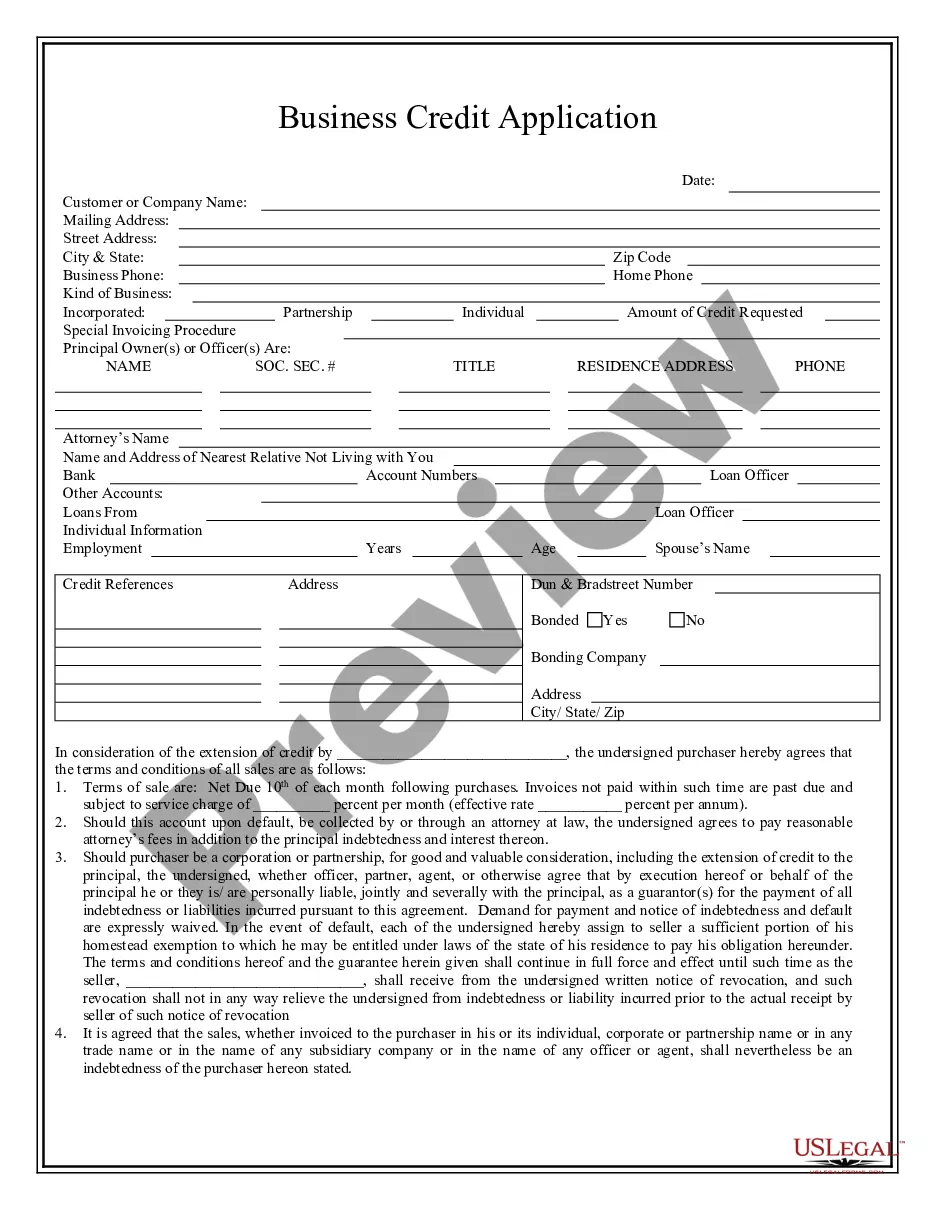

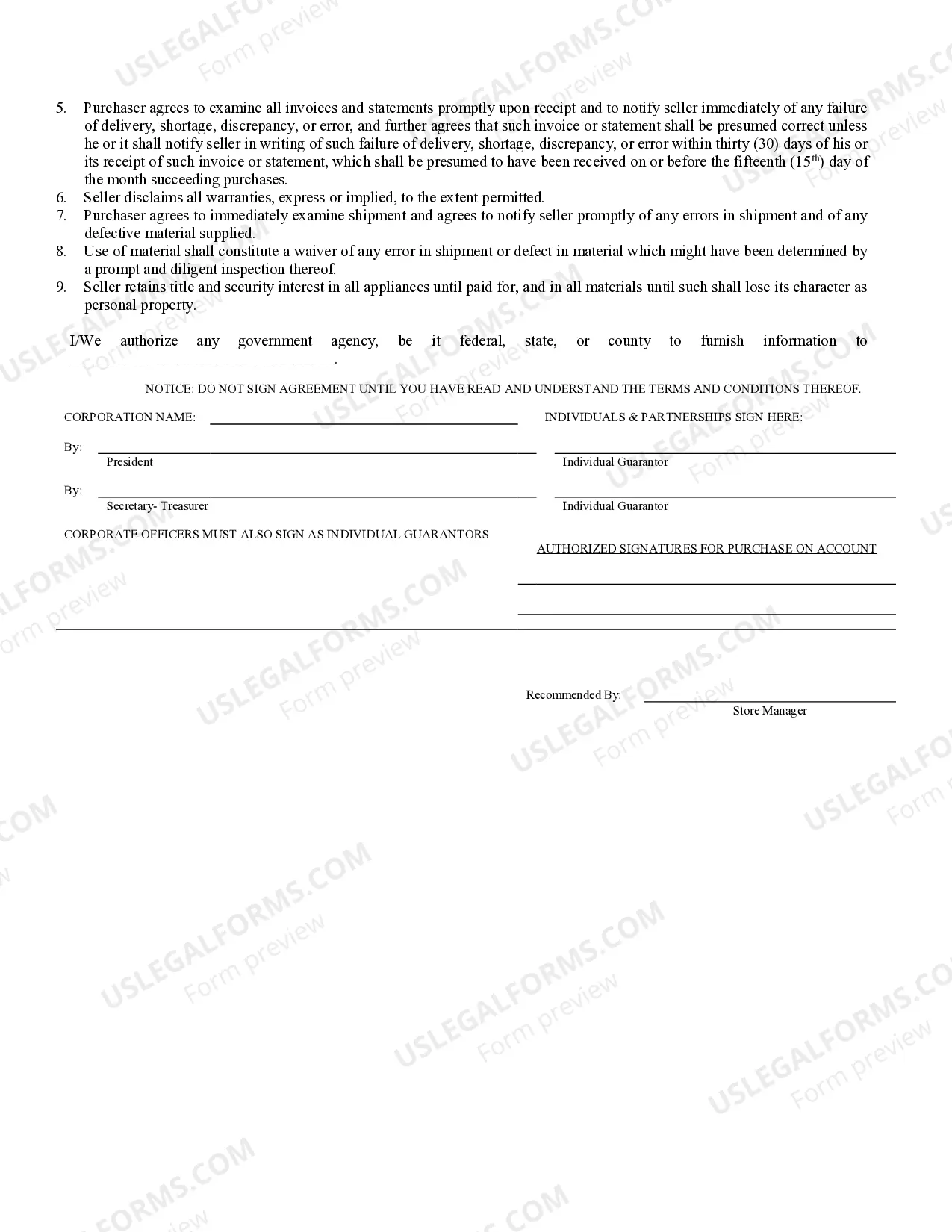

Naperville Illinois Business Credit Application is a comprehensive form that local business owners in Naperville, Illinois can utilize to apply for credit from various financial institutions or lenders. This application provides a means for businesses to request funds for business growth, expansion, working capital, inventory purchases, equipment upgrades, and other financial needs. The Naperville Illinois Business Credit Application is a crucial step in securing credit facilities for businesses operating in the city. By providing detailed information about the company's financial background, credit history, industry, ownership structure, and future projections, this application helps lenders assess the creditworthiness of the business and make informed decisions regarding loan approvals, interest rates, and credit limits. Key components of the Naperville Illinois Business Credit Application include: 1. Business Information: This section requires the business name, legal structure, contact details, and other relevant identification information. 2. Business Financials: Here, the application focuses on the financial health of the business. It typically requires financial statements, including balance sheets, profit and loss statements, cash flow statements, and tax returns. These documents help lenders evaluate the business's revenue, expenses, profitability, and overall financial stability. 3. Credit History: This section delves into the credit history of the business, requiring details about previous loans, credit lines, and payment histories. Lenders analyze this information to determine the borrower's creditworthiness and assess any potential risks associated with extending credit. 4. Business Plan: Many Naperville Illinois Business Credit Applications also include a section where applicants can outline their business objectives, strategies, and projected financial performance. This information demonstrates the applicant's vision and potential for success, giving lenders insights into the purpose of the requested credit. 5. Collateral: In cases where the business intends to provide collateral for the requested credit, such as real estate, equipment, or inventory, this section provides an opportunity to list and describe the assets being offered as security. Different types of Naperville Illinois Business Credit Applications may exist depending on the specific lender or financial institution. For instance, banks, credit unions, and alternative lenders may have their own unique application forms, although they generally cover similar aspects of the business's financial background and creditworthiness. Securing business credit is a crucial aspect of many Naperville Illinois-based businesses' growth and success. By diligently completing the Naperville Illinois Business Credit Application and highlighting their strengths, businesses increase their chances of obtaining favorable credit terms and accessing the funds necessary to drive their operations forward.

Naperville Illinois Business Credit Application

Description

How to fill out Naperville Illinois Business Credit Application?

Do you need a reliable and inexpensive legal forms provider to buy the Naperville Illinois Business Credit Application? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Naperville Illinois Business Credit Application conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is good for.

- Restart the search if the form isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is done, download the Naperville Illinois Business Credit Application in any provided format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal paperwork online for good.