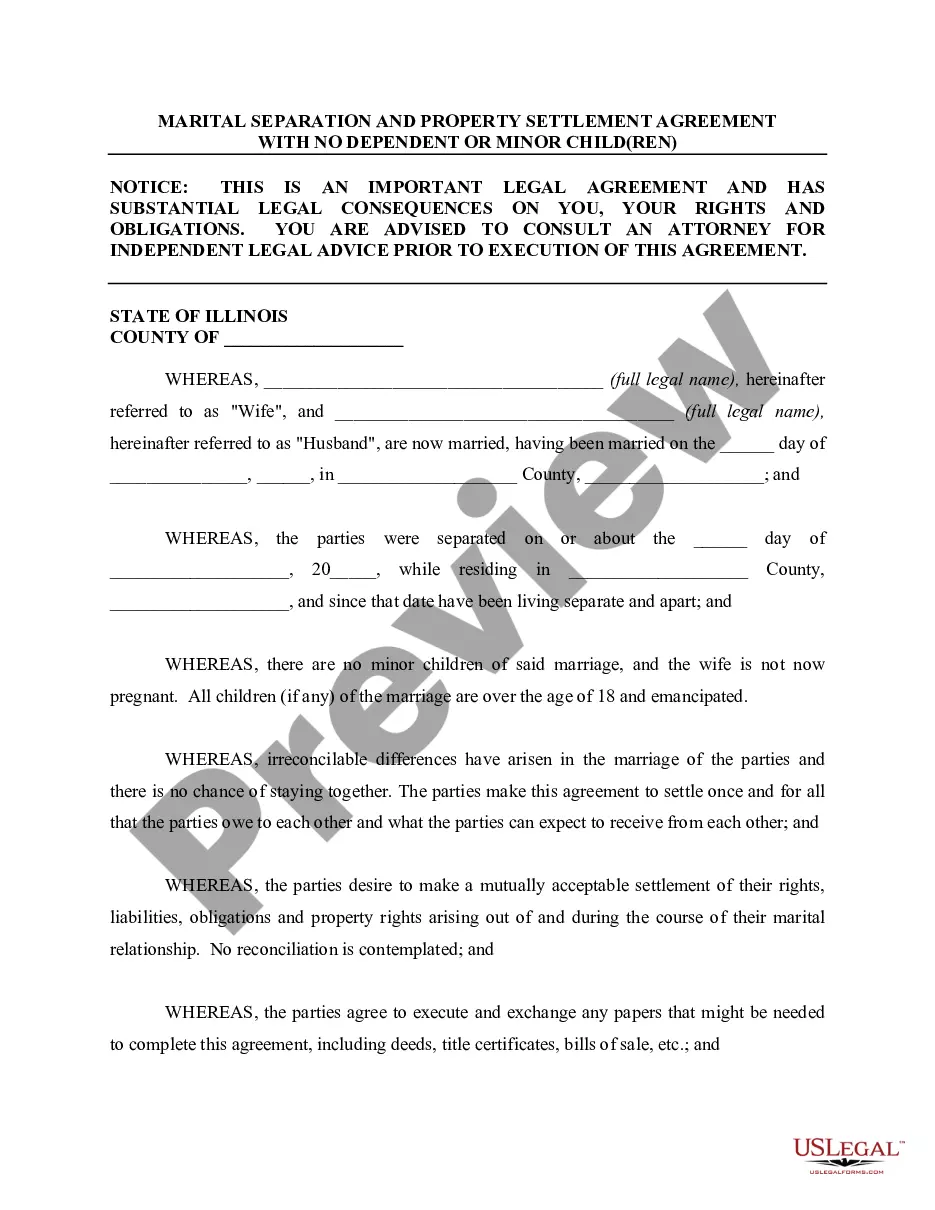

Cook Illinois Marital Settlement Agreement - no children OR adult children

Description

How to fill out Illinois Marital Settlement Agreement - No Children OR Adult Children?

Locating authenticated templates that align with your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the files are accurately organized by category and jurisdiction, making it as simple as ABC to search for the Cook Illinois Marital Settlement Agreement - no children OR adult children.

Complete the transaction. Enter your credit card information or utilize your PayPal account to pay for the service.

- For users already acquainted with our service who have accessed it previously, obtaining the Cook Illinois Marital Settlement Agreement - no children OR adult children requires merely a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- New users will need to follow slightly more steps to complete the process.

- Review the Preview mode and form description. Ensure you’ve chosen the correct one that fulfills your needs and entirely matches your local jurisdiction regulations.

- Look for another template, if necessary. If you encounter any discrepancies, employ the Search tab above to locate the appropriate one. If it fits your criteria, proceed to the next step.

Form popularity

FAQ

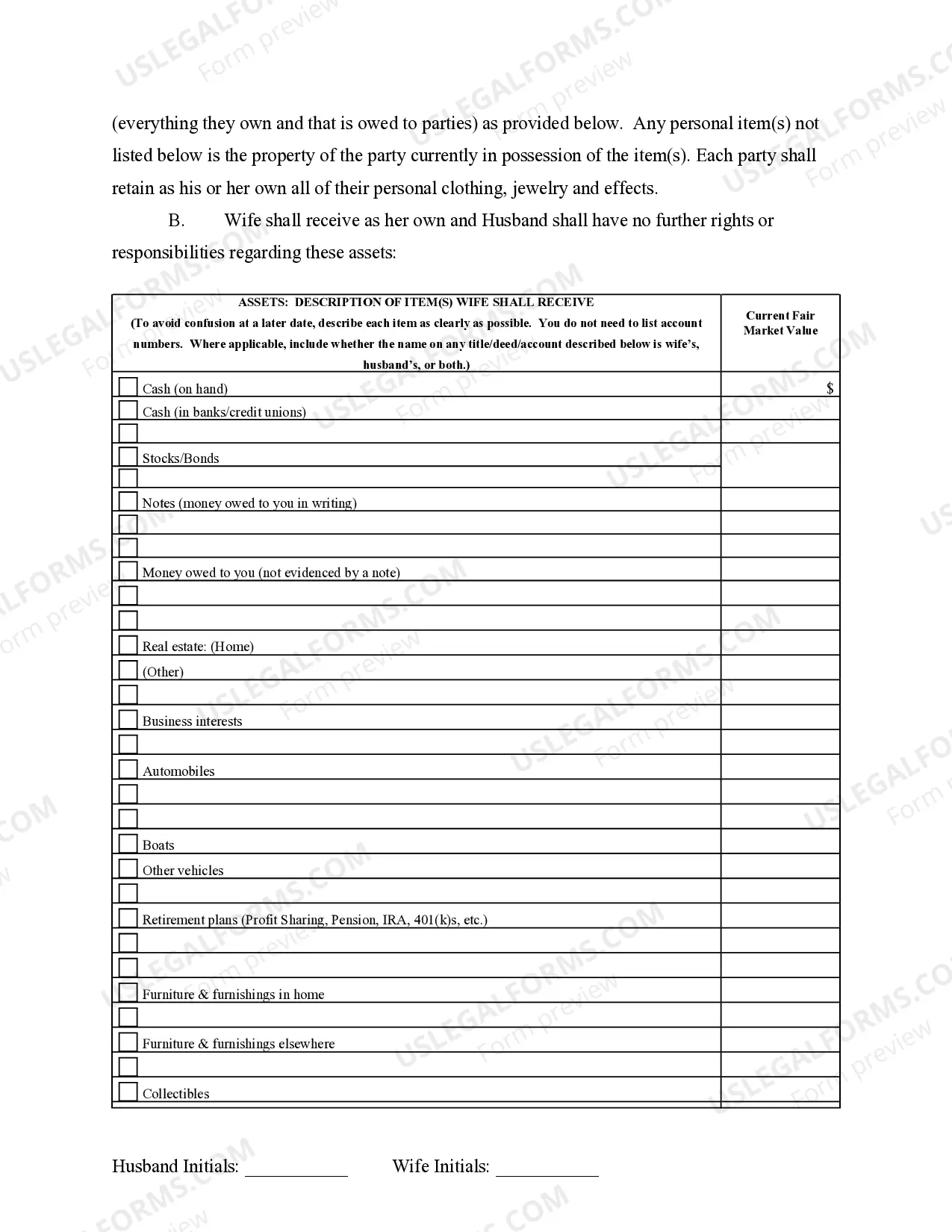

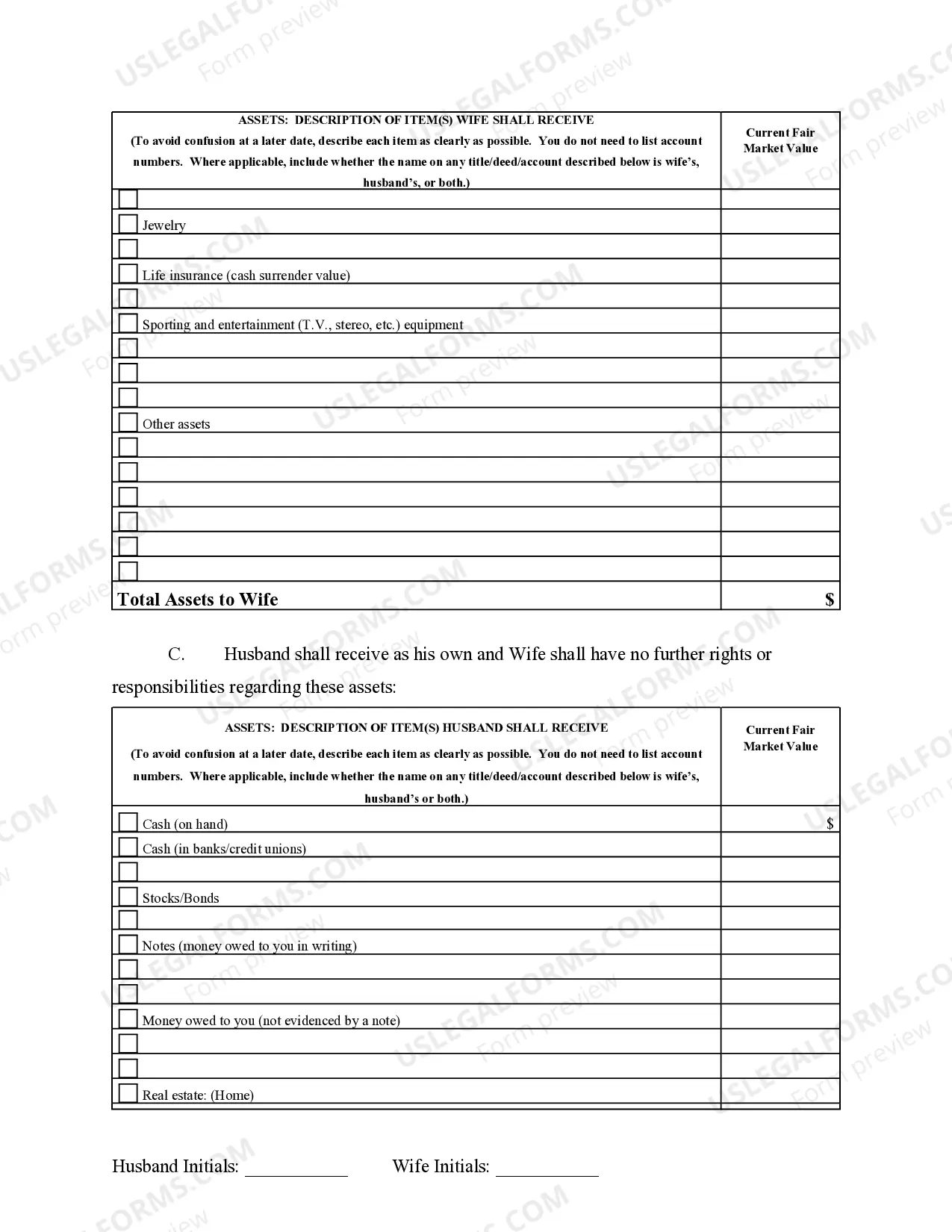

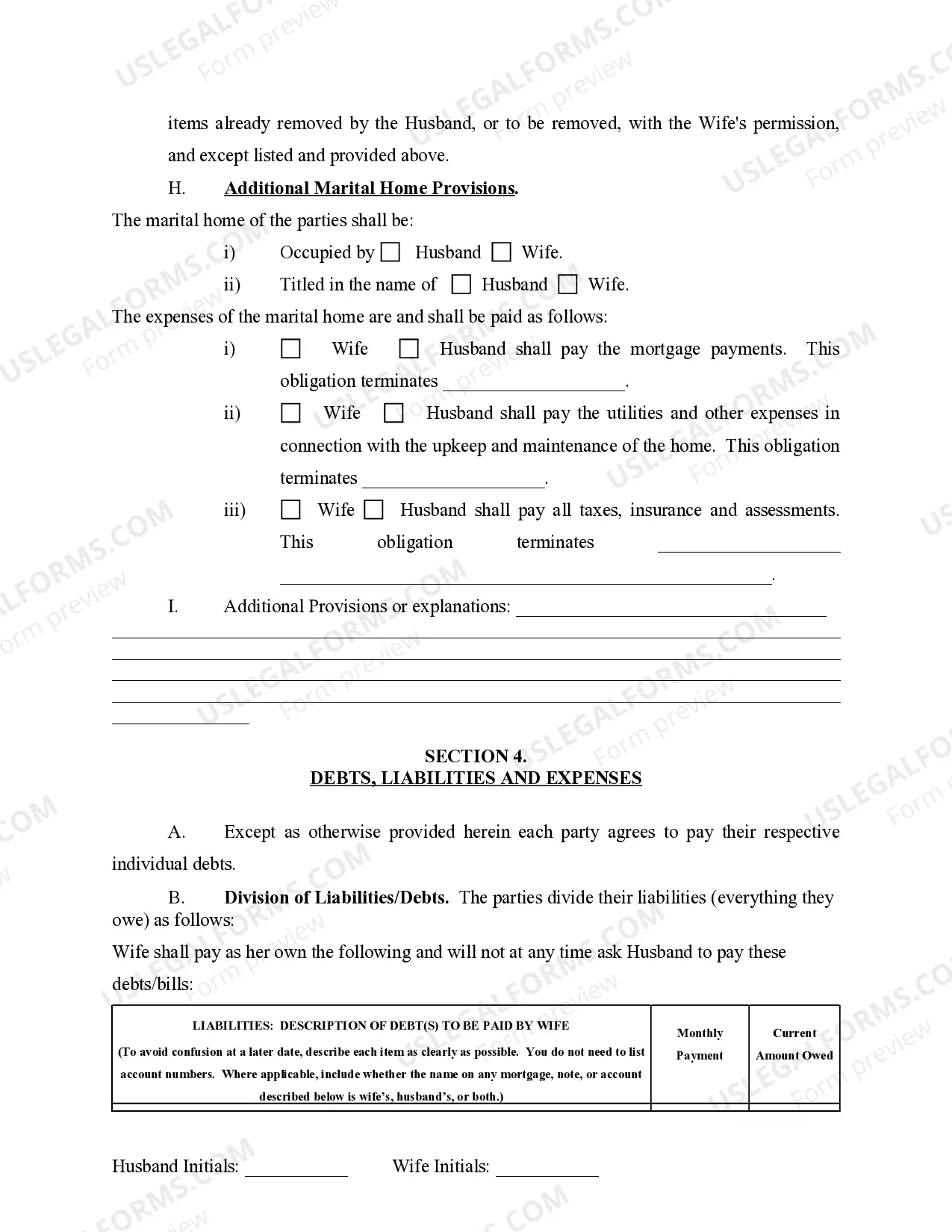

If you are married and the house is not in your name, it may still be considered marital property subject to division during a divorce in Illinois. The court looks at contributions made by both spouses, like mortgage payments and upkeep. Addressing this scenario in your Cook Illinois Marital Settlement Agreement - no children OR adult children clarifies ownership and asset distribution, providing both sides with certainty.

In Illinois, the division of a house during a divorce depends on whether it is considered marital or non-marital property. Generally, if the house was purchased during the marriage, it is subject to division. Creating a clear Cook Illinois Marital Settlement Agreement - no children OR adult children can assist both parties in agreeing on how to handle the property and ensures a smoother transition.

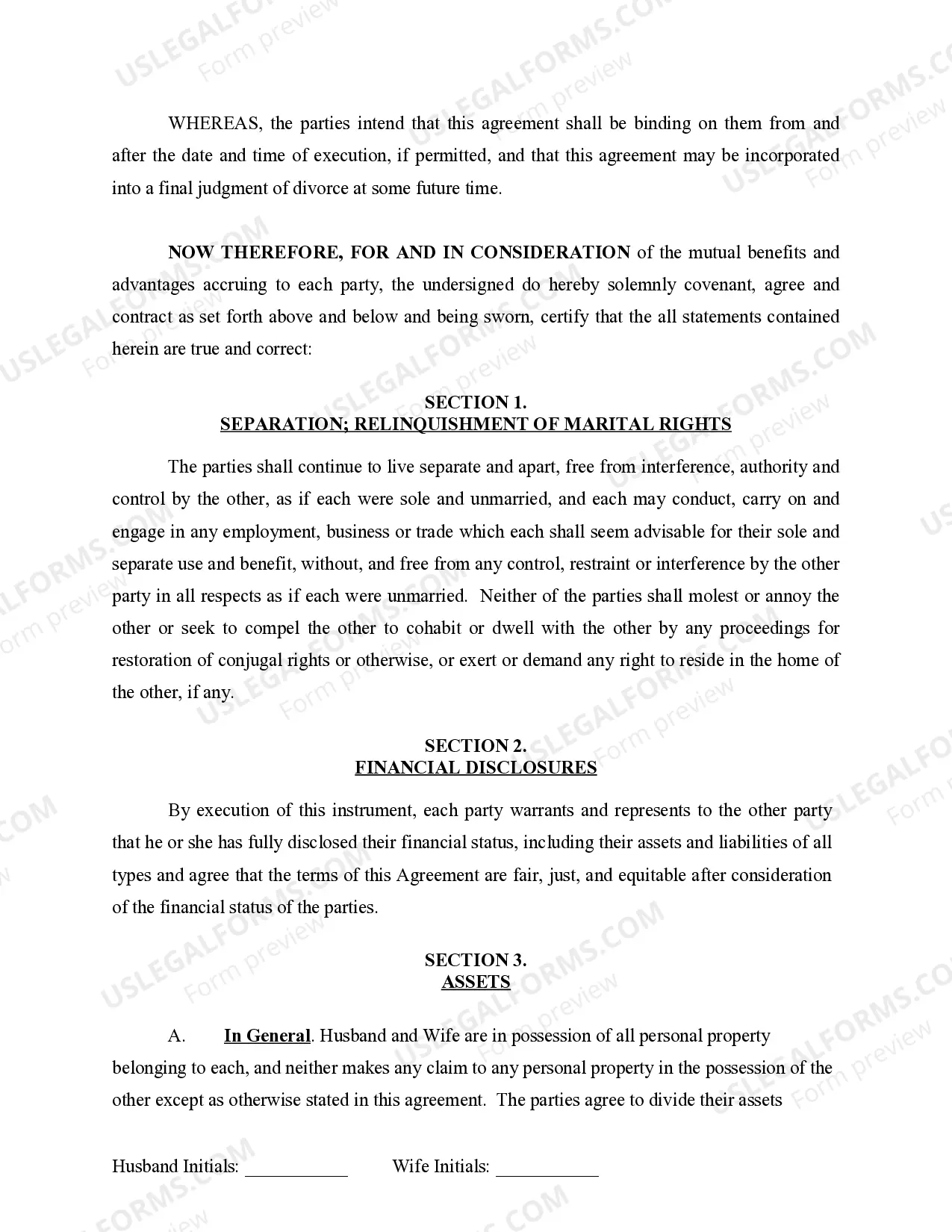

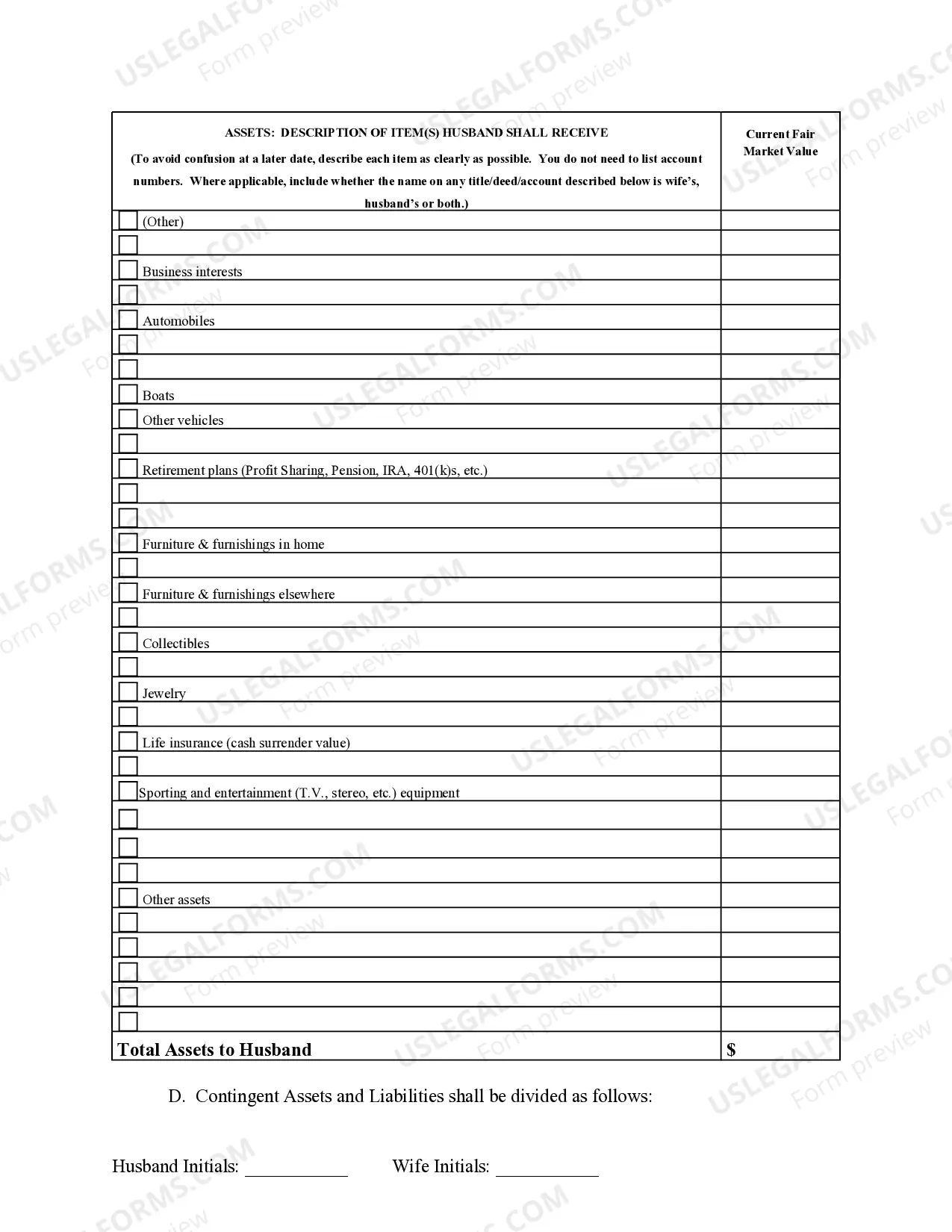

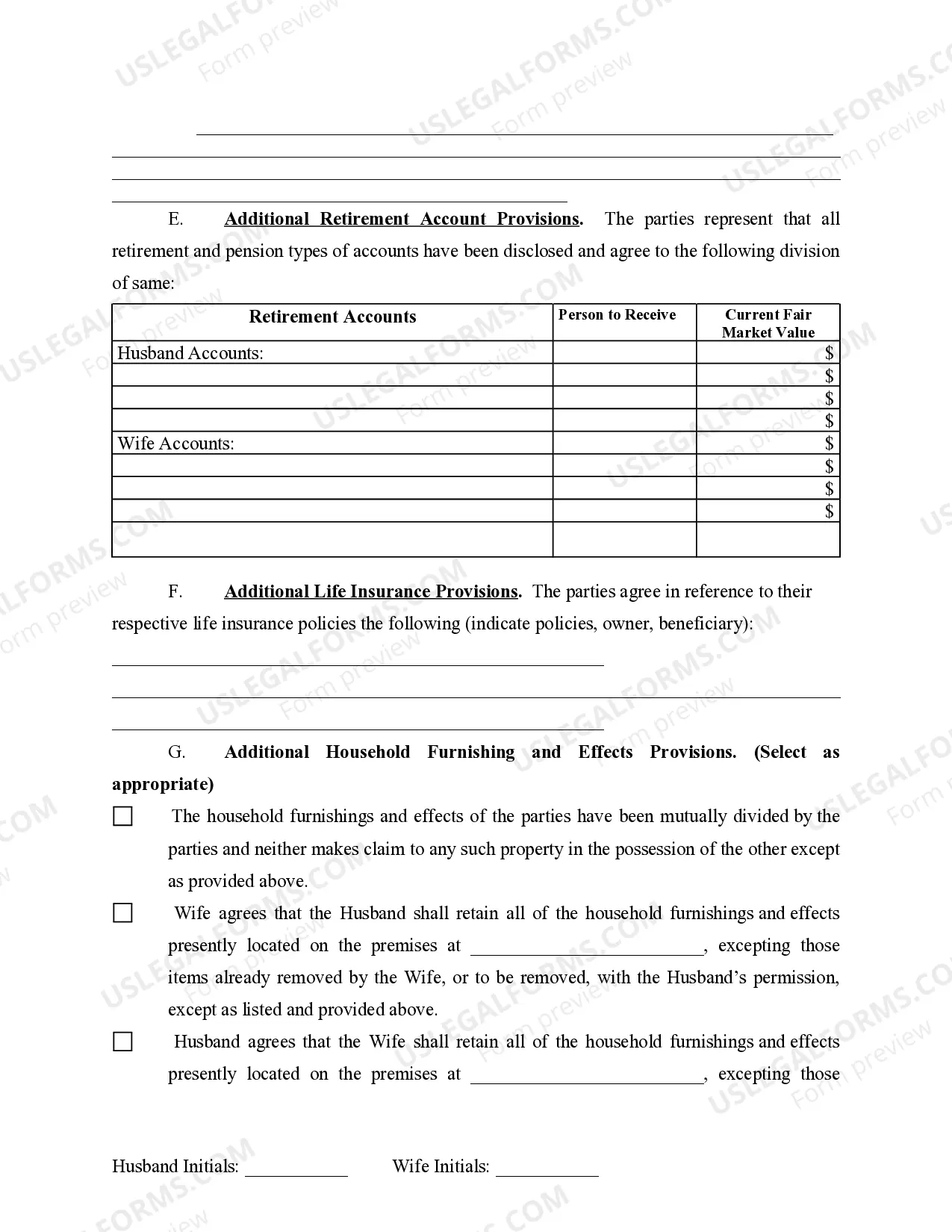

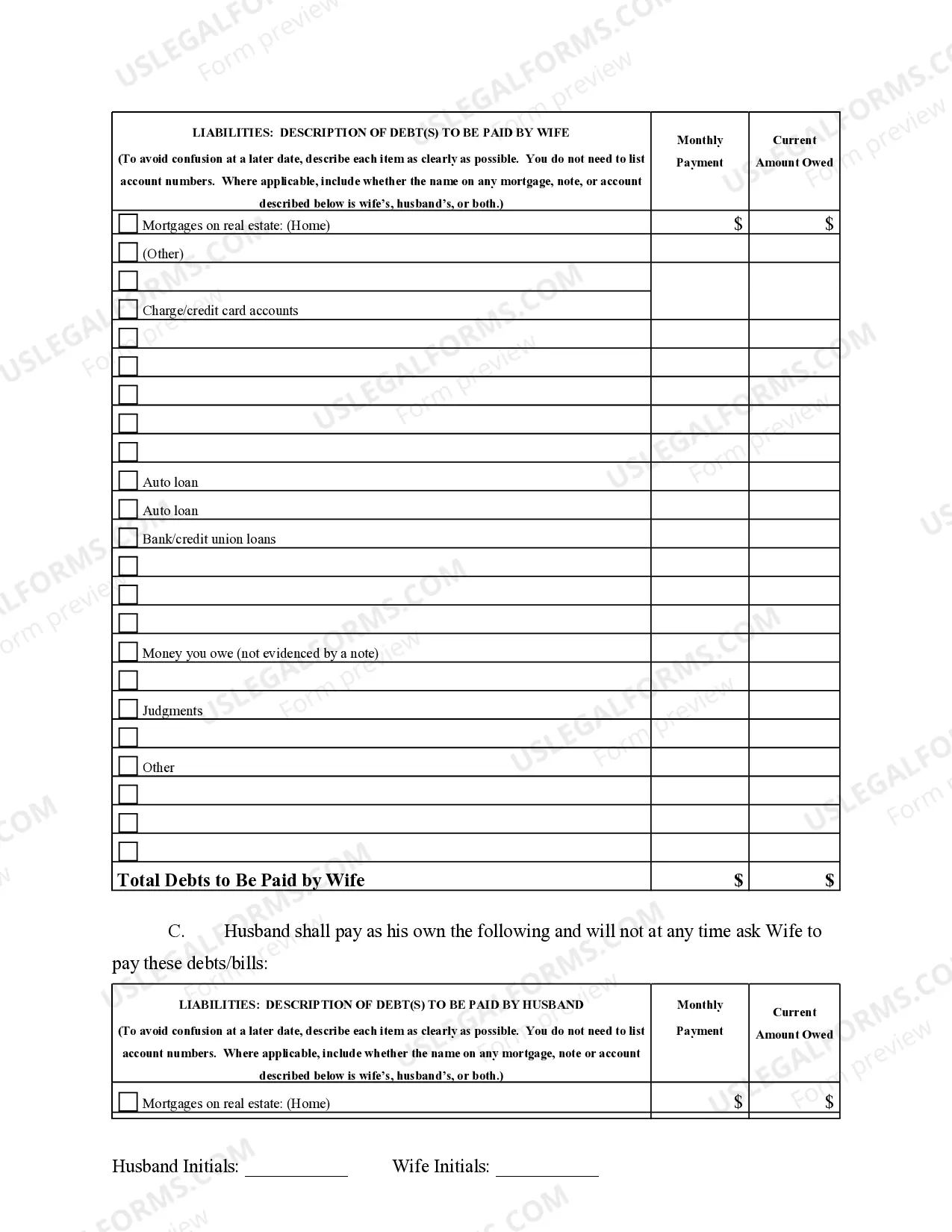

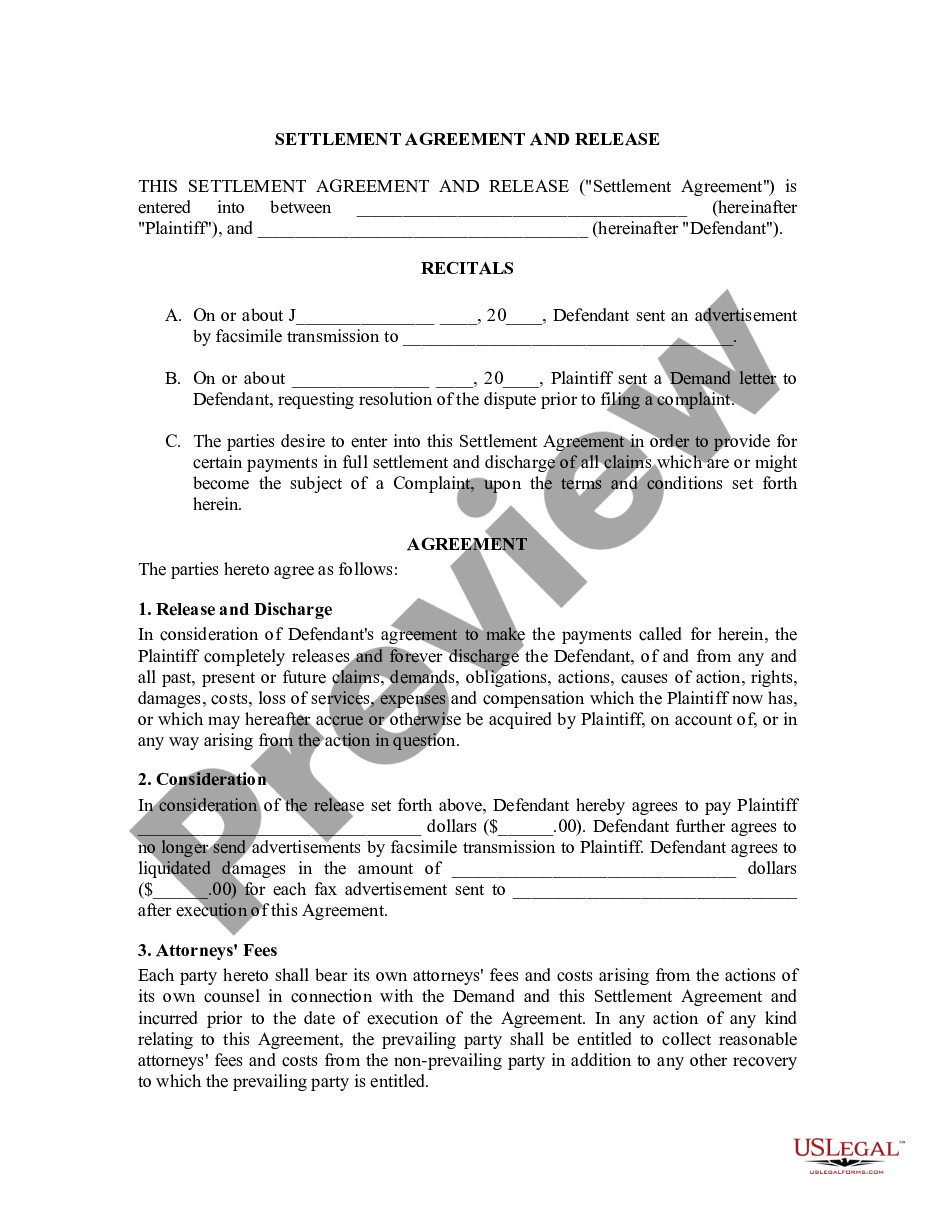

A typical divorce settlement in Illinois often includes the division of assets, spousal support, and an agreement on debt responsibility. Each party usually receives half of the marital property, depending on various factors like income and contributions to the marriage. A well-structured Cook Illinois Marital Settlement Agreement - no children OR adult children can help both parties understand their rights and obligations clearly.

In Illinois, property acquired before marriage generally remains separate property. However, the situation can become complicated if marital funds contribute to the home's value or if the home was treated as joint property. For your peace of mind, you might want to detail property ownership clearly in your Cook Illinois Marital Settlement Agreement - no children OR adult children, to avoid potential disputes.

Writing a Cook Illinois Marital Settlement Agreement - no children OR adult children involves several key steps. Begin by outlining the terms that both parties agree to, including asset division, spousal support, and any other relevant issues. You may find it beneficial to use platforms like UsLegalForms, which provide templates and guidance to simplify the process and ensure that your agreement complies with Illinois law.

To initiate a separation agreement, first discuss the terms with your spouse to reach a consensus. Once you agree on the details, you can draft a Cook Illinois Marital Settlement Agreement - no children OR adult children that outlines your arrangement. Employing the resources from uslegalforms can greatly assist in creating a legally sound agreement that addresses your needs and complies with Illinois laws.

Yes, it's possible to achieve a legal separation without going to court by creating a mutual Cook Illinois Marital Settlement Agreement - no children OR adult children. However, you must still file the agreement with the court to gain legal recognition. Using platforms like uslegalforms can assist you in drafting an enforceable agreement that meets Illinois legal standards without needing to appear in court.

To start the separation process in Illinois, one spouse must file a petition for separation in the appropriate court. Along with this petition, it's advisable to prepare a Cook Illinois Marital Settlement Agreement - no children OR adult children to outline the terms of the separation. Utilizing uslegalforms can help you expedite this process by offering reliable forms and instructions to accurately complete and file your documents.

Filing a separation agreement in Illinois involves preparing the document and submitting it to the local court. It’s essential to ensure the agreement meets all legal requirements, particularly for a Cook Illinois Marital Settlement Agreement - no children OR adult children. You can use resources from platforms like uslegalforms to make the process smoother, as they provide templates and guidance tailored for Illinois.

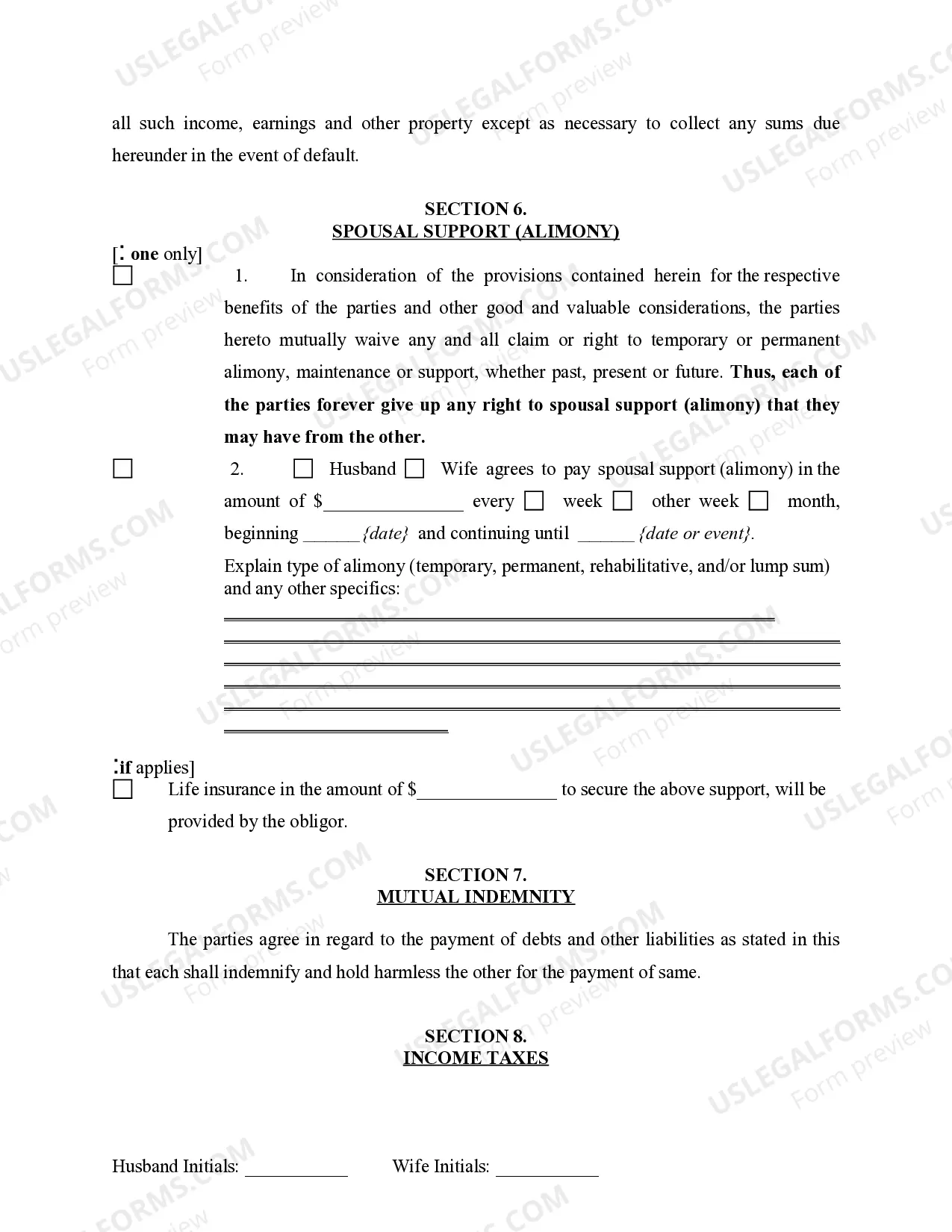

The 20-year divorce law in Illinois refers to the fact that spousal support may be awarded for a duration equal to the length of the marriage after 20 years. Under the Cook Illinois Marital Settlement Agreement - no children OR adult children, this can guide financial expectations during and after divorce proceedings. It's essential to discuss your specific situation with a professional for tailored advice.