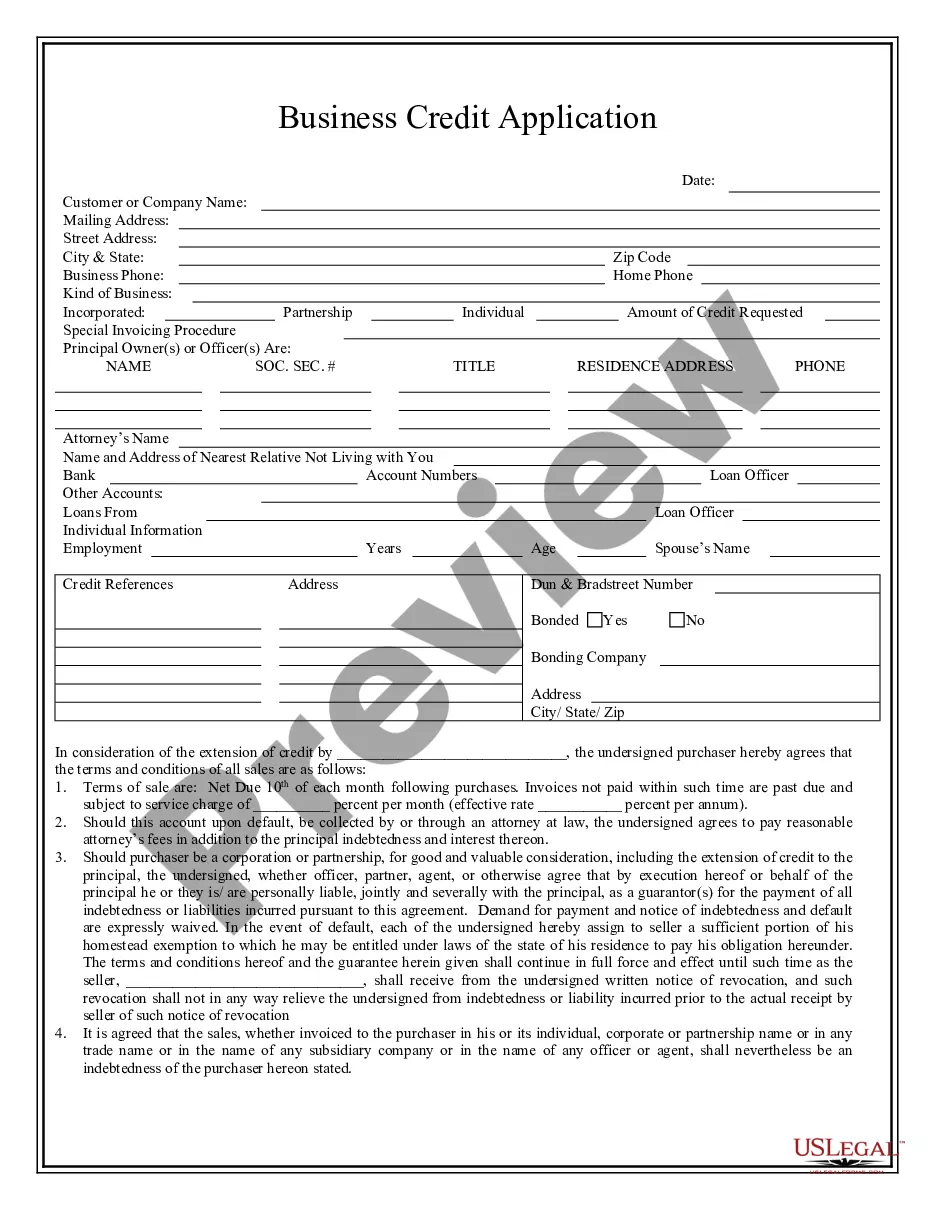

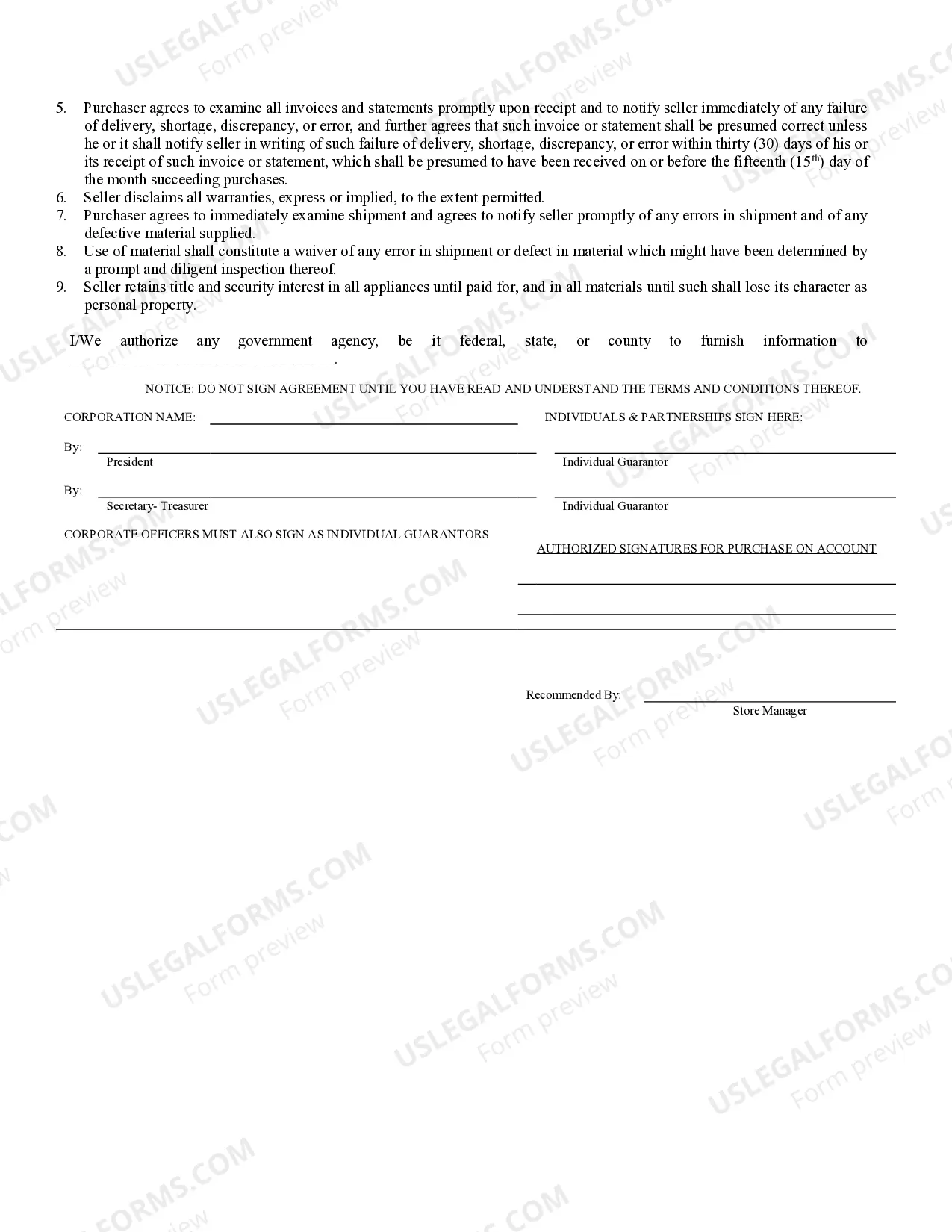

Rockford Illinois Business Credit Application is a vital step for businesses in the city to secure the necessary funding and credit to support their operations and growth. This application is typically used by businesses, both small and large, in Rockford, Illinois, to request credit from financial institutions or lending organizations. One prominent type of Rockford Illinois Business Credit Application is the Small Business Administration (SBA) loan application. SBA loans are backed by the government agency, which provides a guarantee to lenders, encouraging them to offer loans to businesses with limited credit history or collateral. This type of credit application is specifically designed to support small businesses in Rockford, Illinois. Another type of Rockford Illinois Business Credit Application is the commercial loan application. This application is generally used by established businesses in need of financing for various purposes, such as purchasing equipment, funding real estate purchases, or expanding their operations. Commercial loan applications require businesses to provide detailed information about their financial history, projections, and collateral. Additionally, there are credit applications for specific industries in Rockford, Illinois, such as manufacturing, healthcare, retail, and hospitality. These industry-specific credit applications may have additional requirements and considerations that are tailored to the unique needs of businesses operating in those sectors. When filling out a Rockford Illinois Business Credit Application, business owners are typically required to provide crucial information, such as their company's legal name, address, contact information, ownership details, financial statements, tax returns, projected financials, and purpose of the credit or loan. The application process may also require additional documentation, such as business licenses, personal financial statements of the business owners, bank statements, and business plans. The Rockford Illinois Business Credit Application plays a vital role in determining the business's creditworthiness, and it helps financial institutions assess the risks and merits of providing credit or loans. Lenders evaluate the application based on factors such as the business's credit score, revenue projections, financial stability, industry performance, and collateral offered, among other criteria. Business owners in Rockford, Illinois, must ensure they carefully and accurately complete the Business Credit Application to increase their chances of approval and secure the financial resources needed to support their operations, expand their ventures, or reinforce their financial stability.

Rockford Illinois Business Credit Application

Description

How to fill out Rockford Illinois Business Credit Application?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, as a rule, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Rockford Illinois Business Credit Application or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Rockford Illinois Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Rockford Illinois Business Credit Application would work for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!