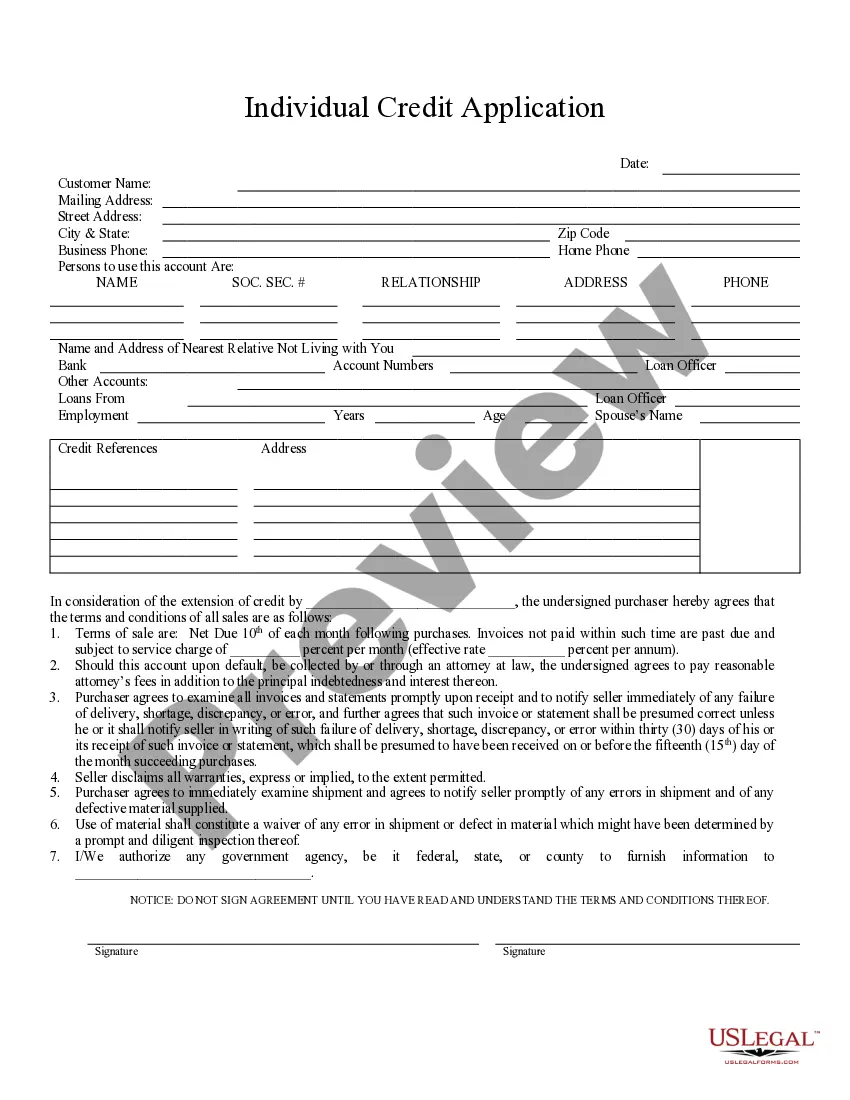

The Elgin Illinois Individual Credit Application is a comprehensive form that individuals residing in Elgin, Illinois, can fill out to apply for credit from various financial institutions and lenders. This application is vital for individuals seeking loans, credit cards, mortgages, or any other form of credit within the Elgin area. The Elgin Illinois Individual Credit Application serves as a primary tool for financial institutions to assess an individual's creditworthiness and determine their ability to repay borrowed funds. It is filled with various sections that require the applicant to provide detailed personal and financial information, ensuring a thorough evaluation of their creditworthiness. Keywords: Elgin, Illinois, individual credit, application, loans, credit cards, mortgages, creditworthiness, personal information, financial information, repayment ability. Different types of Elgin Illinois Individual Credit Applications may include: 1. Personal Loan Credit Application: This type of application is specifically designed for individuals seeking personal loans from banks or other lending institutions. It requires applicants to provide personal information, employment details, income, expenses, credit history, and other relevant financial information. 2. Credit Card Application: For individuals interested in obtaining a credit card, this application allows them to provide the necessary information for evaluation by credit card issuers. It may require details such as personal identification, employment information, income, monthly expenses, current debts, and credit history. 3. Mortgage Credit Application: Individuals looking to finance a home purchase or refinance their existing home in Elgin can utilize this type of application. It typically includes sections for personal information, employment details, financial status, assets and liabilities, and other related data required by mortgage lenders. 4. Student Loan Application: Geared towards students residing in Elgin, this application is tailored specifically for those seeking financial aid for educational purposes. It generally demands personal information, income details (if applicable), educational background, and any additional financial information required by educational institutions or loan providers. Regardless of the specific type, the Elgin Illinois Individual Credit Application serves as a crucial document in the credit evaluation process. Completing this application accurately and honestly increases the chances of securing credit and obtaining favorable terms from lenders within the Elgin area.

Oportun Elgin

Description

How to fill out Elgin Illinois Individual Credit Application?

If you are searching for a relevant form template, it’s extremely hard to choose a better place than the US Legal Forms website – one of the most extensive online libraries. With this library, you can get a huge number of document samples for business and personal purposes by categories and regions, or keywords. Using our advanced search feature, getting the most recent Elgin Illinois Individual Credit Application is as elementary as 1-2-3. Moreover, the relevance of every document is confirmed by a group of expert lawyers that regularly check the templates on our website and update them according to the newest state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Elgin Illinois Individual Credit Application is to log in to your account and click the Download button.

If you use US Legal Forms the very first time, just follow the instructions below:

- Make sure you have chosen the sample you need. Look at its description and make use of the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the appropriate record.

- Affirm your decision. Click the Buy now button. Following that, pick the preferred subscription plan and provide credentials to register an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the received Elgin Illinois Individual Credit Application.

Each template you add to your account has no expiry date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to receive an additional duplicate for editing or creating a hard copy, feel free to come back and download it once again at any moment.

Take advantage of the US Legal Forms extensive library to get access to the Elgin Illinois Individual Credit Application you were seeking and a huge number of other professional and state-specific templates on a single website!