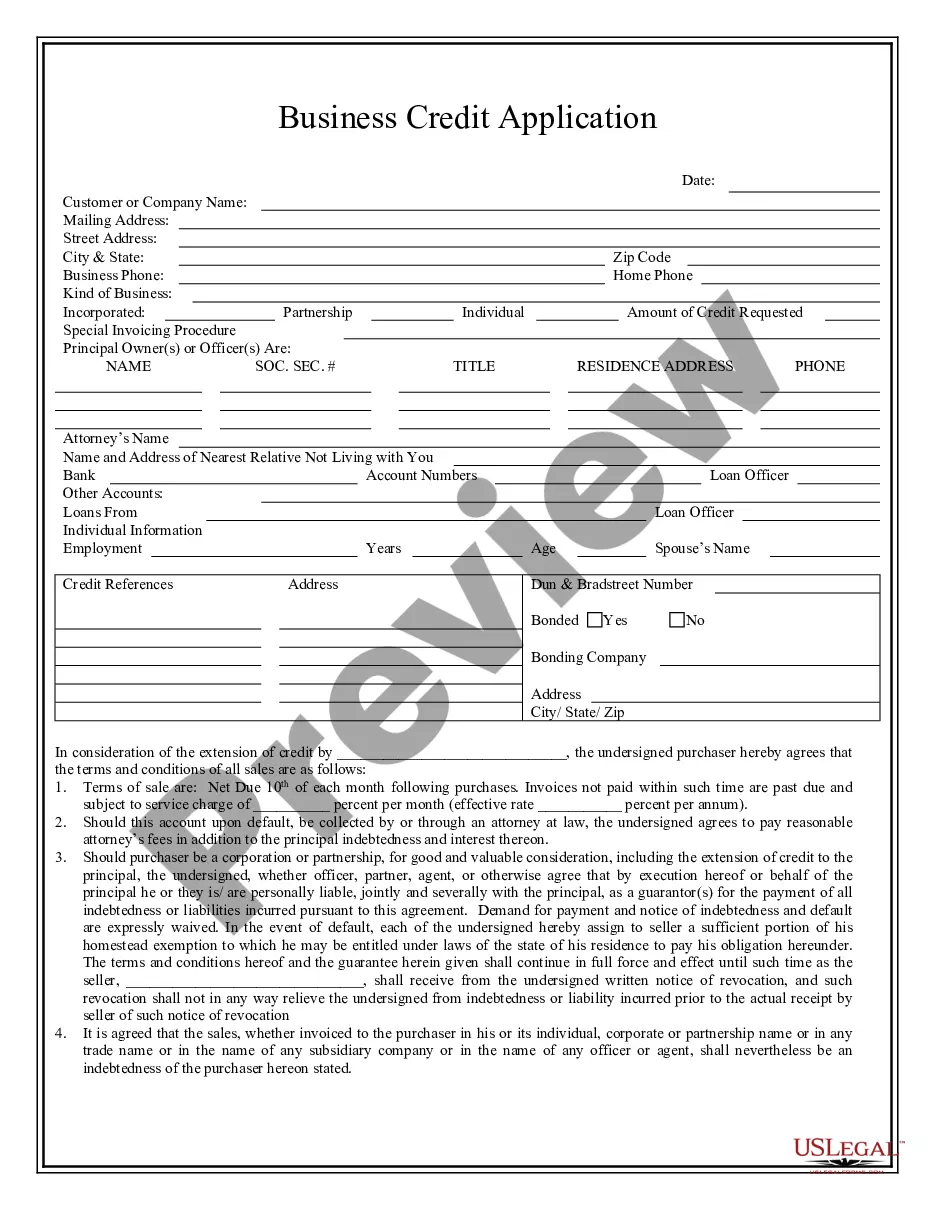

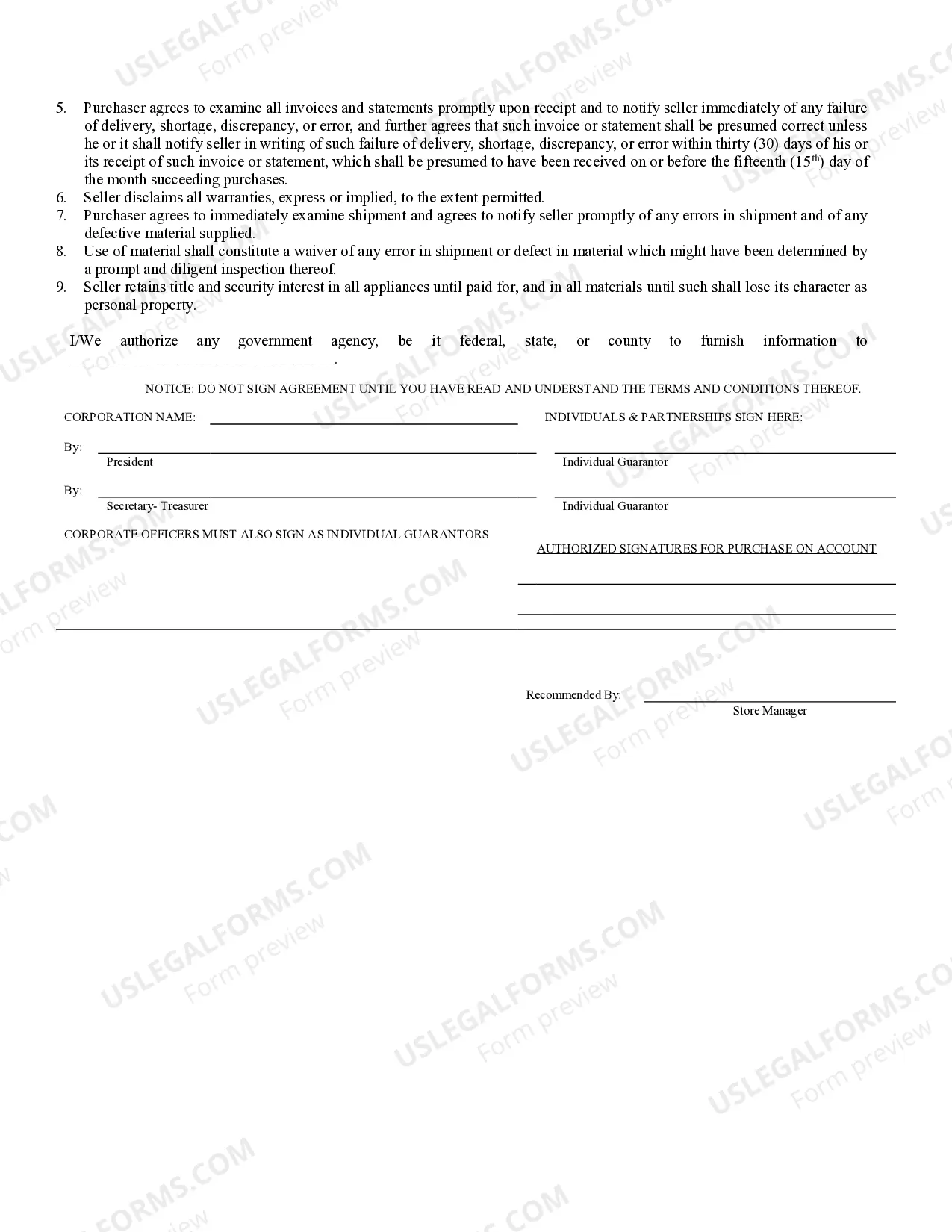

Elgin Illinois Business Credit Application serves as a crucial tool for local businesses in Elgin, Illinois, seeking financial support to manage their operations, expand their services or invest in growth opportunities. The application process enables businesses to apply for credit and establish a line of credit with financial institutions or lenders, granting them access to funds that can be utilized to meet their specific business needs. The Elgin Illinois Business Credit Application typically requires businesses to provide detailed information about themselves, including but not limited to their legal business name, address, contact information, industry type, years in operation, and ownership structure. Additionally, applicants may need to furnish financial statements, tax returns, bank statements, and other relevant documents to support their creditworthiness. In Elgin, Illinois, there are different types of Business Credit Applications available to cater to the varying needs of local businesses: 1. Startup Business Credit Application: Designed specifically for newly established businesses, this application is tailored to assess the creditworthiness of startups lacking an extensive operating history or financial track record. 2. Small Business Credit Application: Geared towards small businesses in Elgin, this application is suitable for enterprises with limited revenue and fewer employees. It focuses on evaluating the financial stability and capacity of small businesses to handle credit effectively. 3. Mid-sized Business Credit Application: As its name suggests, this application is aimed at medium-sized businesses operating in Elgin, Illinois. It accommodates companies with a moderate revenue stream, an established customer base, and a stronger ability to repay credit obligations. 4. Large Corporation Credit Application: Tailored for large corporations with substantial revenue, extensive operational history, and higher credit requirements, this application addresses the unique financial needs of larger-scale businesses in Elgin, Illinois. The Elgin Illinois Business Credit Application evaluates various factors before extending credit to businesses. Lenders typically scrutinize the applicant's credit history, current debt obligations, payment performance, cash flow projections, industry trends, and market conditions. Based on this assessment, the lender determines the credit limit, interest rate, repayment terms, and other conditions that will accompany the business credit line. By utilizing the Elgin Illinois Business Credit Application, local businesses gain access to essential financial resources that can contribute to their growth and overall success. Whether it's funding working capital, purchasing equipment, expanding inventory, or investing in marketing campaigns, businesses in Elgin can leverage these credit applications to fuel their entrepreneurial endeavors.

Elgin Illinois Business Credit Application

Description

How to fill out Elgin Illinois Business Credit Application?

If you are looking for a valid form template, it’s impossible to choose a better service than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can find a large number of document samples for organization and personal purposes by categories and regions, or keywords. With the advanced search function, discovering the most up-to-date Elgin Illinois Business Credit Application is as easy as 1-2-3. Furthermore, the relevance of every file is confirmed by a group of professional attorneys that on a regular basis check the templates on our platform and update them according to the latest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Elgin Illinois Business Credit Application is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the form you want. Look at its description and utilize the Preview option (if available) to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to get the proper record.

- Confirm your selection. Select the Buy now option. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Select the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Elgin Illinois Business Credit Application.

Every form you save in your account has no expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to get an extra duplicate for enhancing or printing, you may return and export it once again at any time.

Take advantage of the US Legal Forms extensive library to get access to the Elgin Illinois Business Credit Application you were looking for and a large number of other professional and state-specific templates in a single place!

Form popularity

FAQ

A business credit application form is the actual document that contains the details needed to evaluate a business for credit. This form generally asks for financial statements, business information, and references. Utilizing the Elgin Illinois Business Credit Application form streamlines the approval process and helps businesses move forward with their financing needs.

A business credit application is a formal document that businesses fill out to request credit from lenders. It typically includes information about the business's structure, revenues, and existing debts. By submitting an Elgin Illinois Business Credit Application, businesses showcase their financial status and reliability, allowing lenders to make informed decisions.

Business credit refers to the creditworthiness of a business, just like personal credit for individuals. It allows businesses to borrow funds or establish lines of credit without relying solely on the owner's personal credit history. The Elgin Illinois Business Credit Application helps build this credit by evaluating the business's financial health and payment history, which lenders use to assess risk.

Yes, your LLC typically requires a business license to operate legally in Illinois. The exact licensing requirements will depend on the type of services or products you offer. Check with local authorities to ensure you fulfill all necessary obligations. This compliance is essential as you prepare your Elgin Illinois Business Credit Application.

The best license for your small business largely depends on your type of operation and your location. Common licenses include general business licenses, professional licenses, or service-specific permits. Evaluating your business model and local regulations helps in determining the appropriate license. This decision is significant when you consider the details in your Elgin Illinois Business Credit Application.

To determine if you need a business license in Illinois, start by examining the nature of your business and your local municipality's regulations. You can also consult the Illinois Department of Financial and Professional Regulation for guidance. Another essential step is to assess any industry-specific requirements. Gaining a clear understanding of these factors will support your Elgin Illinois Business Credit Application.

Having an LLC does not automatically exempt you from needing a business license in Illinois. Depending on your business type and location, licensing requirements might still apply. It is best to check local and state laws to determine the specific requirements for your LLC. This research can greatly help when preparing your Elgin Illinois Business Credit Application.

Yes, you can create an LLC even if you do not actively run a business. Some individuals form an LLC as a protective measure for future business endeavors. However, it is important to maintain compliance with state laws and ongoing fees. If you plan to utilize it later, you might consider how it aligns with your Elgin Illinois Business Credit Application.

Certain businesses may operate without a license in Illinois, such as sole proprietorships and informal service providers. Generally, you do not need a license if your business does not require specific regulations. However, to ensure compliance, check local government regulations. It’s crucial to understand the requirements before applying, especially when considering Elgin Illinois Business Credit Application.