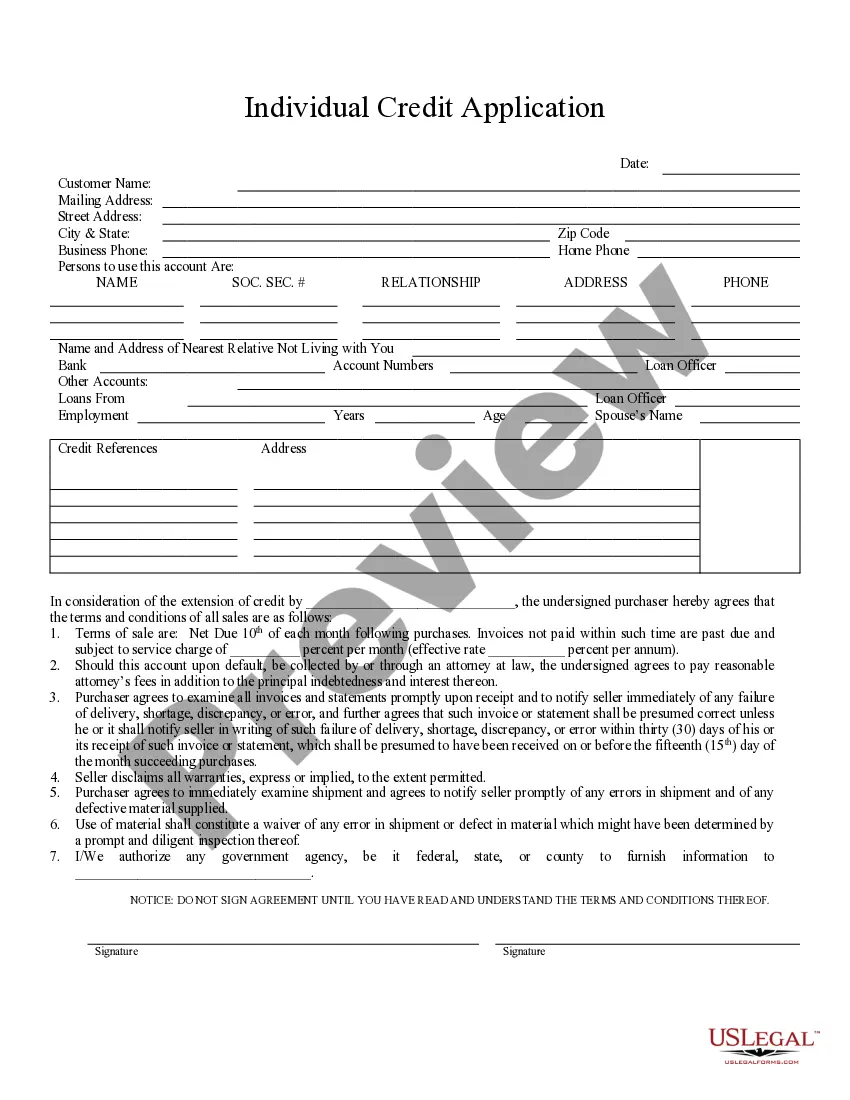

Joliet Illinois Individual Credit Application is a form that individuals residing in Joliet, Illinois, can fill out to apply for credit from various financial institutions or lenders. It serves as an important tool for lenders to assess an individual's creditworthiness and make informed decisions on whether to extend credit to them. Below are some relevant keywords and types of Joliet Illinois Individual Credit Application: 1. Personal Information: The Joliet Illinois Individual Credit Application typically requires individuals to provide their full name, date of birth, Social Security number, contact information (phone number, address), and employment details. 2. Financial Information: This section includes fields to provide details about an individual's income, such as their occupation, employer information, monthly or annual income, and any additional sources of income, such as rental properties or investments. 3. Credit History: Applicants are usually asked to disclose details about their current and past credit accounts, including open accounts, outstanding balances, payment history, and any previous bankruptcies, foreclosures, or delinquencies. 4. Debt Details: This section requires individuals to list their existing debts, such as mortgages, auto loans, student loans, credit card balances, and any other outstanding loans or obligations. 5. Assets and Liabilities: Applicants are typically required to provide information about their assets, such as real estate, vehicles, investments, and other valuable possessions. They also need to disclose any existing liabilities, such as outstanding tax debts or legal judgments. 6. References: The credit application may ask for references, including names, contact information, and their relationship with the applicant. These references can offer additional insights into an individual's character and reliability. 7. Authorization and Consent: Before submitting the credit application, individuals are usually required to grant their consent to the lender to obtain and verify their credit reports from credit bureaus and other financial institutions. 8. Multiple Types: While there may not be specific "types" of Joliet Illinois Individual Credit Application, various lenders or financial institutions might have their own customized versions with slightly different formats or additional sections based on their specific requirements and lending policies. It is important to note that each lender may have its own specific Joliet Illinois Individual Credit Application form with slight variations in information requested. Therefore, individuals should carefully review and complete the application according to the instructions provided by the specific lender they are applying to.

Joliet Illinois Individual Credit Application

Description

How to fill out Joliet Illinois Individual Credit Application?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Joliet Illinois Individual Credit Application or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Joliet Illinois Individual Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Joliet Illinois Individual Credit Application is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!