A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

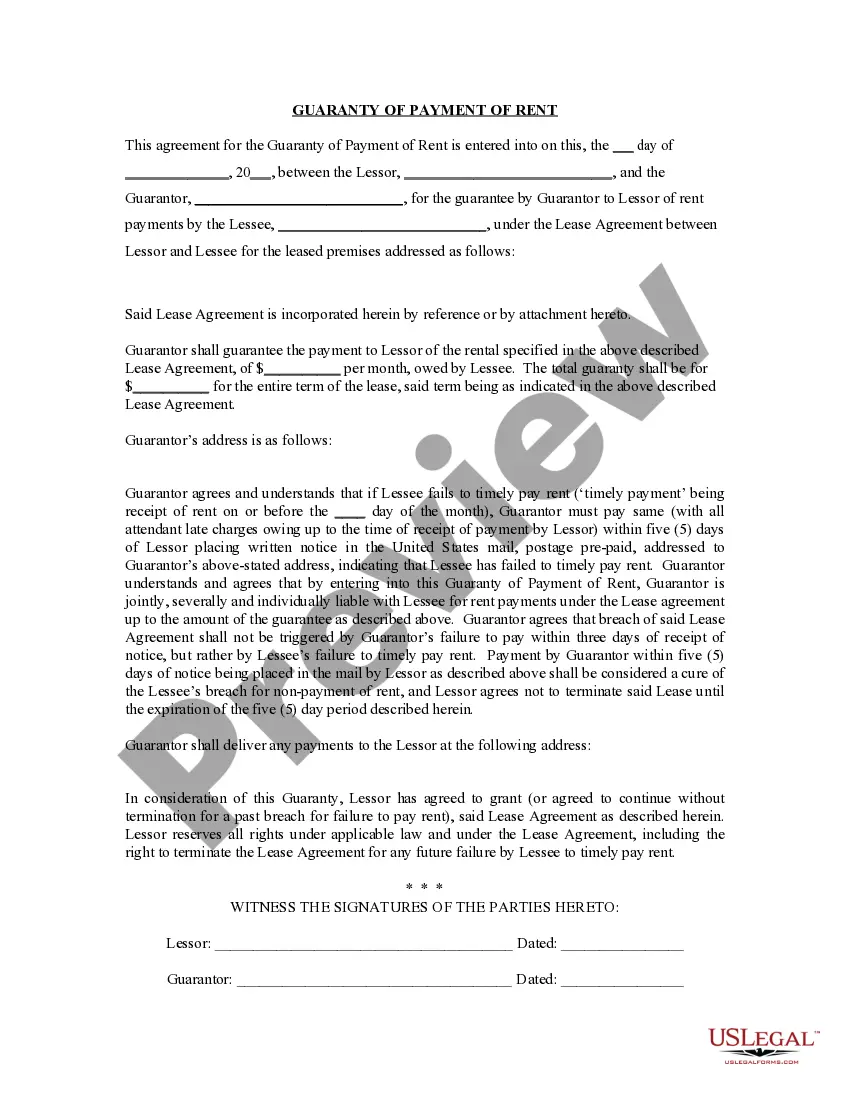

The Chicago Illinois Guaranty or Guarantee of Payment of Rent is a legal document that is commonly used in Chicago when leasing a property. It is a written agreement that provides assurance to the landlord that the tenant will make timely rent payments and fulfill all financial obligations under the lease agreement. This document serves as a guarantee and provides the landlord with additional security in case the tenant fails to pay rent. The purpose of the Chicago Illinois Guaranty or Guarantee of Payment of Rent is to protect the landlord's financial interests. It typically involves a third party, known as the guarantor or the guaranty, who agrees to be financially responsible for the tenant's rent payments in case the tenant defaults. The guarantor is usually a close associate, such as a family member, friend, or a business partner, who is willing to provide this additional financial support. There are several types of Chicago Illinois Guaranty or Guarantee of Payment of Rent that can be used depending on the circumstances of the lease agreement: 1. Personal Guaranty: This is the most common type of guaranty in which an individual, usually the tenant's parent or spouse, becomes the guarantor. The personal guarantor agrees to pay the rent in the event of default by the tenant. 2. Corporate Guaranty: In cases where the tenant is a business entity or corporation, a corporate guaranty may be required. A representative of the corporation signs the guaranty and assumes responsibility for the rent payments if the tenant fails to comply with the lease terms. 3. Co-Signer Guaranty: A co-signer guaranty involves a third party, usually a close friend or relative, who co-signs the lease agreement and assumes joint financial responsibility for the rent payments. If the tenant fails to pay rent, the co-signer becomes liable for the outstanding amount. The Chicago Illinois Guaranty or Guarantee of Payment of Rent includes certain key components to ensure its legality and effectiveness. These components may include the names and addresses of all parties involved, the amount of rent to be guaranteed, the duration of the guaranty, and specific clauses outlining the circumstances under which the guarantor becomes financially responsible. It is important to note that the Chicago Illinois Guaranty or Guarantee of Payment of Rent is a legally binding agreement, and all parties involved should thoroughly review its terms and conditions before signing. Seeking legal advice is recommended to fully understand the rights and responsibilities of all parties involved.The Chicago Illinois Guaranty or Guarantee of Payment of Rent is a legal document that is commonly used in Chicago when leasing a property. It is a written agreement that provides assurance to the landlord that the tenant will make timely rent payments and fulfill all financial obligations under the lease agreement. This document serves as a guarantee and provides the landlord with additional security in case the tenant fails to pay rent. The purpose of the Chicago Illinois Guaranty or Guarantee of Payment of Rent is to protect the landlord's financial interests. It typically involves a third party, known as the guarantor or the guaranty, who agrees to be financially responsible for the tenant's rent payments in case the tenant defaults. The guarantor is usually a close associate, such as a family member, friend, or a business partner, who is willing to provide this additional financial support. There are several types of Chicago Illinois Guaranty or Guarantee of Payment of Rent that can be used depending on the circumstances of the lease agreement: 1. Personal Guaranty: This is the most common type of guaranty in which an individual, usually the tenant's parent or spouse, becomes the guarantor. The personal guarantor agrees to pay the rent in the event of default by the tenant. 2. Corporate Guaranty: In cases where the tenant is a business entity or corporation, a corporate guaranty may be required. A representative of the corporation signs the guaranty and assumes responsibility for the rent payments if the tenant fails to comply with the lease terms. 3. Co-Signer Guaranty: A co-signer guaranty involves a third party, usually a close friend or relative, who co-signs the lease agreement and assumes joint financial responsibility for the rent payments. If the tenant fails to pay rent, the co-signer becomes liable for the outstanding amount. The Chicago Illinois Guaranty or Guarantee of Payment of Rent includes certain key components to ensure its legality and effectiveness. These components may include the names and addresses of all parties involved, the amount of rent to be guaranteed, the duration of the guaranty, and specific clauses outlining the circumstances under which the guarantor becomes financially responsible. It is important to note that the Chicago Illinois Guaranty or Guarantee of Payment of Rent is a legally binding agreement, and all parties involved should thoroughly review its terms and conditions before signing. Seeking legal advice is recommended to fully understand the rights and responsibilities of all parties involved.