final payment due at the end of the term. This final "balloon" payment usually covers the remaining principal and any outstanding interest. When drafting a Chicago Illinois Promissory Note, it is essential to include key elements such as the loan amount, interest rate (if applicable), repayment terms, payment schedule, late payment penalties, and conditions for default. Both parties must sign and date the document to validate its enforceability. Obtaining legal advice from a professional or utilizing pre-approved templates for specific loan agreements can ensure compliance with Chicago and Illinois state laws regarding Promissory Notes.

Free preview chicago mortgages form

How to fill out chicago Promissory Note?

If you’ve already utilized our service before, log in to your account and download the Chicago Illinois Promissory Note on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Chicago Illinois Promissory Note. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!