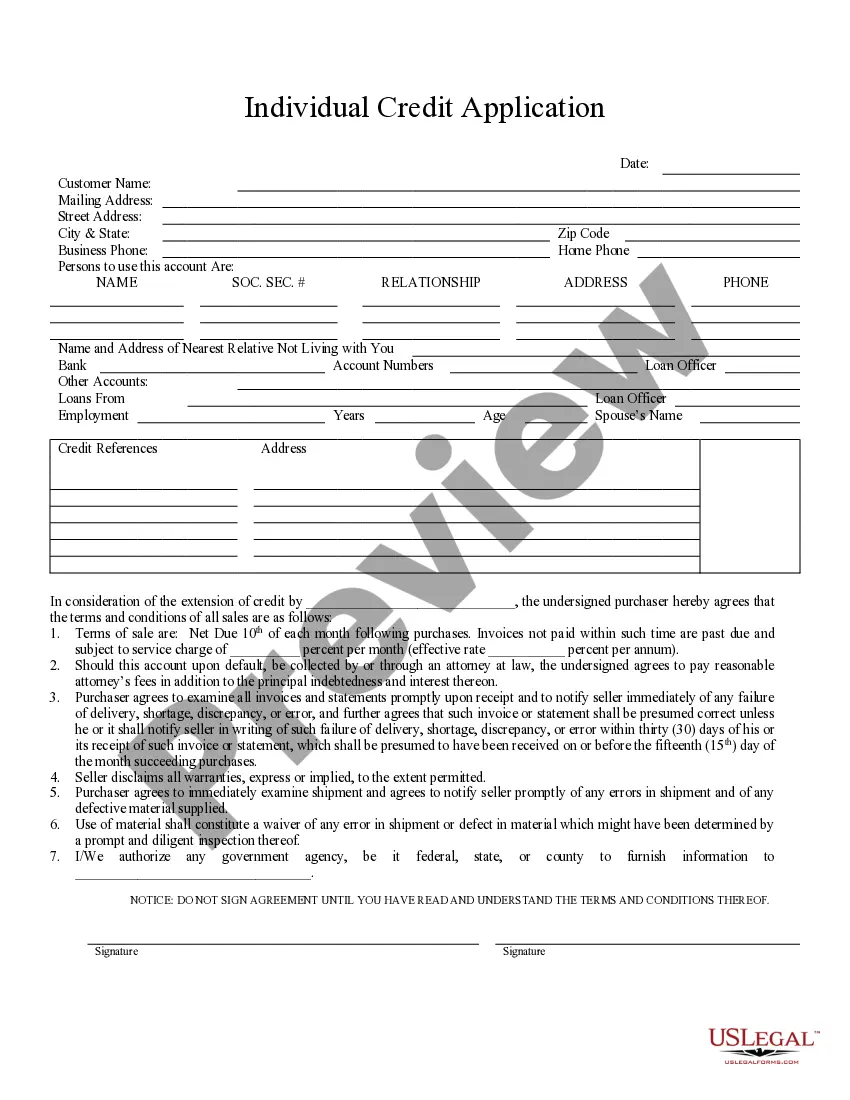

The Cook Illinois Individual Credit Application is a comprehensive form used by individuals in the Cook County area of Illinois to apply for credit services from financial institutions or other lending entities. This application serves as a means for borrowers to request loans, credit cards, or other credit options for personal or business purposes. The Cook Illinois Individual Credit Application requires applicants to provide detailed information about themselves, including their full name, contact details such as address, phone number, and email address. It also entails furnishing personal identification details such as social security number or taxpayer identification number. Other essential information that applicants must provide includes their employment history, current occupation, and income details. Applicants may need to disclose their current and previous employers, positions held, length of employment, and income earned. Additionally, the Cook Illinois Individual Credit Application typically requests details related to the applicant's financial situation. This may include providing information about existing debts, monthly expenses, and obligations such as mortgages, car loans, credit card balances, or other outstanding loans. Furthermore, the application may ask the applicant to include references, such as personal contacts or individuals who can vouch for their creditworthiness. It is essential to note that there may be different types of Cook Illinois Individual Credit Applications, depending on the specific credit option being sought. These may include: 1. Personal Loan Application: This type of application is used when the borrower is seeking a loan for personal use, such as home improvements, debt consolidation, or unexpected expenses. 2. Credit Card Application: For individuals looking to obtain a credit card, a separate application form is usually required. This form typically asks for information specific to credit card applications, including credit history, desired credit limit, and information about existing credit cards. 3. Business Credit Application: Entrepreneurs or small business owners who require credit for their business ventures often need to complete a specific business credit application. This application may require additional details regarding the nature of the business, financial statements, and business credit history. 4. Mortgage Application: Homebuyers seeking a mortgage loan in Cook County, Illinois, will be required to complete a mortgage application tailored to the specific requirements of mortgage lenders. This type of application typically demands extensive financial information, property details, and personal identification information. Regardless of the type, the Cook Illinois Individual Credit Application is a vital document for individuals in Cook County seeking credit or financial assistance. It serves as a means for lenders to assess a borrower's creditworthiness and determine their eligibility for the requested credit option.

Cook Illinois Individual Credit Application

Description

How to fill out Cook Illinois Individual Credit Application?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any legal background to create such paperwork from scratch, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform provides a massive library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Cook Illinois Individual Credit Application or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Cook Illinois Individual Credit Application in minutes using our trusted platform. In case you are already an existing customer, you can go on and log in to your account to get the appropriate form.

However, if you are unfamiliar with our library, ensure that you follow these steps before downloading the Cook Illinois Individual Credit Application:

- Be sure the form you have found is suitable for your location considering that the rules of one state or area do not work for another state or area.

- Preview the document and go through a short outline (if provided) of cases the paper can be used for.

- In case the form you chosen doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- Log in to your account login information or register for one from scratch.

- Select the payment method and proceed to download the Cook Illinois Individual Credit Application as soon as the payment is through.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.